Visualizing The Path Forward

Understanding the path dependency of the Fed

Path dependency is THE KEY to understanding how to align yourself with the mechanics of financial markets. The reason WHY economists are always wrong is because they have the wrong orientation toward the future. They make linear extrapolations instead of moving from one state to another on a path-dependent base. In other words, you don’t want to make predictions of an “inevitable” destination, you simply want to align your actions with how the current state is setting up for the next state.

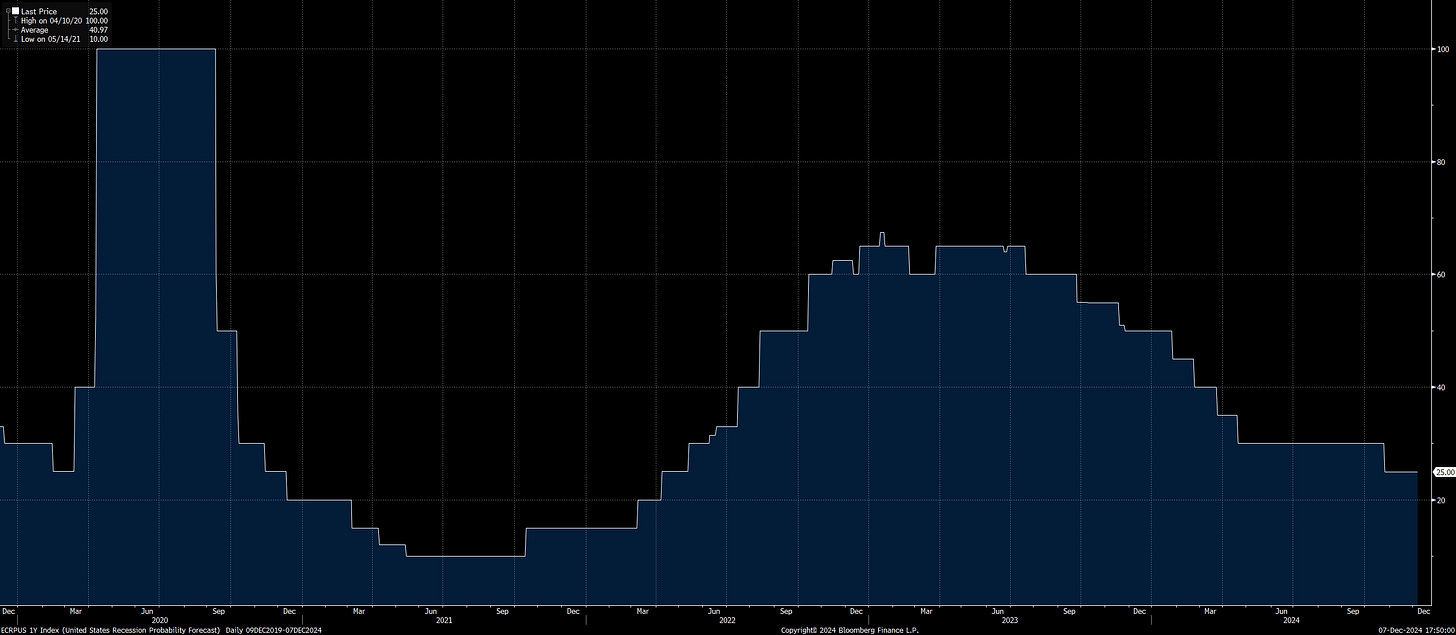

The chart below shows the consensus expectations of the probability of a recession. You will notice that it was at its highest when the Fed’s hiking cycle was at the extreme and the yield curve was the most inverted.

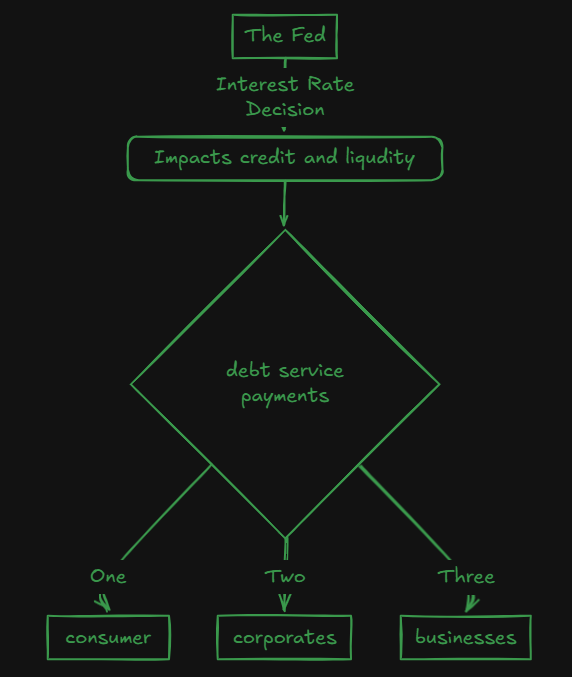

Many of these economists will try using the yield curve to make a linear extrapolation of the future (link). In reality, the economic system and HOW to interact with it is much more complex. Even the simple visualization below is reductionistic:

How does the Fed connect to this? The primary job of the Fed is to manage the discount rate on which the entire financial system turns. These interest rates are transmitted to the entire economy:

This brings up the question, WHERE are we right now with the Fed and path dependency? The framework for this has been comprehensively laid out in the macro report published earlier this week but I want to dig a little deeper here:

The Fed’s actions in connection to how growth changes will determine how assets move over the next 90 days. The difficulty is in the fact that the Fed's decision is BOTH a response to and an input into growth and inflation.

Right now, the forward curve is pricing 38bps of cuts in 2025. If growth surprises to the downside then the forward curve is likely to price more. If growth and inflation surprise to the upside, we are likely to price LESS.

This is WHY mapping all the components of growth, inflation, and liquidity is so critical. If you can have some degree of knowledge into the timing and degree of changes in these economic variables, then it can frame decision-making with significantly more clarity. If you haven’t already downloaded the Macro Rate Matrix Dashboard, I would encourage you to do so here. We will be releasing a new updated version of this spreadsheet every single week in January so that you have a complete picture of all major economic data. This will automatically update and seamlessly feed you a clear picture of what is taking place.

Pulling Things Together:

As we come to the end of the year, I have a simple (yet difficult) challenge for you: Ask yourself these three questions

Do I have a proper interpretive framework to be a clear thinker on a macro basis?

Do I have a proper flow of information for my framework that consistently paints a comprehensive picture of WHERE we are?

How can I improve #1-2?

If you have well-thought-out and robust answers to these questions, you will be entering 2025 with a huge advantage.

Accelerate fren

The information on this website/Substack is for information purposes only. It is believed to be reliable, but Capital Flows does not warrant its completeness or accuracy. The information on the website/Substack is not intended as an offer or solicitation for the purchase of stock or any financial instrument. The information and materials contained in these pages and the terms, conditions and descriptions that appear, are subject to change without notice. Unauthorized use of Capital Flows websites and systems including but not limited to data scraping, unauthorized entry into Capital Flows systems, misuse of passwords, or misuse of any information posted on a site is strictly prohibited. Your eligibility for particular services is subject to final determination by Capital Flows and/or its affiliates. Investment services are not bank deposits or insured by the FDIC or other entity and are subject to investment risks, including possible loss of principal amount invested. Your use of any information which is proprietary to Capital Flows or a third-party information provider shall only be used on individual devices without any right to redistribute, upload, export, copy, or otherwise transfer the information to any centralized interdepartmental or shared device, directory, database or other repository nor to otherwise make it available to any other entity/person/third party, without the prior written consent of Capital Flows.

Great points! Thank you.