Macro Report: On The Edge Of Volatility

A deep dive into how the credit cycle impacts growth and inflation

30,000 Ft Macro:

The macro regime has changed A TON since the beginning of the year and it is very easy to lose perspective for WHERE we are. In this report, I want to set the macro context and then zoom all the way into HOW interest rates fit into this context.

The main point I want to start with is how this idea of “Don’t fight the Fed” is one of the most misleading statements in the market today. Why? Because every agent in the economy functions under a specific set of constraints. These constraints frame the distribution of probabilities for ALL actions.

The Fed has constraints on them that are significant but the market excessively focuses on the constraints of a recessionary environment. People believe the Fed will be “forced to cut” but not that the Fed will be “forced to hike.” Why would people believe only one side of the distribution of constraints? Because there continues to be an anchoring to this “inevitable business cycle” framework that a recession is the next macro event on the timeline.

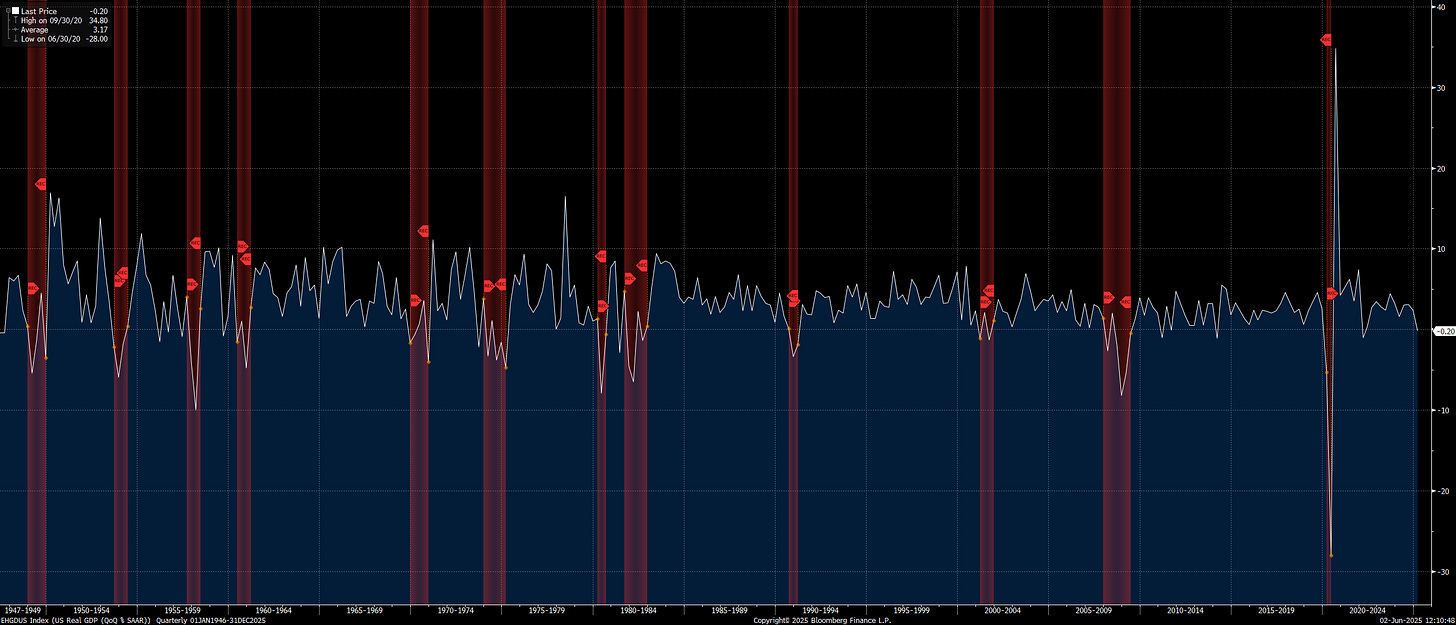

Saying that a recession will take place in the future is like saying the Earth will continue to orbit around the sun, everyone knows this which is why it provides ZERO value. Right now real GDP is sitting in negative territory just after the market hit peak fear due to the tariff risk.

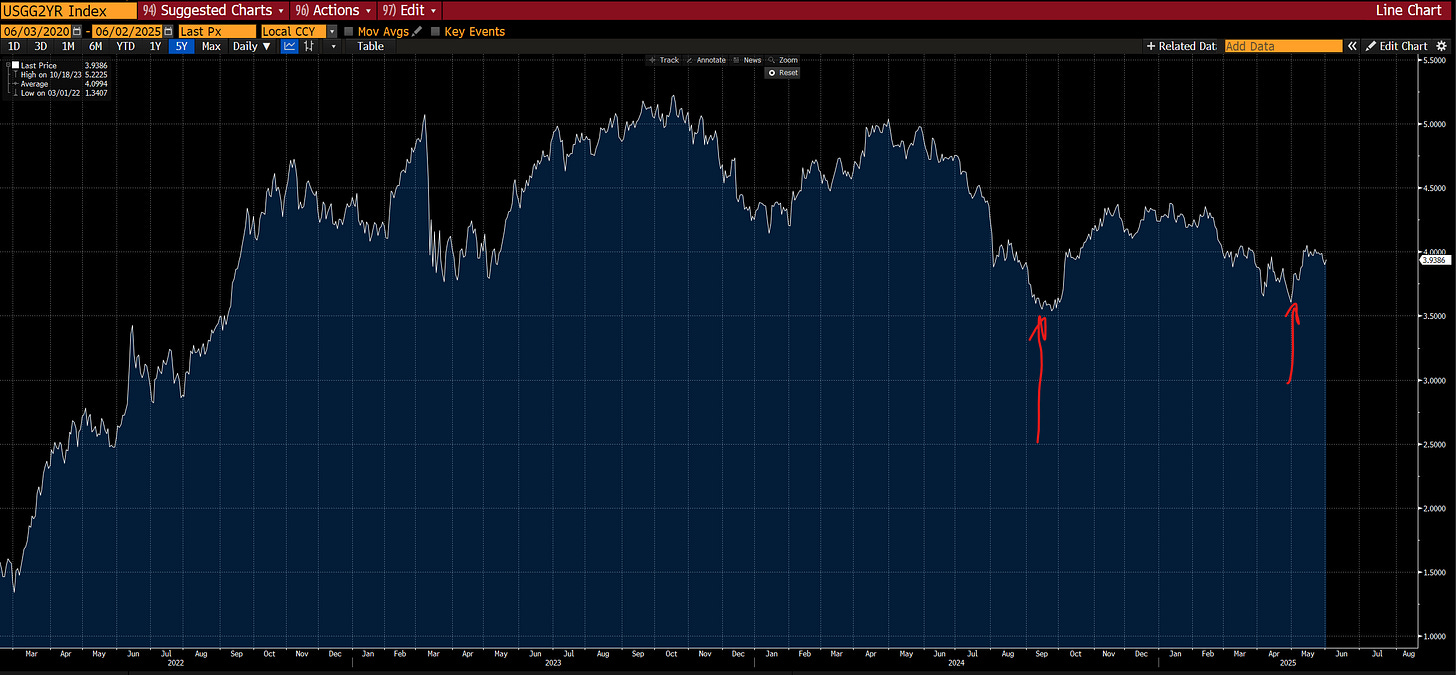

The problem with this is that everyone extrapolated it to the downside and priced A TON of rate cuts by the Fed. This is why the 2-year interest rate moved to its recent lows.

All of us know that the Fed has control over the short end but they can only influence the long end. As myself and Prometheus Research talked about in our educational webinar, the long end is determined by long-term nominal GDP expectations:

Notice that during 2021, 10-year rates went up even as the Fed pinned rates at zero. This is an indication that even if the Fed wants to hold rates at an overly restrictive or overly accommodative level, the long end will show them they need to adjust. So notice that we have just begun to have 10-year rates move ABOVE Fed Funds over the last 3 months.

The Z5 and Z6 SOFR contracts are showing HOW MUCH the interest rate market is pricing cuts by exact FOMC meetings. You will notice that at the extreme the forward curve was pricing 125bps (left chart) of cuts for this year! The Z6 SOFR contract (right chart) was pricing 150bps of cuts at the extreme when recession fears were at their highs. What is happening now? Everyone is realizing that betting on a recession is a really bad idea but people arent realizing that it could get way worse. In my view, we could price 25bps in Z5 and 75bps in Z6 in the next couple of months. If this happens, it will reverberate across the duration risk curve and push long-duration bonds (TLT) even lower.

If you want to see the whole breakdown on this, see this report:

Economic Data:

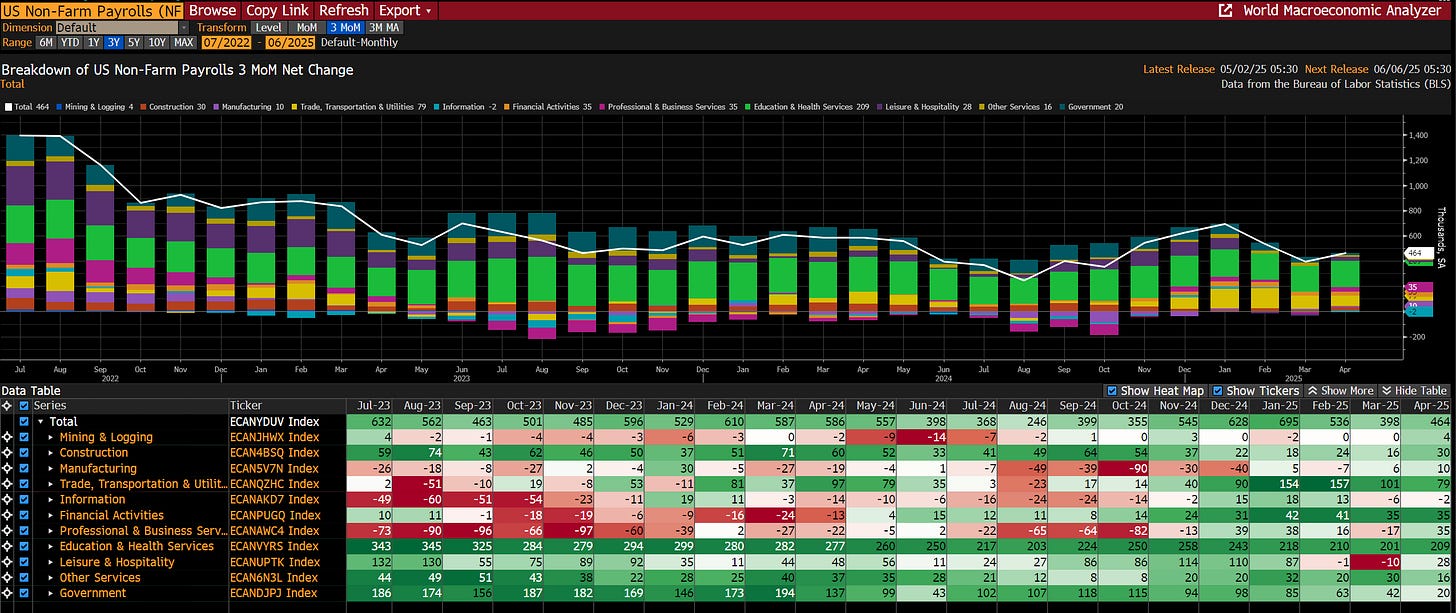

The same people who say “don’t fight the Fed,” are also severely misunderstanding WHAT the labor market forces truly are. We are seeing NFP add a significant number of jobs to the US economy every month.

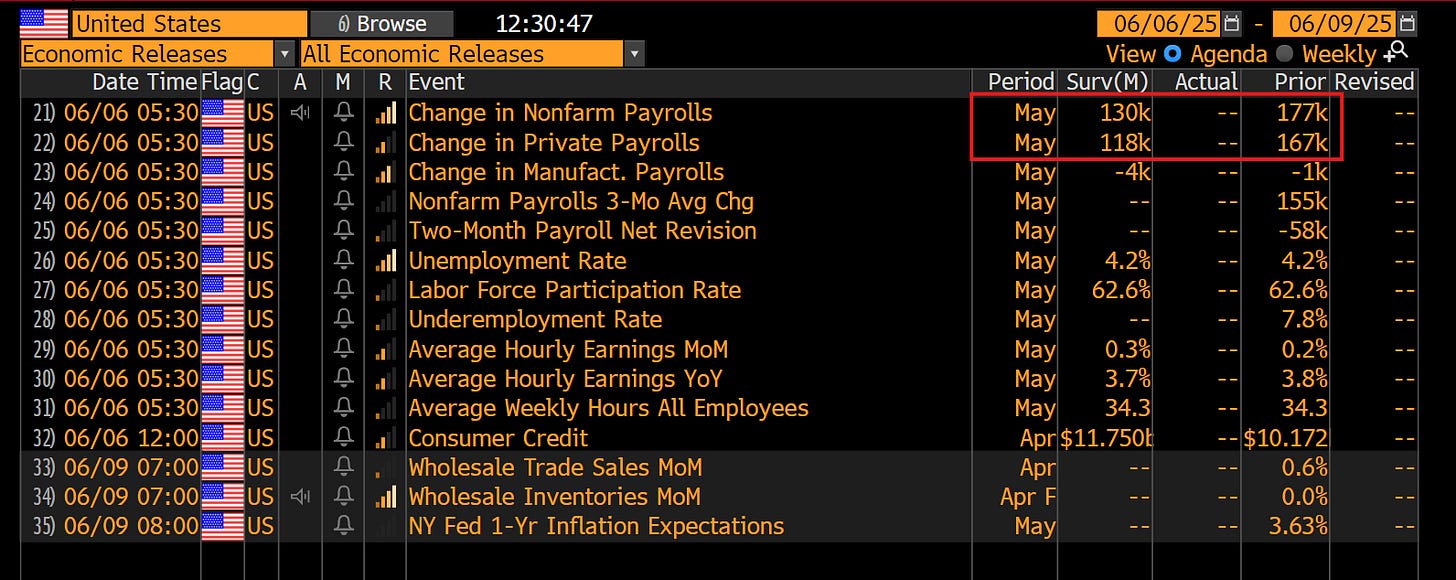

This week, we are expected to add another 130k jobs on the whole and 118k for private payrolls:

Let me explain this further, when jobs are being added to the US economy, this is almost like the Fed doing QE in financial markets. It is a massive impulse that creates a lot of money in the system. Every time someone gets hired, they start making money and spending money which in turn creates MORE money in the system. When you increase the supply of money in the system, you decrease the value of money relative to all other stuff. If this increase in the supply of money has enough of a pervasive impact, it not only impacts the short-term value of money (short-term bills/STIR pricing) but also the long-term value of money (long-term bonds).

Just imagine if the Fed came out tomorrow and said they are going to start doing QE again, the market would gap up. When labor market data shows expansion, everyone discounts it as “just the economy”, “bad labor market data” or “don’t fight the Fed” even though long-duration bonds keep moving down.

TLT is approaching its lows again and the labor market is growing at a very steady pace.

The Choice:

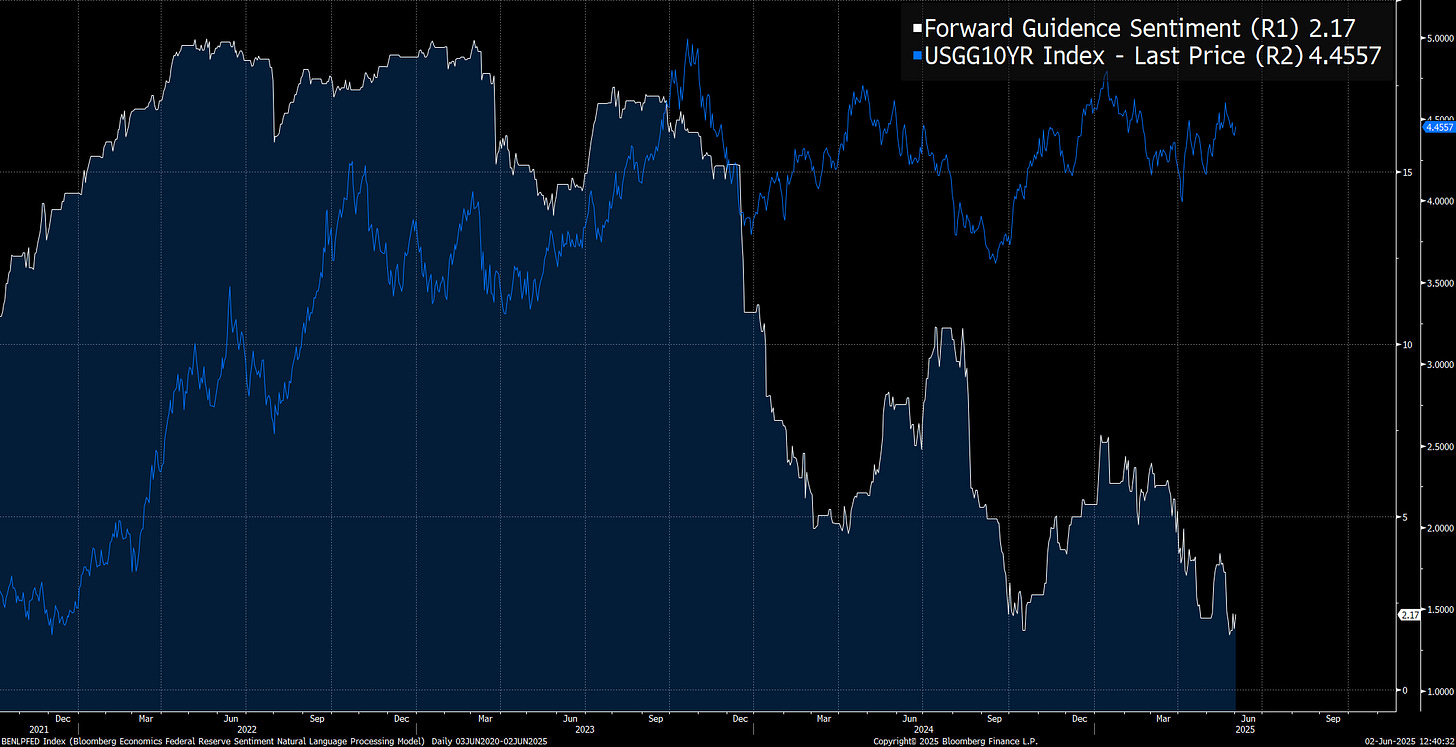

The consequence of not understanding the long end is the gap that is beginning to build between long-term interest rates (blue) and the forward guidance from the Fed (sentiment model in white). If the Fed continues to diverge from what the underlying economy and the long end of the curve are doing, there will be consequences in the US dollar and risk assets.

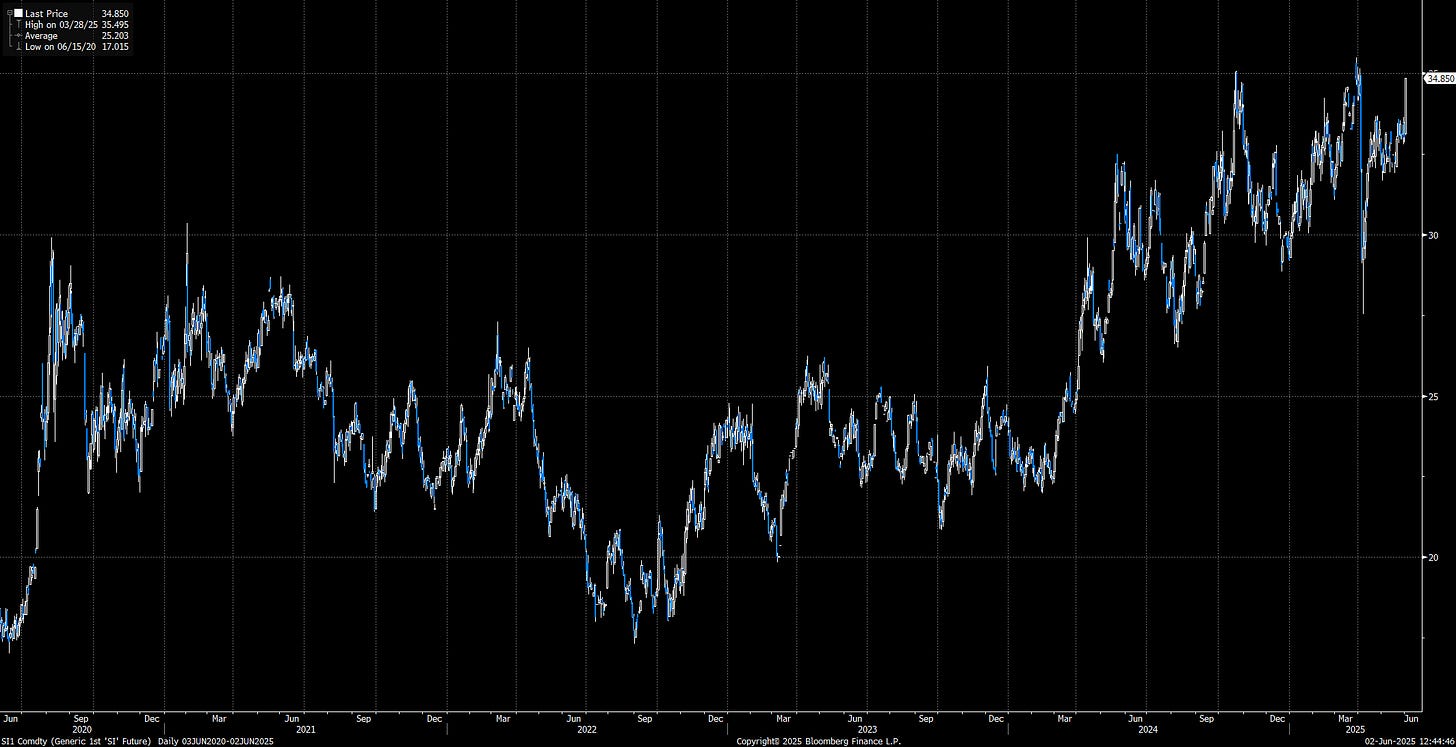

This is why gold, silver, and crude are rallying today. Crude is up with put skew positioning unwinding (CL view originally laid out here: LINK):

Gold will continue to melt up and is likely to hit an ATH soon:

And its the same story with silver:

When the Fed is falling behind the curve and creating a divergence like this, risk assets, metals, and energy will function as the release valve for capital flows until the Fed plays catch up. Once the Fed does play catch up and shift their stance less dovish, you want to be OUT OF THE WAY. Timing this dynamic will be THE key to generating macro alpha this year. This will be one of the primary focuses of the Capital Flows Substack as well as the new models I will be releasing today.

You can find the spaces recording I did today on these macro views here: LINK

As always, a Pepe for the culture:

The information on this website/Substack is for information purposes only. It is believed to be reliable, but Capital Flows does not warrant its completeness or accuracy. The information on the website/Substack is not intended as an offer or solicitation for the purchase of stock or any financial instrument. The information and materials contained in these pages and the terms, conditions and descriptions that appear, are subject to change without notice. Unauthorized use of Capital Flows websites and systems including but not limited to data scraping, unauthorized entry into Capital Flows systems, misuse of passwords, or misuse of any information posted on a site is strictly prohibited. Your eligibility for particular services is subject to final determination by Capital Flows and/or its affiliates. Investment services are not bank deposits or insured by the FDIC or other entity and are subject to investment risks, including possible loss of principal amount invested. Your use of any information which is proprietary to Capital Flows or a third-party information provider shall only be used on individual devices without any right to redistribute, upload, export, copy, or otherwise transfer the information to any centralized interdepartmental or shared device, directory, database or other repository nor to otherwise make it available to any other entity/person/third party, without the prior written consent of Capital Flows.

What's really mixing up bond managers and their view on Fed forward dovishness is the stupid political feud narrative between Trump and Powell, in addition to managers either not wanting to admit they were sucked into the media narrative of doom and gloom and they're now stuck traders, or, they just hate Trump and should not be managing people's retirements point blank.

So what I'm understanding is that the fed's forward guidance is leaning towards cuts/pauses but hikes aren't even in the conversation which is where the divergence between the long end and forward guidance is? and that divergence shouldn't be there?

the long end is going up because the economy is growing (jobs being added = liquidity being added) and nominal GDP is expected to rise.

and as long as the FED remains with dovish guidance, capital will flow into risk assets (tech? BTC?), energy, and metals (copper included? since its more tied to manufacturing).

BUT when the FEDs tone shifts toward hiking, the markets will then shift hard and fast out of risk assets/metals/energy and into..?

Wondering how that last part ends and what "timing it" would look like? would the shift in tone at whatever FED meeting that happens at likely start a bear market? but since cuts are priced in at least til the end of the year, are we looking at 2026? (this last part is where I'm mostly struggling to understand)

Thanks!!