Trades: Week Ahead / ES

Skew for catalysts

Hello everyone,

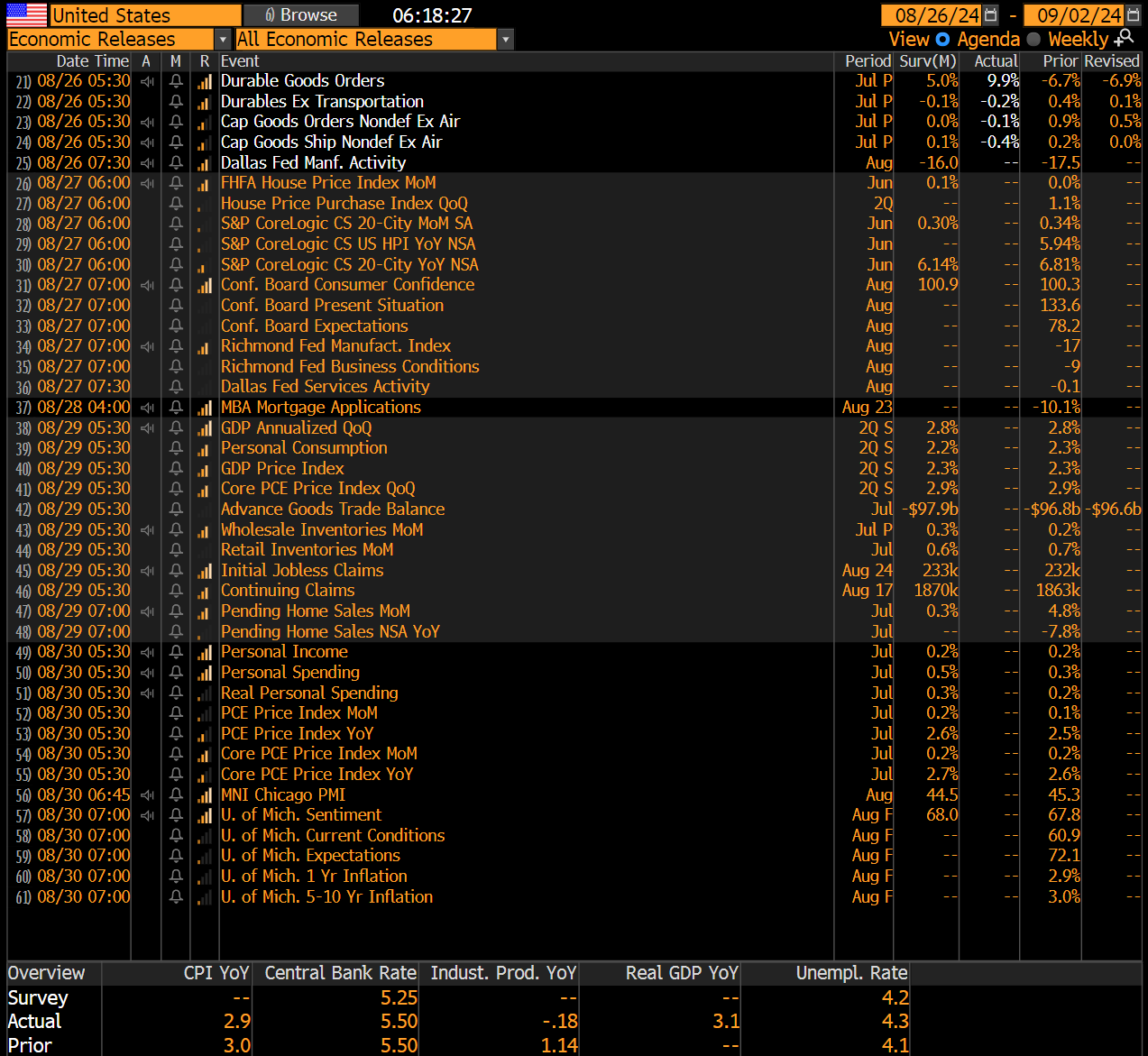

The main data prints for this week are going to be GDP and the personal income and outlays data. The PCE data will inform our view of consumption in both goods and services. This is likely to show inflation decelerating and resilience in real services and goods spending:

The implication is that we are likely to see Goldilocks continue. Please see the macro alpha primer here: Link. Watching the stock-bond correlation during these prints will be key this week since GDP and PCE will provide further clarity into the degree of Goldilocks.

Last week at Jackson Hole, we saw significant hedging pressure from the wicks to the upside and downside. I laid out how these hedging pressures work in this primer: Link

The hedging pressure from last week sets the skew for this week. Please review the macro report for the context of the trades I am going to lay out below:

Trades:

Keep reading with a 7-day free trial

Subscribe to Capital Flows to keep reading this post and get 7 days of free access to the full post archives.