The Bitcoin Positioning Risk

The stages of macro liquidity and positioning risk

The use case for Bitcoin and its function in the global financial system has been laid out in the educational primer here:

We are at a critical point in terms of price action for Bitcoin. Why? The arbitrary levels of 100k matter a lot less than WHERE we are with macro liquidity and positioning.

We have seen returns YTD be positive and the returns on a 3-month rolling exhibit considerable strength:

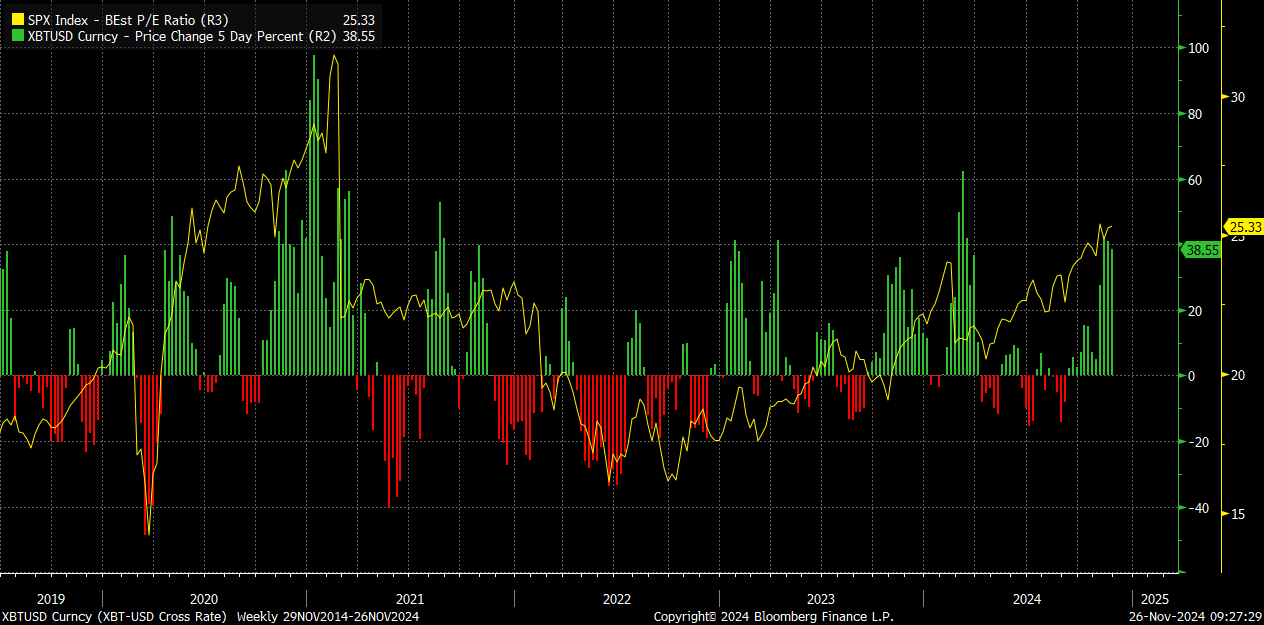

You will notice that the periods of greatest positive returns in BTC typically overlap with valuation multiples (yellow) in the S&P500 expansion. Why is this? Because macro liquidity is the primary factor causing valuation multiples to expand in ALL risk assets.

You can read about this valuation dynamic here:

The Risk:

The risk is that positioning has significantly over-extrapolated the SPEED of positive returns in Bitcoin. Similar to how the forward interest rate curve can over-extrapolate the speed of cuts by the Fed, the equity market can over-extrapolate the speed of positive returns.

For example, call skew in all the major BTC proxies has completely blown out. MSTR 0.00%↑ COIN 0.00%↑ and RIOT 0.00%↑ all have incredibly elevated levels of implied volatility indicating that positioning is paying a massive premium for being long. In other words, we would need to see a massive move UP to justify the premiums priced by the option market.

Think about it like this. No one is saying BTC is going to zero, we are just mapping the risk-reward on a time horizon that is actionable. The conceptual parallel that took place recently was when NVDA 0.00%↑ had call skew blow out to the upside as it deviated significantly from moving averages. These marked short-term tops in the longer-term bullish trend.

This is the same dynamic taking place in Bitcoin right now. We are at the top of the stdv range with elevated valuations across risk assets, a strong dollar, and rates at highs.

This was initially laid out in this report:

And trades being run:

You will notice the DXY index and BTC have been moving with a positive correlation for the last 2 months. This will be important to watch because it is very possible that this correlation remains positive as the DXY falls AND BTC pulls back marginally or simply consolidates.

Main Idea: The implication of the logic and chart above is NOT to get incredibly bearish on Bitcoin. Rather, it is a recognition that we are likely to see some consolidation or short-term pullback in BTC (as well as proxies) until this call skew mean reverts.

We are already up 34% for the month of November which is incredibly high for typical seasonality and the call skew blowing out makes it more difficult for positive returns in December UNLESS the skew mean reverts back down fast enough.

More on this for paid subscribers in the next alpha report.

The information on this website/Substack is for information purposes only. It is believed to be reliable, but Capital Flows does not warrant its completeness or accuracy. The information on the website/Substack is not intended as an offer or solicitation for the purchase of stock or any financial instrument. The information and materials contained in these pages and the terms, conditions and descriptions that appear, are subject to change without notice. Unauthorized use of Capital Flows websites and systems including but not limited to data scraping, unauthorized entry into Capital Flows systems, misuse of passwords, or misuse of any information posted on a site is strictly prohibited. Your eligibility for particular services is subject to final determination by Capital Flows and/or its affiliates. Investment services are not bank deposits or insured by the FDIC or other entity and are subject to investment risks, including possible loss of principal amount invested. Your use of any information which is proprietary to Capital Flows or a third-party information provider shall only be used on individual devices without any right to redistribute, upload, export, copy, or otherwise transfer the information to any centralized interdepartmental or shared device, directory, database or other repository nor to otherwise make it available to any other entity/person/third party, without the prior written consent of Capital Flows.

Excellent. Thanks