Trades: Alpha Report, Week Ahead, Macro Convo

We remain risk on!

Big Picture:

The data prints last week confirmed the macro regime we are in. GDP came in above expectations and initial claims remain suppressed. This is not a recession!

The PCE prints came in line with expectations:

There are several things to take note of in the personal income and outlays data:

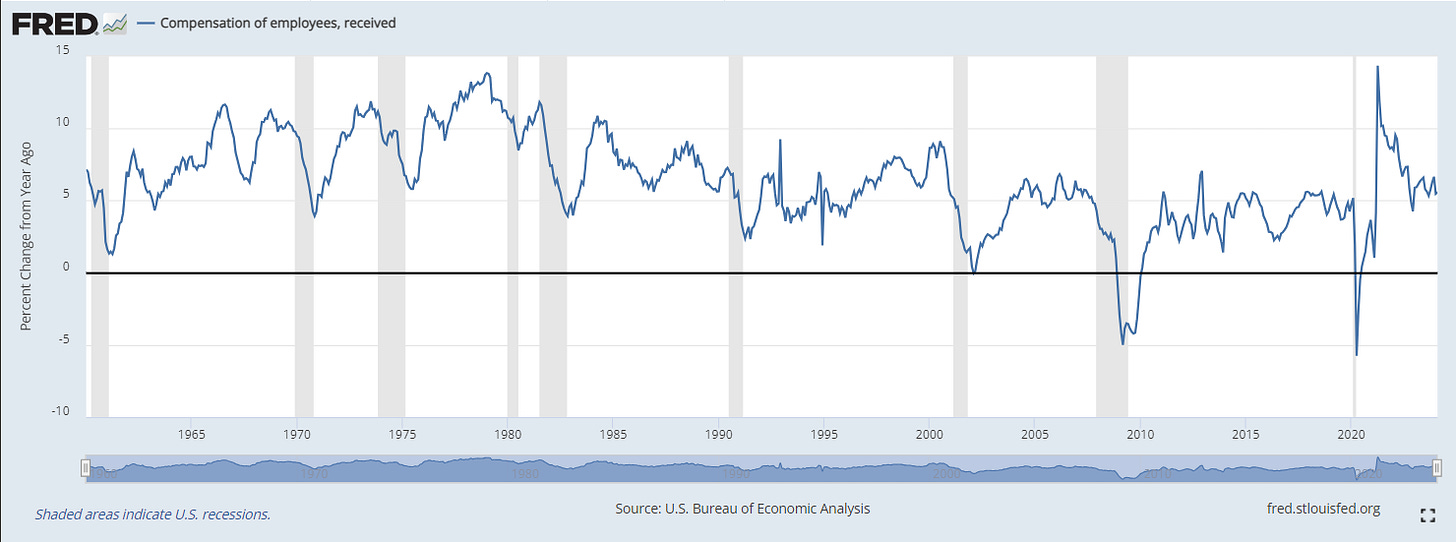

First, the compensation of employees remains elevated:

This is directly connected to the wage input which is directly connected to inflation. The implication is that reaching the 2% target in inflation has a low probability for 2024:

Second, real growth remains strong. Real PCE accelerated marginally:

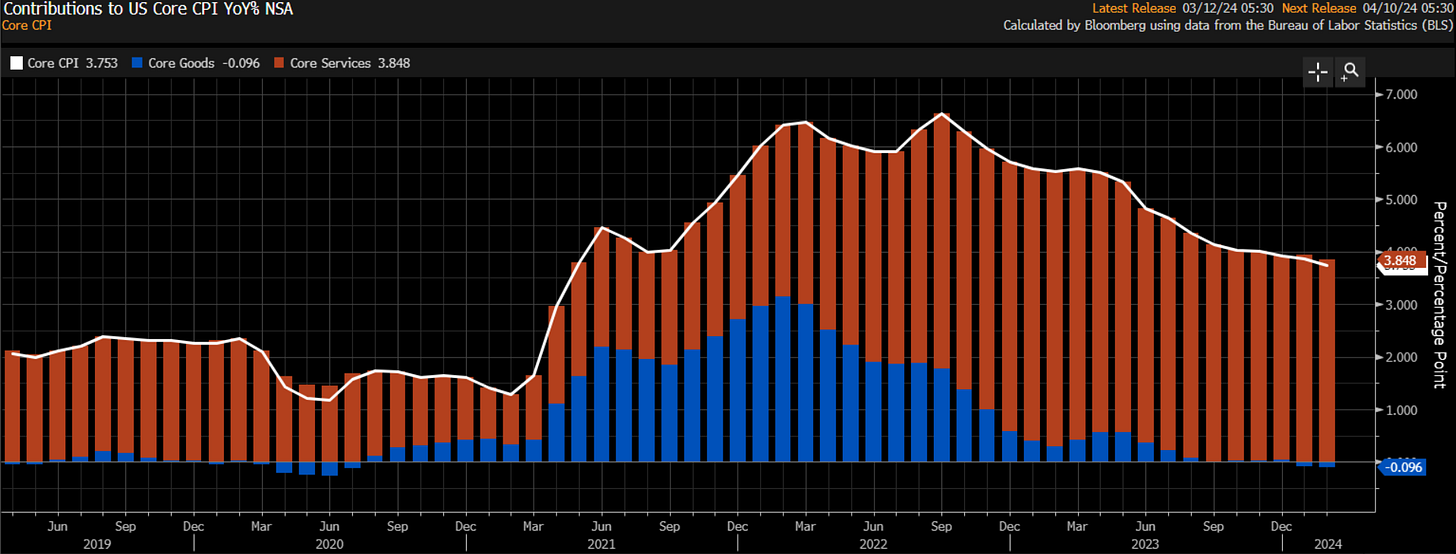

A marginal divergence took place between services and goods consumption. This is likely connected to WHY we are seeing resilience in service components of inflation:

As we can see, goods have been contributing a disinflationary pressure while service inflation is not decelerating as fast as the Fed would like:

Week Ahead:

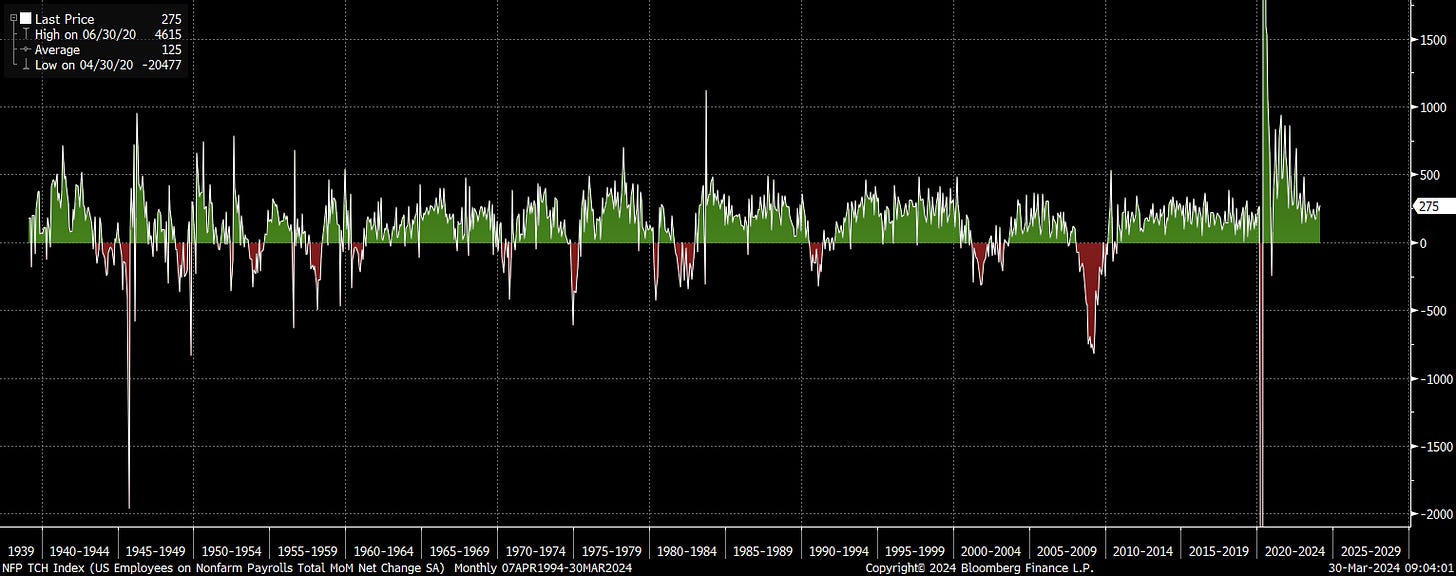

The construction spending print will be important to get an idea of the investment line item of GDP. The ISM prints will be important for thinking about the goods and services components of PCE and the NFP print is going to be the main data print of next week:

I will just say this, everyone is getting so overblown on the recent NFP revisions. In my mind, it literally doesn’t matter. If something is taking place in macro land, it will be reflected across a multiplicity of datasets. Even with revisions, we are so elevated in NFP right now!

Alpha Report:

I want to close with two things:

Alpha Report: specific trades for this macro regime

Macro Conversation: how economic data works

I recently did a Twitter Spaces with Prometheus Research on how to think about economic data, you can find it here: Link. This was an awesome convo (maybe a little nerdy)!

I would encourage you to follow Prometheus Research on this though because they run this entire process incredibly well! I subscribe to their ETF portfolio and it’s one of the best investments I have ever made.

Alpha Report Below: (as a reminder to free Subscribers, tomorrow will be the last day to lock in the price of the Substack at $50 a month or $600 annually. The price will increase to $60 a month or $720 annually on April 1st).

Keep reading with a 7-day free trial

Subscribe to Capital Flows to keep reading this post and get 7 days of free access to the full post archives.