Trades: FOMC The Direction Of Rates / Equities

The markets confusion around Powell

I want to start this article with how forward guidance works. Many people misunderstand how to connect the comments of Powell and other govonors to the market because they know very little about the pricing of the forward curve.

Let’s start with a very simple idea: the short end of the curve is pricing WHERE the Fed Funds rate will be over a specific period of time. This can be a rolling period of time such as the 2 year interest rate (represented by ZT futures) or specific SOFR contract representing a fixed date in the future. For example, The Decmeber 2025 SOFR contract is pricing what the Fed Funds rate will be in Decemeber of 2025. Below is a chart of the long trade I have been running in this contract (link):

Here is the deal, Powell looks at his Bloomberg terminal every single day to see how the forward curve is pricing the actions he plans to take. He watches how all economic releases get priced into markets and he is aware of all the views people have across all major camps.

All of us had a reasonable degree of conviction that Powell is planning to cut in Septemeber. Why is this? Because he intentionally didn’t push back against the pricing of the forward curve. Think about it like this, coming in today’s meeting, Powell knew that the Septemeber contract was pricing a rate cut. He could of said something specific intended to communicate to the market that he doesn’t want it priced that way. When he doesn’t push back on the market then he is functionally providing confirmation that as things stand with the data, its ok. He actually did this before today’s meeting as well.

Rememember, the market is always pricing what is UNKNOWN. As information moves across the spectrum of uncertainty to certainty, the market readjusts its expectations of the future. Powell knows this and contributes to this. When he provides rhetoric for forward guidance in the curve, it is in both what he does say and doesn’t say that provides signal.

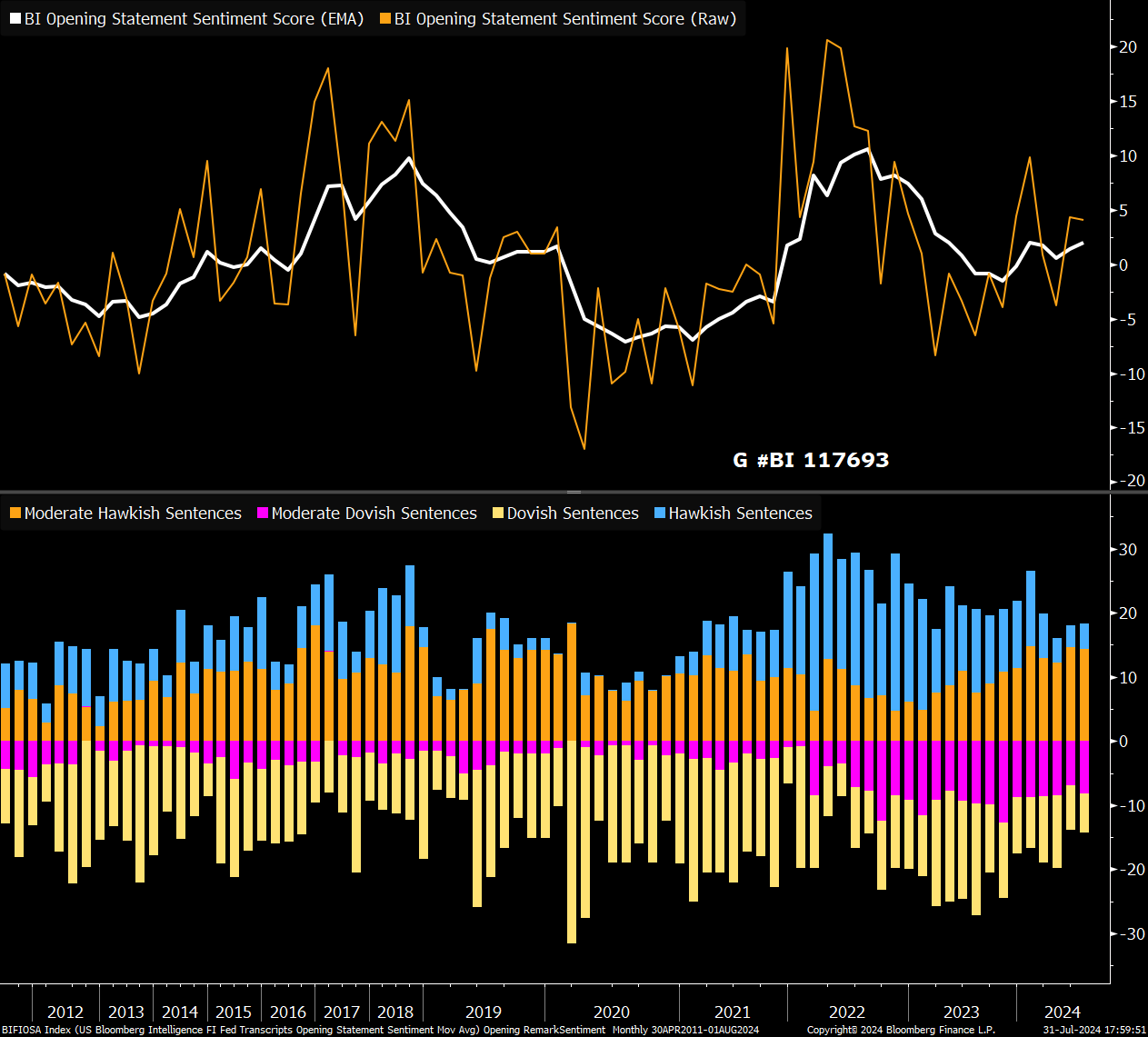

Right now, Powell is still keeping a very even tone in his rhetoric but it remain biased to the dovish side:

The question you should be asking now is, what are the implications of the meeting today on interest rates and equities? We are going to dive into this but first, please check out the announcement article I did here. There will be a price increase on Monday August 5th. If you subscribe BEFORE then, you will lock in the lower price.

Alright let’s get into markets!

Trades:

Keep reading with a 7-day free trial

Subscribe to Capital Flows to keep reading this post and get 7 days of free access to the full post archives.