The Risk Of China And It's Geopolitical Implications On Global Liquidity

Geopolitics interacting with global capital flows

If you understand the ideas laid out in these two Twitter threads, you functionally understand how the US and China are operating from a geopolitical and capital flows perspective.

China from a geopolitical perspective: https://x.com/wolfejosh/status/1884704944160194601

China from a capital flows perspective: https://x.com/Brad_Setser/status/1884090435792166990

Josh is right on point when he talks about China's playbook. What you have to realize is that US participants like pension funds are making decisions purely based on returns while China is making decisions based on geopolitical interests. In other words, China will gladly give a higher return for capital if that means gaining a geopolitical advantage. Pension funds are trying to outperform and meet their liabilities so they don’t care.

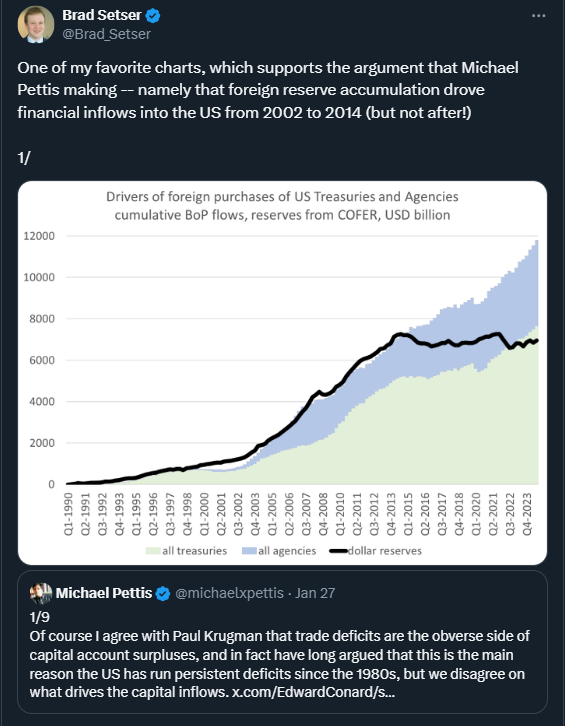

This geopolitical strategy by China is directly tied with HOW they are managing their capital account. The US deficit is directly connected to the capital account and China:

When the US has the reserve currency and an open capital account, this means large countries (like China), can take advantage of this dynamic if they have a higher time preference than the US (which operates on 4 year political cycles). We are now seeing Chinese valuations at the low end of the range:

And the US in the opposite place:

How does this tangibly connect to equities? We have seen China collapse against sectors like semiconductors. Now as policy from the Trump administration is going to begin impacting flows between the relative AI developments and capacities:

I already explained how this connects to crypto and with the way things are developing, crypto and AI are becoming increasingly linked.

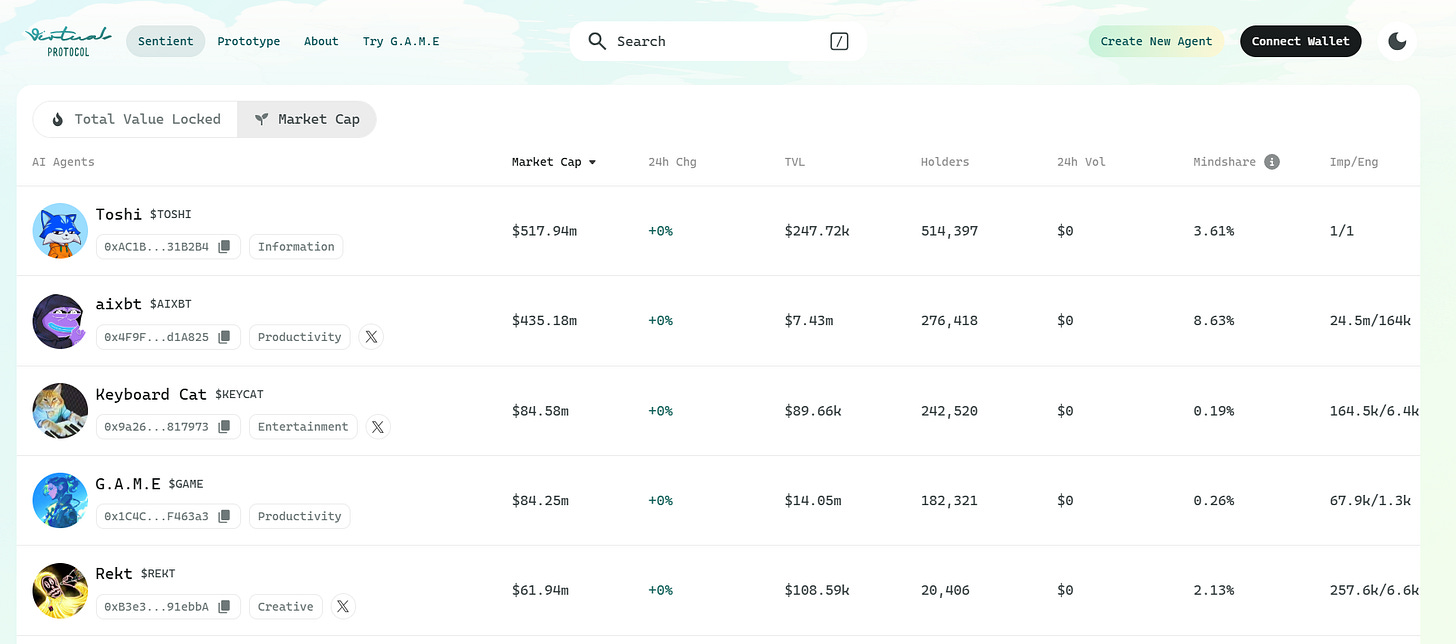

This is reflected in projects like the Virtuals protocol that links AI bots with crypto. While the market cap is small, we are already seeing the interaction of AI bots with AI bots using crypto as the settlement layer.

This is clearly being addressed by the new administration (link) but the more important question will be WHAT policy decisions will take place? The AI news about DeepSeek is making explicit what has been implicit for years now. The relationship between the US and China will be THE defining geopolitical relationship of this decade. It will impact financial markets and influence US government spending as we move through the economic cycle. This is why understanding it is absolutely critical.

If you want to dig into these concepts more, I would encourage you to read this book:

As always, a Pepe for the culture

The information on this website/Substack is for information purposes only. It is believed to be reliable, but Capital Flows does not warrant its completeness or accuracy. The information on the website/Substack is not intended as an offer or solicitation for the purchase of stock or any financial instrument. The information and materials contained in these pages and the terms, conditions and descriptions that appear, are subject to change without notice. Unauthorized use of Capital Flows websites and systems including but not limited to data scraping, unauthorized entry into Capital Flows systems, misuse of passwords, or misuse of any information posted on a site is strictly prohibited. Your eligibility for particular services is subject to final determination by Capital Flows and/or its affiliates. Investment services are not bank deposits or insured by the FDIC or other entity and are subject to investment risks, including possible loss of principal amount invested. Your use of any information which is proprietary to Capital Flows or a third-party information provider shall only be used on individual devices without any right to redistribute, upload, export, copy, or otherwise transfer the information to any centralized interdepartmental or shared device, directory, database or other repository nor to otherwise make it available to any other entity/person/third party, without the prior written consent of Capital Flows.

I always like valuation bands. Nice one.

Thanks for the book recommendation, looks a solid read!