Macro Report/Insights: Flow Signals

We are shaking positioning

Hello Everyone,

I have been very clear about my views since the FOMC high in bonds. I shared a comprehensive tweet last night, breaking down positioning. The tweet was posted perfectly, but when I woke up this morning, it was literally gone. What can you do?

So, let's focus on what is happening. There are some key things you need to know.

At the previous FOMC meeting, the market was pricing a 0% probability of a 25bps hike in June. Now, we are pricing a 33% probability.

This has caused bonds across the curve to fall back to the bottom of their range.

Now, let me explain the risk-reward scenario a bit. It's not complicated. The market was pricing cuts across the curve, and the economy is not deteriorating fast enough to justify any cuts. Therefore, the forward curve sets up for downside in bonds if the data doesn't completely fall apart.

Think about this risk-reward situation: the forward curve was pricing something unlikely, and all we needed was for the economic data not to completely collapse for bonds to fall to the lower end of their range. These were the two variables that skewed the risk-reward balance.

From this perspective in bonds, you can begin to see why I have had a bearish view on gold and a bullish view on the Dollar against the Euro.

Think Bigger Picture:

The setup mentioned above was very short-term. I want you to think bigger picture. What is happening?

We are experiencing a short squeeze in equities and flushing long positioning in bonds. I believe this is all setting the stage for a larger equity sell-off and bid in bonds.

The market has an excellent way of finding the point of maximum pain before reversing. There is a reason we aren't shorting the index right now and are long the Dollar against the Euro.

Switching Gears:

Several other thoughts:

Sector rotations continue to show tech and communications leading the way in this short squeeze:

NVDA is a perfect example of this. The simplest mention of “AI” and the stock goes to the moon.

One of the most obvious things is a recent article about Steve Cohen. Essentially, Cohen says he's bullish on stocks because of AI. Now, you might think, "Oh wow, Steve Cohen, who has exceptional returns and is really good at trading." Yes, Cohen runs an incredibly successful hedge fund. But he's one of the most competitive individuals in the industry. Do you really think he's here to help you out of the goodness of his heart? He uses every advantage possible! If anything, this signals to me that I want to be out of all AI stocks.

These types of situations occur frequently. Big players often appear on CNBC and discuss their portfolio before they change their position. If you haven't read it, I wrote an article on some of the insider dynamics of the industry:

What to watch:

In my last article, I mentioned how you need to keep a close eye on the Yuan given the data prints we saw out of China. This is directly connected to the price action of gold, bonds, and equities.

Weston Nakamura at Blockworks did an exceptional video on this. I would encourage all of you to watch it: https://twitter.com/acrossthespread/status/1659129704400699394

I am closely monitoring all commodities right now because if the dollar is bidding against all major currencies, especially the Yuan, commodities could make considerable moves to the downside.

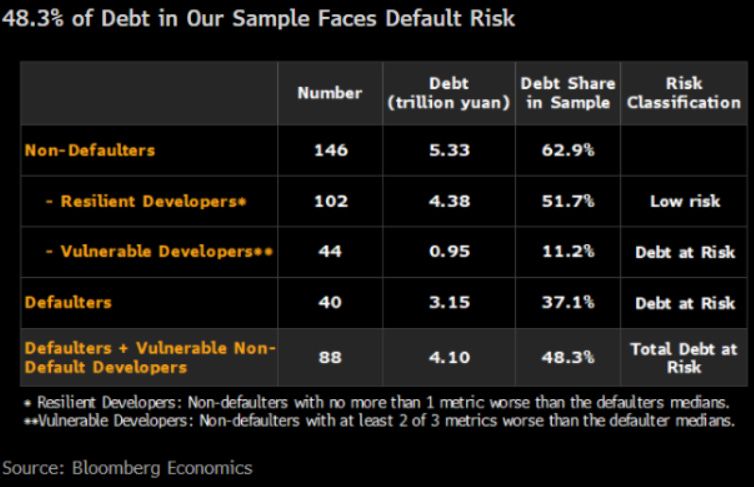

China has an exceptionally bleak outlook, and we are in the very early innings: Given the current debt metrics, Bloomberg estimates that 11.9% of GDP is at risk of default. Here's the deal, none of us know the real numbers, but they are likely MUCH higher.

I referenced this chart in a previous article: Needless to say, China is in for a tough decade. When the time comes, I will be trading it.

Thriddio Asset Management shared a great chart in their most recent Substack: The forwards are already leading the way for a strong dollar.

Final Thoughts:

In my opinion, we are in the final stages of a bear market rally where shorts are getting squeezed and uninformed money is going long. This won't end well. Remember, you earn 4.20% (current 2-year yield) to sit on the sidelines and watch.

I am always executing a lot of trades, but the main one I have shared on this Substack is the long dollar one. I have been patient, but the time will come when I will be executing a lot more, so be ready.

As always, none of this is investment advice!!!

Thanks for reading!

So, when you have this view—bonds down, dollar up, commodities down, etc.—do you trade them all or only pick one, like going long on USDEUR, since they are all the 'same' trade or at least based on the same view?

Great article!

I love the update