Macro Regime Tracker: The Fed's Mistake

Macro regime and risk assets qualified clearly

The Macro Regime Tracker offers a daily lens on how shifts in growth, inflation, and liquidity affect short-term risk and reward. Leveraging machine learning, AI, and cross-asset data, it identifies macro changes and their impact on market positioning.

Macro Regime Tracker Index:

Macro Regime Context

Macro Tear Sheets: Equities, Fixed Income, FX, Crypto, and Commodities

Macro Regime Dashboard: Excel spreadsheet for economic data and interest rates

Growth, Inflation, Fixed Income, Credit, and Equities Regime Tracker

AI and Machine Learning Strategies - Macro Regime and Positioning Premiums Strategies: S&P 500, 2-Year Interest Rates, Gold, and Bitcoin

Macro Regime Context:

I want to make an important contextual point for the macro regime: long-end rates are compressing in a range on a cyclical basis as the Fed has paused YTD. This is setting the stage for the next move in interest rates which will force the Fed to change its stance.

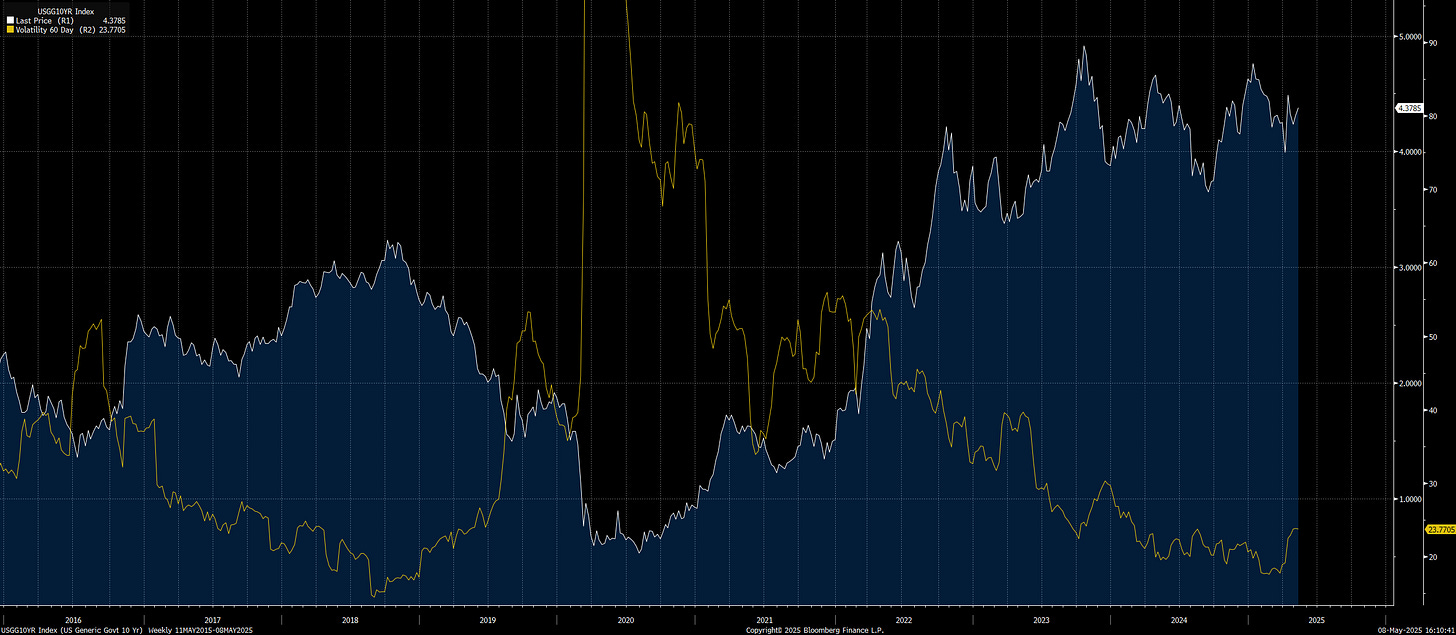

The chart below shows that volatility has been compressing as the 10 year has been in a range since 2023:

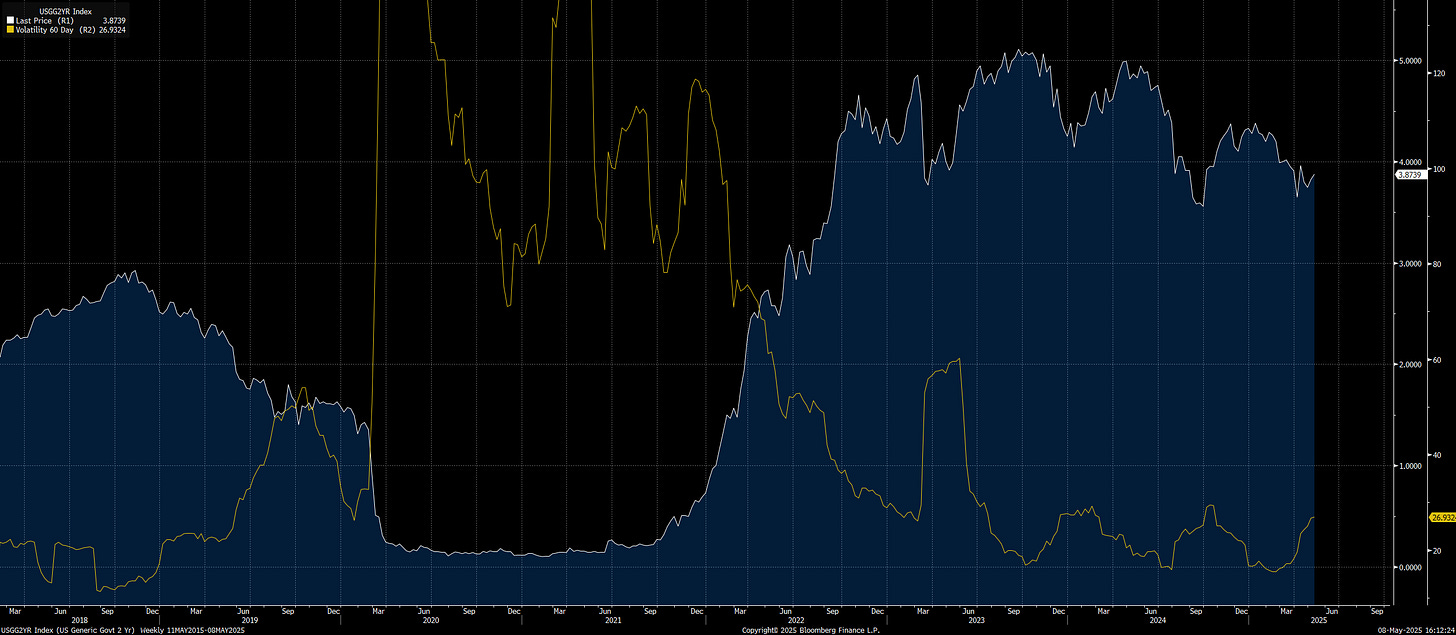

2-year volatility has been marginally different as bearish drift has taken place during the Fed’s cutting cycle.

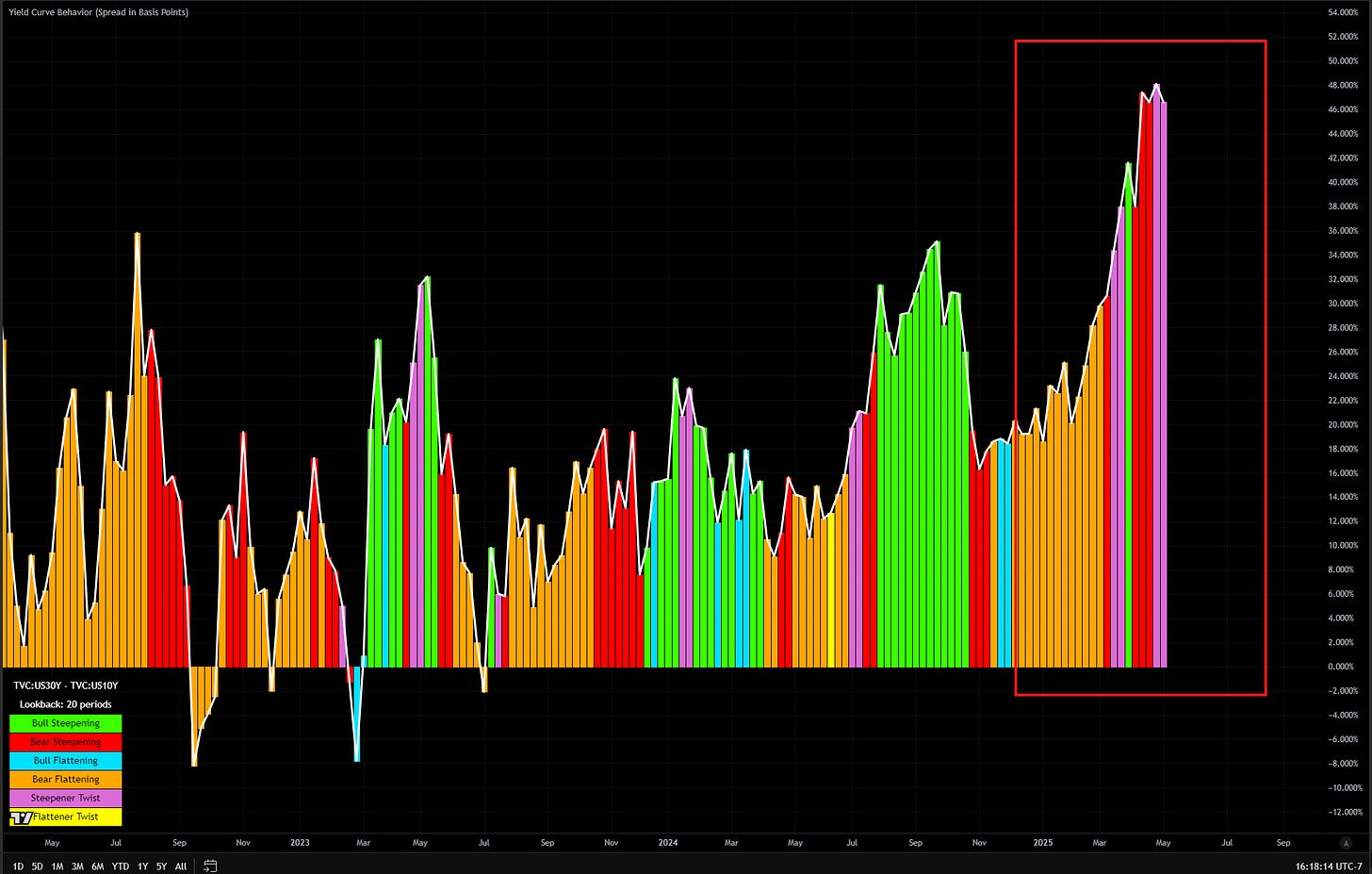

The problem with this is that since the beginning of 2025, the curve has been bear flattening, steepener twisting or bear steepening. The bull steepening was only momentary for the sell off in equities.

Why does this matter? Because the long end of the curve is screaming higher nominal GDP, and inflation is still above 2%. I know that core CPI has decelerated to 2.8% but all of us know that the data has been pretty biased in light of the tariff risk because corporations are buying and selling preemptively. This is why the 10 year is higher even as CPI is moving down.

Now we are unwinding the recession positioning completely as the Z5 contract approaches 50bps this year.

As I have laid out, the entire recession narrative is highly unrealistic based on the actual data.

You can find the full breakdown of ideas here:

The macro bet that takes advantage of this context is laid out here:

And there are now 8 days left to lock in the discount for the future upside on the Substack.

Main Developments In Macro

*TRUMP: TODAY WILL BE VERY BIG, EXCITING DAY FOR US, UK

*TRUMP: PACT WITH UK IS A 'FULL AND COMPREHENSIVE' ONE

*TRUMP: “TOO LATE” JEROME POWELL IS FOOL, WHO DOESN’T HAVE CLUE

*TRUMP SAYS THERE'S VIRTUALLY NO INFLATION

*BANK OF ENGLAND CUTS KEY INTEREST RATE A QUARTER-POINT TO 4.25%

*BOE POLICYMAKERS SPLIT THREE WAYS OVER INTEREST RATES

*BOE: 5 VOTED FOR QUARTER-POINT CUT, 2 FOR HALF, 2 FOR NO CHANGE

*BOE'S BAILEY: NEED TO STICK TO 'GRADUAL AND CAREFUL' APPROACH

*BOE SEES INFLATION AT 1.9% IN 2Q 2027, 1.9% IN 2Q 2028

*EU PROPOSES TARIFFS ON €95 BILLION OF US GOODS IF TALKS FAIL

*LUTNICK: UK DEAL OPENS ACCESS TO US AG PRODUCTS, MACHINERY

*LUTNICK: UK ETHANOL, BEEF, MACHINERY, AGRICULTURE MKTS NOW OPEN

*LUTNICK: 10% TARIFF STAYS ON FOR UK

*TRUMP: UK AGREES TO $10B BOEING PROCUREMENT IN DEAL

*TRUMP: WE INTEND TO MAKE A DEAL WITH THE EU

*MACKLEM: TARIFFS TO CAUSE PERMANENT IMPACTS EVEN IF REMOVED

*TRUMP: 10% IS PROBABLY THE LOWEST END FOR A TARIFF

*TRUMP: 10% BASE RATE FOR UK NOT A TEMPLATE, WILL BE HIGHER

*TRUMP: WILL ASK CHINA FOR HELP ON UKRAINE-RUSSIA DEAL

*TRUMP: I DON'T WANT TO BOMB IRAN

*TRUMP: EVERYONE IS CUTTING EXCEPT FED'S POWELL

*TRUMP: US DOING WELL EVEN WITHOUT FED CUT

*LUTNICK: THINK THE 10% BASELINE TARIFF STAYS

*LUTNICK: GOING TO ROLL OUT DOZENS OF DEALS

*LUTNICK: IF COUNTRIES OPEN MARKET, BEST THEY CAN DO IS 10%

*LUTNICK: WANT 50% OF CHIPS DOMESTIC

*LUTNICK: IN FAVOR OF RAISING TAX RATE ON HIGH EARNERS

*LUTNICK: BESSENT FOCUSED ON CHINA TALKS; I'M DRIVER ON OTHERS

*LUTNICK: FOCUSED ON BIG COUNTRIES FOR NEXT TRADE DEALS

*LUTNICK: WANT A TRADE DEAL FROM A BIG COUNTRY FROM ASIA

*LUTNICK: CAN BE 'SMART' ON SECTORIAL TARIFFS IF NATIONS OPEN

*LUTNICK: MOST INTERESTING REGION IN RELATION TO CHINA IS EU

*EL SALVADOR BUYS MORE BITCOIN: THE BITCOIN OFFICE

Macro Tear Sheets: Equities, Fixed Income, FX, Crypto, and Commodities

Macro Regime Dashboard: Excel spreadsheet for economic data and interest rates

Growth, Inflation, Fixed Income, Credit, and Equities Regime Tracker

The Macro Regime Model offers a real-time view of growth, inflation, and yield curve dynamics, integrating these with credit market shifts, equity risk premiums, and positioning data. It connects upcoming catalysts to statistical drivers of asset prices, creating a unified framework that quantifies skew and clarifies risk-reward across asset classes.

Keep reading with a 7-day free trial

Subscribe to Capital Flows to keep reading this post and get 7 days of free access to the full post archives.