They sold everyone a lie and then became the new establishment

How the greatest lie in crypto is setting the stage for the largest change

They sold everyone a lie and then became the new establishment

For years, the crypto market promised to transform a broken financial system, only to recreate a new establishment dominated by “influencers” who extracted billions while selling financial freedom to everyone else.

That promise is now unraveling. Disillusionment is growing because crypto was marketed as a way to lift people locked out of home ownership and rising living costs into a system where they would finally be valued on equal footing. Instead, it reproduced the same generational and capital divides under a different banner.

As this cycle of broken promises unfolded, the ecosystem drifted away from solving real problems and toward constantly reshaping its narrative to attract fresh capital. Each shift was less about utility and more about sustaining price.

First, Bitcoin was supposed to overthrow the traditional financial system. Then the focus moved to institutional adoption. Eventually, the bullish case collapsed into full capitulation, with the same maximalists who once rejected legacy finance now demanding integration through ETFs, 401k allocations, and traditional portfolios. Only a few years earlier, they were condemning the system they now rely on to legitimize and inflate their holdings.

The maximalist movement traded ideology for access, replacing anti-system rhetoric with appeals to institutional support. They now argue for ETFs and even central bank Bitcoin purchases, not to escape the fiat system, but to inflate their own net worth. Like the boomers who bought homes for pennies on the dollar decades ago, they preach financial escape to newcomers while sitting on a Bitcoin cost basis below $5,000.

The Secret Shift

As crypto’s narrative continuously morphed to pull in new buyers under the banner of “store of value,” a quieter shift took place. Founders and speculators began to assume that higher prices could only come from pushing tokens into the traditional financial system so that “regular people” could buy them.

Over time, this hardened into a single, narrow belief: crypto could only succeed by being absorbed into TradFi.

But what if that framing is backward?

What if the goal was never to bring crypto into TradFi?

What if the real value unlock lies in bringing TradFi into crypto, using crypto-native infrastructure to solve the largest unsolved problem in global capital flows?

Let me lay out the thesis in simple terms.

The global financial system is overwhelmingly denominated in dollars, both for trade and for capital flows. The largest and most important markets are interest rates and FX because they determine how nominal and real changes reverberate through every good, service, and asset priced in dollars.

To operate at scale within this system, financial institutions and corporations must hedge their interest rate and FX exposure. Doing so allows them to focus on their core businesses while neutralizing macro risk that would otherwise dominate their balance sheets and cash flows.

Leverage is not optional in a global system of this size. It is the mechanism that allows risk to be priced, transferred, and absorbed without consuming the capital needed to run the real economy. Efficient leverage keeps markets liquid, spreads tight, and risk flowing to those willing to hold it.

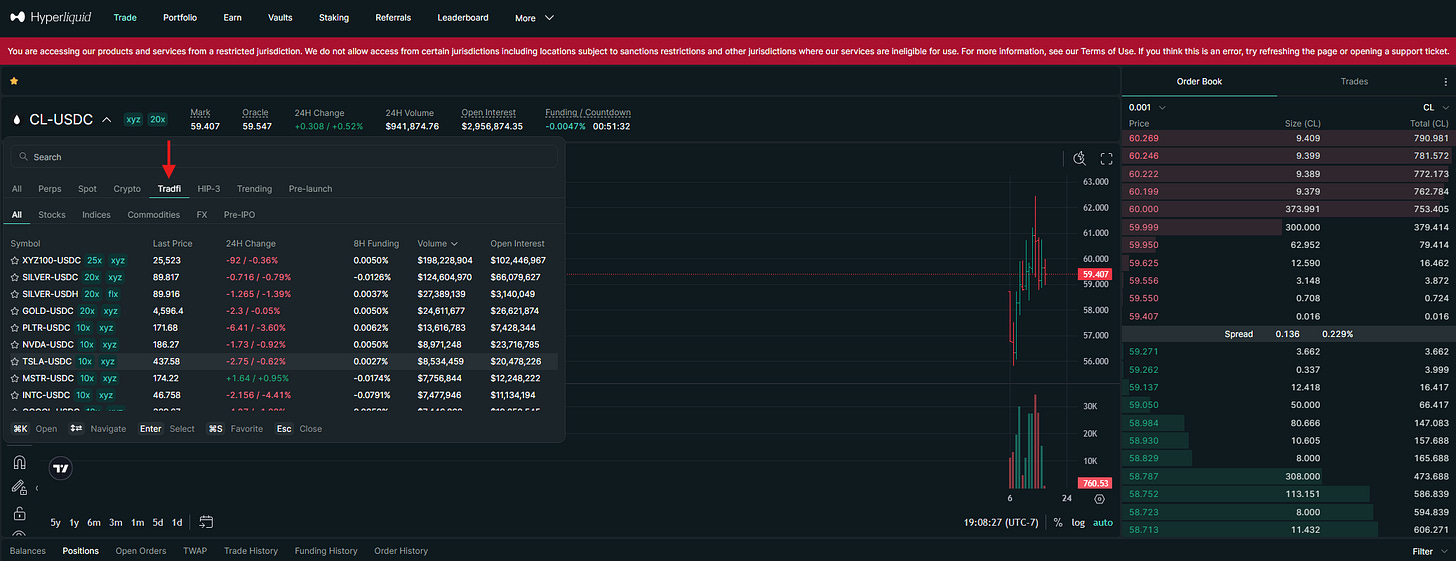

Crypto’s unrealized opportunity was never Bitcoin as a currency or a store of value. It was the ability to deploy leverage-native market infrastructure outside legacy constraints. For most of its history, crypto products fixated on price appreciation narratives instead of solving how leverage actually functions in global markets. Platforms like Hyperliquid invert this entirely by becoming a one-stop venue where efficient leverage can be applied to real-world interest rate and FX risk, not just tokens. As traditional financial assets are integrated, volume in rates and FX will surpass crypto itself, because this is where real hedging demand lives. This flips the prevailing narrative on its head: the future is not crypto entering TradFi, but TradFi migrating to crypto-native infrastructure that finally treats leverage as the core utility of a functioning global market.

This is WHY my largest macro bet is focused on Hyperliquid. (I took the paywall off the report that explains my entire thesis)

I also recorded an entire livestream explaining WHERE we are in the liquidity cycle, how it connects to Bitcoin, and how all of this funnels into Hyperliquid, as well as the PURR treasury company I am betting on.

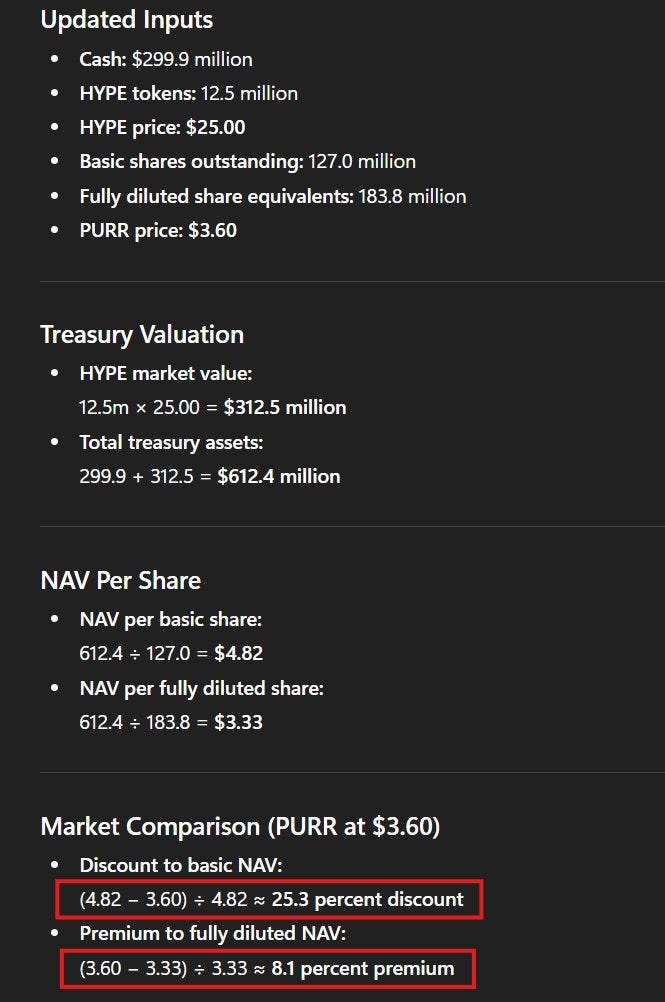

(You can put this image into AI anytime and have it run the fair value model, so you know how much of a premium or discount we are at)

Divergence In Consensus

The growing disillusionment in crypto is not accidental, and it is not cyclical fatigue. It is the natural outcome of a market that promised systemic change but spent a decade recreating the same wealth dynamics under a different aesthetic. What failed was not the technology. What failed was the framing.

Crypto did not lose its way because Bitcoin did not become a global currency or because ETFs arrived too late. It lost its way because the market mistook price appreciation for transformation, and narrative adoption for structural utility. The obsession with getting crypto “into” the traditional financial system was always backward. It assumed legitimacy flowed from incumbency rather than from solving real constraints.

The real constraint in the global system has never been narratives. It has been the efficient deployment of leverage across interest rates and FX, the two markets that actually govern how capital moves, how risk is hedged, and how balance sheets survive. That is where scale lives. That is where demand is non-negotiable. And that is where the existing system remains slow, fragmented, and capital-intensive.

This is why the next phase of crypto will not be defined by tokens competing to be money, or narratives competing for retail attention. It will be defined by infrastructure that allows global financial risk to be priced, hedged, and transferred more efficiently. Platforms that understand this are not trying to bring crypto to TradFi. They are bringing TradFi to crypto, and in doing so, they are finally addressing the problem crypto was supposed to solve all along.

The irony is that the most important shift in crypto is happening precisely when the market feels the most disillusioned.

The information on this website/Substack is for information purposes only. It is believed to be reliable, but Capital Flows does not warrant its completeness or accuracy. The information on the website/Substack is not intended as an offer or solicitation for the purchase of stock or any financial instrument. The information and materials contained in these pages and the terms, conditions and descriptions that appear, are subject to change without notice. Unauthorized use of Capital Flows websites and systems including but not limited to data scraping, unauthorized entry into Capital Flows systems, misuse of passwords, or misuse of any information posted on a site is strictly prohibited. Your eligibility for particular services is subject to final determination by Capital Flows and/or its affiliates. Investment services are not bank deposits or insured by the FDIC or other entity and are subject to investment risks, including possible loss of principal amount invested. Your use of any information which is proprietary to Capital Flows or a third-party information provider shall only be used on individual devices without any right to redistribute, upload, export, copy, or otherwise transfer the information to any centralized interdepartmental or shared device, directory, database or other repository nor to otherwise make it available to any other entity/person/third party, without the prior written consent of Capital Flows.

Doesn’t this argue for ethereum since most financial institutions are building on ETH or ETH L2s?

if you can mention in the stream why you find hyperliquid that transformative and what your expectations are, would be great.

competition from robinhood, coinbase etc could be a big threat