The macro report with the cyclical skew for interest rates has been laid out here:

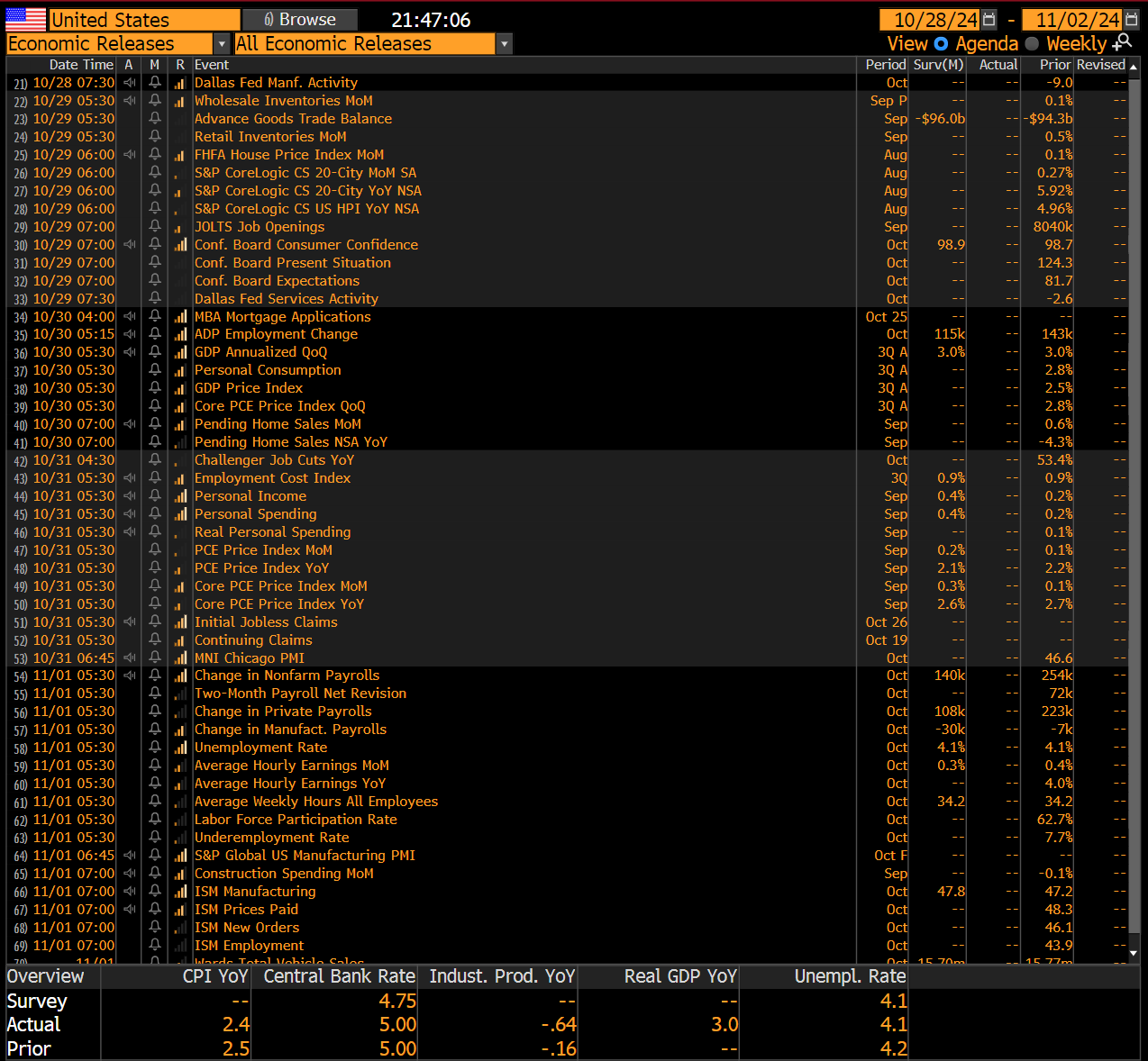

While the view for rates has not changed, it is clear that we need the NFP and FOMC catalyst to set a durable bottom in bonds. These catalysts don’t occur until next week and the week after.

We have broken the risk-reward barrier noted for the ZN trade (link).

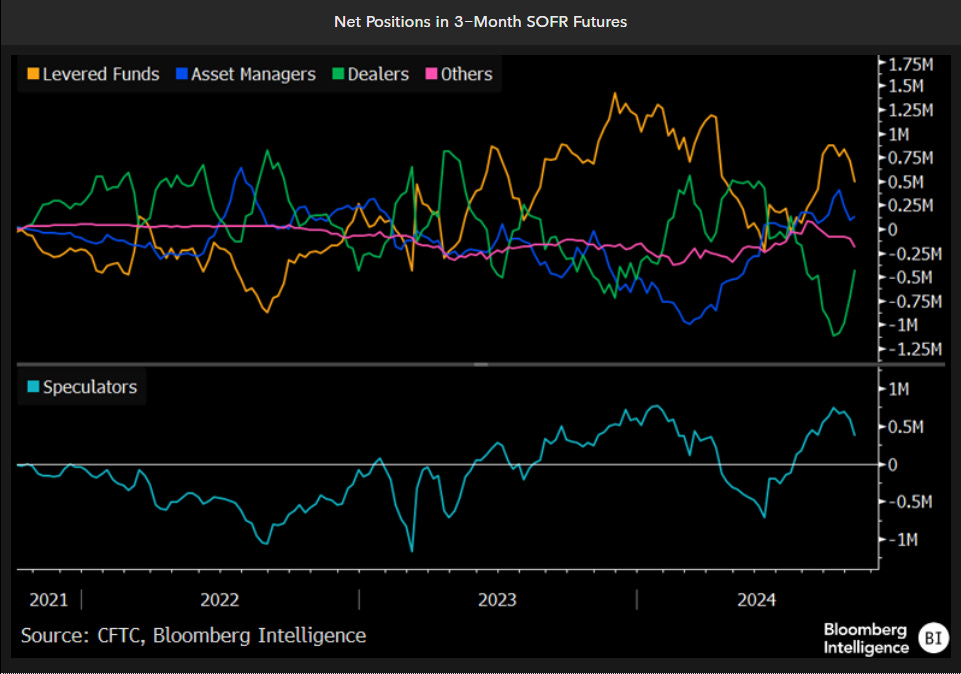

For the time being, I am turning neutral on bonds until we move through NFP and set more of a durable bottom. While the short end (ZT or Z5 SOFR contract) has less downside than duration, we are unlikely to see the upside realized until after FOMC. As a result, degrossing marginally until then isn’t a horrible idea.

The macro view laid out remains the same but we are moving around the positioning tensions in rates. The other views laid out in the macro report continue to come to fruition as equities rally, metals rally, Bitcoin rally and crude remains at lows.

As long as implied vol remains elevated for rates, we are going to see wider ranges. Implied volatility (white) remains at a premium to realized vol (orange)

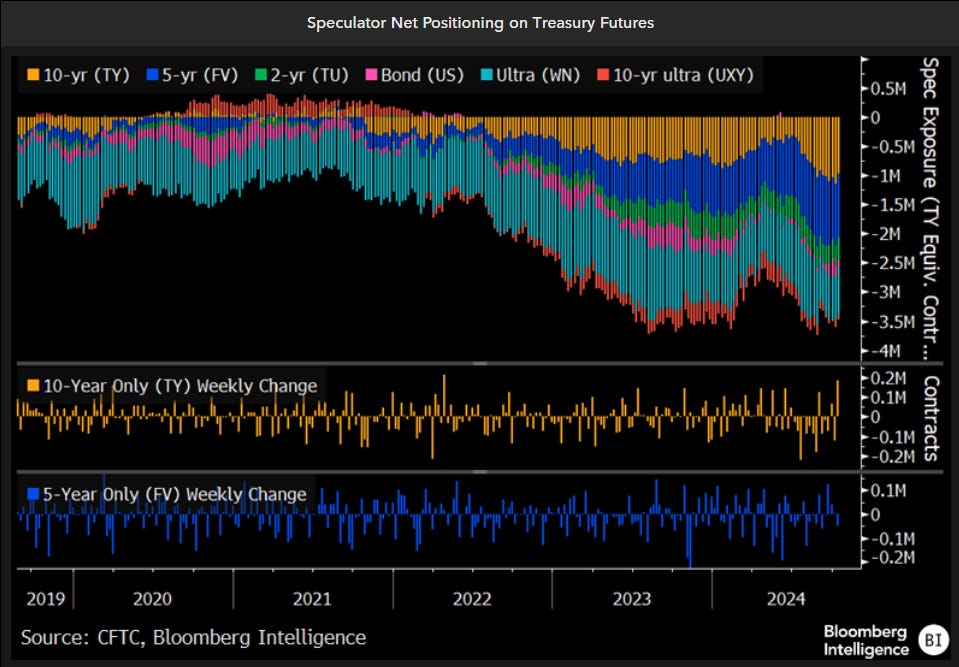

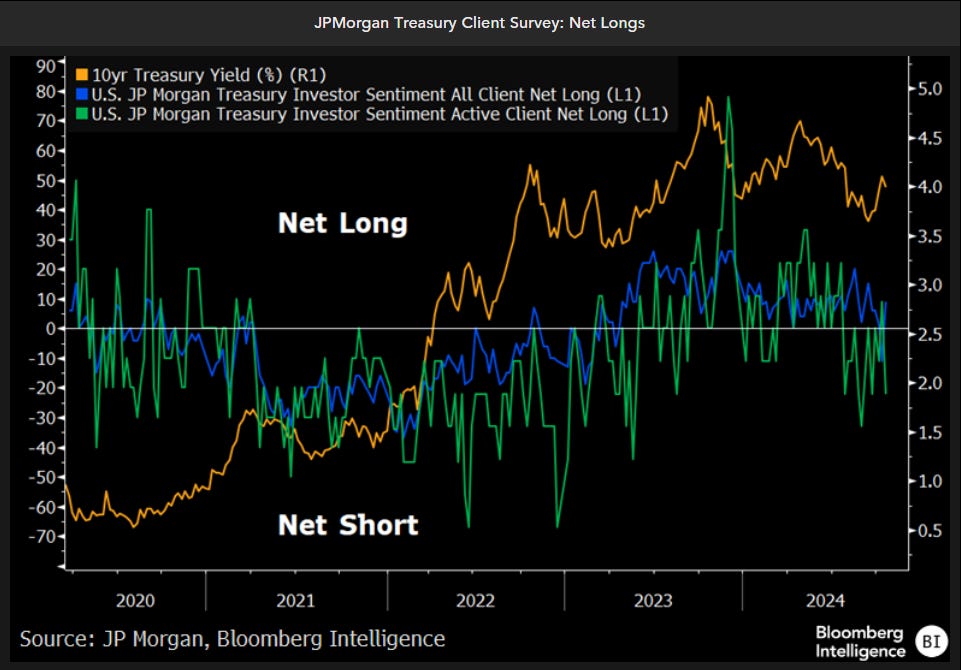

Some additional charts on rates:

It’s clear the put skew is blown out. The question is simply WHEN we set a bottom.

The curve steepening we have seen since the last FOMC is primarily bear steepening. It is difficult for these TYPES of moves to have durability in the macro regime we are currently in.

Keep a close eye on things moving forward because once bonds make a durable bottom and we get a positioning shock to equities through a macro catalyst like NFP or FOMC, this will set the stage for the next trade. Patience is critical here.

The information on this website/Substack is for information purposes only. It is believed to be reliable, but Capital Flows does not warrant its completeness or accuracy. The information on the website/Substack is not intended as an offer or solicitation for the purchase of stock or any financial instrument. The information and materials contained in these pages and the terms, conditions and descriptions that appear, are subject to change without notice. Unauthorized use of Capital Flows websites and systems including but not limited to data scraping, unauthorized entry into Capital Flows systems, misuse of passwords, or misuse of any information posted on a site is strictly prohibited. Your eligibility for particular services is subject to final determination by Capital Flows and/or its affiliates. Investment services are not bank deposits or insured by the FDIC or other entity and are subject to investment risks, including possible loss of principal amount invested. Your use of any information which is proprietary to Capital Flows or a third-party information provider shall only be used on individual devices without any right to redistribute, upload, export, copy, or otherwise transfer the information to any centralized interdepartmental or shared device, directory, database or other repository nor to otherwise make it available to any other entity/person/third party, without the prior written consent of Capital Flows.

Which article hold I look at to understand how to use the implied vs realised vol to understand how to position for a trade ?

BUT FINTWIT SAYS THE FED HAS LOST CONTROL AND RATES ARE GOING TO 14%!?!?! ahahaha