NEW MODEL - How Are Interest Rates Moving The S&P500

The beginning of a new launch

NEW MODEL - How Are Interest Rates Moving The S&P500

Today, I am happy to announce the beginning of a new suite of models for Capital Flows!

If you have been following me for any period of time, then you understand how valuable it is to understand interest rates because they are the price of money, and ALL things are denominated in money. In simple terms, interest rates are the asymmetrical linchpin on which the entire economy and financial market turn.

If you understand WHERE interest rates are going, then you will consistently have a better understanding of the TYPE of interest rate risk and macro risk you are taking on.

The question many people have is, HOW do I connect interest rates to the specific asset I am taking views on? If interest rates move up 10bps, what is the implication for my specific situation?

This is exactly what the new suite of models will be mapping.

Interest Rate Sensitivity Regime and Scenario Analysis:

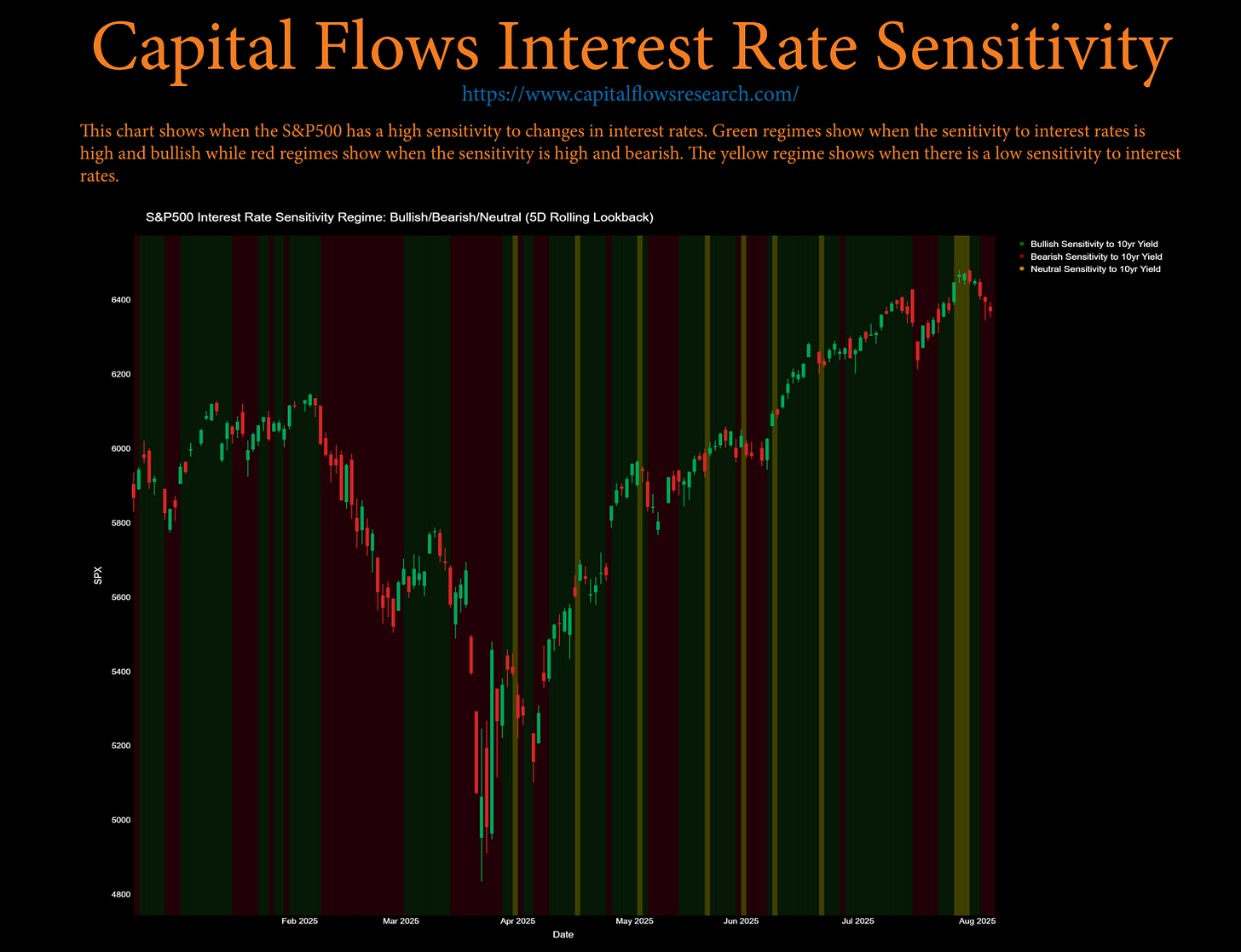

The model below takes interest rates and maps HOW they are impacting the S&P500 in either a bullish or bearish manner. In simple terms, are the current moves in interest rates helping push SPX up or down?

Then we take this regime and say, based on the current regime that we are in, where is the S&P500 likely to move for every bps change in interest rates? This could be to the upside OR to the downside. The ranges and sensitivity to interest rates are always dynamic, so the bottom panel of this model shows HOW WIDE the current range in the scenario analysis is relative to history.

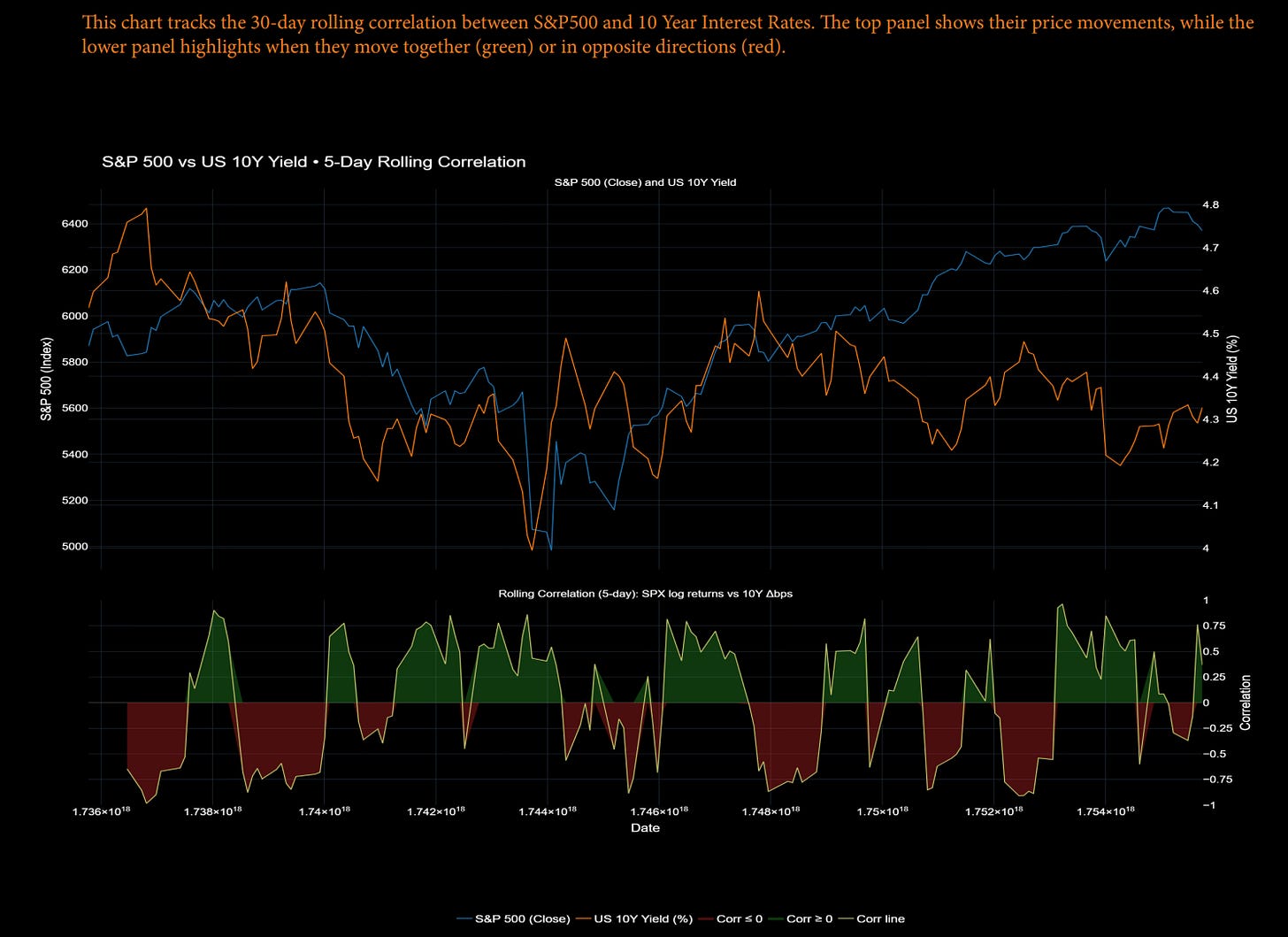

We can then gain more context for the two models above by looking at the outright chart and correlation of SPX to the 10-year, so we always know the context for WHERE we are:

The full PDF for these models on the S&P500 is available here:

Is There More?

Having a model for the S&P500 is nice, but don’t interest rates impact everything?

Beginning Sunday, I will be sending out models on how interest rates are impacting EVERY MAJOR ASSET AND EQUITY SECTOR.

These will be sent out and updated every single day in the macro regime tracker section (link)

There will also be some additional special things, but I will save that for Sunday.

“You wasted $150,000 on an education you coulda got for $1.50 in late fees at the public library.”

The information on this website/Substack is for information purposes only. It is believed to be reliable, but Capital Flows does not warrant its completeness or accuracy. The information on the website/Substack is not intended as an offer or solicitation for the purchase of stock or any financial instrument. The information and materials contained in these pages and the terms, conditions and descriptions that appear, are subject to change without notice. Unauthorized use of Capital Flows websites and systems including but not limited to data scraping, unauthorized entry into Capital Flows systems, misuse of passwords, or misuse of any information posted on a site is strictly prohibited. Your eligibility for particular services is subject to final determination by Capital Flows and/or its affiliates. Investment services are not bank deposits or insured by the FDIC or other entity and are subject to investment risks, including possible loss of principal amount invested. Your use of any information which is proprietary to Capital Flows or a third-party information provider shall only be used on individual devices without any right to redistribute, upload, export, copy, or otherwise transfer the information to any centralized interdepartmental or shared device, directory, database or other repository nor to otherwise make it available to any other entity/person/third party, without the prior written consent of Capital Flows.