Hey everyone!

I am going to cover how to trade gamma squeezes since the AI narrative is in full force and I recently bought calls on a gamma squeeze:

I am going to keep it super basic so that all the newer people can have a proper intro.

Technical Definition:

A "gamma squeeze" is a term used in the financial markets to describe a scenario in which the price of a security rapidly increases due to large-scale buying activity, often caused by a knock-on effect related to options trading.

Here's a step-by-step breakdown of how a gamma squeeze might happen:

Investors buy large quantities of call options for a specific stock. A call option is a financial contract that gives the buyer the right, but not the obligation, to buy a stock at a specified price (the strike price) within a specific time period. The seller of the call option is obliged to sell the stock at the strike price if the buyer decides to exercise the option.

The entities selling these options, often market makers, then hedge their positions to limit potential losses. They do this by buying the underlying stock that the options are based on. The reason for this is to have the stock on hand if the option buyers decide to exercise their options, forcing the market maker to sell them the stock at the strike price.

The process of market makers buying the stock to hedge their positions can cause the price of the stock to go up. This is especially true if the stock was heavily shorted, or if the volume of options trading is particularly high.

If the stock price continues to rise and gets close to or exceeds the strike prices of the call options, this can cause the options to be "in the money." The market makers may then buy even more of the stock to hedge their positions, causing the price to go up further.

This cycle can potentially repeat, causing the price of the stock to "squeeze" upwards in a rapid fashion. This is the "gamma squeeze."

The role of the market maker is crucial in this scenario. A market maker is a firm or individual who actively quotes both a buy and a sell price in a financial instrument or commodity, hoping to make a profit on the bid-offer spread, or turn. Their role in the options market is to provide liquidity by being willing to buy and sell options at any time.

When the market makers sell options, they don't want to be exposed to a lot of risk if the price of the underlying stock moves significantly. So, they hedge their risk by buying or selling the underlying stock. This hedging process can affect the price of the underlying stock and, if done on a large enough scale, can lead to a gamma squeeze.

In essence, a gamma squeeze is a market dynamic that can happen due to the interplay between options trading and the stock market, particularly involving market makers and their hedging practices. It's a relatively complex phenomenon that reflects the intricate mechanisms of modern financial markets.

Practical Side:

The gamma squeeze is indeed a complex phenomenon and can be influenced by various factors such as momentum, the listing of additional options, market narratives, and high short interest. Let's delve into each of these:

Momentum: Momentum can have a significant impact on the potential for a gamma squeeze. If a stock already has upward momentum, that can attract more buyers and traders, which can lead to more options activity. This, in turn, can lead to more hedging activity from market makers, further fueling the price increase and the momentum of the stock. This feedback loop can exacerbate a gamma squeeze.

Listing of Additional Options: If exchanges list new options with higher strike prices, it can lead to even more options buying activity. Traders who see that the stock has strong upward momentum may be attracted to these higher strike price options, betting that the stock will continue to rise. This additional options activity can lead to even more hedging activity from market makers, driving the price up even further and contributing to a gamma squeeze.

Market Narratives: The stories and narratives that circulate among investors can significantly influence investor behavior. For example, if there's a narrative that a certain stock is set to surge due to a gamma squeeze, it might lead to more buying activity, both in the stock and the options. This increased demand can drive up the price of the stock and, if accompanied by significant options activity, could lead to a gamma squeeze.

High Short Interest: When a large number of shares are sold short, it means many investors are betting that the stock price will decline. However, if the stock starts to rise rapidly (due to factors like a gamma squeeze), these short sellers need to buy the stock to cover their short positions and limit their losses, a process known as a short squeeze. This can push the price up even further. So, a high level of short interest can exacerbate a gamma squeeze when short sellers are forced to cover their positions at the same time market makers are buying shares to hedge their options risk.

These factors can interact with each other in complex ways, potentially creating a feedback loop that drives the stock price rapidly higher.

Example with AMC and GME:

GameStop (GME) and AMC Entertainment (AMC) stocks in 2021 serve as landmark examples of gamma and short squeezes that largely drove the rapid increase in their share prices.

GameStop, a video game retailer, saw its stock price skyrocket in January 2021. The rally was primarily fueled by a gamma squeeze resulting from a surge in buying activity of GME's call options, especially from retail investors rallying on Reddit's WallStreetBets. As the stock price rose, market makers purchased more GME shares to hedge their positions, escalating the price further. Simultaneously, the high short interest in GME amplified the squeeze as short sellers scrambled to cover their positions, causing the stock price to rise even more dramatically.

Similarly, AMC Entertainment, a movie theater chain, experienced a massive increase in its share price in late May and early June 2021. The sudden surge was mainly the outcome of a gamma squeeze, triggered by substantial call options buying activity. This buying frenzy compelled market makers to purchase more AMC shares to hedge, driving the price up. Just like with GME, a high short interest exacerbated the squeeze. Short sellers, trying to limit their losses, were forced to buy back AMC shares, pushing the price up even more.

In both instances, a combination of gamma squeezes and short squeezes were the primary drivers behind the extraordinary surges in GME's and AMC's stock prices.

Example of AI:

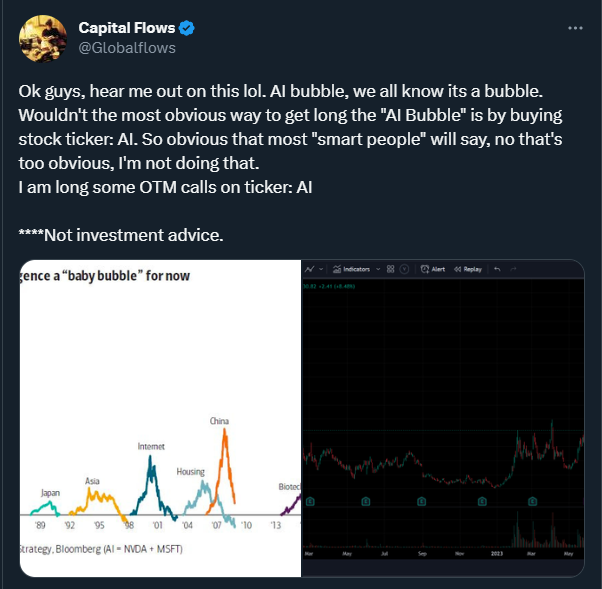

The definitions and examples above set the framework for WHY I bought OTM calls on AI 0.00%↑

https://twitter.com/Globalflows/status/1662113613371576322

We had a perfect alignment of factors:

Momentum to the upside

Bullish AI narrative

Short interest high enough for a short squeeze

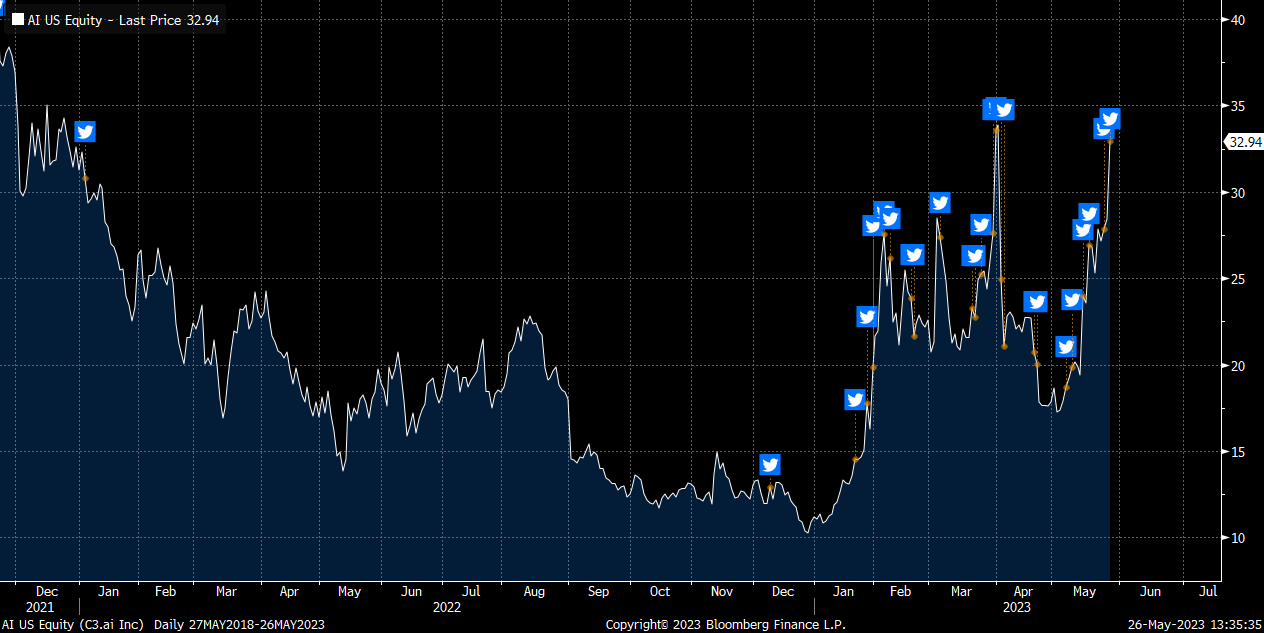

Implied vol spiking with the price:

AI 0.00%↑ was up 13% premarket and then closed the day up 33%. I sold a portion of the position to lock in gains and plan to sell the rest into or after earnings:

https://twitter.com/Globalflows/status/1663543393128157191

When trading gamma squeezes, you basically want to monitor all of the variables I noted above. A gamma squeeze as opposed to a pure short squeeze means the options market is a primary driver of the underlying price. You need to watch open interest and volume across all strikes to properly identify forced buying and selling.

Take The Gain:

When you have parabolic price action like this, taking a gain is always difficult but you want to take gains every time there is an explosive move to the upside. If you are monitoring the underlying forces driving the price, you will be able to have a clearer signal.

In these types of situations, knowing the technical factors is important but the mental side is key as well since there is so much euphoria behind the price. I have really enjoyed

Substack on the emotional side of trading. The main thing to remember: KEEP YOUR SEAT AT THE TABLE!I can’t tell you how many times I have entered a trade, had it go in my favor, and given back on the gains because I was greedy.

Skill + level head = exceptional performance.

Conclusion:

I primarily focus on larger markets and you can see some of the more in-depth analysis below. I am always watching for gamma squeezes though. Let me know in the comments or on Twitter if you would like me to share more trades connected to gamma squeezes.

Macro Report/Insights: Japan, Bonds, FX and Real Rates

Hey everyone, As I have mentioned multiple times, I believe we are near an inflection point in risk assets. I am going to lay out how I view these inflections across all the major asset classes, the specific signals I am watching, and how I am thinking about managing trades.

Thanks for reading!