My Large Macro/Crypto Bet: Updated Analysis, Fair Value Indicator & Full Report

The evidence is stacking up

PURR: Q4 2025 Earnings, Updated Fair Value Model & Live TradingView Indicator

If you have been following my work, then you know I have two simple goals:

Map the macro regime so that I stay on the right side of it.

Find asymmetric bets that function as homerun trades.

This process is what I lay out for paid subscribers every day.

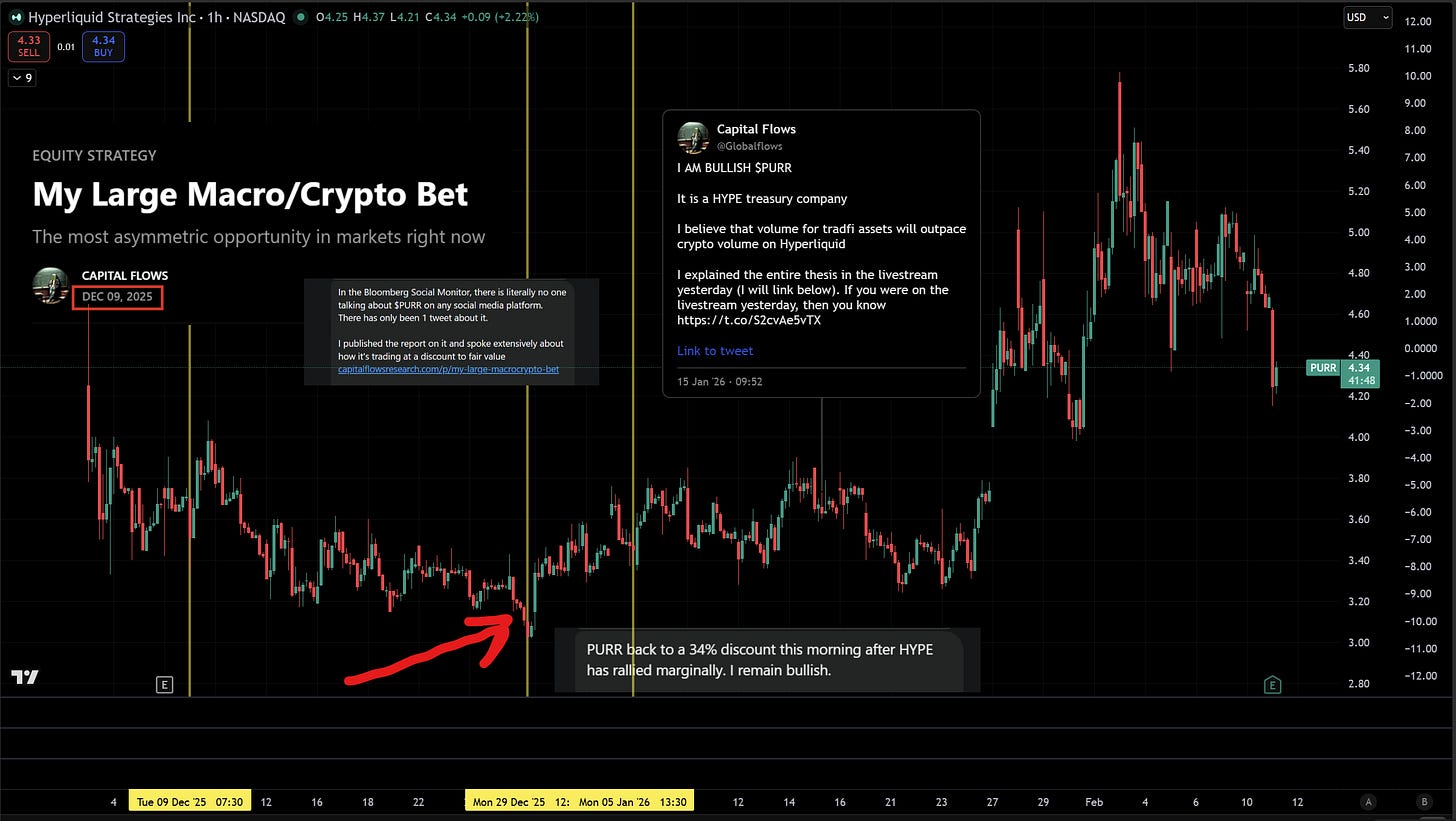

PURR has been one of those bets from the very beginning. I first published the thesis on December 9, 2025, titled “My Large Macro/Crypto Bet,” when Bloomberg Social Monitor showed literally no one was talking about $PURR on any social media platform. There had been one tweet about it. One. I published the full research report (link), spoke extensively on the livestream about how it was trading at a discount to fair value, and laid out why I believed volume for traditional financial assets would outpace crypto volume on Hyperliquid.

By January 15, the thesis was playing out exactly as outlined. I reiterated: I AM BULLISH $PURR. Not because of hype or momentum, but because the fundamental evidence was compounding in the direction I had mapped out.

Here is the progression on the chart:

Every step of this was documented in real time for subscribers. The initial report. The livestream breakdown. The follow-up analysis when price action confirmed the thesis. And now, with Q4 2025 earnings in hand, the evidence has only gotten stronger.

What Just Happened

PURR reported its first set of earnings as a public company. The data confirms everything I laid out in December and then some:

Management deployed $140 million in 63 days, buying HYPE at an average of $25.94 (well below the listing price and today’s price)

HYPE token holdings grew 40% from 12.5M to 17.5M tokens

The company is running at roughly $7M/year in operating costs, and staking revenue alone could nearly cover that

Zero debt. 95.6% equity capitalization. Fortress balance sheet.

HIP-3 non-crypto perps (equities, forex, commodities) now represent >25% of total Hyperliquid volume, confirming the decorrelation thesis I outlined from day one

At today’s prices (PURR $4.43, HYPE $29.07), the stock trades at roughly 1.05x Adjusted NAV. That is a 5% premium to liquidation value for a company that is the only institutional on-ramp for the #12 token by market cap, backed by a former Barclays CEO and a former Federal Reserve president, with a $1 billion equity line of credit for further accumulation.

The market is still not paying attention. And that is the opportunity.

What’s Below

Below the paywall, you will find two things:

The full Q4 2025 earnings breakdown and updated thesis with scenario analysis from bear to max bull.

A custom TradingView indicator that maps PURR’s real-time fair value and mNAV premium/discount using live HYPE prices. Overlay it on the chart and you can see exactly where price sits relative to NAV at any moment.

Keep reading with a 7-day free trial

Subscribe to Capital Flows to keep reading this post and get 7 days of free access to the full post archives.