The Story, 0DTE Research, FOMC

The story you want to hear

Hello everyone, we have a ton of interesting topics to go through in this edition:

Some stories about this Substack and trading

Options research

How to think about this week

Let’s get right into it!

Story:

For those of you without a Twitter account, I recently created a thread and pinned it to my profile, breaking down some of the ways I think about the world.

Here's the link:

https://twitter.com/Globalflows/status/1651289620011941893

Let's delve deeper into this topic:

The most frequent question I receive from people concerns education and learning about financial markets. Interestingly, I actually ran this poll the other day and was a little surprised.

Much of this can be traced back to the "communication problem" I discussed in this article.

Here is the deal, if you genuinely want to learn how to think, you will find the right people and stick with them. It is the people who are adaptive and can act extemporaneously that thrive in any domain of life.

If you want a rough idea of how long the education process takes, I would say that learning anything will take 2 years minimum. This assumes you dedicate almost all of your time to it though. However, part of the problem is the amount of noise and bad education on the internet that can prolong the process. This is why I am so intentional about writing these articles and explaining things. I refuse to take time away from anyone’s educational journey.

Learning is always free, but optimizing your time can cost some money, so it all depends on how quickly you want to progress. In the pinned tweet, I discussed the information age. This applies to education as well. If you can ensure that you're only receiving the highest quality education from the resources you're using, the books you're reading, and the people you're interacting with, then you'll learn much faster.

“You wasted $150,000 on an education you coulda got for $1.50 in late fees at the public library.”

My rule of thumb is that if I delve into any field, I can read 40-50 books and likely possess a working knowledge comparable to most "experts." The primary limitation I face is experience. Yet, I am continually amazed by how little people read. What's important is surrounding yourself with high-performing, intelligent individuals because your network is everything.

I converse with people across the globe almost every single day about markets, central banks, governments, and every topic imaginable. When you develop the ability to think critically about the world, you start to exchange value through information, and we're back to the information age!

It's actually a little funny because I was not intending to share my thoughts publicly on this Substack until multiple people encouraged me to. You don’t realize how valuable your interpretive abilities are until you are put in connection with the right people. This is one of the ways I have made money, simply writing research for specific individuals/firms and providing trade ideas. However, this has always been private.

We shall see where this Substack leads. I have a number of people pledging to the Substack already and want me to have a section where I share a lot more trades. I wouldn’t be opposed to funding a 100k account with my own capital, running it, and then donating any gains to charity. But we will see. If that is something you guys are interested in, then just let me know by sharing this and pledging.

Research

We have some interesting option research to dig into but let me start with a very simple idea:

Don’t mistake the map for the terrain!

What does this mean? Well, imagine you are on an airplane over South Africa that is running out of fuel and about to go down. The pilot screams at you, telling you to hand him the map at your feet. You look at the map and it says, "North America Map." You look at him and say, this isn't going to help us, it's a map of North America. Frantically the pilot just says, I don't care, it's better than nothing!

This illustration is literally how most financial research (or pick any industry/social media platform) functions. They give you a ton of "maps," but they literally have no relevance to your decision-making.

Most of the time, it's better to go into the situation with your eyes wide open instead of staring at something that you know for sure can't help you at all.

Why do I tell you all of this? Just because you have “knowledge” or a model, doesn’t mean it accurately reflects the real world where you are making decisions. I always hear a lot of people talking about a variety of topics with such strong opinions, and I just think, do any of you guys really know what you're talking about? There are so many things on a daily basis I simply decide to withhold judgment on because I think it would be better to embrace the uncertainty than have a false sense of confidence.

One of the best traders I know will always say, "Yeah, maybe." I will share some idea with him or we will talk about some narrative, and his response is always, "Yeah, maybe." And for some reason, he just crushes it in markets every single day.

Alright, let's dig into some research. As you know, part of the process in markets is constantly doing research. See my first article on this: link

There are several papers I am currently reading/looking into:

https://twitter.com/Ksidiii/status/1651999153445122050

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4404704

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4109301

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4426358

You can easily search keywords on SSRN to find these types of papers. There are a number of people who tweet SSRN papers as well.

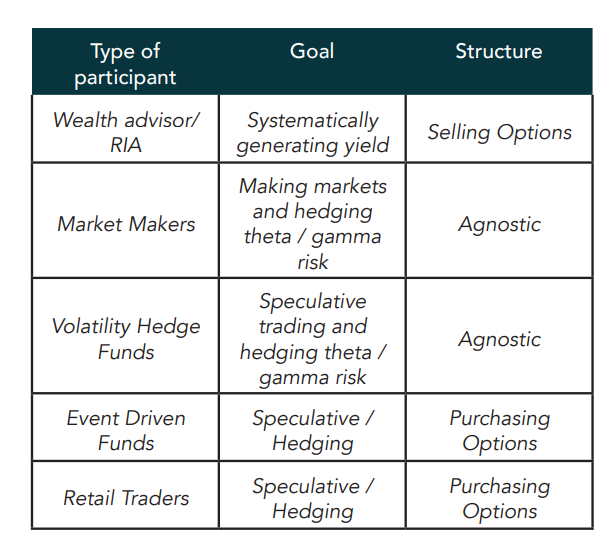

These specific papers focus on the options market, gamma, and 0DTE options. If you are new to financial markets, these are simply instruments that are structured in a manner for you to make bets on various assets.

Ever since zero-dated options were introduced (options or betting instruments that expire at the end of every day), they have taken over the majority of options volume.

Ambrose Paper:

This was a very interesting point, in my opinion. Why does it matter? Because it provides insight into the TYPE of market correction that is likely to occur. 0DTE doesn't mean the VIX will never go up in the future.

The bottom line for this paper: simply being aware of 0DTE options is incredibly important, especially if you are hedging a portfolio, trading on a short time horizon, or placing stops. For example, if you are long or short the market and the 0DTE market causes a ton of stops to get triggered, you could become massively offside if you have slippage. These are things you must consider.

Understanding these types of things goes back to constantly studying the microstructure of the market and how the transaction/liquidity processes are changing.

Retail Traders Love 0DTE Options... But Should They?

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4404704

This paper is a perfect example of why you should know the products you're trading incredibly well.

Gamma Positioning and Market Quality

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4109301

What does this paper mean? Essentially, when someone sells an option, they need to enter the market and hedge their exposure by buying/shorting the underlying asset. When you aggregate the "net positioning" of these players, you can start to get a rough idea of where they can buy and sell. This paper is simply stating that when market makers are forced to sell in order to maintain their hedges, it increases volatility.

Implications:

What do all of these papers mean? I don't want to oversimplify, but I have various option models running at all times across every major market. This is primarily focused on the S&P 500 index, but it's important to watch everything. The 0DTE and overall options market have created a dynamic where we transition from an incredibly stable market to an extremely volatile market that is much faster. The speed at which these types of flows transact is incredible.

A number of people have asked me what resources to look at in order to monitor implied volatility. I will share two:

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3760365

I believe this is one of the best papers out there breaking down intraday characteristics. If you read this along with the book I attached in this Substack, you will be way ahead of most retail people.

https://medium.com/@bertrandlenezet

The second resource is this author on Medium. He has three articles that provide a helpful breakdown of spreads you'll want to be watching. Again, you need to spend time aggregating all the data points, reading books, and building a model. No one is going to hand it to you on a silver platter. The key is to understand how all the moving parts fit together.

Alright, that's enough research for now. I could literally go on for much longer on this, but I just want to give you an idea of what you need to be doing on a consistent basis. Begin to think about how these insights impact your trading or even provide you with opportunities for extracting alpha.

How to think about this week

There are a lot of interesting things for this week. There are many things I am unable to share, but let me provide some broad thoughts:

First, the main event this week will be the FOMC on Wednesday. The market is currently pricing in a 25bps hike. People thinking about the hike are focusing on the wrong thing. Focus on positioning going into the speech.

Second, we have a lot of data prints in the European session on Monday, Tuesday, and Thursday. Watch these prints and rates in Europe during the European session as we move into the US session. Also, remember to watch the European open after the FOMC.

Third, we have AAPL earnings on Thursday. This is the last FANG to release earnings. This will be key to watch and potentially provide a signal depending on the reaction function of equities to the FOMC.

Fourth, watch the NFP print on Friday in the context of Powell's speech on Wednesday. Remember, Powell's speech will frame how you need to think about data moving forward.

Fifth, watch the forward curve in connection with short-term levels in bonds.

Conclusion:

We covered A LOT of stuff. I will end with two things:

I listened to this podcast and it was really good. Perhaps a topic for another article, but I am very intentional about my neurological state and consider my job as being an intellectual athlete. The coach in this podcast is really good. I follow a lot of her work.

If you are enjoying these pieces, I would appreciate it if you shared them with a friend whom you think would find them valuable. As I mentioned earlier, I might consider running a portfolio if there were pledges, but I would need to confirm some details on other projects I’m running.

As always, please feel free to comment with any questions or DM me on Twitter. Thanks for reading!

Incredible content thanks

Amazing piece!