Macro Report: A Storm Is Coming

How Trump, The Fed, and Trade Are Setting Up Flows For The Largest Macro Move Yet

Macro Report: A Storm Is Coming

“What important truths do very few people agree with you on?”

This is the question that I ask myself every single day when I approach markets.

I have models for growth, inflation, liquidity, positioning, and price, but the final frontier in macro is the quality of ideas. Quant funds and new AI tools are stripping out every statistical inefficiency in markets, compressing the edge that used to exist. What remains is macro volatility expressed over higher timeframes.

The Truth:

So let me share with you the truth that very few people agree with me on: I believe we are going to see an increase in macro volatility in the next 12 months that will dwarf 2022, COVID, and potentially 2008, but the SOURCE of volatility will be from an orchestrated devaluation in the dollar against major currencies. Most people think that a fall in the dollar or “dollar devaluation” will cause risk assets to rally but this couldn’t be further from the truth. I believe this is the biggest risk in markets today.

Most investors once assumed mortgages were too safe to trigger systemic panic and dismissed credit default swaps as too complex to matter. The same complacency exists today around the source of potential dollar devaluation. Almost no one is examining the specific mechanism of devaluation that could shift from being a tailwind to a genuine risk for asset prices. You can see this blind spot when you ask people about it. They insist dollar weakness is always bullish for risk assets and assume the Fed would intervene if anything serious occurred. That mindset is precisely why a deliberate, engineered devaluation would likely drive risk assets lower rather than higher.

The Path Forward:

What I am going to do in this article is lay out the full details of how this functions, how to understand the signals for WHEN this risk materialises, and WHAT assets will be impacted the most (positively and negatively).

All of this comes down to 3 things that have converged and are escalating as we approach 2026.

The global liquidity imbalance from cross-border flows creating fragility

The Trump administration’s stance on the currency, geopolitics, and trade

The transition to a new Federal Reserve Chair who will align monetary policy with Trump’s negotiating leverage

The Imbalance:

A structural liquidity imbalance has formed through years of uneven cross-border flows. The issue is not the size of global debt but the way these flows have shaped balance sheets into something inherently fragile. It mirrors the dynamic behind adjustable-rate mortgages before the GFC. Once the unwind starts, the structure itself accelerates the correction, liquidity evaporates, and the process becomes difficult to stop. It is a mechanical vulnerability embedded in the system.

All of this starts with how the US is the single place in the world that buys everyone else’s stuff. And it’s easy because the dollar as the reserve currency is so strong that it allows us to import everything at a fraction of what we could make it for here. Every time the US buys stuff from the rest of the world, we give them dollars in return. The majority of the time, foreigners take these dollars and put them into US assets in order to maintain its trade relationship and because it’s the only game in town. Where else are you going to bet on the AI revolution, robotics, or people like Elon Musk?

This cycle takes place over and over: The US buys stuff →gives foreigners dollars→foreigners buy US assets→US gets to buy more cheap stuff because foreigners keep holding US dollars/assets.

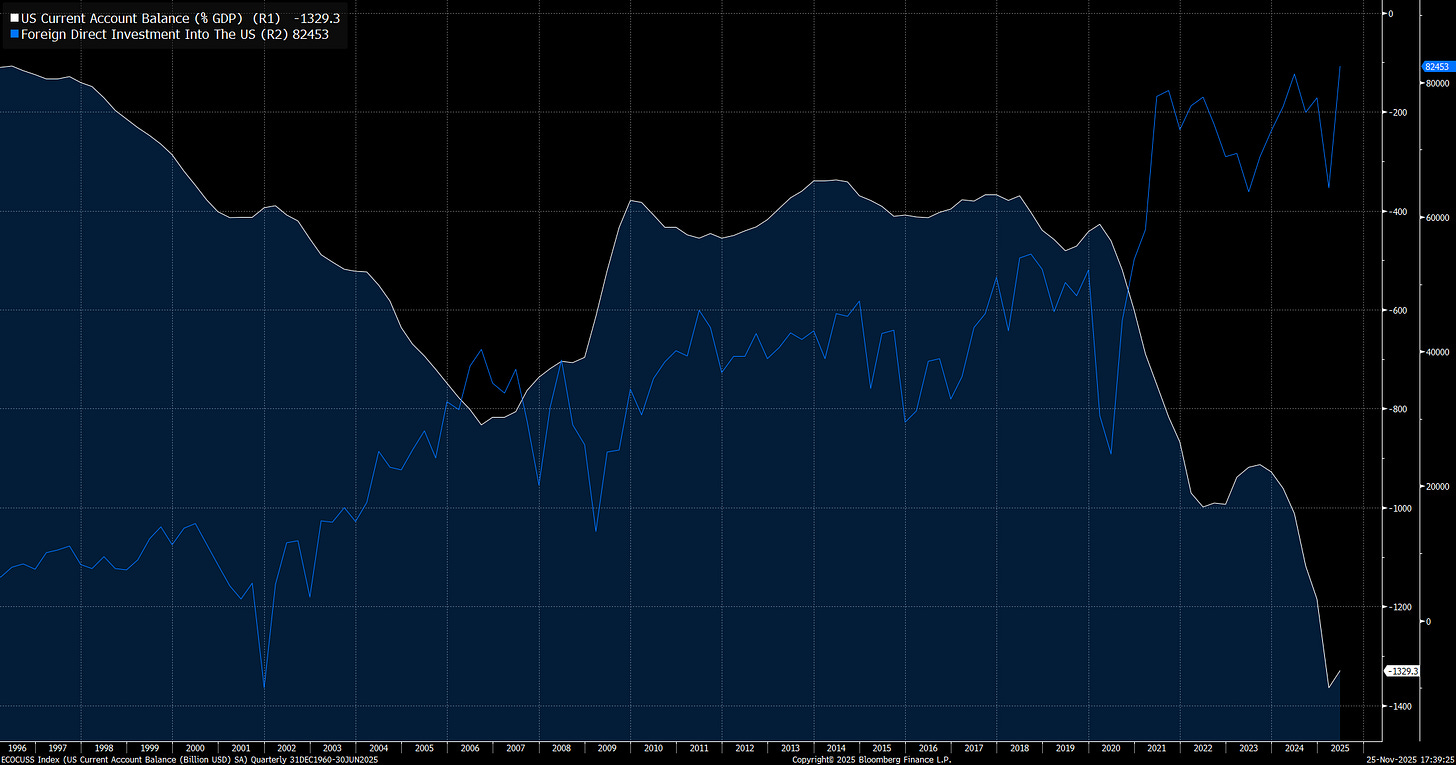

This cycle has created a massive imbalance where the US current account (imports vs exports: white line) is at an extreme. The flip side of this coin is that investment by foreigners in US assets (blue) is at its highest in history:

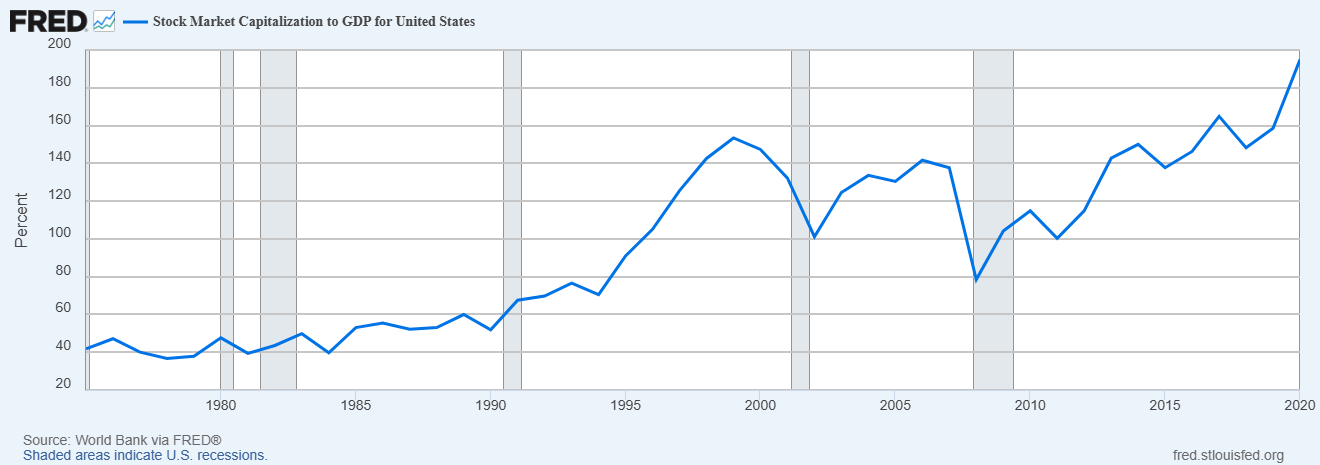

When foreigners continue to buy US assets indiscriminately so that they can continue exporting their goods and services to the US, this is WHY we are seeing S&P500 valuations (price to sales ratios) at all-time highs:

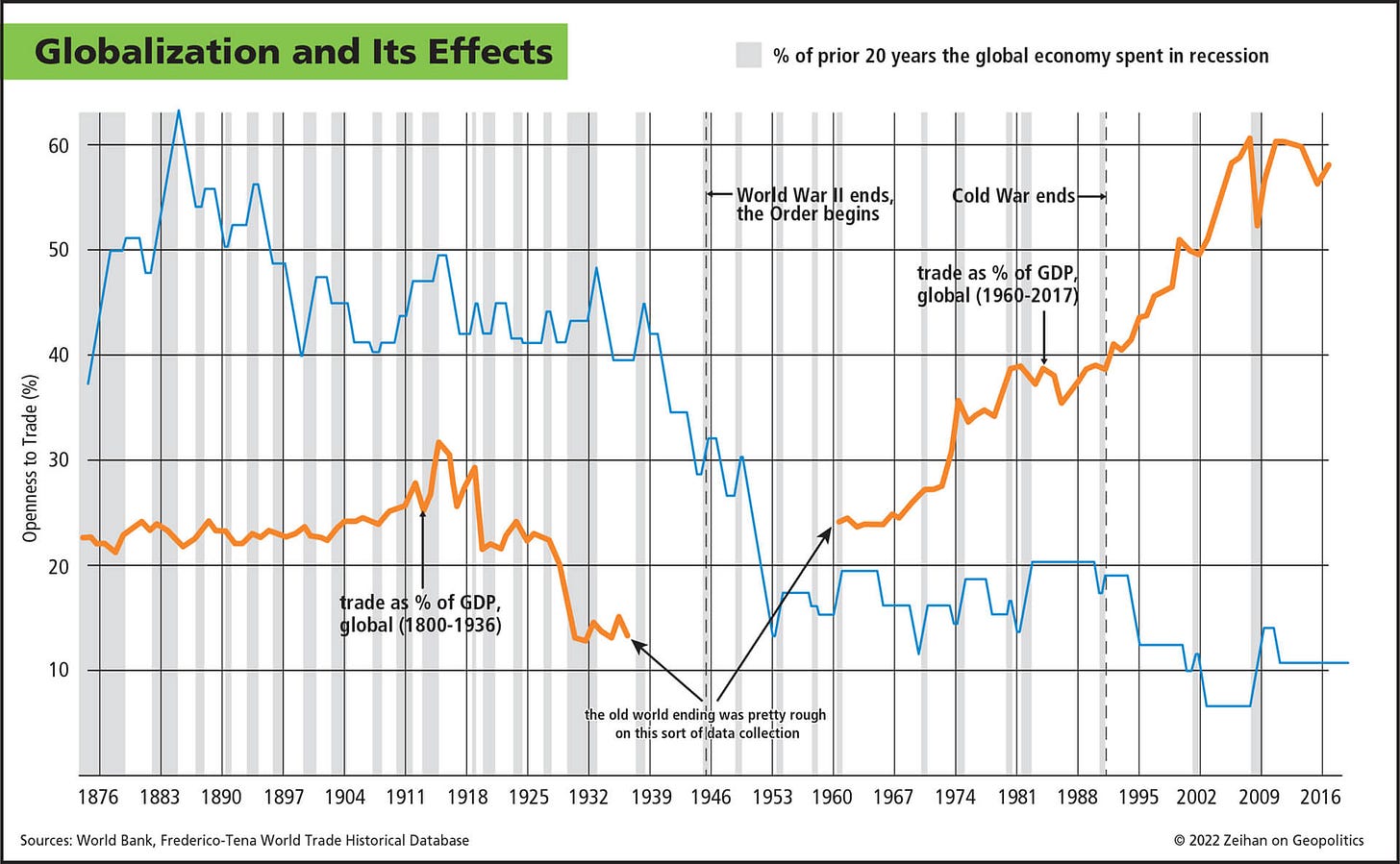

Traditional equity valuation frameworks come from the value-investing world shaped by Warren Buffett. That approach worked well in a period with limited global trade and far less liquidity across the system. What people overlook is that global trade itself expands liquidity. The current account on one side is the capital account on the other. In practical terms, when two countries trade, their balance sheets become cross-collateralized, and those cross-border flows exert a powerful influence on asset prices.

For the US, as the largest importer of goods, capital flows to the US, which is WHY the market cap to GDP ratio is significantly higher than the 1980s when all of the value investing frameworks were formed by Graham and Dodd in Security Analysis. This is not to say valuations don’t matter, but that on a total market cap basis, it is due to changes in macro liquidity instead of “Mr Market acting irrationally.”

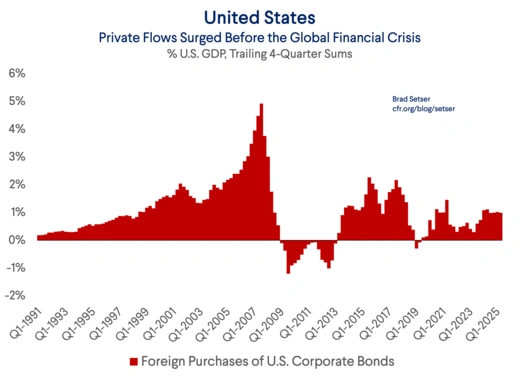

One of the primary sources that fueled the fragile capital structure in the mortgage market during the run-up to the GFC was foreign investors buying US private sector debt:

Michael Burry big short in the GFC was the fragile capital structure, and the liquidity was the repricing that changed as domestic and crossborder flows shifted. This is why I find the analysis Michael Burry very interesting right now in connection with the cross-border/liquidity analysis I am doing:

Foreign investors are sending increasing amounts of capital into the United States, and both foreign flows and passive flows are becoming ever more concentrated in the top seven stocks.

The important thing to note here is the TYPE of imbalance taking place. Brad Setser does an excellent job explaining how the carry trade dynamic taking place with cross-border flows is creating a massive amount of complacency in markets on a structural basis:

Why does all this matter? Well because a lot of financial models now assume, incorrectly I think, that the dollar will rally in the event of future financial instability—say, a selloff in U.S. equities or credit. That makes it easier for investors to continue to hold dollar assets unhedged.

The logic of the argument goes a bit like this—sure, my fund is very overweight U.S. financial assets because of the “dominance” of the U.S. in global equity indexes right now, but that risk is partially offset by the natural hedge provided by the dollar, as the dollar often rallies into bad news. The dollar thus will likely rally in the event of a significant equity market correction (as it did in ‘08 or, for very different reasons, 2020), and hedging dollar risk effectively means undoing a natural hedge.

Conveniently the expectation that the dollar serves as an equity (or credit) market hedge based on past correlations also increases current returns, because it provides a reason not to hedge U.S. market exposure at a time when hedging is expensive.**

There is risk, however, that past correlations won’t hold.

If the dollar rallied in 2008 not thanks to its reserve currency status but rather because the funding currencies in a carry trade tend to rally in a carry unwind (and that destination currencies in carry trades tend to selloff), investors should not assume that the dollar will rally in future instability.

One thing is absolutely clear: the U.S. is currently on the receiving side of most carry trades.

https://www.cfr.org/article/foreign-money-flowed-out-us-not-during-global-financial-crisis

This is the critical thing that makes today’s world so different: A foreigner’s return on the S&P500 is determined by the return in the index AND the return in the currency. If the S&P500 rallies 10% in a year, this doesn’t imply a positive return for the foreign holder if the dollar drops a compensurate amount against their local currency.

Here is a chart of the S&P500 (blue) and S&P500 hedged. You can see that if you’re taking into account the currency change, this can dramatically change your returns over the years. Now, think about what happens when you compress all of these years into a short period of time. You can create massive risks driven by cross-border flows.

This brings us to the acceleration toward the catalyst that is putting this global carry trade at risk: The Trump administration’s stance on the currency, geopolitics, and trade.

Trump, FX, and Economic Warfare:

When we entered this year, two very specific macro changes took place that accelerated HOW MUCH risk exists in the global balance of payments system.

We saw the dollar sell off AT THE SAME TIME that US equities sold off because it was driven by tariffs and cross-border flows as opposed to domestic delinquencies. This is exactly the TYPE of risk that stems from the imbalance I noted above. The real problem is that if the dollar is selling off at the same time as equities, any intervention by the Fed will push down the dollar even more, which would almost certainly further amplify the downside in equities (the opposite of conventional wisdom around the Fed put). When the source of selling is external and based on the currency, the Fed is in a much more difficult position. This shows that we have already entered the “macro end game” where the currency is becoming the asymmetrical linchpin for everything.

Trump and Bessent are openly pursuing a weaker dollar and using tariffs as leverage to gain the upper hand in the economic conflict with China. If you have not followed the research I have published on China and its deliberate use of economic warfare against the United States, you can watch the YouTube video I recorded titled The Geopolitical End Game. The essential point is that China is intentionally hollowing out the industrial bases of other countries, creating dependence and giving itself the leverage it needs to execute its broader strategic objectives.

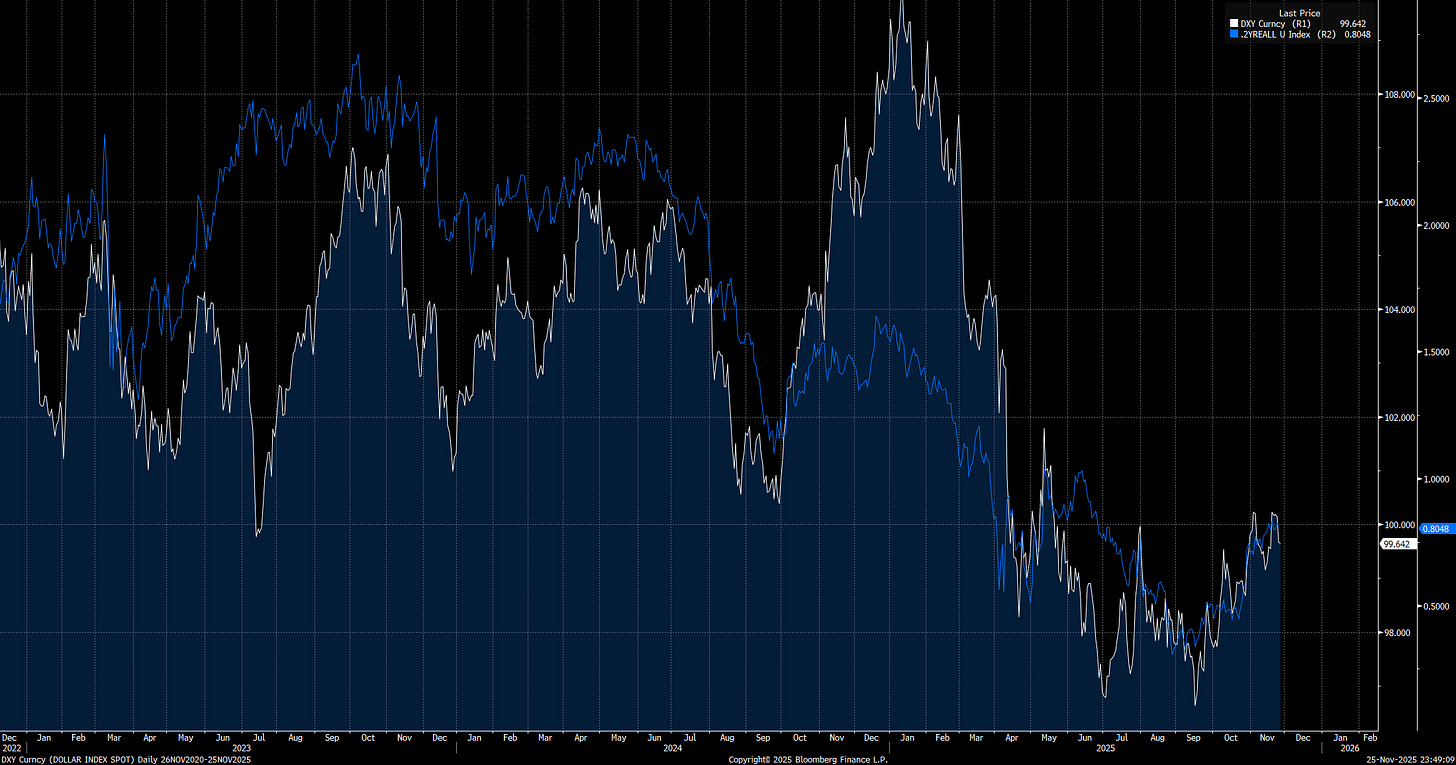

The moment that Trump takes office (red arrow), the DXY begins to fall, and this is only the beginning.

Notice that short-end real rates have been one of the primary drivers of the DXY, which means monetary policy is one of the key inputs into this, along with the tariffs by Trump.

Trump needs the Fed to be more accommodative in monetary policy because it helps weaken the dollar, not just because he wants to pump the economy. This is exactly why he put Steven Miran onto the board of the Fed, an individual who intricately understands how global trade functions.

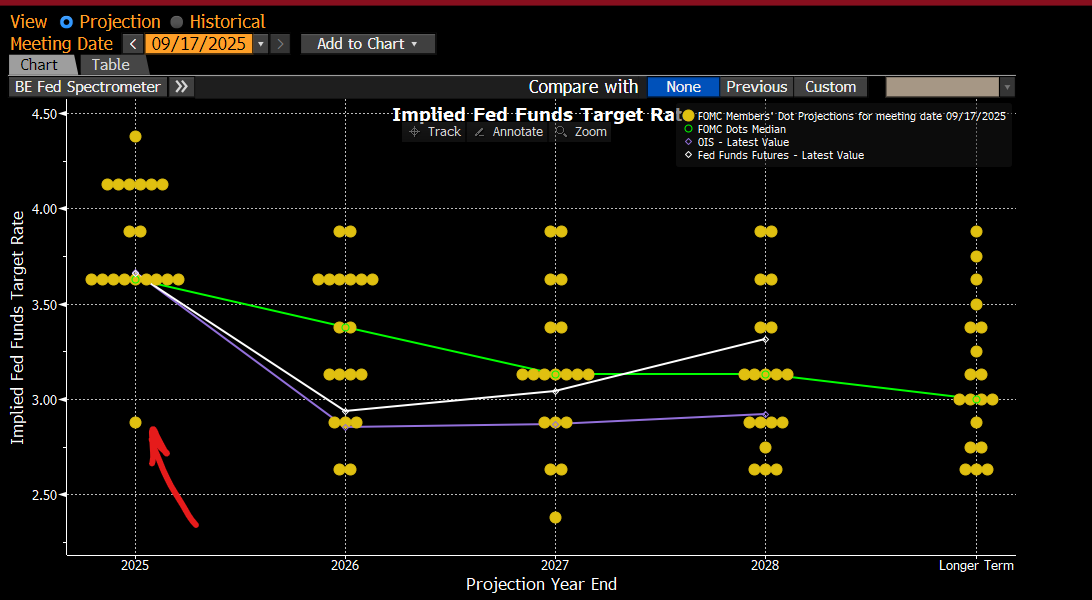

What is the first thing that Miran does? He puts his dotplot projections 100bps BELOW all other FOMC members because he is sending a signal that he is extremely dovish and trying to pull other members more dovish as well.

MAIN IDEA: Here is the core dilemma. The United States is in a real economic conflict with China, and it must actively engage or risk losing strategic dominance. Yet a weaker-dollar policy achieved through significantly looser monetary policy and aggressive trade negotiations cuts both ways. It can boost domestic liquidity in the short term, but it also suppresses cross-border flows. A weaker dollar can trigger foreign investors to reduce exposure to U.S. equities at the very moment the currency weakens, as they adjust to new trade terms and a shifting FX regime. It places the United States on a cliff: one path requires confronting China’s economic aggression, while the other risks a broad repricing of U.S. equities driven by a weaker dollar against major currencies.

New Fed Chair, Midterms, and Trump’s Big Play:

We are watching a global imbalance develop that is directly tied to cross-border flows and the currency. This has accelerated since Trump took office and began confronting the largest structural distortions in the system, including the economic conflict with China. These dynamics are not theoretical. They are already reshaping markets and global trade. All of this is building toward the catalysts coming next year, when a new Fed chair steps in during the midterms and Trump enters the final two years of his term, determined to leave a defining mark on American history.

I believe Trump will push for the most aggressively dovish monetary stance possible to drive a weaker-dollar policy until inflation risk forces a reversal. Most investors assume a dovish Fed is always bullish for equities, but that only holds in a resilient economy. It breaks down when dovish policy triggers an unwind in cross-border positioning.

If you have followed my research, you know that long-end rates always price central bank policy errors. When the Fed cuts too aggressively, long-end yields rise and the curve bear steepens to counter the mistake. The Fed’s advantage right now is that inflation expectations (chart: 2 year inflation swaps) have been collapsing for a month, which shifts the balance of risks and gives them room to be dovish in the short term without igniting meaningful inflation pressure.

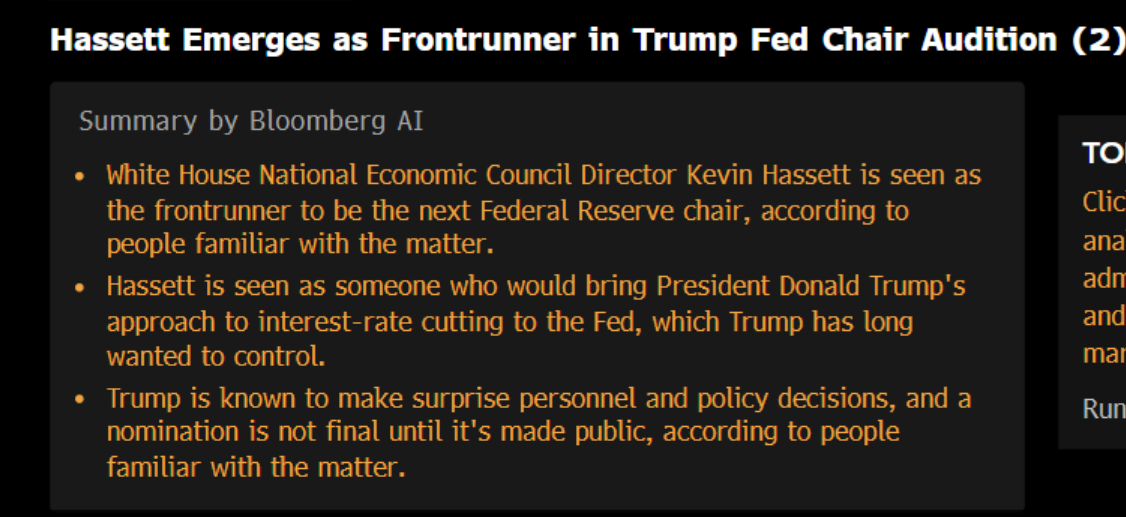

As inflation expectations are falling, we are getting news about a new Fed chair who will come in next year and likely be more aligned with Miran than the rest of the other governors:

If the Fed brings the terminal rate (currently sitting at the 8th SOFR contract) more in line with the change in inflation expectations, this would begin to bring real interest rates LOWER and weaken the dollar: (since inflation risk just fell, the Fed has room to do this)

We have seen the recent rise in real interest rates (white) cause the dollar (blue) to slow its downward momentum, but this is creating a larger imbalance that is setting the stage for further cuts, which will likely push the dollar lower.

If Trump wants to reverse global trade imbalances and confront China in the economic conflict and the AI race, he needs a materially weaker dollar. Tariffs give him the negotiating leverage to secure trade deals that align with a weaker-dollar strategy and preserve U.S. dominance.

Here is the problem. Trump and Bessent have to thread the needle: avoid a politically damaging outcome going into the midterms, manage a Fed with several governors who are far less dovish, and hope that a weaker-dollar strategy does not trigger an equity selloff by foreigners that widens credit spreads into a vulnerable labor market. That combination could easily tip the economy into a recession.

The biggest risk is that valuations are at historic extremes, which makes equities more sensitive to liquidity shifts than ever before. This is why I believe we are approaching a major inflection point over the next 12 months. The number of potential catalysts that could trigger an equity selloff is rising sharply.

“What important truths do very few people agree with you on?”

The market is sleepwalking into a structural risk that almost no one is pricing: an engineered dollar devaluation that turns what investors assume is a tailwind into the primary source of volatility over the next year. The complacency around a weaker dollar is the same complacency that surrounded mortgages before 2008, and it is precisely why a deliberate devaluation would hit risk assets far harder than investors expect.

I firmly believe that this is the most overlooked and misunderstood risk in global markets. I have been actively building models and strategies around this single tail event so that I can be short the market with size when a real capitulation occurs on a structural basis.

Timing The Macro Inflection Point:

What I want to do now is tie these ideas directly to the tangible signals that reveal when this specific risk is rising, as cross-border flows begin to shift the structure of macro liquidity.

Positioning unwinds happen often in U.S. equities, but understanding the driver behind them determines how severe the selling pressure can become. If the unwind is driven by cross-border flows, the fragility is far greater, and the level of caution required is significantly higher.

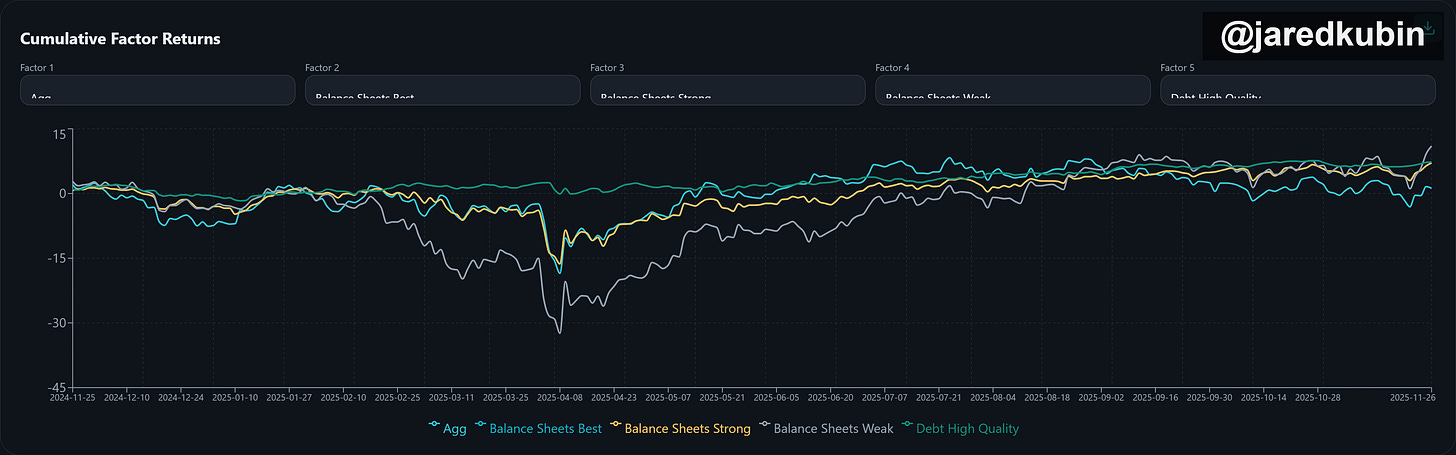

The chart below shows the primary periods of time when cross-border positioning is beginning to create more selling pressure in US equities. Monitoring this will be critical:

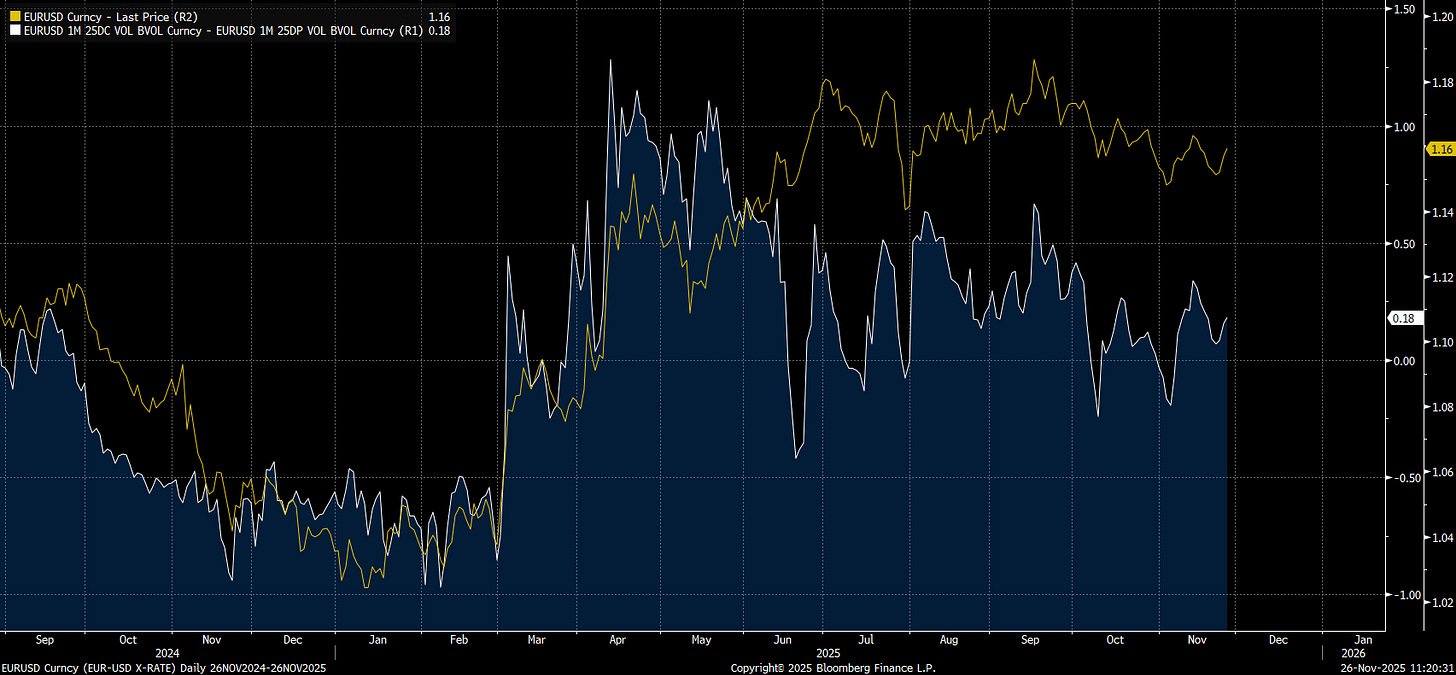

Notice that since the EURUSD rally during the March selloff, when call skew surged, the market has held a higher baseline level of call skew. That elevated base is almost certainly tied to the underlying structural positioning risk in cross-border flows.

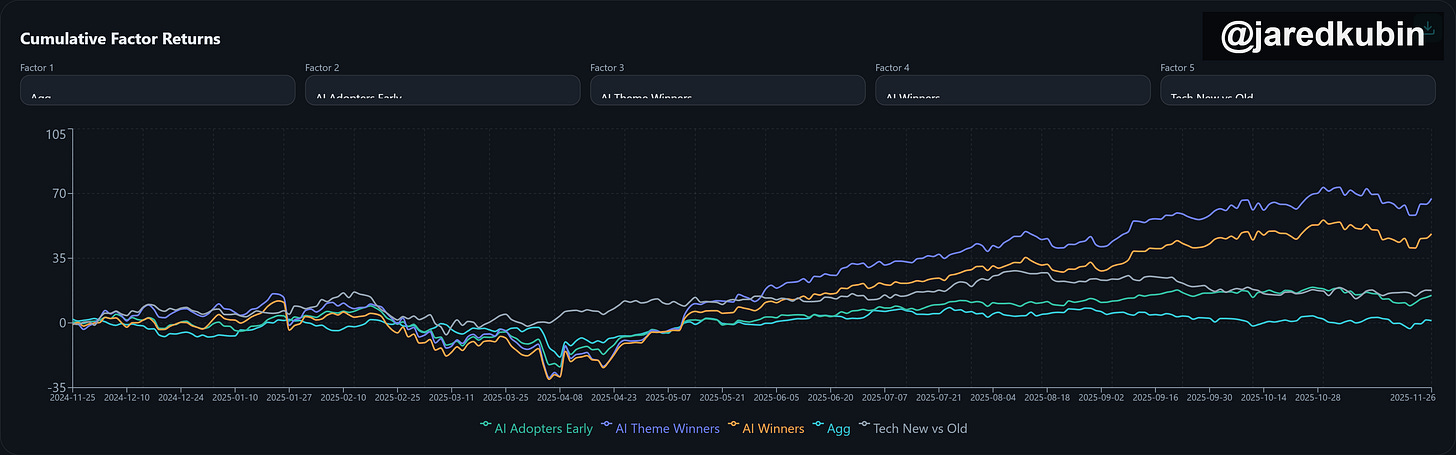

Anytime cross-border flows are the source of liquidity expansion or contraction, it is linked to the net flows through FX. Understanding WHERE foreigners are putting up and taking down exposure in US equities is critical because it will function as a signal about risk beginning to increase. The primary way I suggest people track this is through the factor models at https://www.liquidationnation.ai/. The underlying performance of factors, sectors, and themes is a critical signal in understanding HOW AGGRESSIVE flows of capital are functioning in the system.

This will be especially important for the AI theme, as more and more capital gets concentrated disproportionately:

In order to explain HOW these flows connect further, I will be publishing an interview for subscribers the first week of December with Jared Kubin (you should follow him on twitter: LINK), the founder of https://www.liquidationnation.ai/, who has been an invaluable resource in my own learning journey.

The primary signals for WHEN cross-border selling occurs are:

The dollar is selling off against major pairs as cross-asset implied volatility rises. Watching skew on major pairs will be a critical signal for confirmation (you can do this on the CVOL tool: LINK)

Equities sell off as the dollar falls. Downside in equities will likely be led by the highest beta names/themes underperforming as low-quality stocks get crushed (this is why you want to follow https://www.liquidationnation.ai/)

Cross-asset AND cross-border correlations are likely to go to 1 as the largest global imbalance has even a small unwind. Watching equities and factors in other countries will be critical.

The ultimate signal will be if the Fed tries to make some type of liquidity injection that actually causes the dollar to sell off even further and amplify equity selling pressure. This would be even more dangerous if stagflationary pressures were occurring domestically due to an orchestrated dollar devaluation from policy. (see Brad Setser’s article on this: https://www.cfr.org/article/foreign-money-flowed-out-us-not-during-global-financial-crisis )

Even though gold and silver rallied marginally during the cross-border selling earlier this year, they still sold off when a true capitulation took place because they are cross-collateralized with the entire system. While holding gold and silver likely has upside, they will not provide diversification benefit during a real blowout in the VIX. The only way to benefit will be from actively trading, owning hedges, being short the dollar, and being long volatility.

Here is the biggest problem, though: We are in a period of the cycle where holding cash has a lower and lower real return. This is systematically forcing capital out the risk curve to get positioning net long before liquidity shifts. Timing this shift will be key because not being long equities during a credit cycle has risks just as significant as not being hedged or in cash during a bear market.

(I am long gold, silver, and equities right now because we still have upside in liquidity forces, which I laid out for paid subscribers: LINK)

The Macro End Game:

The core message is straightforward: global markets are overlooking the single most important risk of this cycle. A deliberate weakening of the dollar, colliding with extreme cross-border imbalances and stretched valuations, is setting up a volatility event that echoes the same complacency we saw before 2008. You cannot know the future with certainty, but you can analyze the present correctly. And the present is already signaling that pressure is building beneath the surface.

Understanding these mechanics is essential because it tells you exactly which signals to monitor as this risk moves closer. Awareness itself is an edge. Most investors still assume dollar weakness is automatically bullish. That assumption is as dangerously misplaced today as the belief that mortgages were “too safe” in 2007. This is the quiet beginning of the macro endgame, where the structure of global liquidity and currency dynamics becomes the decisive driver of every major asset.

For now, I remain bullish equities, gold, and silver. But the storm is forming. And when my models begin to show incremental increases in this risk, I will shift bearish on equities and publish that shift immediately for subscribers.

If 2008 taught us anything, it is that the warning signs are always visible if you know where to look. Monitor the right signals, understand the dynamics, and you will be prepared when the tide turns.

The information on this website/Substack is for information purposes only. It is believed to be reliable, but Capital Flows does not warrant its completeness or accuracy. The information on the website/Substack is not intended as an offer or solicitation for the purchase of stock or any financial instrument. The information and materials contained in these pages and the terms, conditions and descriptions that appear, are subject to change without notice. Unauthorized use of Capital Flows websites and systems including but not limited to data scraping, unauthorized entry into Capital Flows systems, misuse of passwords, or misuse of any information posted on a site is strictly prohibited. Your eligibility for particular services is subject to final determination by Capital Flows and/or its affiliates. Investment services are not bank deposits or insured by the FDIC or other entity and are subject to investment risks, including possible loss of principal amount invested. Your use of any information which is proprietary to Capital Flows or a third-party information provider shall only be used on individual devices without any right to redistribute, upload, export, copy, or otherwise transfer the information to any centralized interdepartmental or shared device, directory, database or other repository nor to otherwise make it available to any other entity/person/third party, without the prior written consent of Capital Flows.

Super interesting and informative--somewhat scary, too.

Cap, have you read "The Big Print" by Lawrence Lepard? He basically comes to a similar conclusion, but believes that the collapse of the dollar will cause a significant rally in Bitcoin. I imagine you think Bitcoin would be similarly susceptible to a major correction as you noted for gold and silver. Would love your thoughts.

What a banger report

Bless the maker and his works