Big Picture:

There are two major ideas in macro that are taking place under the surface of short-term headlines. If you understand these ideas, the developments in BOTH equities and bonds as well as their correlation will become increasingly clear.

Major Ideas to understand:

How tariff risk and its geopolitical significance impact balance of payments as well as international relationships.

How the aggressiveness of central banks is impacting growth and credit markets.

The focus on tariffs in the news is well-known and its impact on currencies like the Canadian Dollar and Mexican Peso:

These tariffs are taking place within the larger geopolitical context of the US experiencing the negative effects of being the world’s reserve currency while also operating on the 4-year political cycle that creates challenges for achieving lasting change.

Geopolitical Tensions:

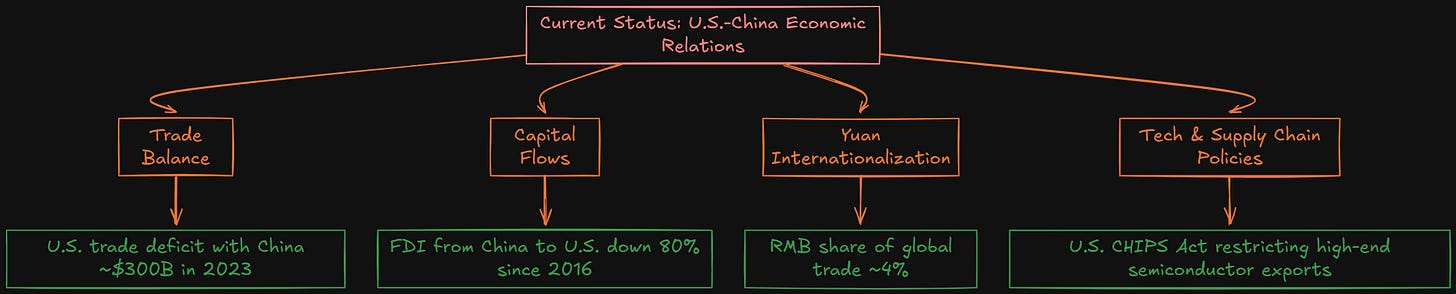

The geopolitical tensions between the US and China ARE and WILL CONTINUE TO BE the defining dynamics of this decade. When you have the largest current account deficit (the US) and the largest current account surplus (China) in the world competing for power, all goods, services, and capital flows get caught in the middle.

China is attempting to increase its trade balance through proxy exporting which means routing their goods and services through Mexico or other countries. The US has tried restricting high-end exports but this is only functioning as a speed bump in the road.

This dynamic with the chips is directly connected to the entire AI revolution taking place. This is WHY the DeepSeek news was so important to contextualize:

The context of the semi-conductor space with DeepSeek in the context of geopolitical tensions makes the recent move in capital flows incredibly interesting:

Surging Investment in Asian Markets: Hedge funds significantly increased their exposure to Asian equities in recent weeks, reaching the most bullish positioning since 2016. China and Hong Kong accounted for nearly half of these regional inflows (Feb 14–20), followed by Japan (23%) and others like Taiwan. This shift has made Asia “the most overweight region” in global portfolios, as funds rotated out of North America into Asian markets. A tech-driven stock rally – fueled by the debut of a breakthrough AI model called DeepSeek – propelled Hong Kong’s Hang Seng Index to a three-year high in February, lifting major tech shares (e.g. Alibaba up over 60% year-to-date). These inflows signal investor optimism about Asia’s growth and innovation prospects, even as they create concentration risks if sentiment shifts.

-Reuters

The tariff risk is about inflation risk but it is also about HOW the tensions between the US and China as well as every country in between is going to play out. This risk on the geopolitical side interacts with the stance of central banks in a very unique way which frames the drivers for stocks and bonds.

Regime Tracker:

The Regime Tracker is published every day and provides helpful context into some of the dynamics I am laying out below:

Central Banks, The Forward Curve, and FX Risk:

The developments with central banks have created additional divergences as growth and inflation differentials are made explicit. The primary example of this is how the ECB and Fed are creating a spread in their actions right now. The chart below is of the ESTRON Rate and the 2 year swap which is functionally showing HOW AGGRESSIVE cuts or hikes are being priced in the forward curve. You will notice there are 47bps of cuts being priced.

Keep reading with a 7-day free trial

Subscribe to Capital Flows to keep reading this post and get 7 days of free access to the full post archives.