Strategic Positioning: Rates, Curves, Currencies

A Deep Dive Into STIRs, Duration, and FX in Today's Macro Regime

The Macro Context For Flows:

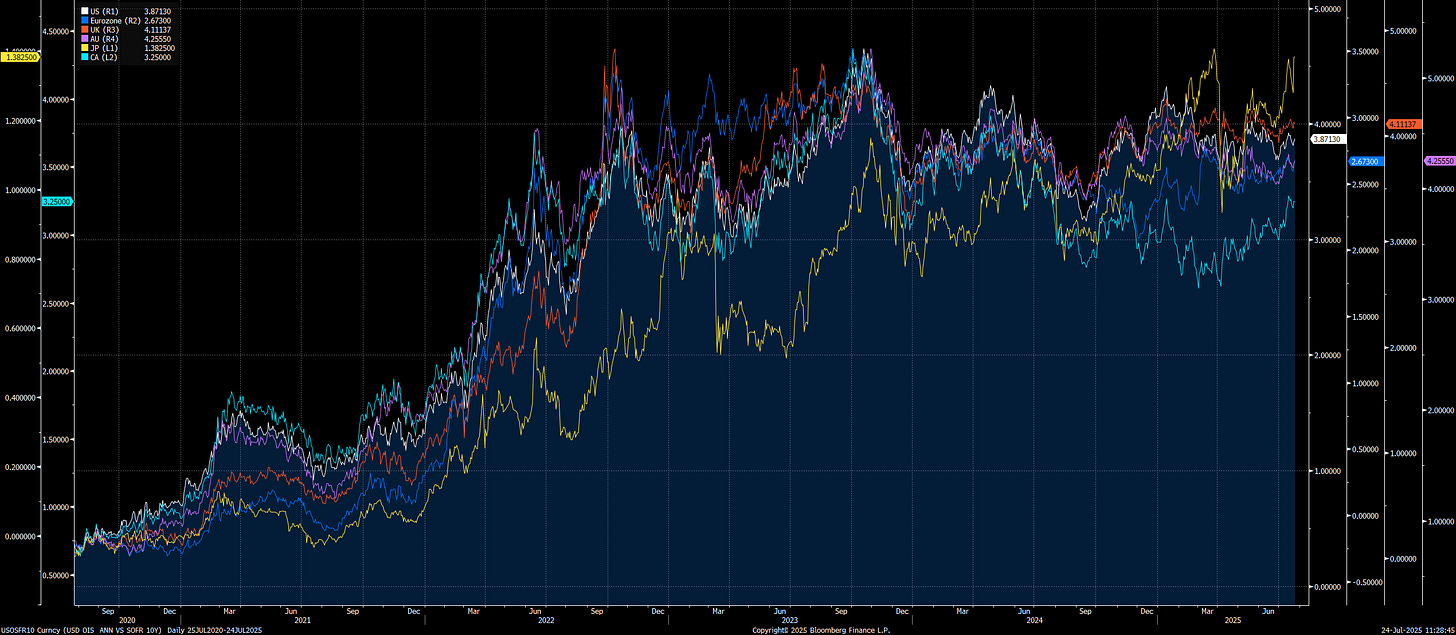

Over the last 4 years, long term interest rates across ALL major countries have risen to an elevated level. While there has been a reasonable degree of dispersion between long-end rates between countries, it is clear that they are at a higher LEVEL. The fundamental question traders and businesses with interest rates risk are asking is WHERE are rates going next. Are they moving higher, lower, or remaining in the wide range-bound trend we have seen over the last 4 years?

The starting point for understanding WHERE interests are likely to move is by understanding WHY they have established a trend at this higher level over the last 4 years.

My goal in this report is to explain:

1) The context in which the higher level of interest rates is operating,

2) The specific drivers that would keep the range intact or cause a change in the trend

3) The connection of these drivers to the respective yield curves, FX pairs, and positioning.

Keep reading with a 7-day free trial

Subscribe to Capital Flows to keep reading this post and get 7 days of free access to the full post archives.