This trade write-up will break down the updates that took place during FOMC today and explain the risk-reward for running trades in equities, bonds, and credit.

Big Picture:

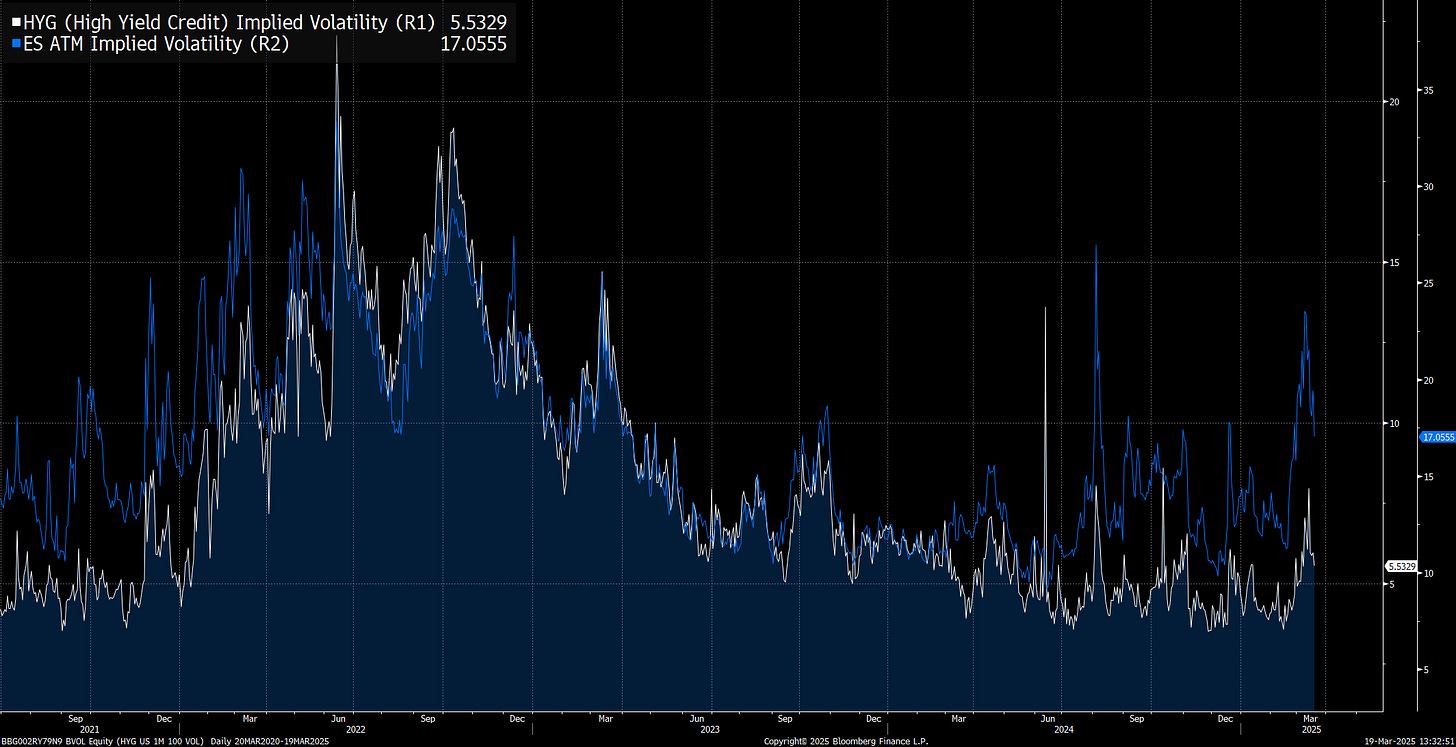

The first thing I want to start with is the fact that there has been a step up in the LEVEL of volatility for risk assets that is likely to continue through Q2 given the risks we are facing. Both high-yield credit volatility and equity volatility are consolidating at a higher level and their retracement from highs was NOT met with a significant bid in equities.

The step up in basis for volatility has overlapped perfectly with the 2 year making a lower high on a cyclical basis. This is no accident and speaks to WHERE we are on a cyclical basis. When we connect the cyclical forces with shorter-term catalysts like the FOMC meeting today, we can have a clear picture of the scenario analysis and risk-reward for assets.

We are entering a period in the cycle that will become increasingly difficult due to the shifts in correlation, higher levels of volatility, and underlying shifts in growth.

Keep reading with a 7-day free trial

Subscribe to Capital Flows to keep reading this post and get 7 days of free access to the full post archives.