Macro Regime Tracker: Volatility

Macro regime and risk assets qualified clear

The Macro Regime Tracker offers a daily lens on how shifts in growth, inflation, and liquidity affect short-term risk and reward. Leveraging machine learning, AI, and cross-asset data, it identifies macro changes and their impact on market positioning.

Macro Regime Tracker Index:

see the most recent macro report here

Per usual, all the systematic models and strategies are updated below.

Main Developments In Macro

U.S. Economy & Labor Market

FED RELEASES BEIGE BOOK SURVEY OF US ECONOMIC CONDITIONS

FED BEIGE BOOK: MOST DISTRICTS SEE LITTLE OR NO GROWTH

TREASURIES RISE AFTER JOB OPENINGS FALL MORE THAN ESTIMATED

BLOOMBERG DOLLAR SPOT INDEX FALLS TO DAILY LOW AFTER JOLTS DATA

US JULY JOB OPENINGS 7.181M; EST. 7.380M

US JULY JOB OPENINGS RATE 4.3%

US JULY JOB QUITTERS 3.208M; EST. 3.166M

US JULY QUITS RATE 2.0%

US JULY LAYOFFS 1.808M; EST. 1.639M

US JULY LAYOFFS RATE 1.1%

US FINAL JULY NON-DEFENSE CAPITAL GOODS ORDERS EX-AIR RISE 1.1% M/M

US FINAL JULY NON-DEFENSE CAPITAL GOODS SHIPMENTS EX-AIR RISE 0.7% M/M

US JULY FACTORY ORDERS EX-TRANS RISE 0.6% M/M; EST. +0.6%

US JULY FACTORY ORDERS FALL 1.3% M/M; EST. -1.3%

US FINAL JULY DURABLE GOODS ORDERS FALL 2.8% M/M; EST. -2.8%

Federal Reserve & Monetary Policy

MIRAN: INDEPENDENCE OF MONETARY POLICY CRITICAL FOR FED

MIRAN: INDEPENDENCE OF MONETARY POLICY IS A CRITICAL ELEMENT

MIRAN: COMPOSITION OF FED'S BALANCE SHEET IS OPEN QUESTION

MIRAN: CENTRAL BANK MAIN JOB IS TO PREVENT DEPRESSION, INFLATION

TILLIS WANTS COURT RULING BEFORE REPLACING FED'S COOK: POLITICO

FED CONFERENCE TO DISCUSS STABLECOINS, AI, TOKENIZATION

FEDERAL RESERVE TO HOLD OCT. 21 PAYMENTS INNOVATION CONFERENCE

TAYLOR: NEUTRAL RATE OF INTEREST IS QUITE LOW, FURTHER TO GO

U.S. Politics & Policy (Macro-Relevant)

TRUMP: HARDER TO WIN AI RACE AGAINST CHINA WITHOUT TARIFFS

TREASURY DEPARTMENT ISSUES STATEMENT ON FSOC MEETING

TRUMP: THINK REPUBLICANS WILL VOTE FOR BUDGET EXTENSION

TRUMP REPEATS CRITICISMS OF VENEZUELAN DRUGS, MIGRANTS

TRUMP: VENEZUELA HAS BEEN VERY BAD ACTOR

Geopolitics (U.S. Links)

NAWROCKI: DISCUSSED BOOSTING NUMBER OF US TROOPS IN POLAND

TRUMP: US SOLDIERS WILL REMAIN IN POLAND

TRUMP: RELATIONS WITH POLAND ARE BETTER THAN EVER

TRUMP: WILL DISCUSS TRADE WITH POLAND'S NAWROCKI

CARNEY HAD 'LENGTHY, CONSTRUCTIVE' TALK WITH TRUMP ON MONDAY

Macro Tear Sheets: Equities, Stock/Bond Correlation, Fixed Income, FX, Crypto, and Commodities

Macro Regime Dashboard: Excel spreadsheet for economic data, interest rates, and real estate.

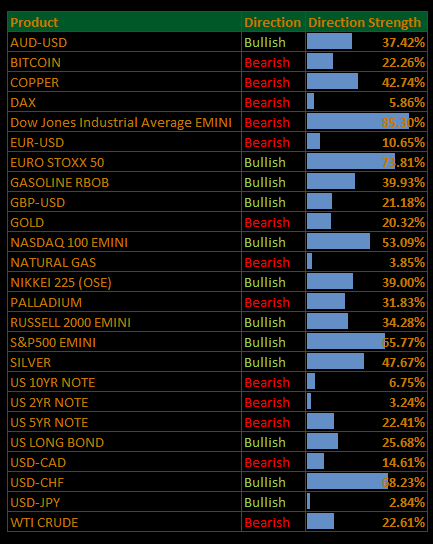

Momentum and Mean Reversion Models: Equities, Commodities, Fixed Income, and Currencies

You can find the educational primer and video explanation of these models here: LINK

Growth, Inflation, Fixed Income, Credit, and Equities Regime Tracker

The Macro Regime Model offers a real-time view of growth, inflation, and yield curve dynamics, integrating these with credit market shifts, equity risk premiums, and positioning data. It connects upcoming catalysts to statistical drivers of asset prices, creating a unified framework that quantifies skew and clarifies risk-reward across asset classes.

Keep reading with a 7-day free trial

Subscribe to Capital Flows to keep reading this post and get 7 days of free access to the full post archives.