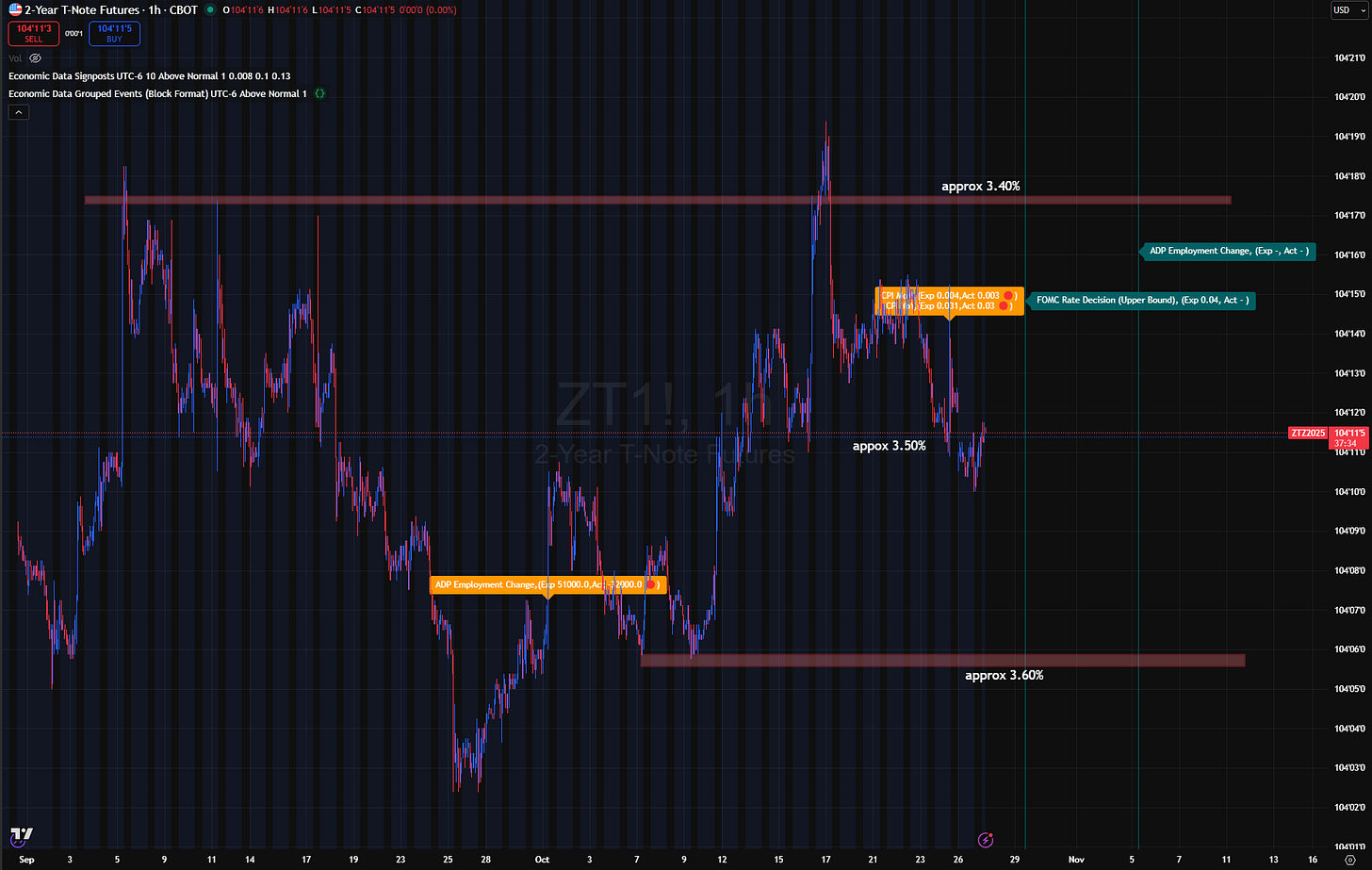

ZT – Anchored in Goldilocks: Growth Solid, Front-End Range Intact

The front end remains remarkably stable post-CPI, with 2-year yields effectively locked in a 20–25 bp range and currently sitting in the middle. Despite a softer inflation print, the front end refused to break lower, confirming that the market’s conviction now rests on the labor side of the mandate, and less so for the inflation side.

The message from price action is clear: inflation is moving into the background; the next move likely belongs to labor.

See big picture macro views here:

Growth, Inflation, and Liquidity Context

Keep reading with a 7-day free trial

Subscribe to Capital Flows to keep reading this post and get 7 days of free access to the full post archives.