The Impact Of Tariffs On Macro Liquidity

How the US/China Trade War Impacts Cross border flows

The Impact Of Tariffs On Macro Liquidity

One of the fundamental beliefs I have about markets right now is that everyone has become overly focused on the Fed and completely forgotten about cross-border liquidity.

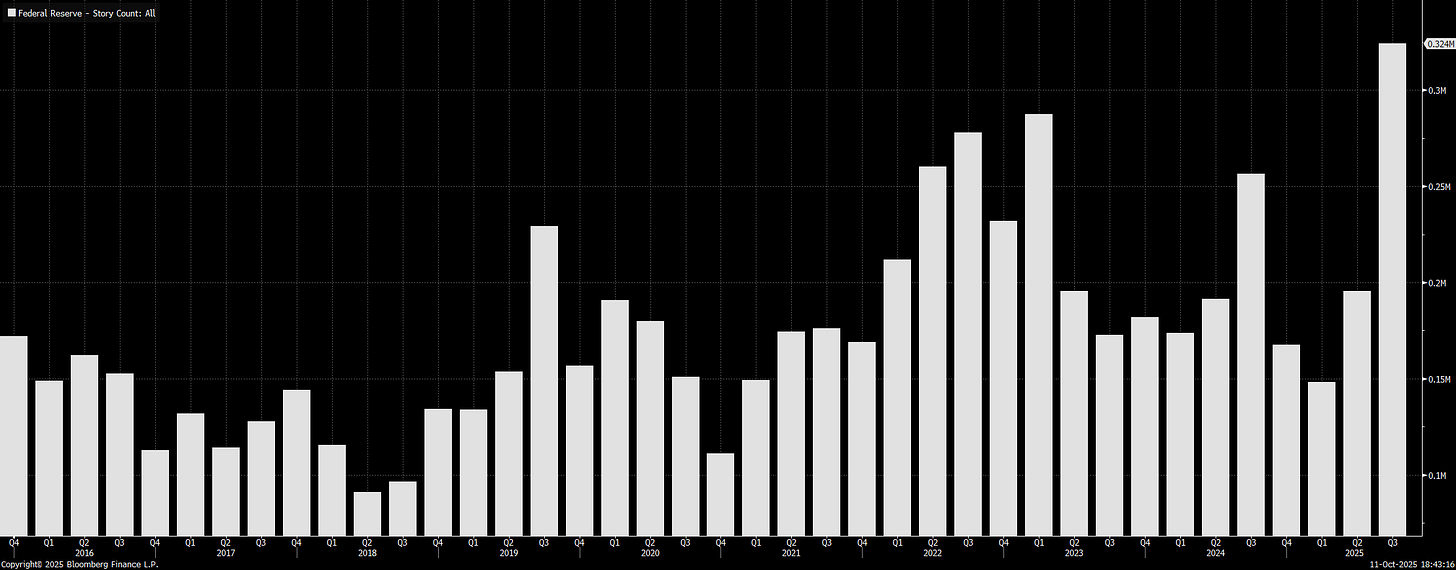

Since 2018, when the Fed kept real rates too high and triggered a major equity selloff, market participants have been fixated on every move the Fed makes. The story count alone has increased exponentially:

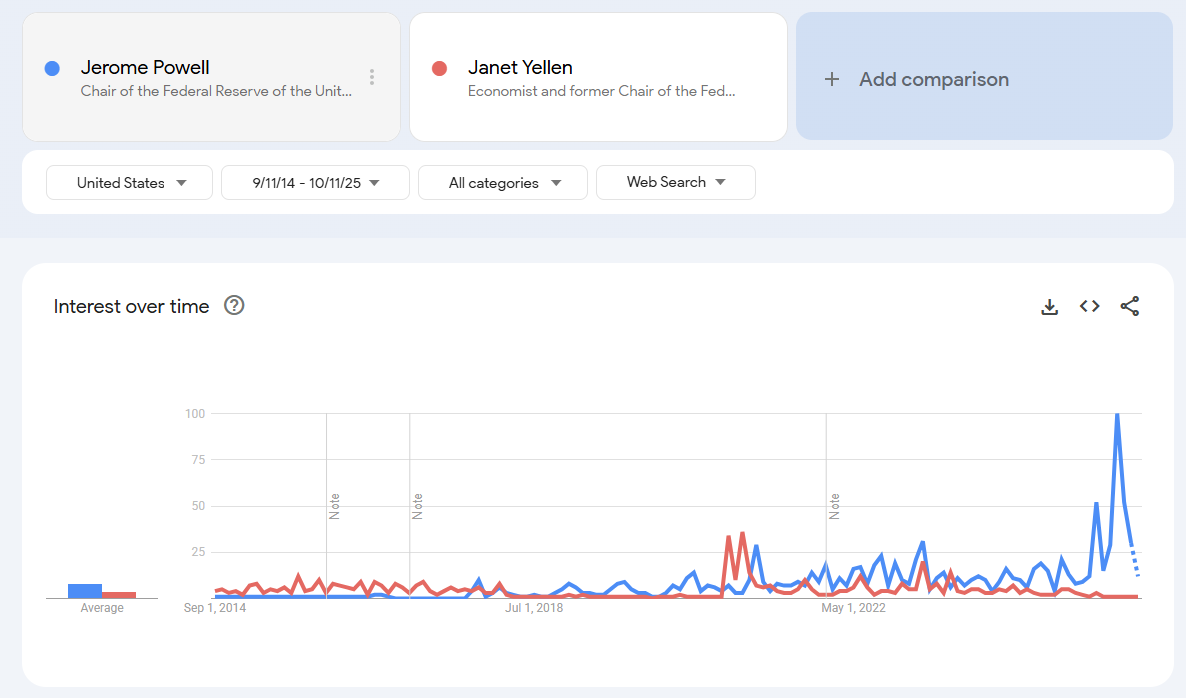

During the 2010s, few people paid close attention to the Fed chair. But by 2021, that changed. Social media began distorting and amplifying expectations in ways never seen before. Today, the consensus among economists, analysts, and sell-side research is being driven less by original risk research and real risk-taking, and more by social media narratives.

This collective obsession is distracting from the most significant risk in the global system: cross-border flows. Tariffs are tied not only to trade relationships and geopolitics, but also to HOW MUCH capital foreign investors can allocate to US equities. This core misunderstanding explains WHY tariff headlines trigger equity selloffs and HOW they reshape global liquidity flows. (Chart below shows foreign direct investment into the United States)

All of this is setting the stage for much larger shifts in the global system, but the key questions are HOW and WHEN this will unfold. I’ve already outlined my equity views, but I want to go deeper into the causal mechanics driving short-term, day-to-day movements.

Tariffs and Macro Liquidity:

I want to explain HOW the mechanics of flows work here and then connect this to WHERE we are in equities.

Keep reading with a 7-day free trial

Subscribe to Capital Flows to keep reading this post and get 7 days of free access to the full post archives.