Observations Of The Credit Cycle Moving Into FOMC

The flows setting the stage for a larger structural change

The Feedback Loop Driving Macro Flows:

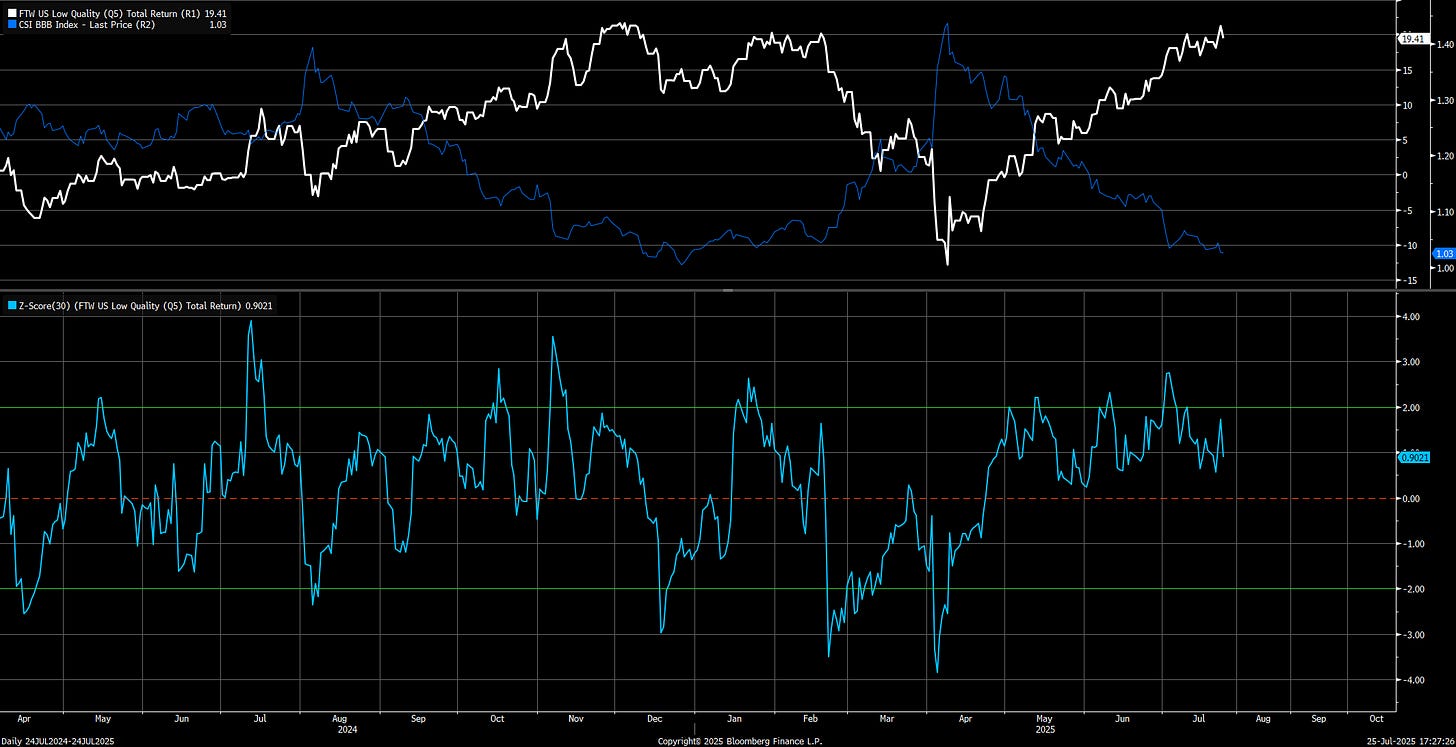

Over the last trading week, credit spreads have continued to compress, indicating that financial conditions remain highly accommodative. This is further reflected in low-quality stocks in the US (white line) maintaining their bullish trend. Additionally, the Z-Score of low quality sectors remains in positive territory, which indicates the strength of the trend in the credit cycle we are currently seeing.

This function of low-quality sectors rallying is directly linked with the logic I laid out for long-end rates here:

Keep reading with a 7-day free trial

Subscribe to Capital Flows to keep reading this post and get 7 days of free access to the full post archives.