Positioning and Microstructure

The education aritcle that you dont want to miss!

This will be the final article in the educational series. This will likely be the most helpful for those of you who actively trade. I really enjoy going through these topics specifically because they are so interesting.

Whatever your involvement in financial markets or whatever timeframe you trade, you will begin to realize that there are a lot of connections people don’t make. In my experience, bridging the gap between the previous articles and this one is where you can really make a lot of money.

So let’s get right into it!

Here was the breakdown in the original article…………

Positioning and Microstructure:

The final thing you want to account for is positioning and the microstructure of the market for a country:

Here is a broad breakdown:

Positioning and Market Microstructure:

- Financial Plumbing

- COT Positioning

- Option Positioning

- Sentiment/ ETF Flows/Mutual Fund Flows, Foreign Investment Flows.

- Active/Passive/Systematic Performance and Positioning

- Autocorrelation of assets and positioning

Microstructure of the market:

- Intraday dynamics/execution

- Globex session

- Seasonality

- Order imbalances

- Market elasticity and liquidity

- Limit Order Book and transaction characteristics

Financial Plumbing

Financial plumbing is understanding how liquidity and collateral transformation work from its inception all the way to when it gets spent in either the economy or financial markets.

This most certainly connects to our previous articles because it is about understanding HOW flows move from one balance sheet to another.

There are three major resources I would point you to on this:

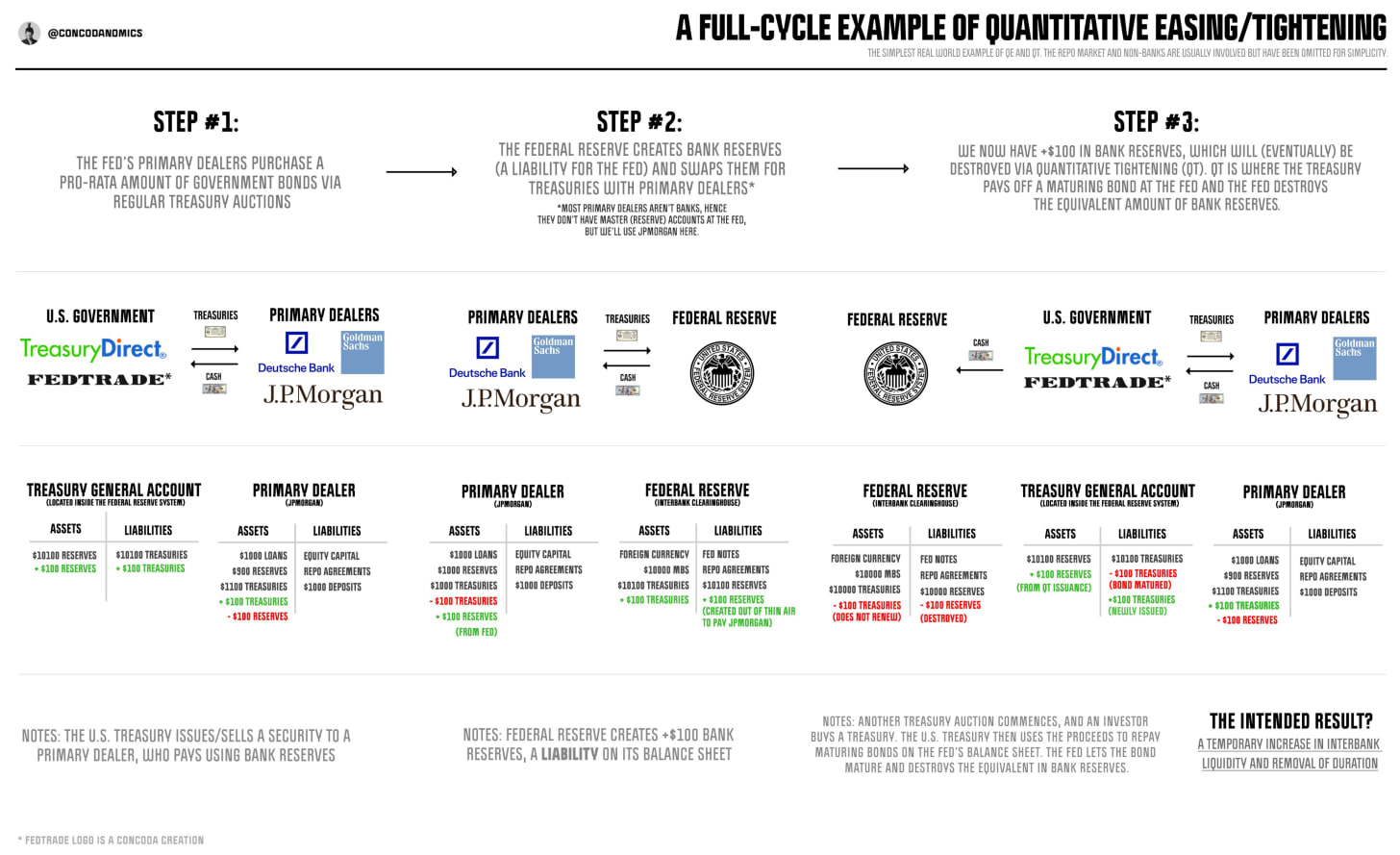

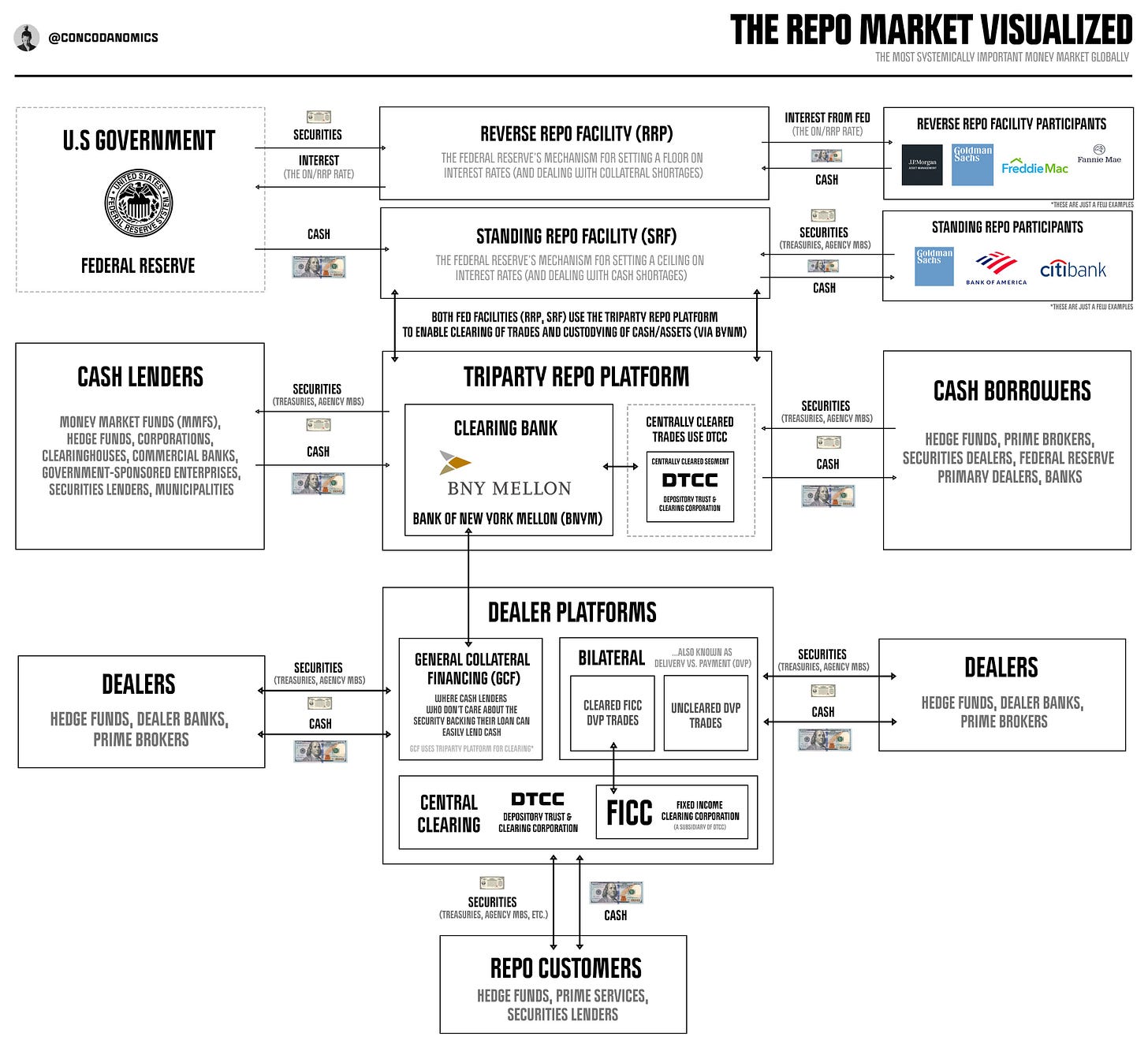

First, go through Concoda threads on Twitter.

His visualizations are the best I have ever seen:

The second resource I would recommend is Joseph Wang and his website.

Joseph does a great job at explaining these things in a very simple format.

The third resource is Michael Howell at Cross Boarder Capital. I would recommend reading his book Capital Wars and watching any interviews he does. His book was incredibly instrumental in my thinking.

The goal is to get a reasonable understanding of these moving parts.

COT Positioning

COT positioning is simply looking at positioning in the futures market. You can see this data here: https://www.cmegroup.com/tools-information/quikstrike/commitment-of-traders.html

What you want to do is look at the long-term trend, 3-month trend, and then weekly change. You can plot this with a Z-Score or rate of change.

A great example of this is the COT positioning at the short end of the curve going into the SVB banking crisis. The net positioning was very short and as soon as the news came out, everyone who was short got squeezed.

What you see is that the more positioning gets one-sided, the less it takes to cause a squeeze.

Watch COT positioning across all assets and compare it with option signals.

Option Positioning

There are several things you always need to monitor when it comes to options.

First, is the opex calendar: the idea behind this is that you need to know all the future catalysts that could potentially change flows. You will begin to see that many times inflection points occur on large opex dates.

https://www.cboe.com/about/hours/us-options/

https://www.cmegroup.com/tools-information/quikstrike/option-settlement.html

https://www.cmegroup.com/tools-information/quikstrike/options-calendar.html

Second, see what the outstanding open interest and volume for options are. Depending on the time period and notional outstanding, gamma hedging can cause the spot price to move a lot, especially in stocks.

Here is a chart:

The main resource I would suggest on this is T1alpha and Mike Green:

I always enjoy Mike’s Substacks as well:

Third, watch implied vol premium and discount. This basically compares what the option market is pricing compared to what is actually realized in the price.

Fourth, the term structure of implied vol. On SPX this would be looking at the spreads of short-dated VIX contracts to longer-dated VIX contracts.

Fifth, watch skew to see how the market is pricing the tails. This can be found on the CVOL tool: https://www.cmegroup.com/market-data/cme-group-benchmark-administration/cme-group-volatility-indexes.html#variance

Ultimately, you are trying to understand how the vol surface changes through time: Here is the vol surface of SPX.

Sixth, watch option positioning across all sectors and compare it to the sector volume. Then compare this to the insights you have generated from equity sectors as they connect to the macro regime (see previous article on this topic).

Sam has done a great job breaking this down at Roaring Meows: @roaringmeows on Twitter.

Sentiment/ ETF Flows/Mutual Fund Flows, Foreign Investment Flows.

Watching large flows into or out of ETFs/mutual funds can be incredibly insightful, especially at inflection points. This is very interesting when it contradicts COT positioning. For example, something I watch is the ETF flows of all the commodity etfs, compare them with COT positioning and then compare the implied vol of both. Some really interesting things can occur. ;)

The same thing with mutual funds and foreign investment flows.

For example, watching Japan's foreign bond buying and the Yen price action in connection with the UST market is very interesting.

Weston does a great job covering this at Blockwoks: probably one of the only podcasts I actually listen to.

All of these data points I have noted send signals. If you are correctly building a framework as to the WHY with economic and fundamental data, then you can have a much clearer understanding of risk/reward.

Active/Passive/Systematic Performance and Positioning / Autocorrelation of assets and positioning

I am actually not able to share a ton of information on this topic due to some projects I am working on but I will share some broad ideas.

Think about how much of the market is active vs passive. Think about the positioning and constraints that these individuals have. Think about how price action and volume would reflect specific circumstances where these agents are constrained to buy or sell.

An interesting paper kind of connected to these ideas: https://www.deshaw.com/assets/articles/DESCO_Market_Insights_Dispersion_in_Stock_Bond_Sensitivities_20220622.pdf

Passive management or funds with very specific systematic charters eventually create specific price action characteristics.

Again, apologies but that is all I am able to share at the moment. You can definitely do some work on this and figure out a lot of alpha.

Alright……moving to the microstructure of the market

Microstructure of the market: Any time you approach a market, you want to keep a continuous research process going on the microstructure and how it is evolving.

- Intraday dynamics/execution: Understanding intraday volume, price action characteristics, signal/noise and other related technical signals can be very helpful. I referenced a couple of papers in the original article that the wifeyalpha Twitter account tweeted.

See the wifey research drop here: probably the single most valuable resource on Twitter in my opinion!

- Globex session: This is simply monitoring returns, volume and data releases as they are priced through every Globex session (Asia, London, US).

For example, here are Yen futures with volume colored by Globex Session.

- Seasonality: I did a short Tweet on this but every asset usually has some degree of seasonality. The point is not to blindly trade seasonality. It’s knowing WHY the seasonality occurs and how this will play into the current macro setup.

Seasonality in specific commodities can be a little more intuitive for people to understand because of the weather component. Here is nat gas.

- Order imbalances/Market elasticity and liquidity/ Limit Order Book and transaction characteristics

I spend the last couple of months reading hundreds of papers and several books on these topics. It is endlessly fascinating and incredibly helpful for interpreting signal to noise as well as executing trades.

The best book I read on it was: “Trades, Quotes and Prices: Financial Markets Under the Microscope”.

Here is the PDF.

If you are just trying to keep it very simple, start by identifying imbalances based on VWAP and comparing them with Globex volume. Then use economic/earnings releases as catalysts for your decisions.

Tradingview has a basic RVWAP script if you don’t know where to start.

Conclusion!

Alright! That is it! By no means was this comprehensive or exhaustive. But if you are brand new to financial markets, it will be a helpful framework for you to take your first steps.

Here is a summary of the previous articles:

First article, research drop: Link

Second article, country analysis: Link

Third article, economic data: Link

Fourth article, asset markets: Link

Final note: in the information age, all you need is to be at the right place at the right time with the right piece of information to be successful. Developing this knowledge is how we accomplish that.

These articles are meant to provide a broad overview of this. You might be thinking, I don’t have the time to build the models and break down every aspect of the market.

That is what the future of this Substack will be about! Thanks for reading!

Great article, really appreciate your suggestions on books + new information sources. You might check this already, but the TFF report can be a useful addition to COT for estimating positioning.

Looking forward to your next articles!

Ben trovato