Replay the Day

What was I thinking while trading today

Today is the type of day you train for in markets. I had a couple DMs and comments asking questions so I am going to lay out HOW I was thinking about today.

What happened? I shorted the high after the CPI rally, held the position, and then shorted again on the FOMC minutes. Why?

First, I always have extreme preparation. You know this if you have been watching my Twitter feed. I am always reading books and refining how I think about markets. I also wrote an entire macro report so that I had a clear understanding of the moving parts and market regime.

Regardless if I publish it or not, I write out all of my thoughts every single day. In order to formulate high-quality thoughts, you need to be able to articulate them. Part of formulating thoughts is the actual writing process itself. College and High School have caused everyone to hate writing papers thereby creating a situation where no one knows that it’s a superpower.

Second, I already knew the specific setups I was looking for. I was simply waiting for execution signals.

You can go to the article I wrote this morning:

Let’s walk through the day:

The CPI print was released which caused stocks AND bonds to rally. This was an immediate signal to me. Why didn’t stocks rally and bonds fall? I talked about this correlation in the macro report.

Basically, when I saw both stocks and bonds rally, I used the opportunity to short equities. Why? Equities have two primary functions that drive price action, the cash flow function and the valuation function. The valuation function is primarily driven by liquidity and yields. So I know when bonds bid with equities, the driver is likely the liquidity function.

Remember in my macro report I said that we are likely to see earnings get revised down sometime in H2. We are at peak liquidity right now (on a short-term basis). Therefore, unless earnings start surprising to the upside, I want to take opportunities to short when we have short-term spikes driven by liquidity.

After the CPI print, I knew that we have low volume till the cash equity open. It was my belief that once we hit the high volume of the open, the order imbalance would revert and the price would move down. This happened in line with my expectations. However, we hit an intraday low and then rallied into FOMC minutes on low volume.

Once we hit FOMC minutes, what happened?

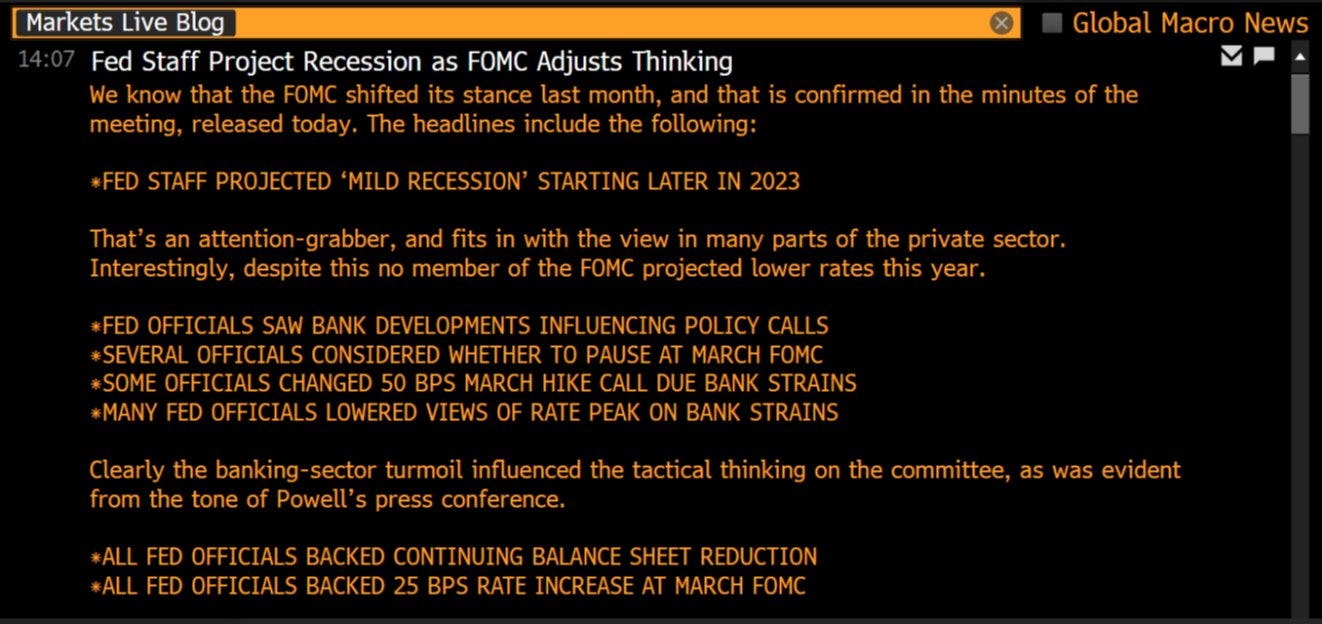

The FED used the “recession” word. This was a huge shift in their language. Their language is very important and calculated. If you want a great book on this, read this (link).

With a bearish bias and an intraday rally on low volume, the minutes immediately biased me to the downside. This is why I immediately tweeted, “short stocks on the minutes”:

https://twitter.com/Globalflows/status/1646212002711482370

From this point, I assumed a red close once we hit the higher volume of the close.

I know there are a lot of assumptions here but what you need to understand is how macro information connects with order imbalance models. You need to be able to identify how people are able to transact in the market and how much they need to move the price in order to get liquidity for their order.

I will do some future articles on how exactly to think about order imbalances and I will use specific examples. For now, go read all the resources in previous articles.

Half of markets (and anything in life) is putting in the time on the back end in order to have the capacity to take risks properly in a single moment. You always need to be ready for the moment when it presents itself!

This is how risk-taking works. It is very possible that today didn’t work out the way I expected and I got stopped out. This is important to keep in mind because losing/making money doesn’t always mean you are smart or right.

Final Thoughts

We have established a short position in ES. This will be held until my systems trade again. It is possible we get stopped out and reestablish the position later. However, when you merge short-term models with a longer-term macro view, you can get trades on with more precision.

Maintain conviction in your research but be flexible and ready to adapt!

Thanks for reading!

This is exactly what i look for as a learning material. I cant thank you enough! I have one question about stock valuation. You said valuation is liquidity and yield. When bond rallies, yield goes down, so does discount rate. Thats naturally bullish right? Then stock should go up just because of that. But you said stock ups because of liquidity. Can you share more of your thoughts on this? I must have missed something obvious.

LOVE this stuff!!