Strategy Development and Risk Management (Guest Writer!)

Very Special Guest Writer Today

Alright, guys! This is going to be an article to remember that I am sure you will come back to over and OVER.

I did 5 educational articles providing a broad overview for quantifying variables such as demographics and geography all the way down to identifying order imbalances for short-term execution.

The question many of you might have is, ok I have these signals and systems, how do I synthesize all of this into an actual P&L profile that consistently produces money? That is what this article is about.

I reached out to my good friend Grant Huebner at Mythic Market Research. He is the CEO there and runs a small team of truly exceptional quants and traders. He is going to provide a breakdown of HOW to think about trading from a business perspective and HOW to have the infrastructure for it. These are the simple things that no one ever talks about but are necessities for any type of success in the market.

Over to Grant……

Strategy development, trading systems, and risk management:

I’m honored that Capital Flows asked me to write a guest post covering strategy development, trading systems, and risk management. It is so important to build a strong foundation in these concepts before building out a trading program. These topics should be explored more deeply. But, I aim to review each topic broadly and share foundational knowledge with you. Please reach out if this article was a big help or if you have any questions. I’m more than happy to answer questions. Now to the data dump.

Strategy Development

When developing a complete strategy, there are two levels one has to consider:

1) The Grand Plan (High-Level view): this is the culmination of all your beliefs and strategies. Your grand plan is the big-picture view of how all your trading strategies and business operations fit together and function as one. An example outline is:

a. Business Operations

i. Accounting

ii. Legal

iii. Execution Platforms

iv. Etc.

b. Worst Case Contingency Plans

i. Natural Disaster

ii. Power outage

iii. Etc.

c. Entity Structure

d. Personnel Management and SOPs

e. Asset Allocation Strategy

f. Risk Management Strategy

g. Trading Desks and Pod Strategies

2) Individual Trading Strategy or Trading System (Micro-view): this is the detailed plan of a trading strategy or trading system.

a. Beliefs

b. Edges

c. Filters

d. Entry Signal

e. Initial Stops

f. Profit Taking Exits

g. Unprofitable Exits

h. General Strategy Statistics

i. Strategy Breakpoint (When do you stop trading this system?)

Both levels of strategy development need to have their own operational plan and research process. Capital Flows hit on this in his very first article! Re-read his posts. There is so much alpha!

Trading is a business and needs to be treated as such. You systematically extract money from the markets when you step back, build a grand plan, and focus on the process. Our job is to make money, not for our individual speculation to be proven correct. So build out your grand plan. This step in professionalism will reveal holes in your trading strategy and bring back the focus on making money and process development.

I recommend running 2 to 3 uncorrelated strategies. For example, if you're a Global Macro Trader focused on catching the year's biggest trends, you may add a mean reversion strategy. If you are a Long Equity PM, consider adding Merger Arb or other event-driven set-ups. The best foundational resources I can provide for individual strategy ideas are:

1) Jim Leitner’s chapter from Inside the House of Money

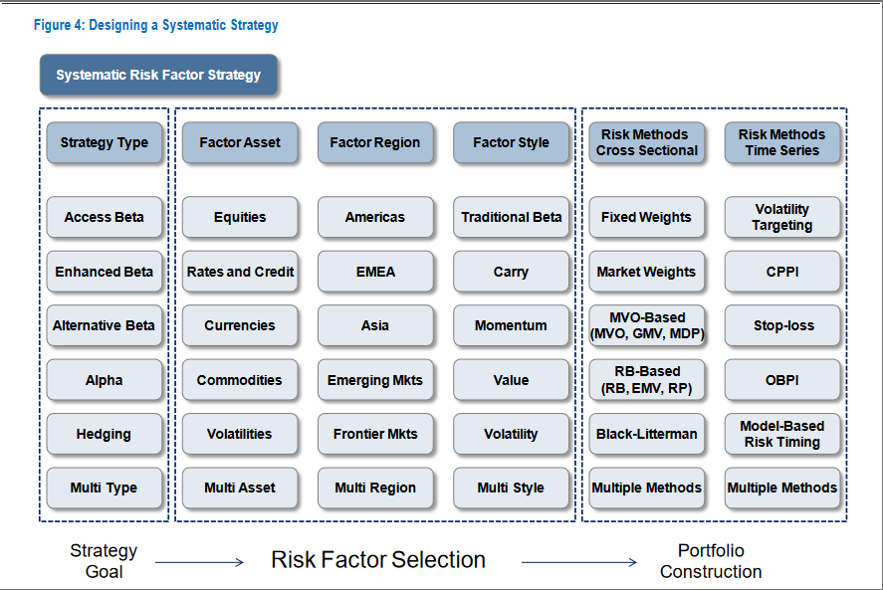

2) JPM’s Systematic Strategies Across Asset Classes

a. https://www.cmegroup.com/education/files/jpm-systematic-strategies-2013-12-11-1277971.pdf

3) Tom Basso’s All-Weather Trader

There are two ideas I would like to present to you:

1) You can't push boundaries without being well-trained in the body of work that created the boundaries

2) Original ideas are overrated, and Improvements to existing work are underrated.

Trading Systems

All the alpha you need is within your grasp. You don't need to read more books, white papers, or watch more YouTube. You don't need any new information! All the information you need to improve your trading is in your trade statistics. They are the reflection in the mirror. Take a good hard look and determine if you like what you see.

Building a system forces you to take time, learn and understand your edge. The trading statistic become real and you can’t lie to yourself. Every Portfolio Manager operates a trading system, and every trading system is ultimately discretionary. For example, your trading system might need better-defined rule sets to combat alpha leakage, or you might have the very best mechanical rules but decide not to take a trade, another form of leakage.

Ultimately, there are two types of Trading Systems:

1) Mechanical

a. Purely Rules Based

2) Rules-Based Discretionary (Thanks Van Tharp for the Term)

a. Systematic Process

i. Understanding Your Decision Tree

Both system types answer the critical question, why did I take this trade?

So why is it essential to systematize as much of the trading process as possible? An algorithm (it doesn't have to be code) is an extension of the portfolio manager. It forces consistent logic in your trading and creates a beautiful compounding effect.

The better you can define your rules, the better you can understand and quantify your edge. The better you know your edge, the better your research on improving your edge will become. The more automated the process, the more mental capital is freed up. When mental capital is freed, impactful decisions and creative improvements will arise.

Also, since trading is a business, algorithms are very low-cost employees. Therefore, if you can develop a mechanic strategy that trades very differently from yourself and is mainly automated, you can expand your trading business and improve your return-to-risk profile.

Computers calculate faster, don't get bored or tired, and can be a massive force multiplier. There is something you do need to keep in mind, though. Algorithms are complete morons too. They follow their logic. ChatGPT spits out the information it is fed. It doesn't do any real thinking. There is no imagination or vision. The algorithm follows the logic that has been coded.

Humans are slow and sloppy. But we have vibrant imaginations and can envision future scenarios. This is why we at MMR work to embrace a Centaur Model. You can read about it here:

https://medium.com/geekculture/centaurs-are-often-more-powerful-than-computers-549f827130d9

Now some things to consider when developing your strategy:

1) Use an ideas first methodology (data mined Ideas are dangerous)

2) There are only so many types of trades, it doesn’t matter if it’s fundamental or technical data you are using

3) Don’t be scared of 40%-win rates, they have tons of benefits

a. Positive Skew

b. Not Entry Dependent

i. High Win Rate Systems are more dependents on entry criteria versus exit criteria.

ii. Most People focus on entries which leaves more edge in exit strategies.

c. Trading lower Sharpe Strategies is a long-term edge.

i. The game is to maximize CAGR to drawdown ratio not Sharpe

1. Gain-to-pain ratio by Jack Schwager is my preferred metric

ii. High Sharpe ratio strategies are more likely to be arbitraged away

1. Also remember: Put selling is a high Sharpe until it blows up.

4) System Components

a. Personal Beliefs

b. Objectives

c. Quantifiable Edges

d. Entry Filters

i. Regimes

e. Entry Signals

f. Initial Stop

g. Profit Taking Exits

h. Correlation to other strategies

i. Position Sizing Strategy

Risk Management

Building a money management strategy is the next step after understanding your system. The core question you need to answer is how to size positions? Trade ideas will not make you money; your asset allocations and risk management will determine your returns. Trading is an expectancy equation, simple algebra. Position sizing must be big enough on high-expectancy trades to outperform the markets. However, those who bet too big blow-up accounts. Even with a positive expectancy system!

There are many position sizing strategies:

1) Fixed Contract

2) Fixed Dollar

3) Fixed Fractional

4) Kelly

5) Optimal F

6) Vol Targeting

7) VAR Models

8) Van Tharp’s Market’s Money

We can take the same system, change the positing sizing technique, and arrive at a different result. As stated above, systems free up mental capital to make real decisions. Position Sizing and risk management are those critical decisions. Unfortunately, they are the most complex topics in financial markets and are often glossed over.

Concepts that need to be investigated for your system are:

1) Varying Position Sizing for Your Edge

2) Correlation

3) Portfolio Heat

4) Worst Case Contingency Planning

5) Leverage

A recommended resource on risk management: https://www.amazon.com/Definitive-Guide-Position-Sizing-Objectives/dp/0935219099

A word of caution. Low Vol Instruments provide a sense of security, so people use a lot of leverage. So, be careful trading low-volatility instruments; they have this knack for blowing out!

I hope that you found this information helpful and provides you with a path to improve your trading. Thank you for reading this entire piece. Capital Flows is a great friend and I’m honored to write a post for him. For more information like this, you can follow us on Twitter: @MythicMkt or our Substack: Mythic Market Research.

You can always reach me at: granthuebner@mythicmarketresearch.com

We also provide consulting services: Strategy Automation, Custom Software Development, and Trading Plan Coaching.

Thanks for reading!