Trades: Factor Flows, Macro, Week Ahead

Risk on/Risk off flows

Hello everyone,

Let me start by saying, there are so many things I want to cover but not enough time in the day. There are so many trades to run but not enough time in the day. There are so many things to learn but not enough time in the DAY!

Where are we?

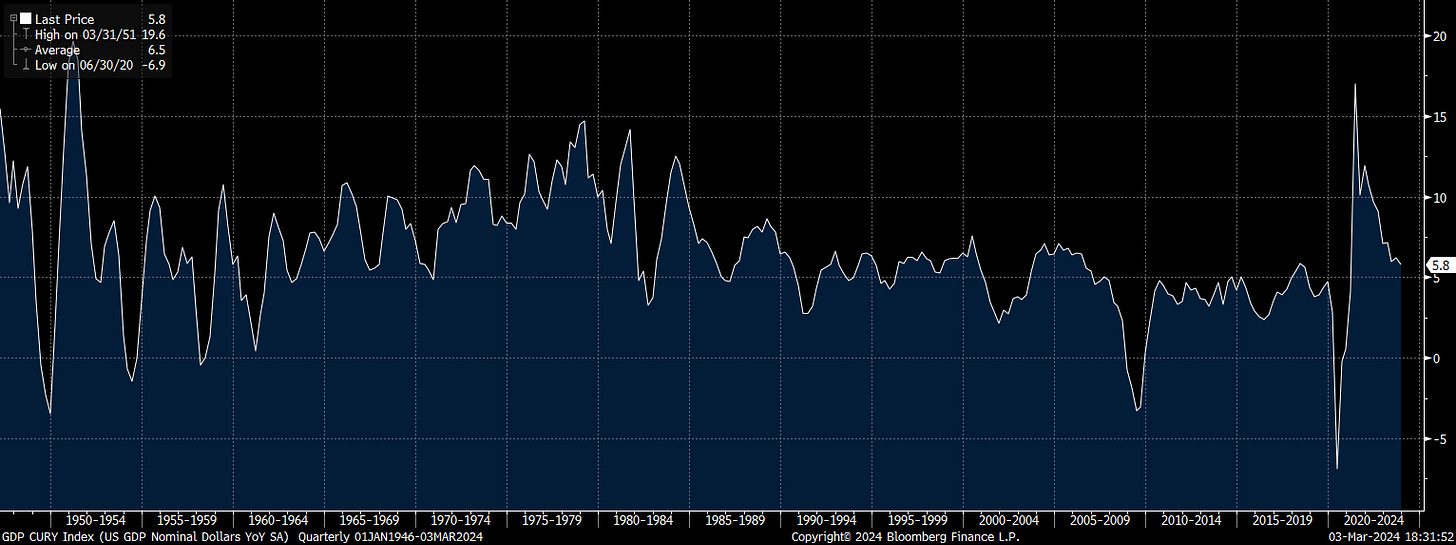

Based on my models and analysis, we are compressing in the macro regime on a cyclical basis before the next inflection point. It is very clear that we have entered into a higher nominal growth environment that isn’t changing any time soon.

The rate hikes by the Fed are not having the desired impact because the majority of debt is fixed rate and the S&P500 has companies with incredibly strong balance sheets:

Now here is the problem, the Fed has clearly paused its stance in tightening policy. Just as the Fed has paused, credit issuance is increasing and MoM CPI is accelerating. There is no evidence of a recession in the imminent future (Q2-Q3 of this year) which means we are unlikely to see a pronounced rally in bonds.

See the full bond report here: Link

See the report where I said equities are going to melt up here: Link

I have been very clear on my stance on both stocks and bonds. I have been bullish stocks for a long time and have been trading bonds tactically.

All of the senior loan officer surveys have begun to loosen:

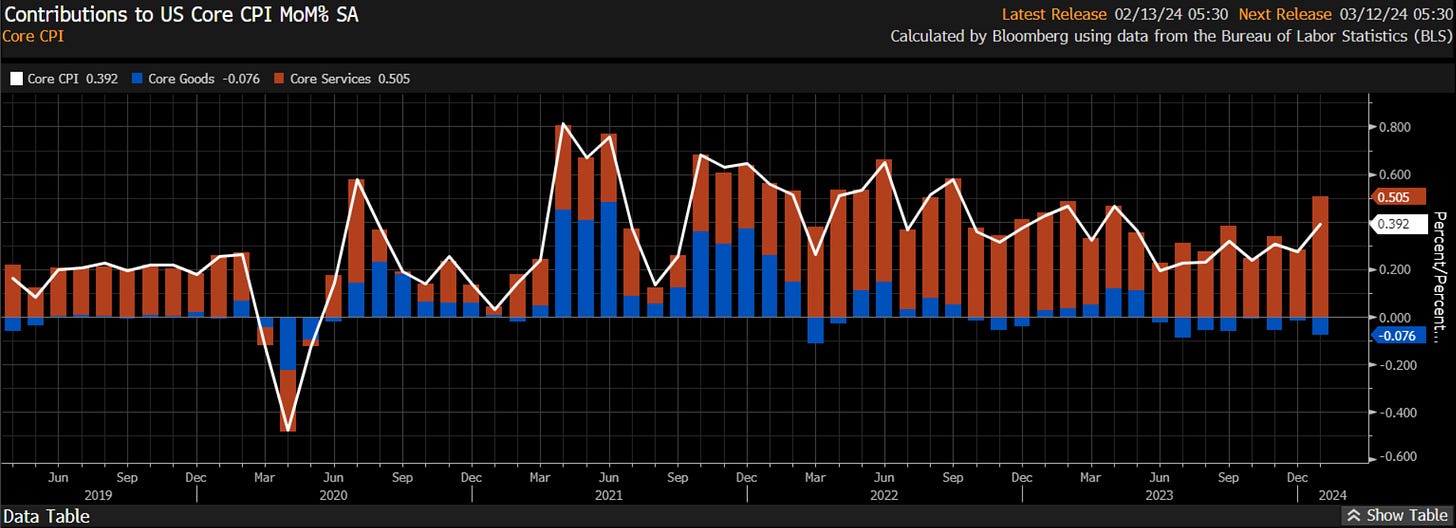

And it is only goods that are dragging inflation prints down:

Now here is the deal, we are basically in an environment similar to 2021 where we are seeing the macro regime provide accommodative liquidity conditions while the Fed holds its stance flat at its current level. Eventually, this regime is going to turn into another acceleration in inflation that the Fed has to respond to. However, it is clear that their rate hikes aren’t having the desired impact and the Treasury isn’t interested in issuing more duration. Until the Fed begins to shift the QUANTITY of money in the system OR the Treasury begins to issue more duration, we are in melt-up mode. Once we begin to see the marginal change in these factors and a shift in risk flows across the curve, that is when the inflection point will occur.

When is the inflection point and what are the current trades?

Keep reading with a 7-day free trial

Subscribe to Capital Flows to keep reading this post and get 7 days of free access to the full post archives.