Regime Shift In Japan: The Melt Up Before The Crash

How Japanese news is impacting US equities and gold

Regime Shift In Japan: The Melt Up Before The Crash

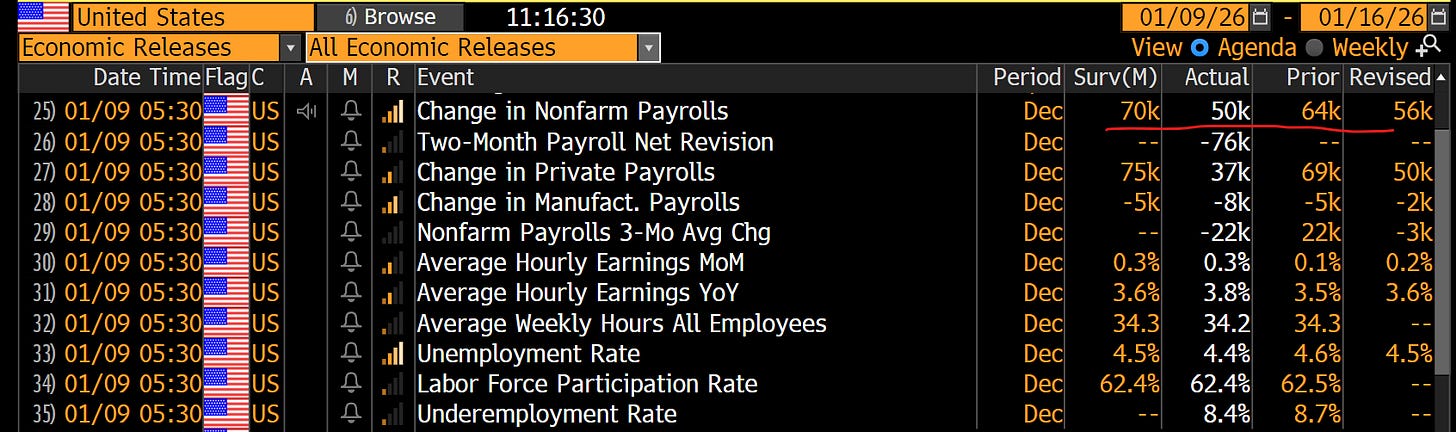

Everyone got so laser focused on the NFP labor market print this morning that they have completely missed the real driver in markets.

While the NFP print came in below expectations, it only moved hedges around marginally.

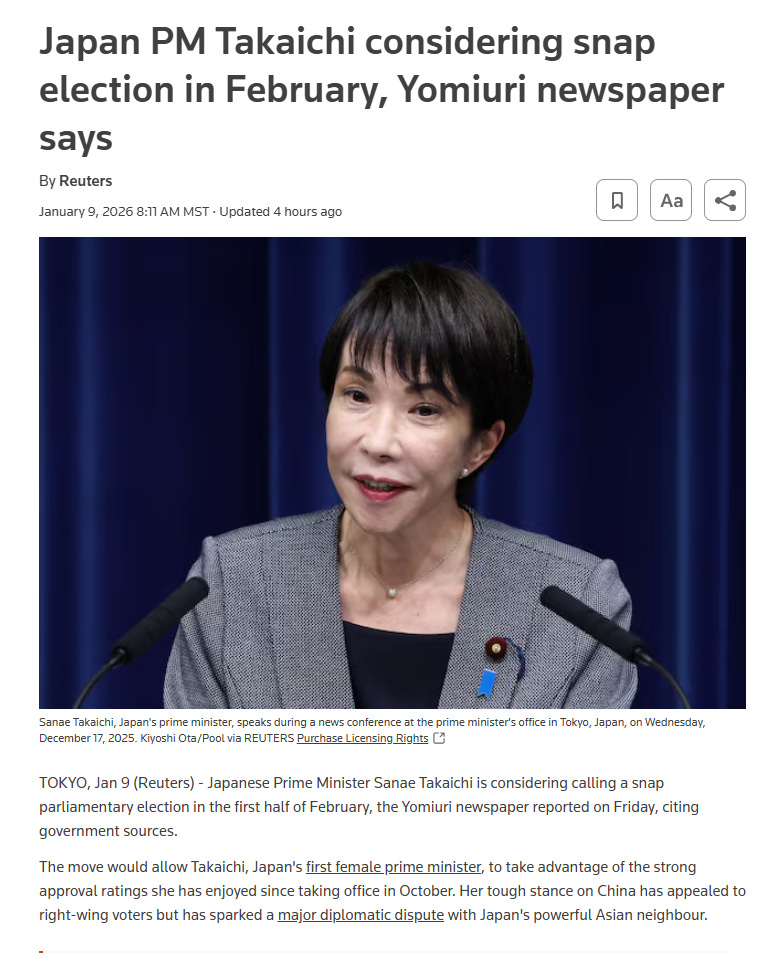

The BIGGER piece of news was out of Japan, and it is literally moving global markets and the risk curve across equities in the United States. Over the last 6 months, the situation in Japan has changed dramatically so that it is actually impating global liquidity and risk flows. Today, the news out of Japan is accelerating the entire fiscal impulse.

To give you an idea of HOW LARGE the change has been, here is the budget deficit in Japan right now. When it turns negative, it represents the Japanese government spending MORE than they take in.

As a result, we saw the Nikkei lead the way and outperform the most as ES, CL, and GC all followed. Why is this happening? Because the liquidity changes in Japan impact the entire world.

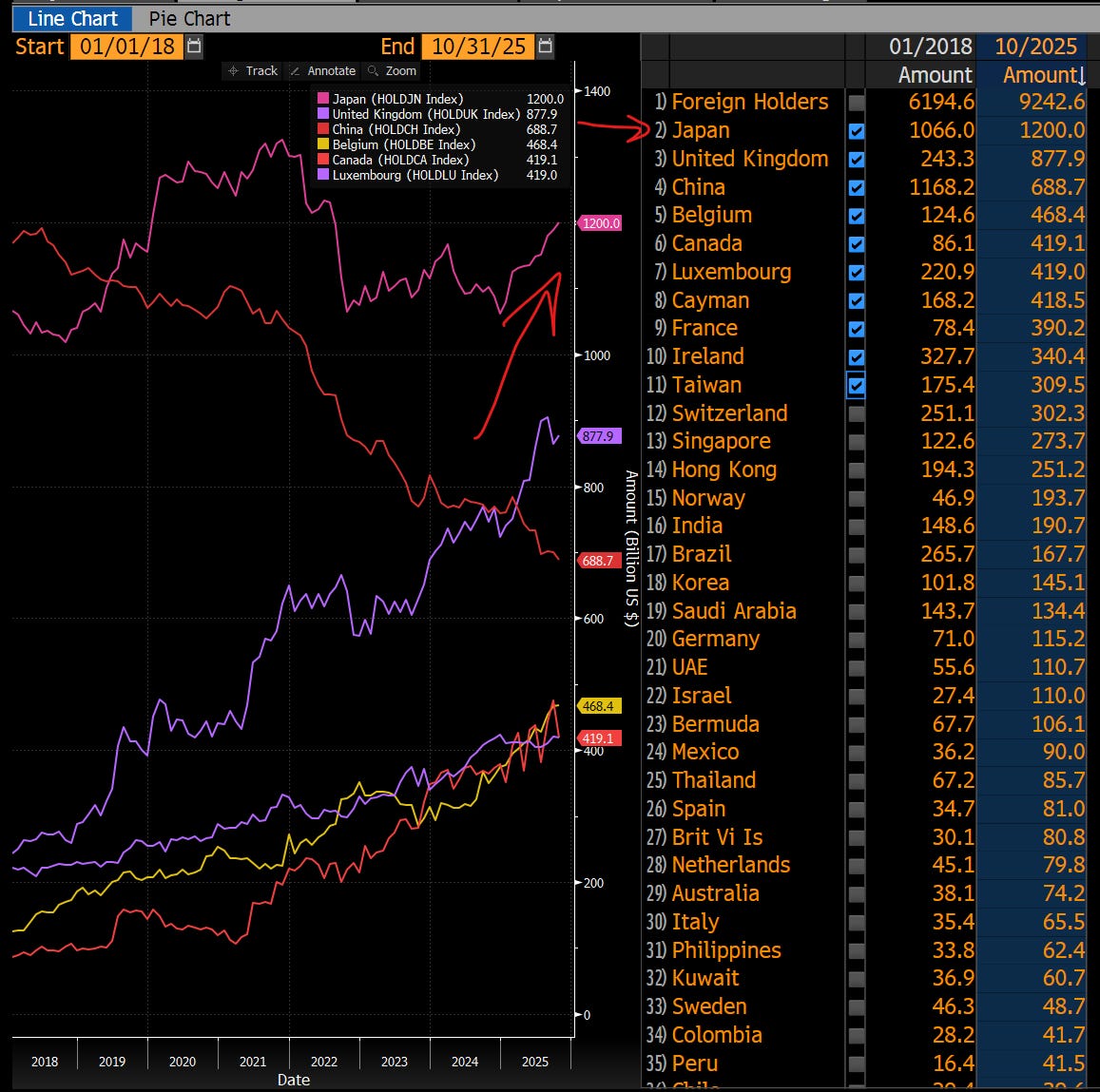

Japan is the largest foreign holder of US treasuries, which means changes in its country directly impact dollar liquidity in US markets.

A Deeper Look At Liquidity Drivers:

If you want to understand WHY these global changes are taking place and HOW the underlying mechanics inform managing risk, you can watch the recording that I just made for paid subscribers. In the recording, I’ll lay out my full playbook for trading these risks: a deeper breakdown of the underlying drivers, how foreign flows interact with BoJ policy, the key scenarios I’m running, and the concrete ways I’m looking to express these views as the current regime comes under pressure.

The video and connected slide deck are linked below:

Keep reading with a 7-day free trial

Subscribe to Capital Flows to keep reading this post and get 7 days of free access to the full post archives.