Recession Risk and The Fed:

I want to cover a very simple question that has a complex and uncertain answer: How far above inflation should the Fed hold interest rates? On a fundamental basis, there is ALWAYS uncertainty around this answer which is why the forward curve of interest rates exists to warehouse and express this risk.

Why does this even matter? the price of money (interest rates) and the amount of actual money (inflation) are inherently linked. Inflation is fundamentally about HOW MUCH money there is in the system relative to the amount of tangible goods and services. Interest rates are about HOW MUCH you have to pay to get money in the system.

What’s Happening Right Now: When the Federal Reserve holds interest rates ABOVE inflation, they are putting downward pressure on prices and attempting to contract to the quantity of money in the system. If you understand how this transmission mechanism works and if the Fed is to aggressive or to accommodative, you can have a clear view about the probability of either inflation or recession taking place.

All in all, if you understand the relationship and transmission between interest rates and inflation then you will have the proper context to understand inflationary and recessionary cycles.

Credit Risk:

The question to ask is HOW WIDE of a spread should the Fed have between Fed Funds and inflation? This is where the theoretical idea of R-Star comes in:

R-star (R*) is the theoretical neutral interest rate that balances the economy, meaning it neither stimulates nor restricts economic growth when inflation is stable. It is unobservable and estimated using models that account for factors like productivity growth, demographics, and global capital flows. Central banks use R*as a benchmark to assess whether current interest rates are expansionary or contractionary relative to economic conditions.

R-Star is a bit theoretical but in reality there are varying degrees of sensitivity in the economy to interest rates. This matters right now because credit spreads have risen marginally from their lows, equities are down from their highs, and everyone is asking, will the economy get hit somehow?

WHERE ARE WE?

The way to understand this accurately is by obtaining a clear picture into HOW credit in the US economy is functioning. We know credit spreads have risen marginally from their lows:

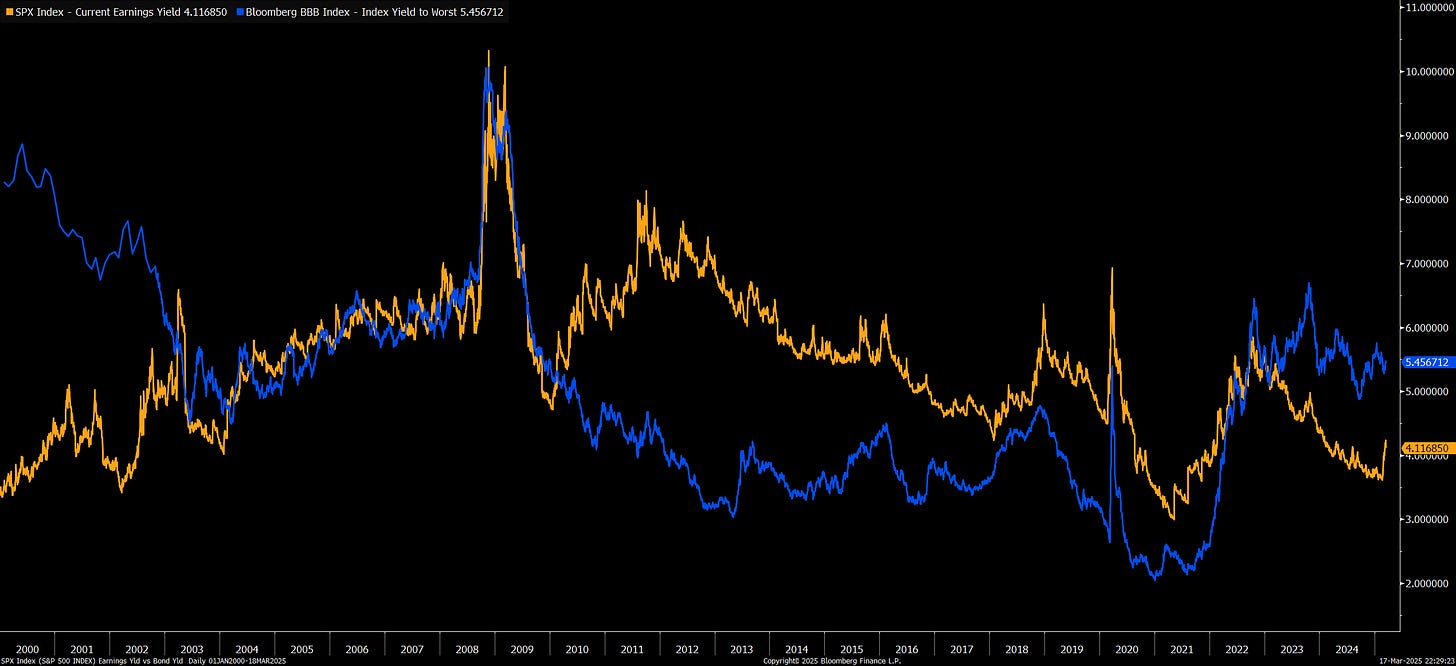

However, we have been seeing a massive spread occur between the yield in SPX and the yield on the BBB index.

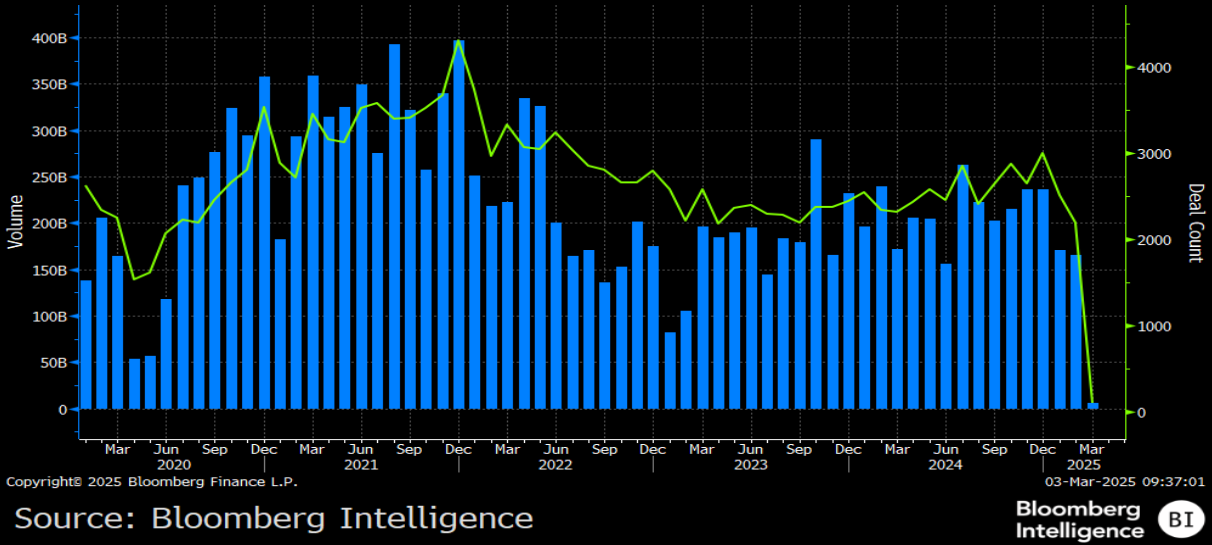

M&A activity is marginally lower than in 2024 for the first two months of the year (reflecting less liquidity):

But overall issuance of high-yield debt remains strong:

As I laid out at the beginning of the regime tracker, we might be a bit rich in US equities which are being unwound by international rotation and the carry trade unwind but we are not seeing warning signals from the credit market yet.

Bringing It All Together:

If we begin to see the higher credit spreads put actual pressure on the credit market then this will begin shutting on off the spigot that feeds credit into the economy resulting will be disinflation and recession. This is NOT happening yet and thus far we are in a regime where repricing due to valuations is the actual driver in markets as opposed to the beginning of a GFC 2.0.

I laid out these tensions in the trade write-up here:

Overall, I am watching the credit market very closely right now because if any warning signs occur, I will be getting short equities and long bonds. For now, the spigots remain on and we are operating in the macro tensions consistently laid out in the macro regime trackers.

As always, a Pepe for the culture. The last thing we need is more dry PowerPoint

The information on this website/Substack is for information purposes only. It is believed to be reliable, but Capital Flows does not warrant its completeness or accuracy. The information on the website/Substack is not intended as an offer or solicitation for the purchase of stock or any financial instrument. The information and materials contained in these pages and the terms, conditions and descriptions that appear, are subject to change without notice. Unauthorized use of Capital Flows websites and systems including but not limited to data scraping, unauthorized entry into Capital Flows systems, misuse of passwords, or misuse of any information posted on a site is strictly prohibited. Your eligibility for particular services is subject to final determination by Capital Flows and/or its affiliates. Investment services are not bank deposits or insured by the FDIC or other entity and are subject to investment risks, including possible loss of principal amount invested. Your use of any information which is proprietary to Capital Flows or a third-party information provider shall only be used on individual devices without any right to redistribute, upload, export, copy, or otherwise transfer the information to any centralized interdepartmental or shared device, directory, database or other repository nor to otherwise make it available to any other entity/person/third party, without the prior written consent of Capital Flows.

Excellent work.

Sweet Pepe too