Recession? Credit Risk?

How far away is the "Big" event everyone is talking about?

A lot has happened in financial markets since the last publication. Things have been a little busy on my end so I am just now circling back to writing this piece.

There are a number of things I am going to touch on: Credit risk, FX, inflation and is there really a systemic risk from Silicon Valley Bank?

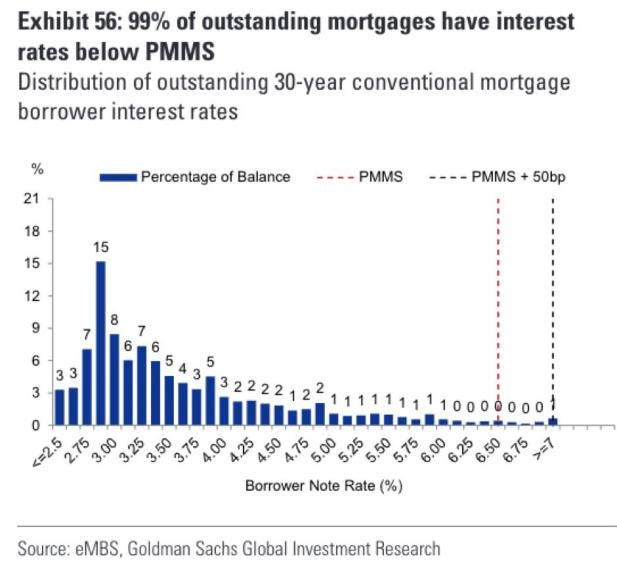

Let’s start with an inflation insight. This was a great chart from Goldman.

Why does this matter for inflation though? When the majority of mortgages have incredibly low fixed-rate mortgage payments, it means the largest expense in the consumer’s life isn’t moving with inflation. The implication is that as wages rise, I can spend more money on other things since my mortgage payment is fixed. This is actually one of the reasons inflation can remain persistent for periods of time.

Let me give you an example, if I locked in my mortgage at 3% during 2020, my monthly payment hasn’t increased. However, my nominal wages have increased considerably. So my largest expense is fixed while my paycheck grows.

Dynamics like this help drive inflation. The question is, how does inflation ever stop? Well it happens when I either lose my job or have to refinance my mortgage. It’s unlikely that I would refinance my mortgage since rates have only increased so the other main option is losing my job.

(Side note: one major reason there were so many mortgage defaults in 2008 was because there were a lot of variable-rate mortgages. There are very few variable rate mortgages this cycle. )

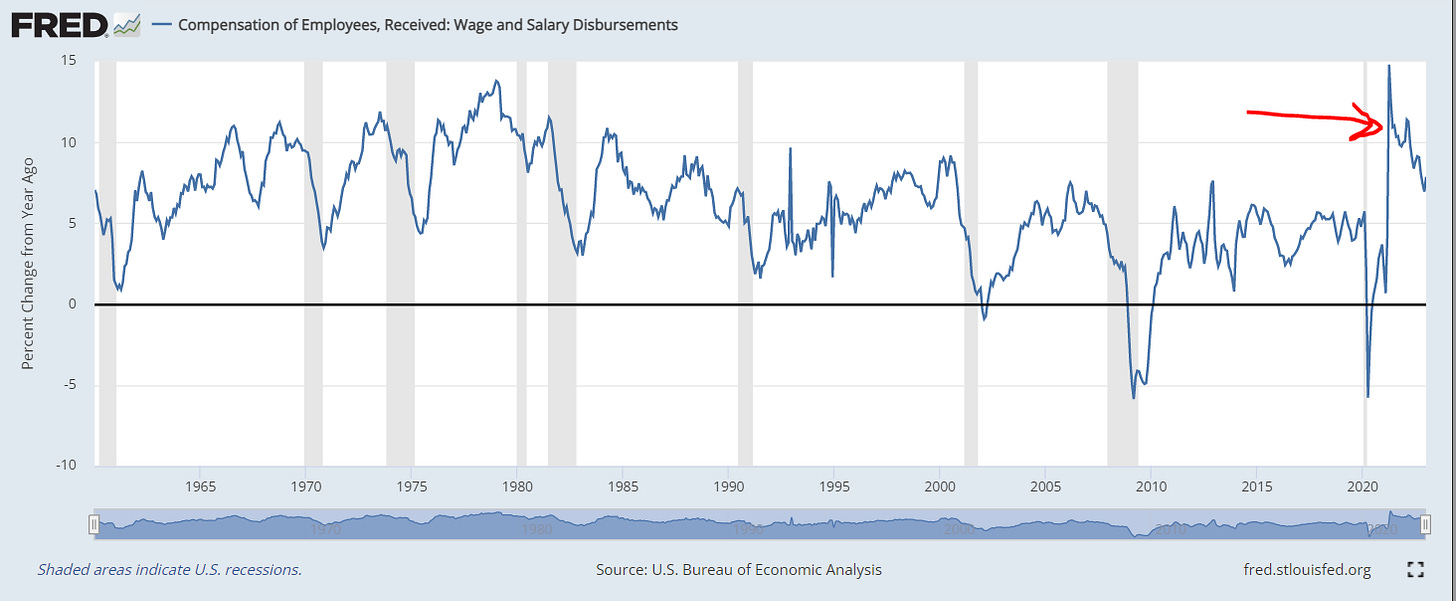

But why would I lose my job? There are a number of reasons but in our current situation, as corporations roll over their debt at higher interest rates, this begins to cut into their profits. Once a company’s profits are at risk, layoffs occur.

The problem is that the situation can easily get out of hand. If I have a company begins laying off employees, those people stop getting a paycheck which means buying less stuff. THEN more people get laid off from all the places the original people bought stuff at. The feedback loop continues.

Part of the way we can see this type of credit and financial risk is by looking at credit spreads: What we can see is credit risk spiked during COVID for obvious reasons. Credit spreads begin to rise again when the FED began their tightening cycle in 2022.

They have since then dropped marginally BUT then this week happened with Silicon Valley Bank.

Systemic Risk?

Credit spreads spiked on the news of Silicon Valley bank this past week because it was going under.

You probably already heard the news about it. What is important to know it is that, in general, banks hedge their duration risk. What does this mean? It means that if I am long some type of 30-year bond then I am also short a similar instrument of comparable maturity. This is basic banking and maturity management 101.

Apparently, Silicon Valley Bank didn’t do that which is pretty shocking. A little funny and ironic that people working there were from Lehman Brothers.

Think about it like this? Over the past 40 years, inflation hasn’t really been a problem. So no one worried about their bond portfolio taking massive losses. After 2008, everyone was afraid of credit risk and never considered duration risk. If you study financial history, it is very clear you need to focus on both but recency bias always gets the best of people.

How am I thinking about this?

What you have to realize is that when a bank goes under, there is a lot of cross-collateralization. The financial system doesn’t operate in a silo. So we don’t know what’s going on below the surface and this is why all banks fell this week. No one knows how much liquidation might happen or if the government will step in.

In these types of situations, liquidations usually happen with a lag. So I would expect some type of volatility this upcoming week as the full effect ripples through the financial system.

HOWEVER, it is important to remember that it’s very easy to over-extrapolate the downside. Before the final liquidation in 2008, there was a lot of news about mortgage issuers having problems. But when rumors of acquisitions came out, all the junk real estate companies short squeezed a ton. This simply means that things dont move in a straight line down until a full liquidation.

Personally, I am waiting and watching. My game plan is that I am going to watch how Japanese banks trade in the Asia session Sunday night because there will most likely be a connection.

I did a previous article providing my short SPX signal. We are now well in the money with the short. It was a great set up and I will likely cover the short sometime this week depending on how the situation unfolds.

However, in general, I will probably be looking to play some bear market rallies as the downside gets over-extrapolated. Big picture though, the fall of Silicon Valley Bank is just another signal that we are in a bear market. Inflation risk is turning into credit risk. During market regimes like this, if you are running a balanced portfolio, your highest allocation is cash.

What to watch? I am keeping my eye on 4 things:

Early stage companies in ETFs like IPO. Silicon Valley Bank had the closest connection to the venture capital sector. So I want to watch all the companies that are closest to those. The IPO etf is all the recent IPOs.

I am also watching the real estate sector and a number of REITs. Very possible we have issues there.

I am watching ALLY stock. It was one of the greatest beneficiaries of the cheap money during 2020 and 2021. It has a lot of exposure to the consumer balance sheet. If it begins to fall considerably, that is probably a signal.

Finally, watch big banks (XLF ETF) and regional banks (KRE ETF).

Thanks for reading