Week Ahead: Macro Set Up / Geopolitical Risk Premia

Don't get confused by the noise

Hey everyone,

I hope each of you had a good weekend!

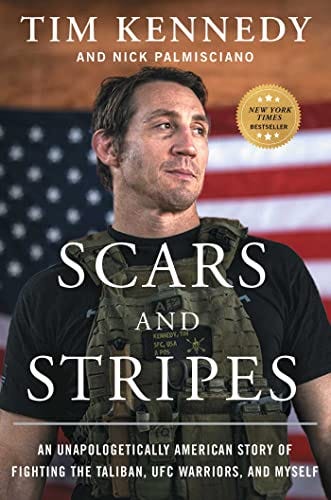

As you know, my weekends generally consist of church, a hike, and reading a good book. I have been reading a number of books but Jaymes Rosenthal | "Invest With Instinct" gave me Scars and Stripes on audible. Let me tell you, one of the best books I’ve ever come across. The guy is a legit legend!

As we go into this week, Jaymes and I are doing a 96-hour fast. I am honestly not sure how it will go because I am running over 6 miles a day and doing a lifting routine. (we will see lol)

I really enjoy reading books about people who push themselves to their limits and then actually do difficult things in life.

Opportunity is always wrapped in difficulty.

With all of that to say let’s jump right into markets!

The main things I am covering today:

Macro Set-Up for this week

Geopolitical Risk premia

Is the 10s03m YC saying imminent risk-off event?

Macro Set-Up for this week:

We remain in a period where volatility is likely to compress. Ultimately, we are likely to have either a reacceleration in inflation OR a recession. The market isn’t pricing either of these scenarios. Given where real GDP is, we are unlikely to have a recession in Q4 of this year. Inflation is likely to decelerate marginally in Q4 which will put minimal pressure on additional hikes. In sum, we are likely to continue seeing the low volatility environment we have seen since SVB.

Keep reading with a 7-day free trial

Subscribe to Capital Flows to keep reading this post and get 7 days of free access to the full post archives.