Real Estate Update: Office

Data Focused

Several days ago I provided a comprehensive real estate report that provided clarity on what is actually happening in the real estate sector:

I will say this over and over: Identifying tensions with robust scenario analysis will get you farther than any perma bear or bull narrative. I say this because I am actively involved in financial markets and real estate markets. I can’t afford to have extreme views that lose me money.

If you are reading this then I know you think the same way. If you can step out of the perma narratives that exist and have ruthless execution, you are already set up for success.

There are several things I want to expand on from the recent real estate report. First, office building occupancy is still well below pre-COVID levels. The Kastle data is something I watch consistently because if there is a pronounced spike in it, it might be an indication of a reversion in consumption patterns:

Vacancy is still high as absorptions are down:

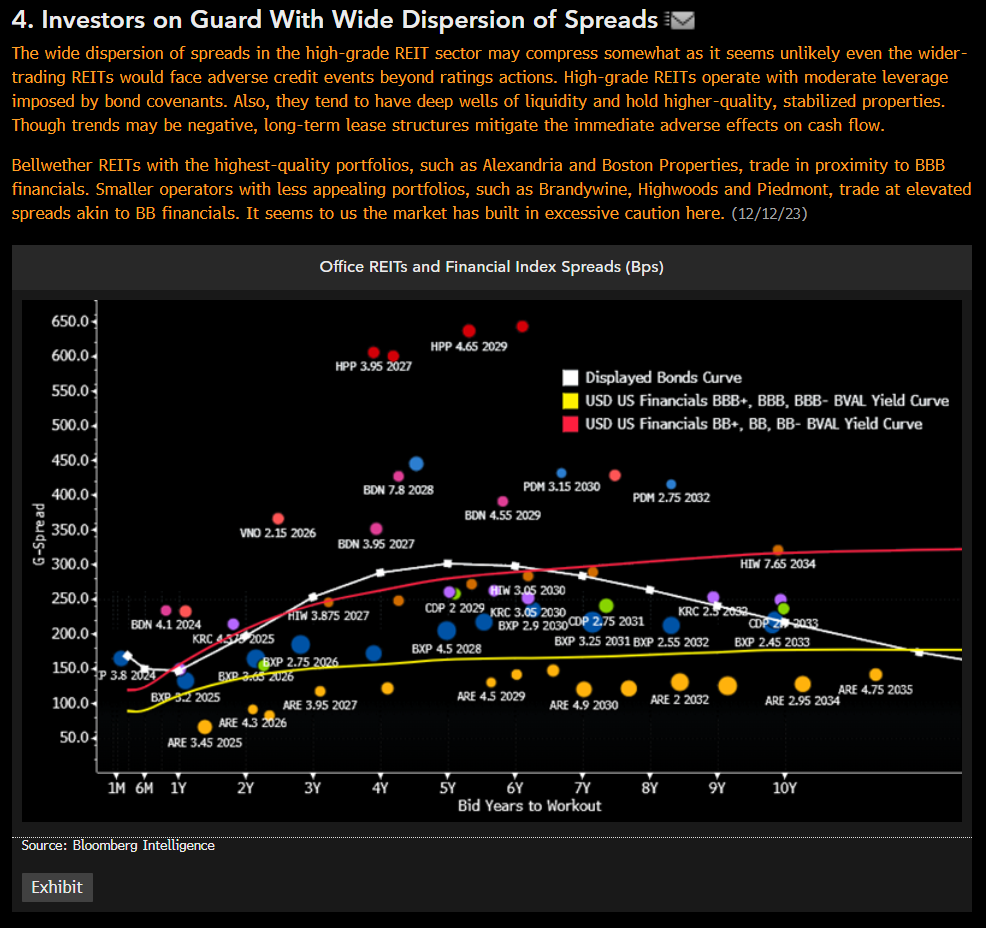

Here is a breakdown of the major office REITs and how they are pricing in risk:

When you are operating in a specific real estate sector, there is a lot of analysis that goes into correctly defining the attribution characteristics driving risk.

If you operate in the real estate sector and you want bespoke research or advising on a specific sector, send me an email at capitalflowsresearch@gmail.com

I run a lot of models on the real estate and REITs. I will say there is a lot of opportunity for generating cash flow in today’s world of idiosyncratic factors causing returns.

Remain adaptive