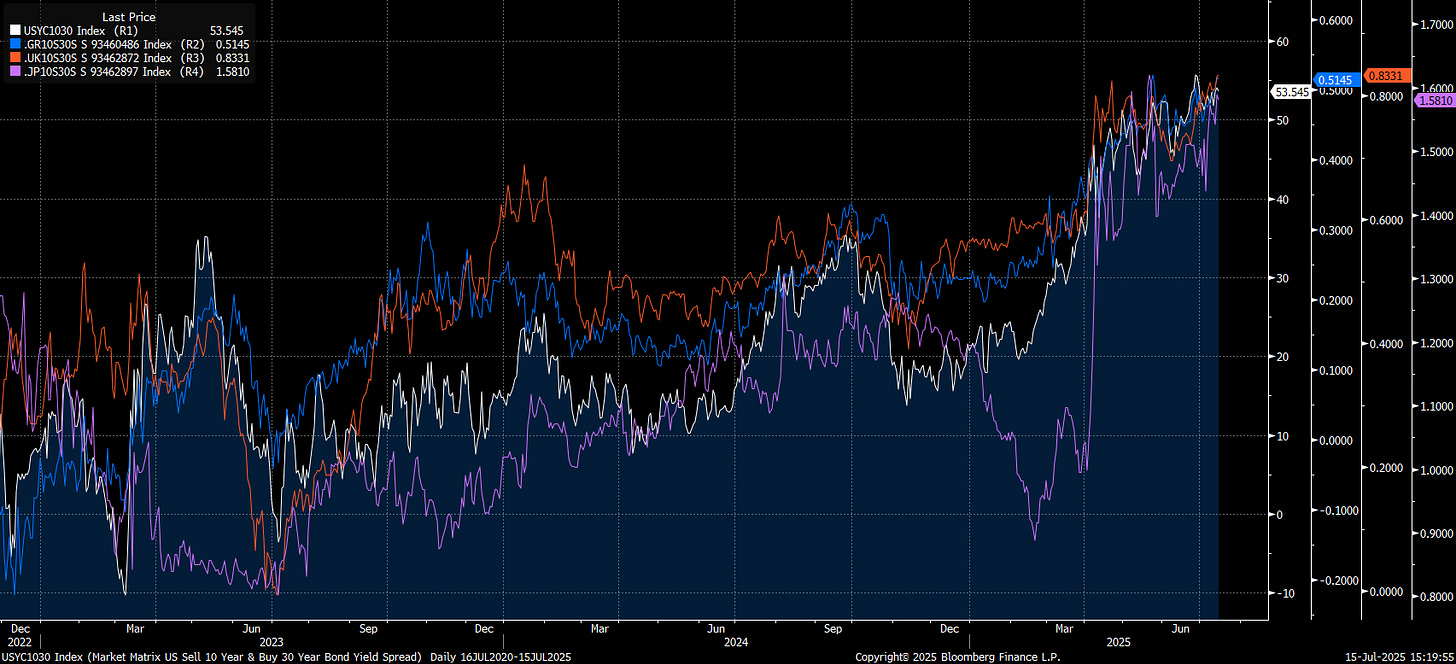

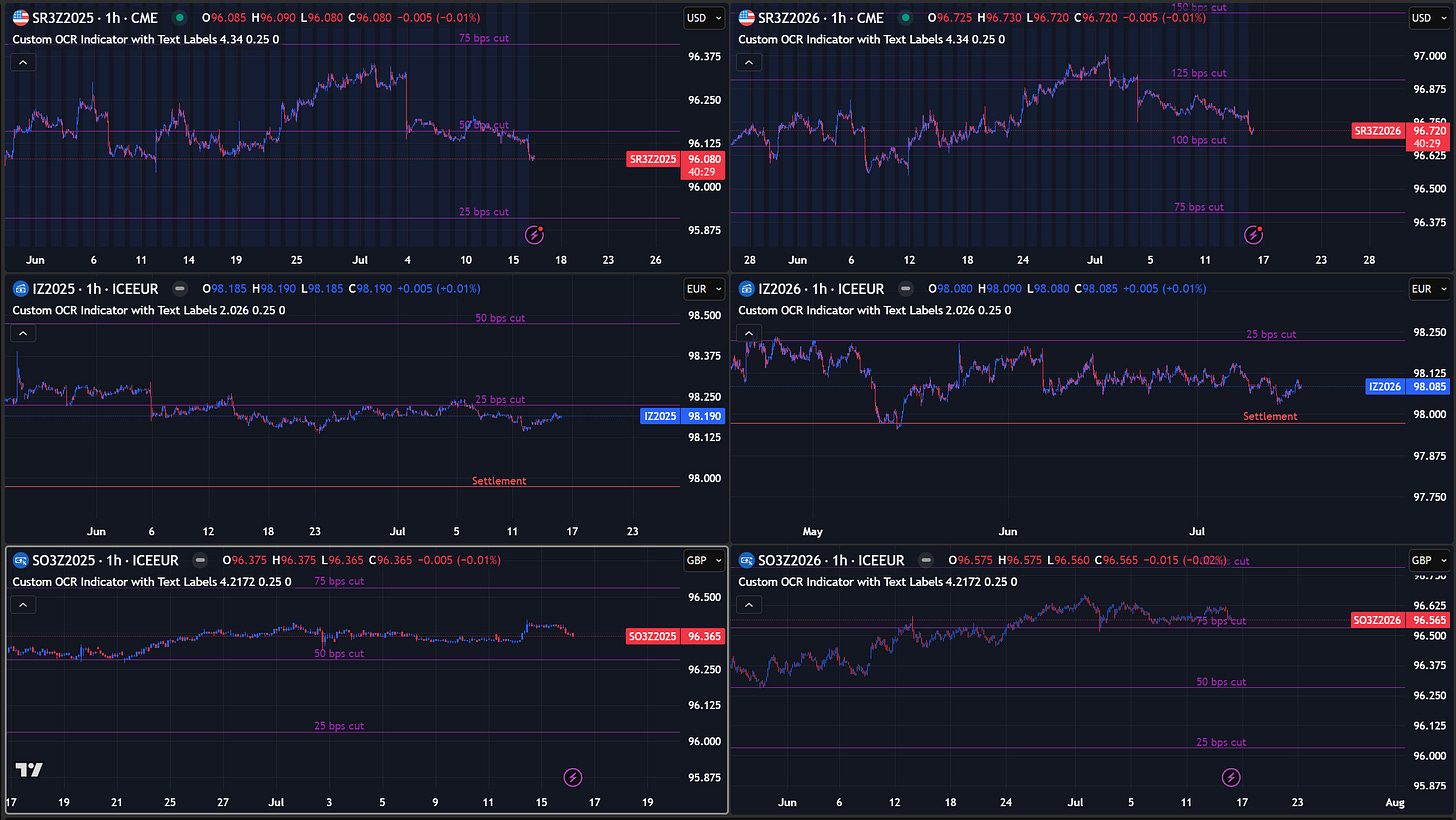

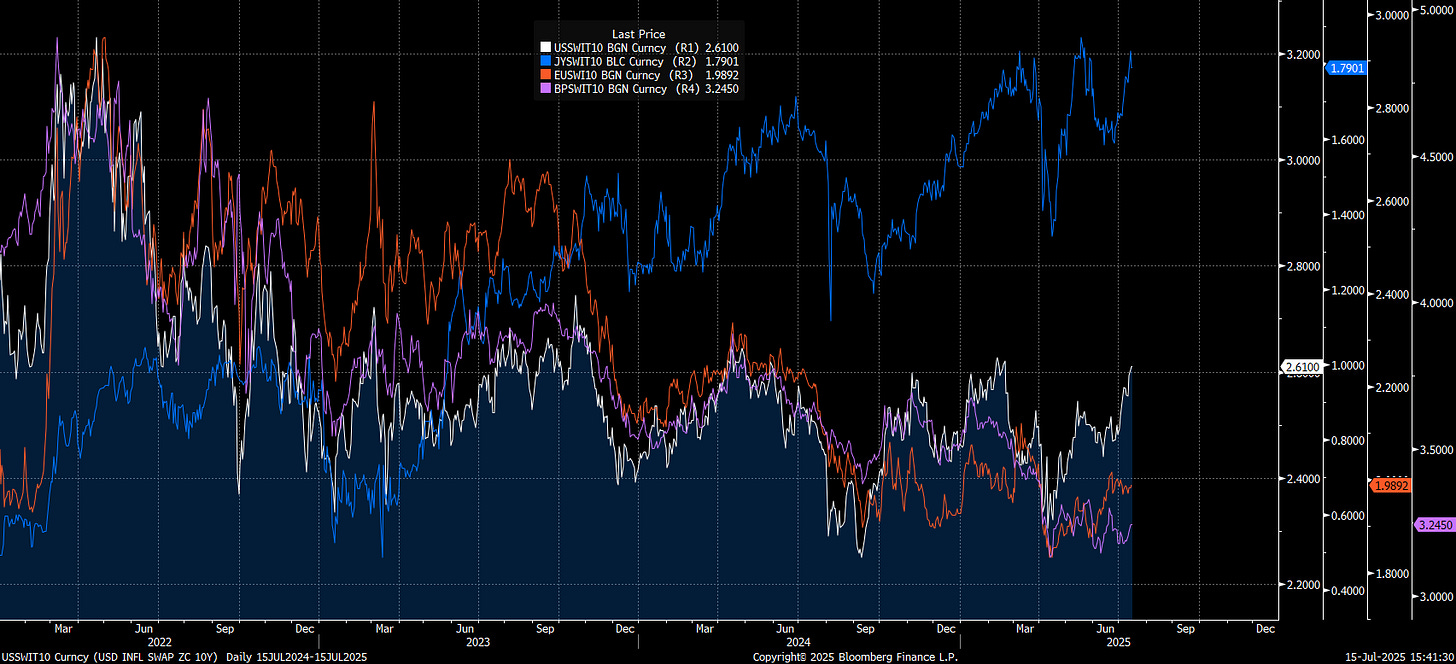

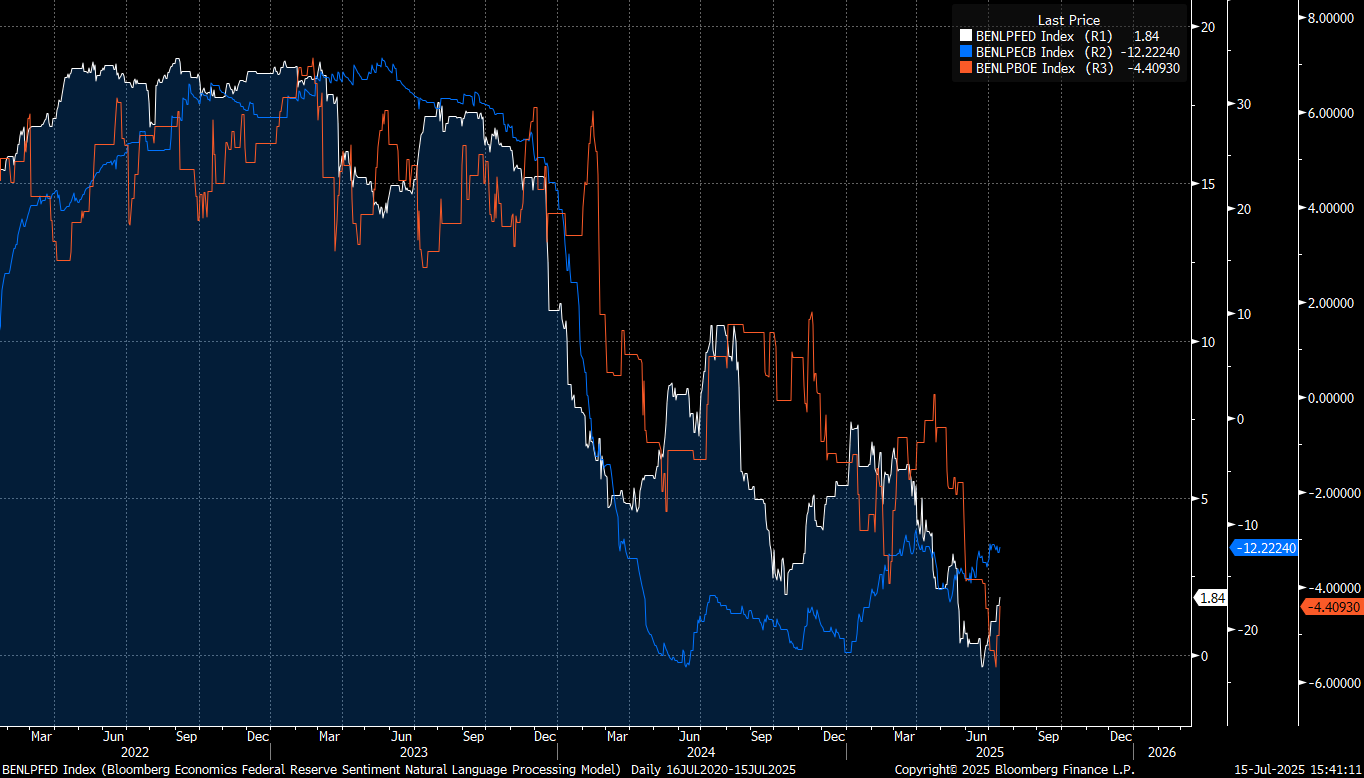

When Central Banks Lose Control: Rates and Risk

How Inflation Chaos Is Forcing a Repricing Across the Global Yield Curve

When Central Banks Lose Control: Rates and Risk:

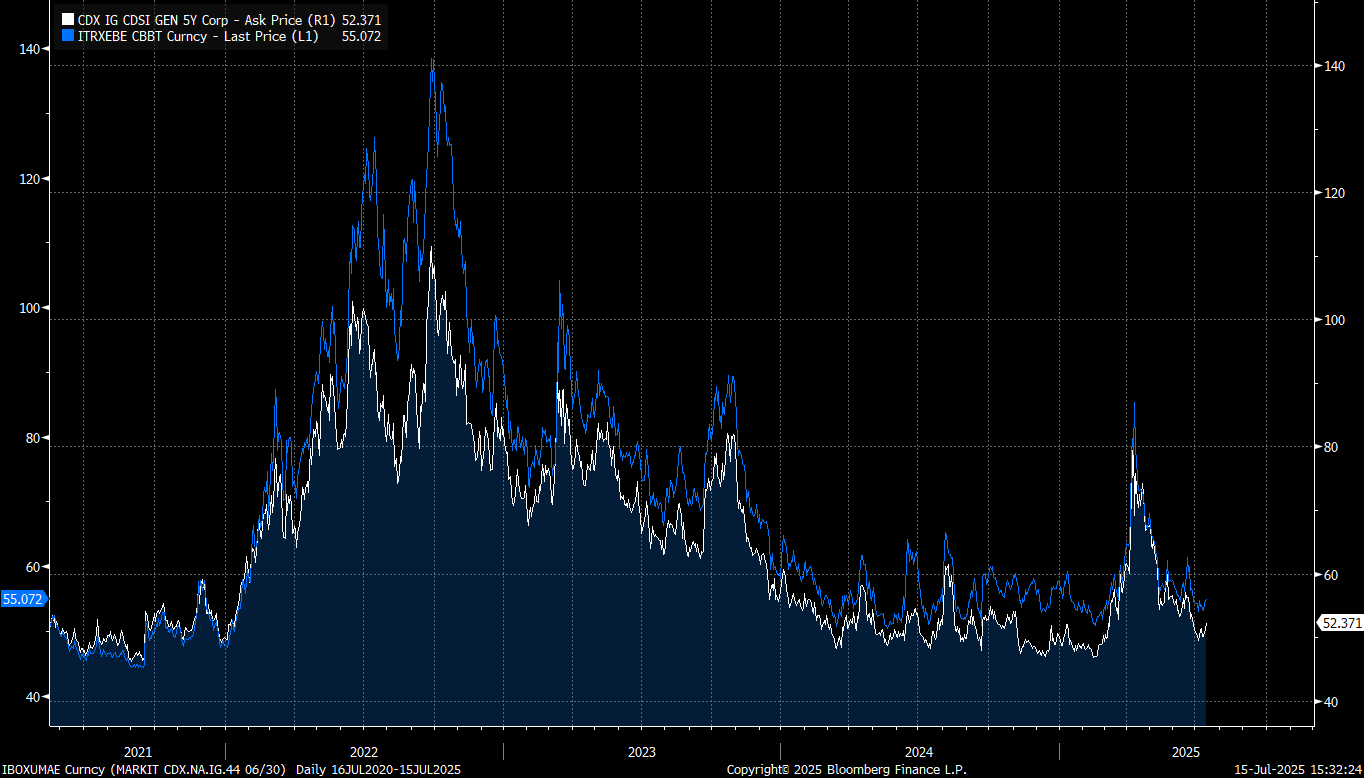

Chart Breakdown:

Interest Rate Academic Papers:

WP 1246 – Monetary policy along the yield curve: why can central banks affect long‑term real rates? (March 2025)

Explores how central banks can shift long‑term real rates through persistent policy changes—even before activity reacts arXiv+6Bank for International Settlements+6arXiv+6Bank for International Settlements+4Bank for International Settlements+4Bank for International Settlements+4.WP 1252 – Monetary policy and the secular decline in long-term interest rates: A global perspective (March 2025)

Documents how major movements in long-term yields—≈70% of drop 1990–2023—occur around FOMC decisions, creating global path dependency Bank for International Settlements+1Bank for International Settlements+1.WP 1231 – Monetary policy in the news: communication pass‑through and inflation expectations (Dec 2024)

Using LLMs, shows media is a critical channel translating central bank communication into household inflation expectations Wikipedia+15Bank for International Settlements+15Bank for International Settlements+15.Quarterly Review Dec 2024 – Targeted Taylor rules: responses to demand‑ vs supply‑driven inflation

Highlights how central banks adjust reaction strength depending on inflation source—crucial for mistiming risk Bank for International Settlements+3Bank for International Settlements+3Wikipedia+3.**Qtr Review Mar 2024 – Quo vadis, r? The natural rate of interest after the pandemic***

Tracks shifts in natural rate (r*), and how misjudging it can cause policy mistakes Bank for International Settlements+15Bank for International Settlements+15Bank for International Settlements+15.WP 1156 – Monetary policy frameworks away from the ELB (Dec 2023)

Discusses framework adjustments post‑ELB, including forward guidance and dual mandate challenges Bank for International Settlements.WP 1100 – Getting up from the floor (May 2023)

Studies pros and cons of abundant vs scarce reserve systems—key for redundancy and balance‑sheet strategy Wikipedia+3Bank for International Settlements+3Bank for International Settlements+3.Annual Economic Report 2024 – Monetary policy in the 21st century: lessons learned (June 2024)

Provides a retrospective on crisis-era policy, emphasizing coherence, safety margins, and nimbleness Bank for International Settlements+1Bank for International Settlements+1.Annual Report 2025 – The next‑generation monetary and financial system (July 2025)

Outlines future-proofing central bank operations, including payment system elasticity and tiered banking Wikipedia+10Bank for International Settlements+10Bank for International Settlements+10.WP 1126 – CBDC and the operational framework of monetary policy (Sept 2023, rev Mar 2024)

Analyses how central bank digital currency could alter reserve frameworks and policy transmission Bank for International Settlements.Qtr Review Mar 2024 – Disagreement over interest rates and policy cycle

Documents trends in uncertainty about rates, offering insight into forward guidance effectiveness Bank for International Settlements+1Bank for International Settlements+1.Annual Economic Report 2024 – Chapter on operating frameworks and balance sheets

Examines the role of balance sheet tools (QE/QT) as complements to rate policy Bank for International Settlements+1Bank for International Settlements+1.

As always, a Pepe for the culture:

The information on this website/Substack is for information purposes only. It is believed to be reliable, but Capital Flows does not warrant its completeness or accuracy. The information on the website/Substack is not intended as an offer or solicitation for the purchase of stock or any financial instrument. The information and materials contained in these pages and the terms, conditions and descriptions that appear, are subject to change without notice. Unauthorized use of Capital Flows websites and systems including but not limited to data scraping, unauthorized entry into Capital Flows systems, misuse of passwords, or misuse of any information posted on a site is strictly prohibited. Your eligibility for particular services is subject to final determination by Capital Flows and/or its affiliates. Investment services are not bank deposits or insured by the FDIC or other entity and are subject to investment risks, including possible loss of principal amount invested. Your use of any information which is proprietary to Capital Flows or a third-party information provider shall only be used on individual devices without any right to redistribute, upload, export, copy, or otherwise transfer the information to any centralized interdepartmental or shared device, directory, database or other repository nor to otherwise make it available to any other entity/person/third party, without the prior written consent of Capital Flows.

Great video break down, much appreciated!

I came across your tweet about the inflation issue today.

"If short end yields are lowered into this type of inflation risk, long end yields will rise and price it. If they try to cap long end yields with YCC then the dollar will fall."

I’m curious to understand if, in this scenario, the volatility of bonds and FX increases, shouldn’t risk assets like Bitcoin and equities benefit from the potential decline in the dollar or am I being too narrow in my analysis?