Macro Regime Tracker: Review

Macro regime and risk assets qualified clearly

The Macro Regime Tracker offers a daily lens on how shifts in growth, inflation, and liquidity affect short-term risk and reward. Leveraging machine learning, AI, and cross-asset data, it identifies macro changes and their impact on market positioning.

Macro Regime Tracker Index:

Macro Regime Context

Macro Tear Sheets: Equities, Fixed Income, FX, Crypto, and Commodities

Macro Regime Dashboard: Excel spreadsheet for economic data and interest rates

Growth, Inflation, Fixed Income, Credit, and Equities Regime Tracker

AI and Machine Learning Strategies - Macro Regime and Positioning Premiums Strategies: S&P 500, 2-Year Interest Rates, Gold, and Bitcoin

Macro Regime Context:

I will be sending out a full report tomorrow covering the macro context and factor flows (see this thread: LINK).

Main Developments In Macro

*TRUMP SIGNED ACTION STRENGTHENING US CYBERSECURITY

*TRUMP'S ORDER ADDRESSES `GROWING DRONE THREATS': WHITE HOUSE

*TRUMP SIGNED ORDER ON SOVEREIGNTY OVER US SKIES

*TRUMP: BESSENT, LUTNICK, GREER TO GO TO JUNE 9 CHINA MEETING

*HARKER: 'VERY CONCERNED' ABOUT FED'S INDEPENDENCE

*HARKER: TAKING PREEMPTIVE ACTION WOULD BE A MISTAKE

*HARKER: FED POLICY IS MODERATELY RESTRICTIVE

*HARKKER: FIRMS WANT POLICY CERTAINTY, NOT GETTING IT

*CARNEY: LI CALL START OF RECALIBRATION OF CHINA RELATIONSHIP

*CARNEY: INDIA MUST BE AT TABLE FOR G-7 TALKS GIVEN ECONOMY SIZE

*TRUMP CALLS SENATE SPECTRUM PLAN 'SERIOUS POWER' ON 6G

*TRUMP PRAISES SENATE REPUBLICANS ON SPECTRUM DEAL

*CITI CHANGES FED RATE-CUT FORECAST TO SEPTEMBER FROM JULY

*TRUMP, S.KOREA'S LEE TO WORK ON TARIFFS RESOLUTION: YONHAP

*TRUMP, S.KOREA'S LEE TO MEET SOON, YONHAP SAYS

*TRUMP IS HOLDING BACK FROM CALLING OUT CHINA OVER RUSSIA AID

*VICE CHAIR FOR SUPERVISION BOWMAN SPEAKS IN PREPARED REMARKS

*BOWMAN: SUPERVISION SHOULD FOCUS ON MATERIAL FINANCIAL RISKS

*BOWMAN: CHANGES HURT LINK BETWEEN RATINGS, FINANCIAL CONDITIONS

*BOWMAN: FED TO REVIEW LARGE FINANCIAL INSTITUTIONS RATINGS

Fed’s Hammack Urges Patience, Not Time to Be Preemptive: NYT

*NAVARRO: A MEETING WITH CHINA EXPECTED IN SEVEN DAYS

Macro Tear Sheets: Equities, Stock/Bond Correlation, Fixed Income, FX, Crypto, and Commodities

Macro Regime Dashboard: Excel spreadsheet for economic data, interest rates, and real estate.

Momentum and Mean Reversion Models: Equities, Commodities, Fixed Income and Currencies

You can find the educational primer and video explanation of these models here: LINK

Here is a summary of all models and their directional strengths:

Growth, Inflation, Fixed Income, Credit, and Equities Regime Tracker

The Macro Regime Model offers a real-time view of growth, inflation, and yield curve dynamics, integrating these with credit market shifts, equity risk premiums, and positioning data. It connects upcoming catalysts to statistical drivers of asset prices, creating a unified framework that quantifies skew and clarifies risk-reward across asset classes.

Key Points To Set The Context:

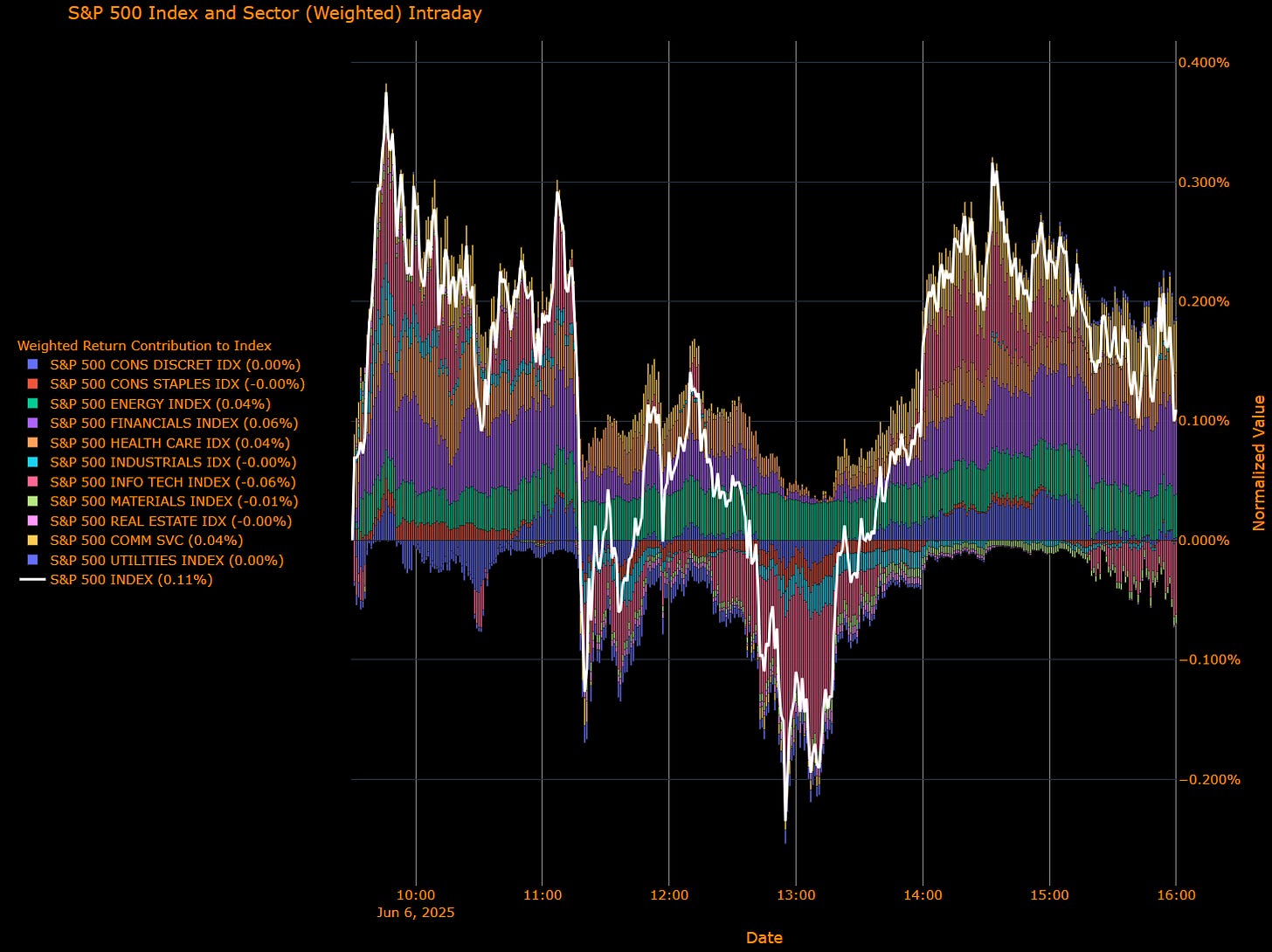

S&P 500 Advances 0.11%, Boosted by Energy and Financials Despite Tech Weakness and Moderating Labor Market

Sector-by-Sector Contribution Snapshot (Weighted Impact)

Energy (+0.04 pp) – Top positive contributor, benefiting from improving sentiment in commodities despite ongoing macro uncertainties.

Financials (+0.06 pp) – Strong positive impact, supported by a rebound in yields and investor optimism despite tariff-induced inflation worries.

Communication Services (+0.04 pp) – Provided positive contribution, buoyed by selective defensive positioning amid cautious overall market sentiment.

Health Care (+0.04 pp) – Contributed positively as investors rotated into defensive and value-oriented sectors amid uncertainty.

Information Technology (-0.06 pp) – Largest negative impact, weighed down by concerns surrounding tariff impacts and broader caution in growth sectors.

Materials (-0.01 pp) – Slightly negative, reflecting muted investor sentiment amid ongoing trade uncertainties.

Industrials (-0.00 pp) – Virtually neutral contribution, indicating balanced positioning amid mixed economic signals and tariff impacts.

Real Estate (-0.00 pp) – Flat, reflecting a balance between yield appeal and investor caution around interest rate outlook.

Consumer Staples (-0.00 pp) – Minimal negative impact, underscoring the sector's defensive positioning amidst cautious trading.

Consumer Discretionary (0.00 pp) – Neutral contribution, reflecting investor hesitation amid tariff concerns affecting consumer sentiment.

Utilities (0.00 pp) – Neutral impact, showing stable investor sentiment despite the defensive nature of the sector.

Sector-by-Sector Performance Snapshot (Unweighted Returns)

Energy (+1.21%) – Strongest performer, driven by optimism in commodity markets.

Financials (+0.43%) – Advanced significantly, benefiting from improved investor sentiment linked to economic stabilization prospects.

Communication Services (+0.44%) – Solid performance, reflecting selective risk-taking amid broader market caution.

Health Care (+0.42%) – Notable positive performance as investors shifted towards stability and value.

Utilities (+0.12%) – Modestly higher, indicating cautious investor rotation into defensive sectors.

Consumer Discretionary (+0.02%) – Slightly higher despite caution surrounding tariff uncertainties and consumer spending.

Industrials (-0.01%) – Marginally negative amid ongoing tariff impacts on manufacturing.

Consumer Staples (-0.01%) – Slight decline, indicative of cautious sentiment despite defensive positioning.

Real Estate (-0.04%) – Minor negative return, highlighting cautious outlook around interest rates.

Information Technology (-0.19%) – Significantly weaker, driven by persistent tariff concerns and broader tech caution.

Materials (-0.39%) – Weakest sector, reflecting amplified caution due to trade-related uncertainties.

Macro Overlay

The S&P 500 rose modestly by 0.11%, buoyed primarily by strength in Energy and Financials. Gains were tempered by persistent weakness in Technology amid escalating tariff-induced inflation concerns and a moderating labor market. The latest US jobs report showed payroll growth moderating to 139,000 with downward revisions in prior months, reflecting cautious employer sentiment amidst tariff-related costs and slower economic activity. Despite wage growth accelerating, the labor force shrank, participation rates declined, and employment in tariff-sensitive sectors weakened, highlighting potential vulnerabilities going forward.

Bottom Line

The S&P 500 closed marginally higher, reflecting positive momentum in Energy, Financials, and defensive sectors despite pronounced weakness in Technology and Materials. Given moderating labor market conditions, ongoing inflationary pressures, and trade uncertainties, you should remain vigilant, monitoring forthcoming economic data and policy signals for signs of sustained market direction.

US IG Credit Wrap — Spreads Tighten Modestly to 54.01 bp Amid Stabilizing Sentiment Despite Ongoing Tariff and Labor Market Concerns

Current Spread: 54.01 bp (▼ ~1.6 bp d/d), showing a modest tightening in spreads. Spreads remain below the 5-year historical average (~63 bp), indicating a cautious stabilization in investor sentiment despite ongoing macroeconomic uncertainties.

Credit Context

< 60 bp: Stable, duration-friendly range supporting insurance and liability-driven investment (LDI) strategies.

60–70 bp: Neutral-to-cautious positioning recommended amid tariff uncertainties and macroeconomic volatility.

> 90 bp: Significant market distress—currently unlikely without a major escalation in geopolitical or macroeconomic shocks.

Macro Overlay

Today's modest tightening in IG credit spreads to 54.01 bp suggests improved investor sentiment, albeit within a cautious framework. Market sentiment was supported by moderate optimism stemming from selective stabilization in economic indicators, despite the latest labor market data revealing gradual moderation in employment growth and continued concerns regarding tariff-driven inflation pressures.

Federal Reserve officials, including Governor Adriana Kugler and Kansas City Fed President Jeff Schmid, have maintained cautious communication around inflation risks and the potential economic impact from sustained tariff measures. Meanwhile, Treasury yields have exhibited a mixed response, reflecting tempered expectations of potential rate cuts by the Federal Reserve later this year.

Investors remain attentive to developments in trade negotiations between President Trump and Chinese President Xi Jinping, weighing carefully any implications of potential resolutions or further escalation in tariff tensions.

Bottom Line

US IG credit spreads narrowed slightly to 54.01 bp, highlighting cautious optimism among investors, tempered by ongoing economic moderation and tariff uncertainties. Vigilance is warranted regarding forthcoming economic data, Federal Reserve communications, and progress in international trade talks to effectively navigate risk management strategies.

Mag7 Model:

Keep reading with a 7-day free trial

Subscribe to Capital Flows to keep reading this post and get 7 days of free access to the full post archives.