Macro Report/Insights: Liquidity, Gold and BTC

How does positioning connect to liquidity?

Let's take a step back for a minute. We need to remember to contextualize the information and insights we have in the proper context and timeframe. The very first article I wrote covered this dynamic:

I would encourage everyone to read it because each person's assets, liabilities, and goals are different. For example, if you are not able to be an active participant in markets, it's probably unwise to try to make decisions based on the short-term insights I share here. For instance, I shared the EURUSD trade. Sure you could trade it but you could also use it as a bigger picture signal or as a learning experience. And remember, the position could always get stopped out! *** And remember, none of this is investment advice!!!!!!*****

Macro Insights:

There are several macro insights I want to go over relating to asset markets:

First, Prometheus Research recently released their macro report. This is one of the few resources I read religiously. I wanted to connect a couple of thoughts to this.

It is also my view that we are likely to enter a recession sometime in the latter half of this year:

The main idea I wanted to bring attention to is the debt service chart Prometheus shared. As you would expect, debt service payments move in lockstep with interest rates. However, there are time lags because debt needs to be rolled over at higher rates.

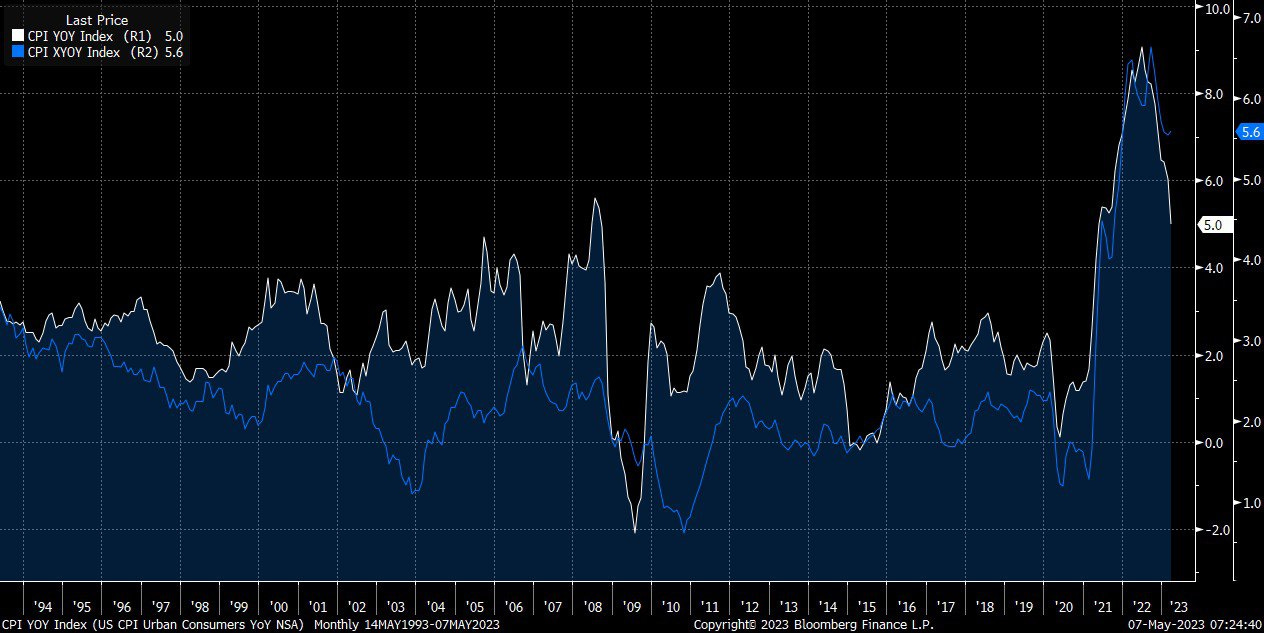

The unique dynamic we find ourselves in today is that a massive amount of debt was taken out while rates were at 0. Then we embarked on one of the fastest hiking cycles in history. Needless to say, a time lag should be expected. This time lag is part of the reason we have seen a divergence in headline and core CPI. Headline CPI includes the food and energy components, which spiked during the invasion last year and have been reverting since then. However, core CPI is directly connected with wages and the labor market which have yet to fall apart.

The issue is that until companies face higher debt service costs that put their profits at risk, they aren't going to lay people off. However, the preconditions for layoffs exist. What we are waiting for is the feedback loop of higher debt service costs causing layoffs, which thereby increases credit risk, which in turn makes debt service costs higher.

All of this connects with several tweets I did on gold, oil, and liquidity:

Gold:

https://twitter.com/Globalflows/status/1654348738004131842

Implied volatility for gold has been spiking with the positive price action recently. Why is this? The liquidity impulse from the Fed, due to the base effects after 2022 and the liquidity injection after the SVB crisis, has pushed up markets and specifically gold. However, I am not very comfortable being long gold here from a fundamental macro perspective, unless we see a continuation of this liquidity impulse.

Right now, we have cuts priced for almost every meeting into the end of the year. We saw the NFP print on Friday come in above expectations. This shocked the positioning that believed we would immediately move into rate cuts. Nick Givanovic brought attention to this on Twitter and provided some excellent insights on it.

I view this idea as connected to gold because as we shock the forward curve with prints like NFP or CPI, gold is likely to experience some negative price action as well. As these prints take place, I also expect the dollar to rally against the Euro marginally. I did a short thread on the dollar here: https://twitter.com/Globalflows/status/1654342169673728000

Gold and BTC:

When we think about liquidity, it is never evenly distributed or occurs in the same way. This is why monitoring a multiplicity of signals is key.

I wanted to bring attention to BTC in this context. Bitcoin is similar and dissimilar to gold in several ways, and understanding these aspects allows you to interpret the price action. In terms of just broad macro flows, real rates are the primary driver for both.

However, there are periods of time when divergences occur. The way that I think about Bitcoin is that it's a risk-on play for liquidity expansion. However, BTC doesn't have the same safe-haven qualities as gold, as evidenced by its price action during geopolitical risk and credit risk events.

Notice that BTC outperformed gold on the upside during 2021 when the liquidity spigot was running hot (notice that the bottom in real rates and the DXY in 2021 overlapped with the tops in BTC). However, the inverse occurred when the Fed started hiking and geopolitical shocks occurred.

Since both gold and BTC are assets without cash flow components, their price action is directly connected to the amount of money in the system. When there is a surplus of money in the system compared to assets, these assets function as "release valves" as capital moves out the risk curve. This is why monitoring the relative performance of all assets as they connect with the price and quantity of money is incredibly informative for knowing where you are in the cycle.

The other signal I would watch is the GLD/GDX ratio. GLD is the gold ETF, and GDX is the gold miners ETF. Generally speaking, when the VIX spikes, GLD outperforms GDX, which makes sense. But you can also compare this with regimes of rising/falling real rates and begin to gain insight into potential inflection points.

I have some strategies running on BTC, but I am working on pulling together more research on it for you guys. If you want to follow someone who has a great handle on the BTC market, check out: https://twitter.com/Trader_XO and his YouTube channel: https://www.youtube.com/TraderXO

Oil:

I did a quick tweet on oil as well, but basically, what happened is we had a gap down of 7% at the futures open the other day. When you have capitulation like this, you almost want to buy blindly, betting on short-term mean reversion since it's clear that stops are getting run and people are being forced to unwind their positions.

Oil tweet: https://twitter.com/Globalflows/status/1654175062486810652

Since I did this tweet, oil is up. I expect some more upside but after the next couple of green candles, I would be weary of chasing.

Positioning:

The types of capitulation in positioning we saw in oil on a short-term basis are what you want to look for across all assets and all timeframes. A simple example is when the BoJ began to intervene in the currency market last year, which set a top in the USDJPY exchange rate.

Events like this are usually the things that create market inflection points. Furthermore, if you understand how this is reflected across all asset classes, then you can have a multiplicity of signals that provide insight into your views. This is why I view a loose connection between gold and the forward curve right now. However, I also realize we are almost at all-time highs, and if some event happens, gold could easily break out, and when it does, it could be epic.

Thanks for reading!

I'm totally with you on Gold: really good potential as an inflection point (low risk entry, good R), but the odds of a breakout are also high.

Tails on either side 🤝