The Research HUB: Flow of Funds

The data no one looks at

This past week, the FED released the Flow of Funds data that comes out every quarter. This is data that few people look at because it is so lagged. However, one thing you should know about economic data is that typically the more lagged the data, the higher the quality.

Many datasets such as the ISM come out monthly but the signal-to-noise ratio of the ISM is lower than GDP which is released quarterly.

So let’s get into an explanation of the dataset, how it fits into a macro framework and then recent developments in the data.

Flow of Funds:

Here is where you can find the technical explanations of flows of funds: https://www.federalreserve.gov/releases/z1/

Here is the FRED Link: https://fred.stlouisfed.org/categories/32251

Let me just say, that if you are trying to trade macro, go through every single technical manual on every economic dataset. It might be dry but it will change your view of the world.

What is this dataset?

The Financial Accounts of the United States includes data on transactions and levels of financial assets and liabilities, by sector and financial instrument; full balance sheets, including net worth, for households and nonprofit organizations, nonfinancial corporate businesses, and nonfinancial noncorporate businesses

From FED Website

Macro Framework:

Whenever you are analyzing macro (or any complex system) you always start by identifying the structures that transmit energy (or in this case capital) and then the actual flow of energy.

In accounting, the flow is the income statement and cash flow statement. The capital structure is the balance sheet. The same could be said of an electrical circuit board as well which is actually why knowing engineering can be helpful.

(Side note, there is a great book called Outsiders by William Thorndike that shows how a lot of successful money managers had engineering backgrounds. It was a great read!)

The primary dynamic that the flow of funds data shows is the balance sheet of each agent in the economy. This is where you would begin assessing the balance sheet conditions of the consumer, corporations, and government. As the flow of capital changes through the economic cycle, it gets transmitted through these balance sheets.

Recent Changes:

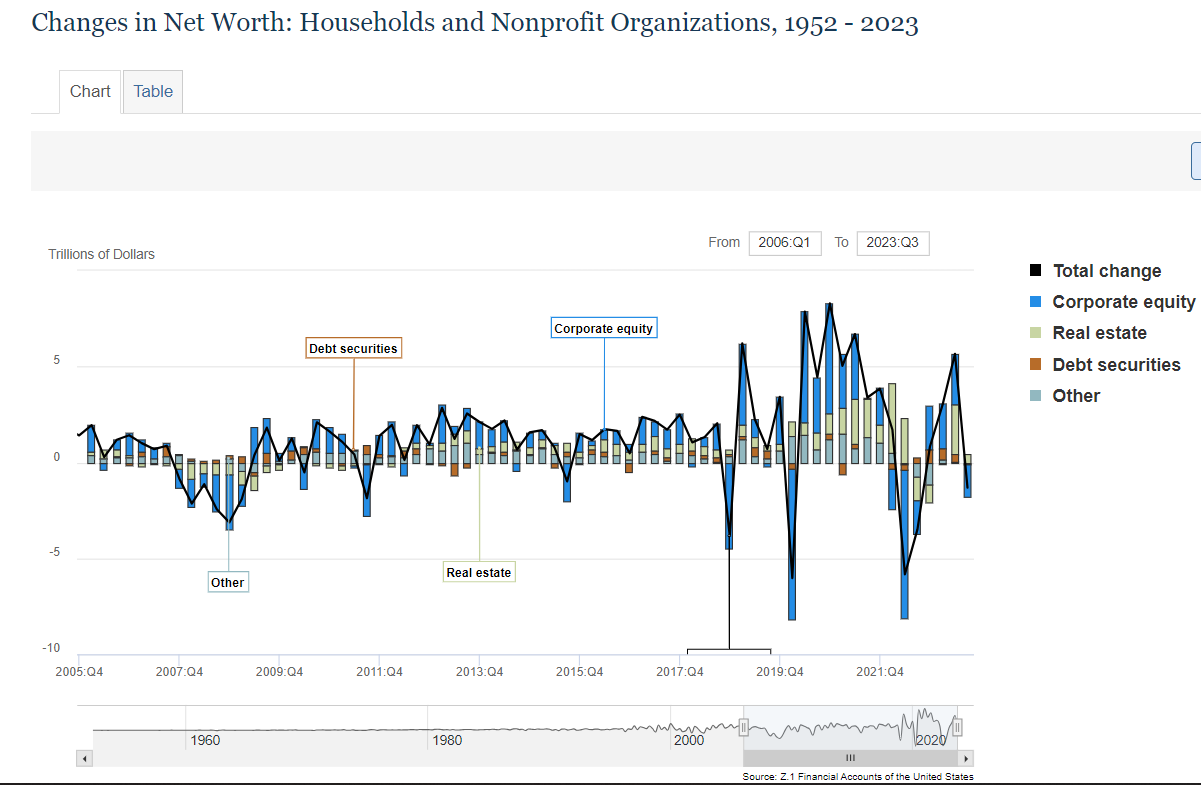

Notice how the net worth of households and nonprofits has changed during 2022 compared to 2008. This visualizes how dramatic of an impact an inflationary bear market can have on one’s net worth.

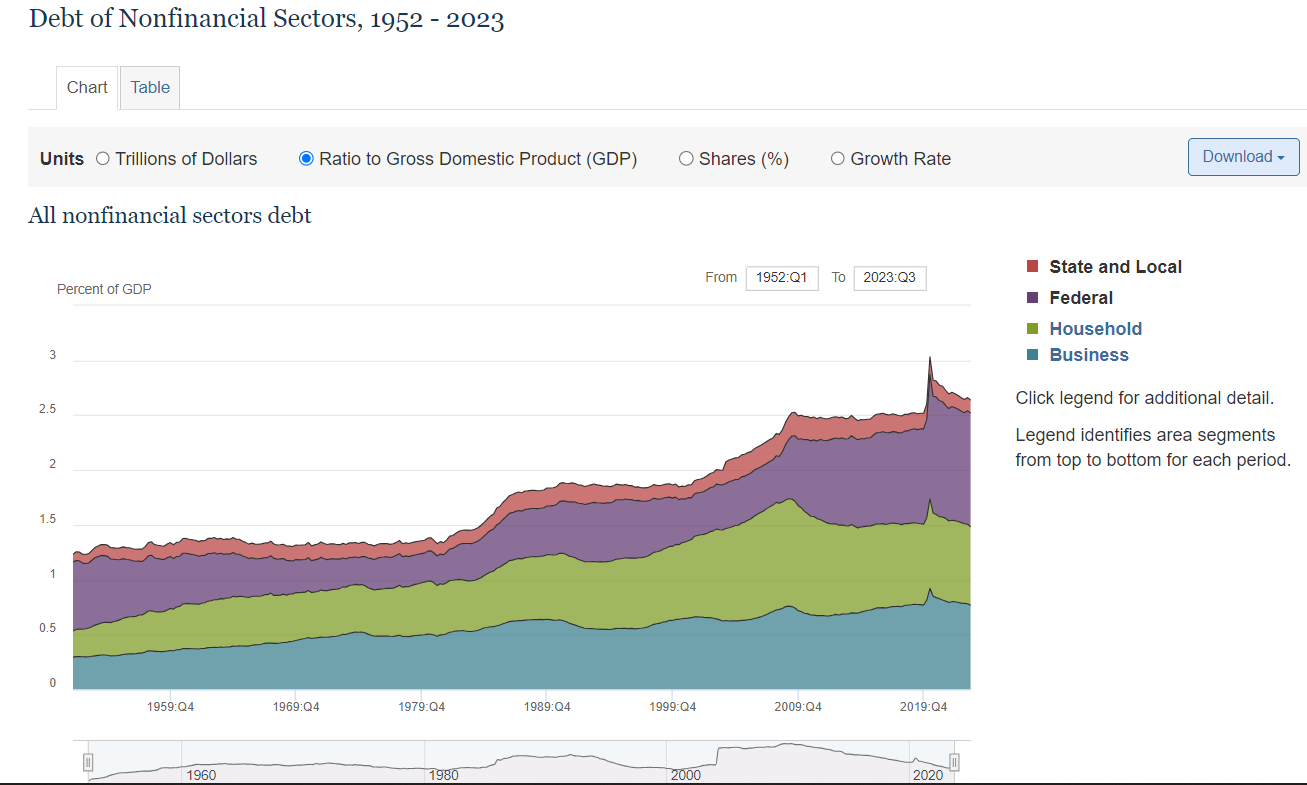

You can also see where the majority of debt is concentrated: on the sovereign balance sheet.

This was one of the things I drew attention to in the macro report:

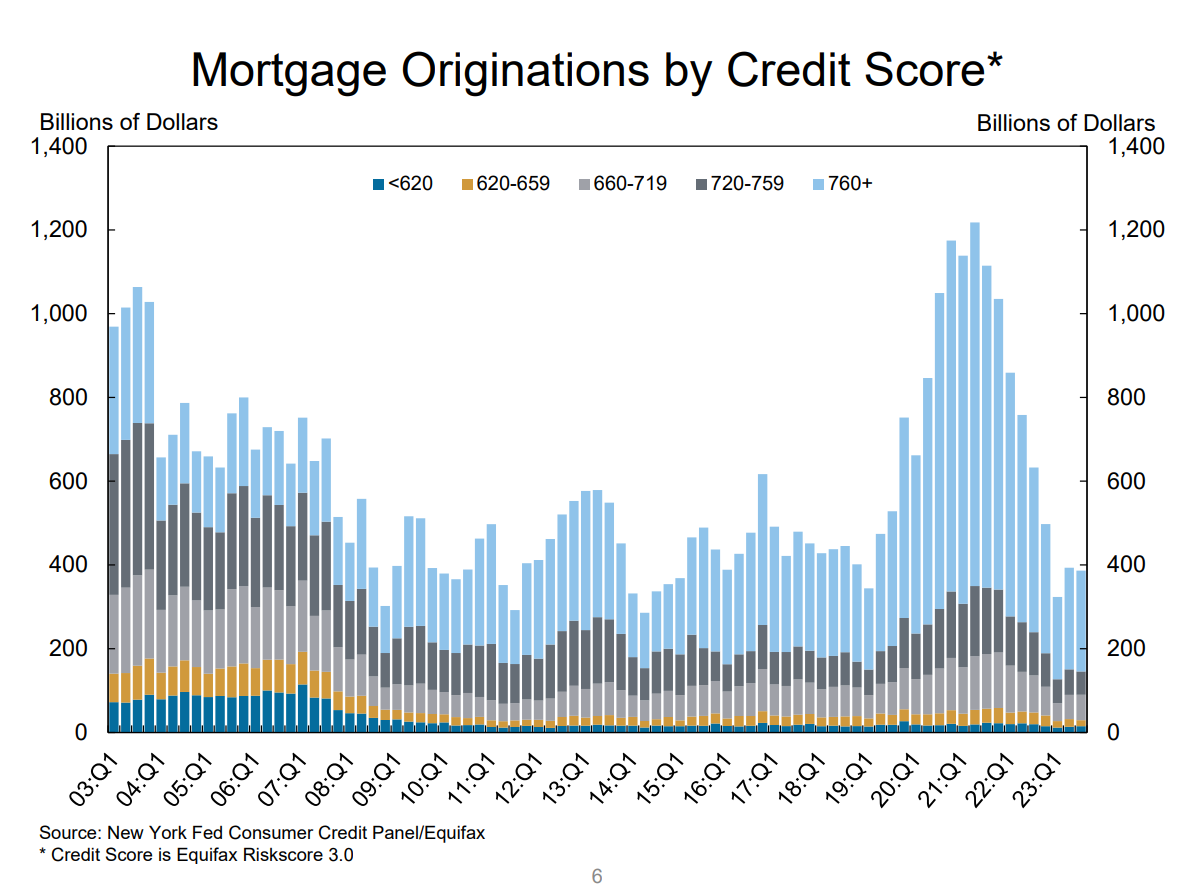

The consumer balance sheet is in a very different place from 2008:

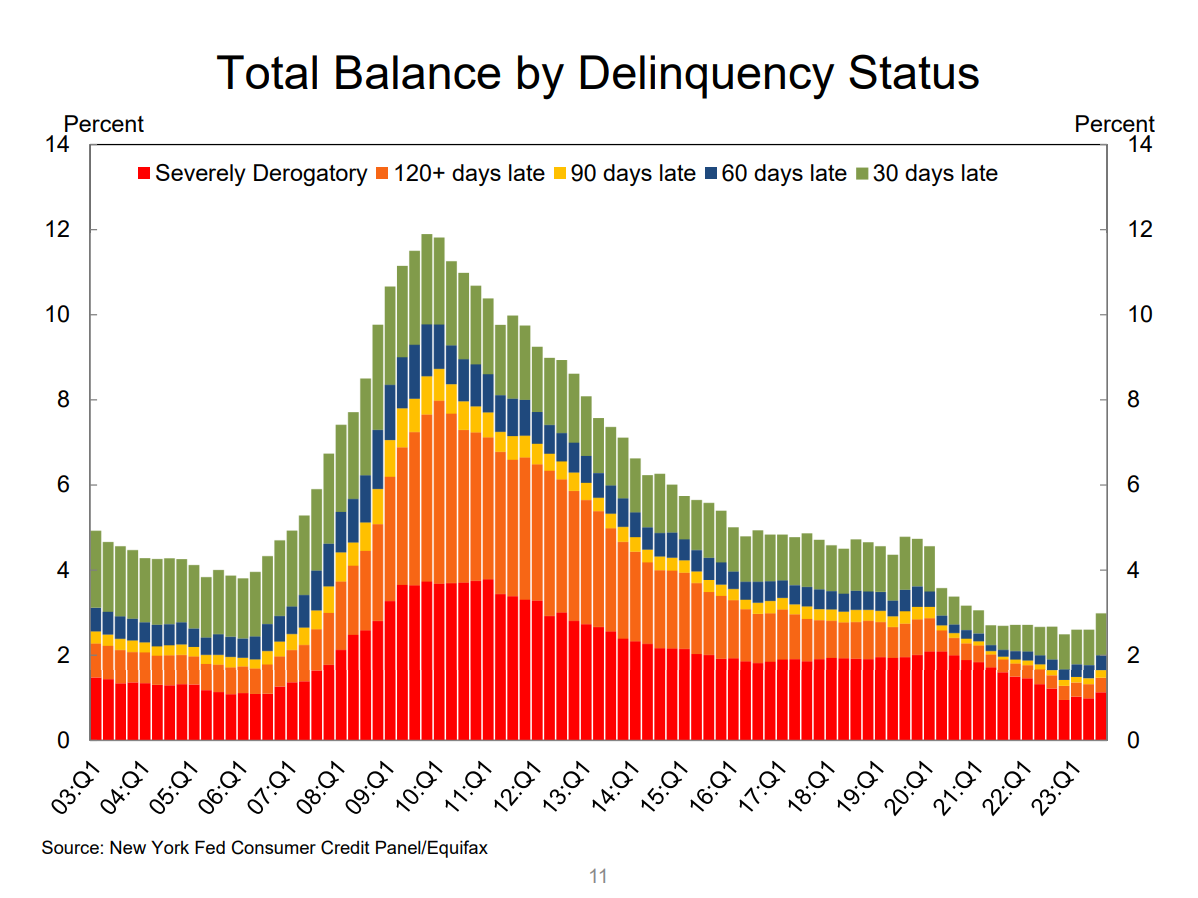

While delinquencies are ticking up, these need to be weighed against the level of nominal growth:

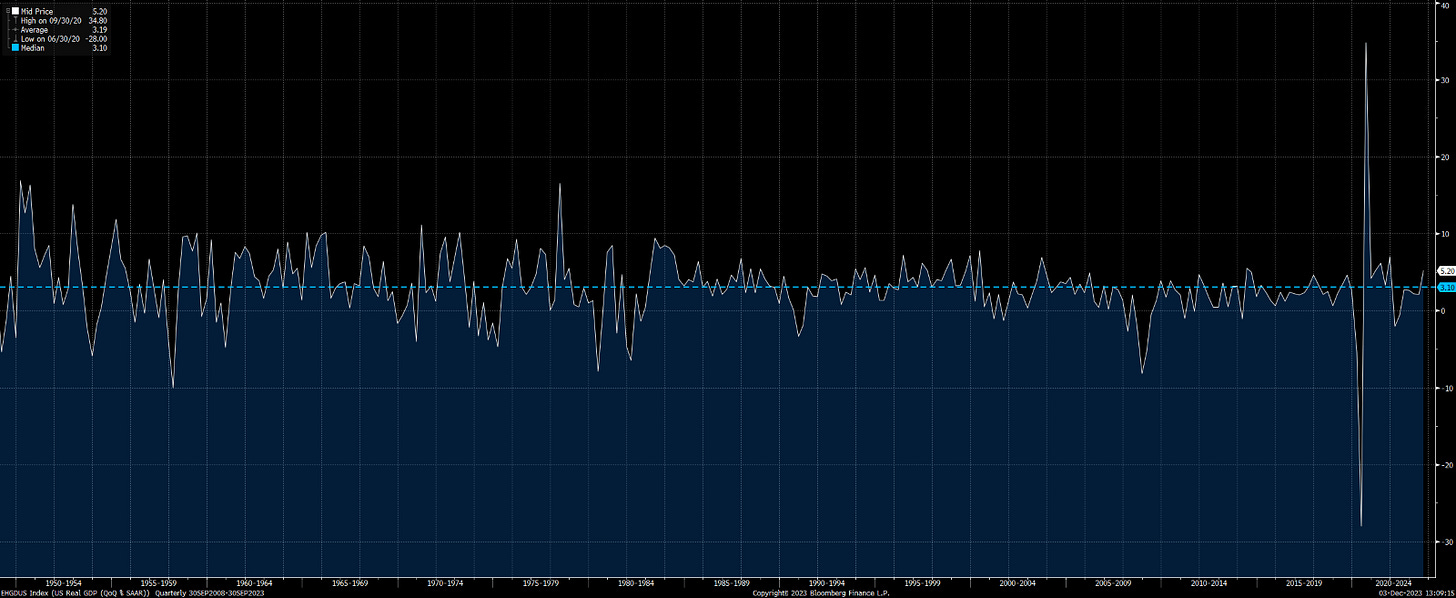

Real growth for Q3 came in at 5.2% with nominal well above that:

Then we have NFP today where the unemployment rate actually went down.

These are all key tensions to weigh when any financial asset.

Conclusion:

If there has been one thing everyone has learned over the past 2 years it’s that macro matters.

If the macro environment is the primary determining factor in the success or failure of a company or portfolio, then you can’t afford to not have a process for it.

In the information age, you simply need to be at the right place, at the right time, with the right information to succeed

The flow of funds: