The Research HUB: Carry

What is a carry and risk premia?

One of the biggest divergences that continues to exist between financial market participants is the silo between the pure fundamental guys and pure price action guys. One of the most important things you can do is correctly connect fundamentals with price action. One of the main ways to accomplish this is to identify the carry of a financial instrument and compare it to the risk-free rate and other financial assets.

Any asset in the financial system has some type of carry attached to it. A “carry” is the payment you get for taking the risk of holding an asset. A risk premia is the premium you get paid over the risk free rate for taking additional risk. These two ideas are fundamental to financial markets.

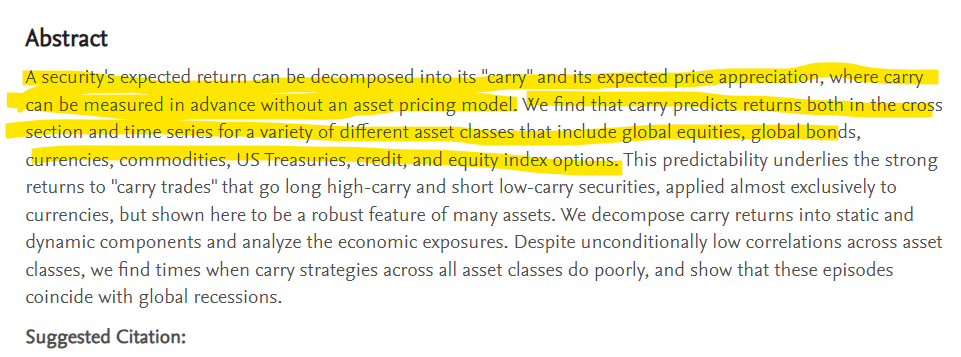

The carry of a financial asset has an intricate connection between the cross-sectional returns and outright momentum of an asset: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2311574

While a Gaussian model shows the distribution of returns as an independent occurrence, in reality, they are highly dependent. The carry can give you significant insight into what part of the distribution is likely to take place: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3035453

Carry and risk premia are all intricately connected in any financial market. The carry of the risk-free rate impacts corporate bonds, equities and any other asset on the risk curve.

The key to quantifying risk and return correctly through the macrocycle is by quantifying these carry’s and risk premias across every asset. Once you accomplish this, you will have visibility into the WHY of an asset’s move. If I don’t know the WHY behind an assets movement then my conviction level for trades drops exponentially.

If you don’t understand the specific conditions moving financial markets, you immediately reduce leverage and raise cash. Most people won’t tell you this because they are tracking the returns of the index and not focusing on absolute and uncorrelated returns. I focus on absolute returns that are asymmetrical and uncorrelated:

If you want to dig into this topic more, check out the resources below:

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3325720

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2695101

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2357894

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2766850

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2968677

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2968677

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3803954

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2856435

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2265901

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2227387

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2632697

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2623794

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3035453

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2399282

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2311574