Macro Regime Tracker: The One Trade

Macro regime and risk assets qualified clear

The Macro Regime Tracker offers a daily lens on how shifts in growth, inflation, and liquidity affect short-term risk and reward. Leveraging machine learning, AI, and cross-asset data, it identifies macro changes and their impact on market positioning.

Macro Regime Tracker Index:

I have laid out all the new models and a breakdown of how everything is converging on the risk we are seeing in interest rates and FX.

Per usual, all of the systematic models and strategies have been updated below.

Main Developments In Macro

US — Markets & Policy

*DOW JONES INDUSTRIALS CLOSES AT FIRST RECORD SINCE DECEMBER

*FITCH: USD SHARE OF GLOBAL RESERVES GIVES FINANCIAL FLEXIBILITY

*FITCH SEES US 2026 GOVT DEFICITS RISING TO 7.8% OF GDP

*FITCH SEES US 2025 GOVT DEFICIT NARROWING TO 6.9% OF GDP

*US RATING CONSTRAINED BY HIGH FISCAL DEFICIT, GOVT DEBT: FITCH

*DEUTSCHE BANK SHIFTS FED RATE-CUT FORECAST TO SEPTEMBER

*TREASURIES RALLY AS TRADERS PRICE IN ADDITIONAL FED EASING

US Stock Futures Rise, Dollar Steady Before Powell: Macro Squawk

Fed Speak — Hammack / Collins

*CLEVELAND FED PRESIDENT BETH HAMMACK SPEAKS ON CNBC

*HAMMACK: PRIVATE CREDIT IS A PLACE WE SHOULD CONTINUE TO WATCH

*HAMMACK: BROAD PICTURE ON FINANCIAL STABILITY LOOKS GOOD

*HAMMACK: NEED TO JUDGE MAGNITUDE, PERSISTENCE OF MANDATE MISSES

*HAMMACK: WE NEED TO BE CAUTIOUS ABOUT REMOVING RESTRICTION

*HAMMACK: THINK WE'RE ONLY A VERY SMALL DISTANCE TO NEUTRAL RATE

*HAMMACK: DON'T HAVE COOK DETAILS BEYOND WHAT I'VE READ IN PRESS

*HAMMACK: RIGHT NOW, I'M SQUARELY FOCUSED ON INFLATION MANDATE

*HAMMACK: BREAKEVEN RATE OF JOBS WE NEED HAS SHIFTED MATERIALLY

*HAMMACK: NEED TO MAINTAIN MODESTLY RESTRICTIVE STANCE OF POLICY

*HAMMACK: WE MAY SEE UNEMPLOYMENT CONTINUE TO RISE AS WELL

*HAMMACK: MY EXPECTATION IS WE'LL SEE INFLATION CONTINUE TO RISE

*FED'S HAMMACK: I HEARD THE CHAIR IS OPEN-MINDED ABOUT SEPTEMBER

*COLLINS: POLICY IS MODESTLY RESTRICTIVE, WHICH IS APPROPRIATE

*COLLINS: NOT A DONE DEAL ON WHAT WE DO AT OUR NEXT MEETING

*COLLINS: JOB GROWTH SLOWING BUT ARGUMENTS FOR TAKING MORE TIME

*COLLINS: SEE UPSIDE RISKS TO INFLATION, DOWNSIDE RISKS ON LABOR

*COLLINS: GROWTH SLOWING BUT OVERALL ECONOMIC FUNDAMENTALS SOLID

Chair Powell — Framework & Risk Balance

*POWELL: SITUATION SUGGESTS DOWNSIDE RISKS TO EMPLOYMENT RISING

*POWELL: LONGER-TERM INFLATION EXPECTATIONS APPEAR WELL-ANCHORED

*POWELL: REMOVED 'SHORTFALLS' FROM STATEMENT ON LONGER-RUN GOALS

*POWELL: LABOR SUPPLY HAS SOFTENED IN LINE WITH DEMAND

*POWELL: TARIFF EFFECTS ON CONSUMER PRICES NOW CLEARLY VISIBLE

*POWELL: WON'T ALLOW ONE-TIME INCREASE TO BECOME ONGOING PROBLEM

*POWELL: SHIFTING BALANCE OF RISKS MAY WARRANT ADJUSTING POLICY

*POWELL: ELIMINATED INFLATION MAKEUP STRATEGY FROM FRAMEWORK

*POWELL: EXPECT TARIFF PRICE EFFECTS ACCUMULATE IN COMING MONTHS

*POWELL: LABOR MARKET IS IN A 'CURIOUS KIND OF BALANCE'

*POWELL: WE CAN'T TAKE STABLE INFLATION EXPECTATIONS FOR GRANTED

*POWELL: SHORT-LIVED TARIFF PRICE EFFECTS A REASONABLE BASE CASE

*POWELL: LABOR-MARKET STABILITY ALLOWS US TO PROCEED CAREFULLY

US — Trade / Industrial Policy / Personnel

*INTEL CEO TO MEET WITH TRUMP AT WHITE HOUSE TODAY: CNBC

*WHITE HOUSE WELCOMES MOVE BY CANADA ON TARIFFS: FOX BUSINESS

*CANADA TO REMOVE RETALIATORY TARIFFS ON MANY US PRODUCTS

*CANADA TO APPLY TARIFF EXEMPTION ON MANY US GOODS UNDER USMCA

*CANADA JUNE RETAIL SALES EX-AUTO RISE 1.9% M/M; EST. +0.8%

*CANADA JUNE RETAIL SALES ROSE 1.5% M/M, MATCHING EST.

*CANADA JULY RETAIL SALES LIKELY FELL 0.8% M/M: STATCAN FLASH

*BESSENT: FAULKENDER PLAYED A CRITICAL ROLE ON ECONOMIC AGENDA

*FAULKENDER HAS SERVED AS DEPUTY TREASURY SECRETARY

*FAULKENDER STEPPING DOWN, BESSENT THANKS HIM FOR TREAS. SERVICE

*TRUMP: WE HAVE AMERICAN BUYERS FOR TIKTOK

*TRUMP SAYS HE'LL FIRE FED'S COOK IF SHE DOESN'T RESIGN

Global Macro — Europe (US-relevant cross-currents)

*ECB OFFICIALS TO STICK WITH STEADY-RATES PLAN AFTER TRADE DEAL

*ECB'S NAGEL: EURO NEAR LONG-TERM AVERAGE, NOT CAUSING CONCERN

*ECB'S NAGEL: THE BAR FOR FURTHER RATE CUTS IS HIGH

*ECB'S NAGEL: INFLATION IS NOT THE POINT ANYMORE

*ECB'S NAGEL: DON'T SEE SO MANY ARGUMENTS FOR MORE EASING

*ECB'S NAGEL: HIGH PROBABILITY GERMAN GROWTH WILL RETURN IN 2026

*NAGEL: GERMAN ECONOMY MAY STAGNATE OR CONTRACT A LITTLE IN 2025

*ECB'S NAGEL: WE HAVE TO FIGHT FOR CENTRAL BANK INDEPENDENCE

*GERMANY FINAL 2Q ADJ. GDP RISES 0.2% Y/Y; EST. +0.4%

*GERMANY FINAL 2Q GDP FALLS 0.3% Q/Q; EST. -0.1%

*EURO AREA 2Q NEGOTIATED WAGES RISE 3.95% Y/Y

Geopolitics (market-relevant)

*EU DISBURSES €4.05 BILLION AID PAYMENT TO UKRAINE

*IRAN, EUROPE FOREIGN MINISTERS AGREE TO FURTHER TALKS AUG. 26

*TRUMP: WE'LL SEE IF PUTIN, ZELENSKIY WILL WORK TOGETHER

Macro Tear Sheets: Equities, Stock/Bond Correlation, Fixed Income, FX, Crypto, and Commodities

Macro Regime Dashboard: Excel spreadsheet for economic data, interest rates, and real estate.

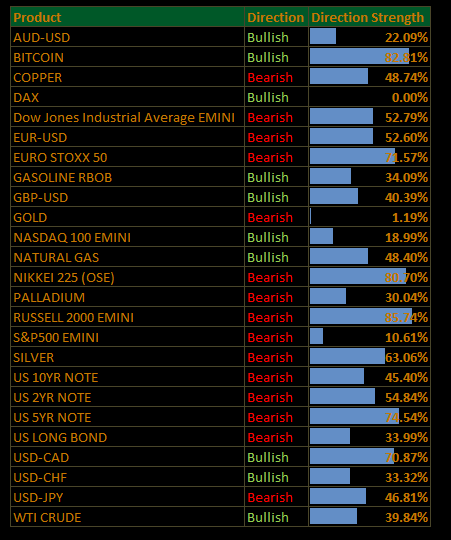

Momentum and Mean Reversion Models: Equities, Commodities, Fixed Income, and Currencies

You can find the educational primer and video explanation of these models here: LINK

Growth, Inflation, Fixed Income, Credit, and Equities Regime Tracker

The Macro Regime Model offers a real-time view of growth, inflation, and yield curve dynamics, integrating these with credit market shifts, equity risk premiums, and positioning data. It connects upcoming catalysts to statistical drivers of asset prices, creating a unified framework that quantifies skew and clarifies risk-reward across asset classes.

Keep reading with a 7-day free trial

Subscribe to Capital Flows to keep reading this post and get 7 days of free access to the full post archives.