Alpha Report: Consumption Model/Update On Short Equities View

The Macro Breakdown moving into FOMC

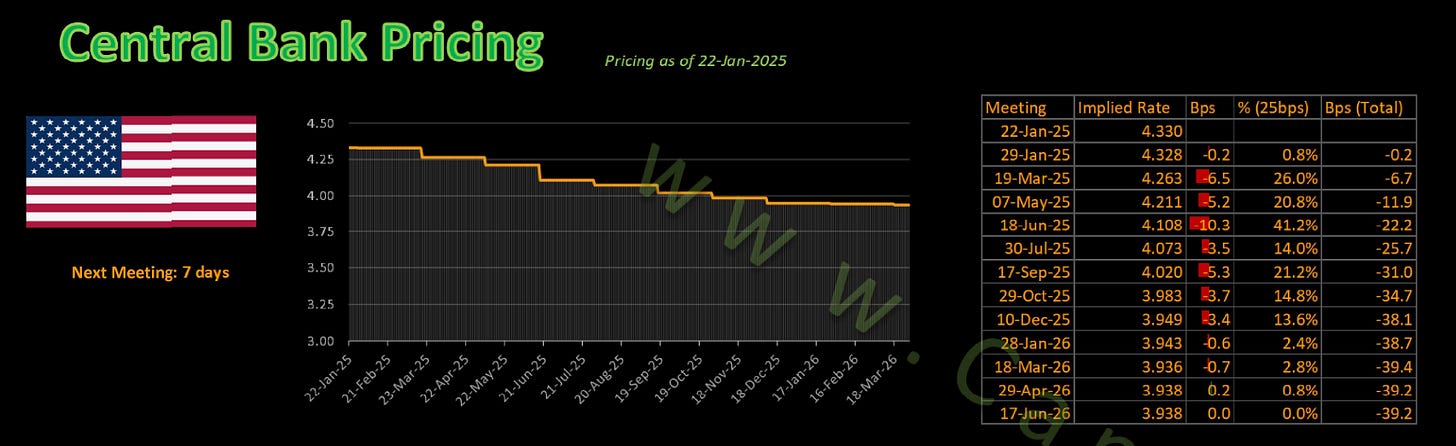

We are moving into one of the most consequential FOMC meetings of the year since there is no meeting in February and the forward curve is already pricing 38bps of cuts for the year:

On top of this, we have the PCE data coming in next week that will be a key input into the Fed’s decision-making framework. The main data points from the personal income and outlays dataset have been added to the Macro Model so that you can have a clear view of nominal and real growth going into FOMC.

Updated Macro Model:

Here is the updated model:

Let me draw your attention to a few key points:

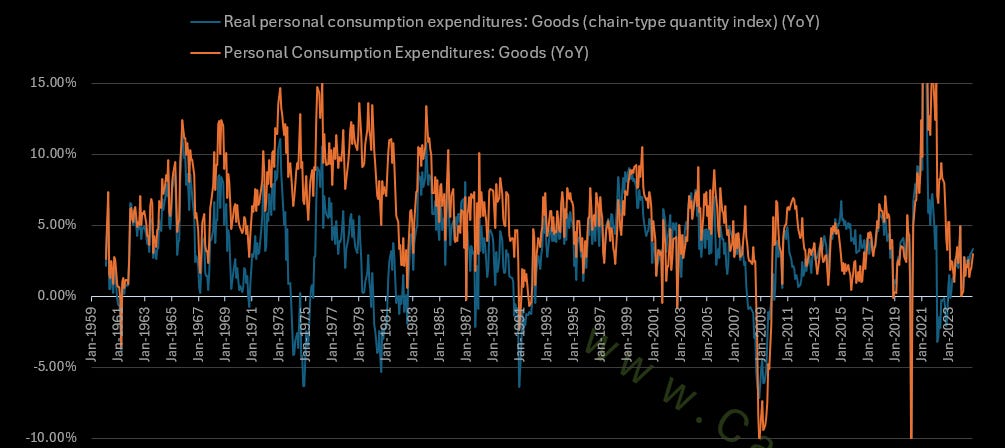

First, consumption of real and nominal goods has been accelerating marginally. It is important to watch this in connection with interest rates due to their higher sensitivity.

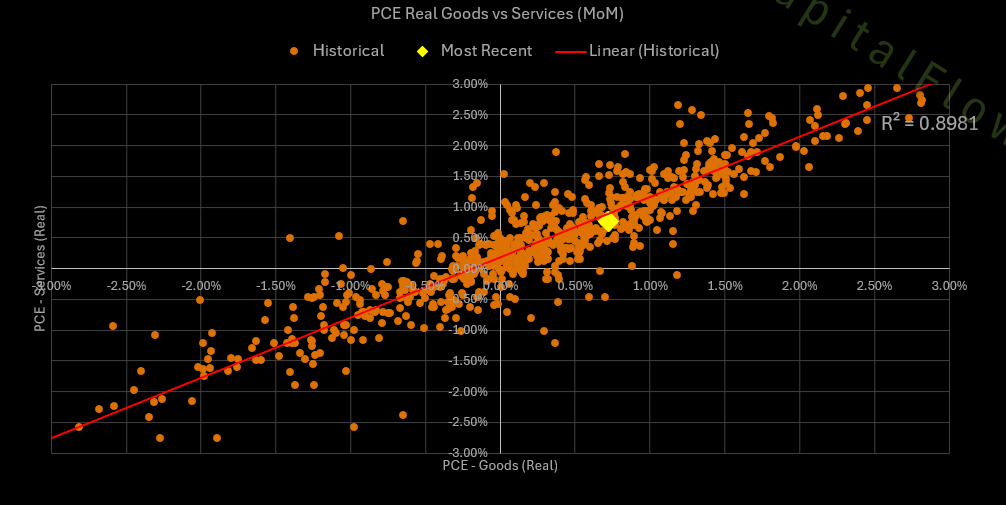

Second, on a MoM basis, we are seeing both goods and services accelerate:

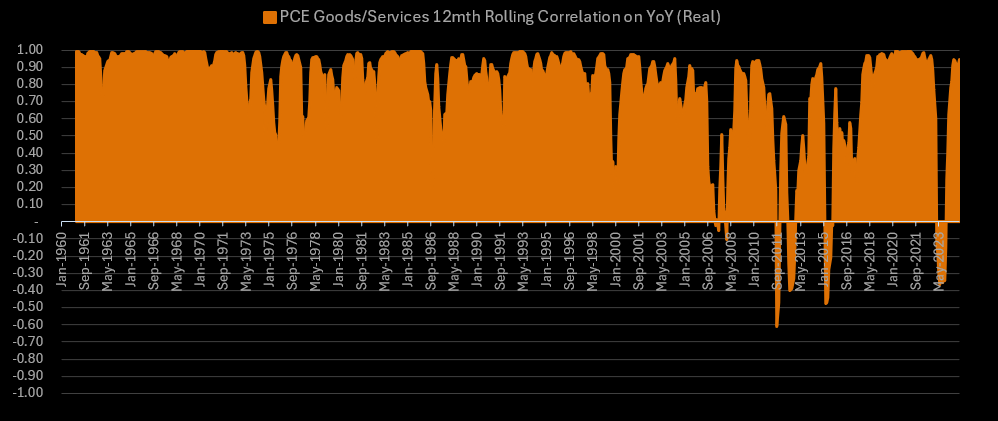

Third, the positive correlation of goods and services speaks to the underlying breadth of consumption:

Watching both nominal and real numbers in consumption directly informs the degree of growth and inflation taking place in the macro regime.

Macro Tear Sheets:

All of the updated Macro Tear Sheets are here:

Short Equity View Update:

The research for the short equity view has been laid out here:

Keep reading with a 7-day free trial

Subscribe to Capital Flows to keep reading this post and get 7 days of free access to the full post archives.