Trades: Alpha Report and Week Ahead

Energy beta and bonds

The macro regime laid out in the macro report continues to be confirmed:

The main events of this week are CPI and the minutes:

Momentum remains squarely skewed to the upside in equities:

Dispersions under the surface continue to produce significant opportunities for generating alpha. See the most recent report by SpearPoint Equity Alpha

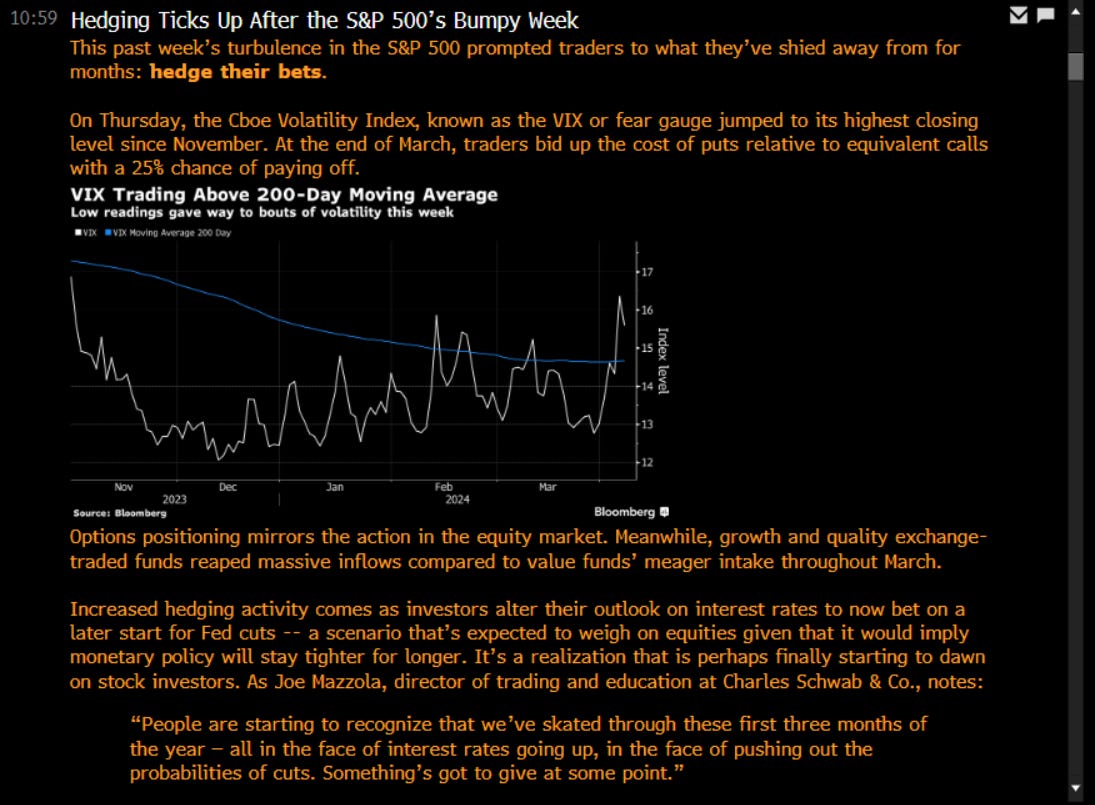

While media participants continue talking about tails, bonds remain in a mean reversion regime as noted in this article:

The equity and bond market has already priced in the Fed cutting rates later than expected. The bigger question is what will happen when these “insurance cuts” are realized?

See the attached alpha report with analysis on bonds, crude, and equities. If my bond strategy triggers a trade this week, I will let you know so keep your notifications on.

Keep reading with a 7-day free trial

Subscribe to Capital Flows to keep reading this post and get 7 days of free access to the full post archives.