Macro Report/Insights: San Diego and CPI

Key flow signals from CPI

Hey everyone,

I hope the week has treated you well!

I spent a little time traveling for work this week but obviously, you need to mix in some pleasure :). I was in San Diego and got to spend some good time with friends. Here are some pictures:

Went to an exceptional Mexican restaurant:

Went to the beach and sat by the pool:

And the sunsets were just beautiful:

All in all, it was a great time. I made some good progress on projects and felt very refreshed.

Got to enjoy the good times……..

Markets:

Alright, let’s talk about some big-picture ideas and markets.

First, there was a great roundtable interview shared by an account I follow on Twitter (link) who always shares exceptional insights.

The interview is primarily focused on energy markets:

Based on this interview and from my own analysis, I think oil is range bound from here. From a bigger-picture perspective, we have had two OPEC cuts that have put downward pressure on the price of oil. However, we have continued to see support around $67:

Let’s shift to the data releases from this past week:

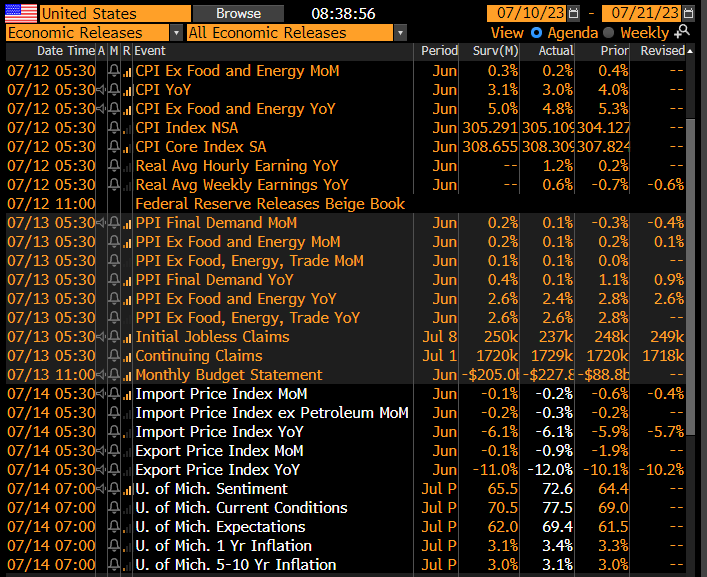

We all know inflation is a problem but the market has had an interesting setup ever since the CPI print came in below expectations. Notice that core inflation came in at 4.8% instead of the expected 5.0%:

As you would expect bonds rallied on the print:

Gold rallied as well:

I know everyone has been focusing on CPI being below expectations but let me draw your attention to several signals most people aren’t talking about.

Keep reading with a 7-day free trial

Subscribe to Capital Flows to keep reading this post and get 7 days of free access to the full post archives.