The Research HUB: Investment Universe

What is the oppurtunity set for allocating a portfolio

One of the things you hear all the time is, “I want a well-balanced portfolio.” Theoretically, if your portfolio is perfectly diversified, you could leverage it exponentially because every asset perfectly offsets others. The problem is, in reality, this is way more complicated.

How should we approach this then? When I think about allocation, I think about isolating causal factors that generate returns. To do this, we need to identify all the moving parts of the system and ALL investable assets.

Enter the period table of investments!

This is a table from the book, The Allocators Edge. If you are new to financial markets, I strongly encourage you to read it.

The main idea of this table is that it breaks down every asset, factor, and strategy. There are many different assets in the world and there are also many different WAYS for extracting returns from them.

For example, a CTA strategy extracts returns very differently from a merger arbitrage strategy. Since the WAY in which these strategies extract returns is fundamentally different, they typically have uncorrelated returns.

The ideal portfolio is one where you have diversification across assets AND strategies. For example, during risk-off events, usually all correlations go to 1 as everything sells off. Think COVID-19 crash or 2022.

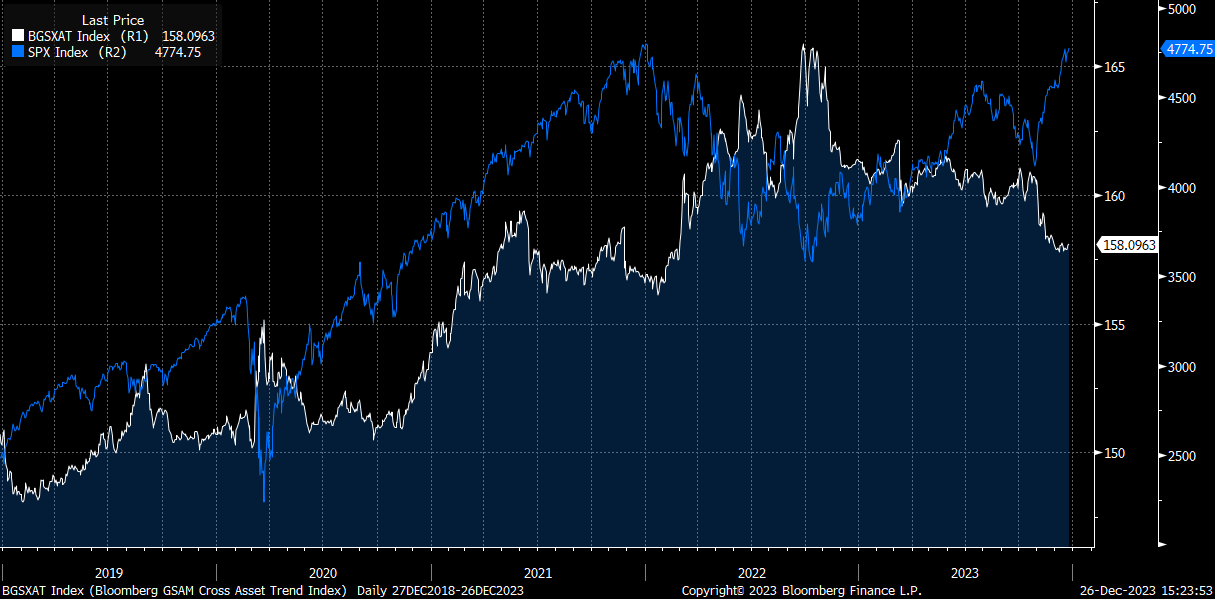

Here is a chart of the CTA trend index and the S&P500. You will notice CTAs outperform during risk-off moves.

Another way to express this is by holding long/short quality factors along with the S&P 500. While this likely underperforms the S&P500 during bull markets, it provides an offsetting factor during risk-off moves, especially if there is a recession. The chart below is the L/S quality index and the S&P500.

You can see that a L/S quality factor is pulling from 2 parts of the period investment table:

The main idea to take away from this is that there are A LOT of different ways to diversify a portfolio that doesn’t include 60/40. The typical risk parity 60/40 portfolio showed its true colors during 2022 when we had one of the worst drawdowns in history.

We don’t know what the future holds but the question you should be asking is, can my portfolio thrive in any environment that occurs? This might mean asking your financial advisor a couple of extra questions after reading the Allocators Edge or it might be building your own system for allocation.

If you are trying to build out a system for strategic allocation like this, check out Mythic Market Research. They do really good work and advise a lot of high-level managers in this type of process. I would also suggest checking out Simplify and Michael W. Green. They have done some great work on creating products and explaining how they might fit into a portfolio on their YouTube channel.

As always, it comes back to this simple idea:

In the information age, you simply need to be at the right place, at the right time, with the right information to succeed