Alpha Report: Debt Ceiling, Geopolitics, and Macro Liquidity

How the stage is set for 2025

Macro:

As we move into 2025, there are several important topics I want to cover because they will directly connect to HOW the macro situation unfolds in terms of macro liquidity and geopolitical risk in the markets.

Main Topics for this article:

Debt Ceiling “Risks”

Geopolitical Risk Premiums

Macro Liquidity

I would encourage you to read the recent pieces published that comprehensively breakdown the economic and financial risks we are facing right now:

Also, be sure to download the Macro Rate Matrix Dashboard. It is 100% FREE and there will be an updated version published on January 1st for all subscribers. This updated version will provide a model of the yield curve and map HOW the yield curve connects to economic data.

These free models are only the beginning. There will be additional tear sheets and models exclusively for paid subscribers as we progress through 2025.

As a reminder, there will be a price increase for the Substack in 2 days to $150 a month. If you subscribe BEFORE January 1st, you can lock in the lower rate of $90 a month. There will be a TON of additional features released in 2025 for paid subscribers and the early adopters get rewarded with locking in the lower rate. If you want to do a free trial to review the macro report and all of the research, you can do it with this link: Link.

I guarantee you the value that this Substack provides will only INCREASE.

Debt Ceiling “Risks”

There has been a lot of talk recently about the “risks” around the debt ceiling.

Here is the thing with the debt ceiling and US debt levels overall: Is there a debt problem in the United States? Yes. Are the negative consequences of this debt problem creating effects on an investable time horizon? No.

Debt to GDP (chart below) is elevated but the Treasury has A TON of levers it can pull to manage outstanding debt.

We aren’t even seeing the US CDS rise like it did during the last debt ceiling “risk” (not).

All of the political narratives Yellen puts out there are noise while we transition into the new administration.

The main driver in the current regime is that the US government is still running a deficit and issuing increasing amounts of debt:

Everyone including foreigners continues to buy this debt because the dollar remains the reserve currency. These narratives around the US defaulting or everyone dumping treasuries are simply false (psyops or just ignorance?).

This connection between the US and foreigners will be critical to understand for the next 4 years.

Geopolitical Risk Premiums

Geopolitical risk is about HOW the interaction between two countries creates risks for specific assets, goods, or services of a country. While there are a lot of different speculations about how the Trump administration will impact specific sectors, there is a clear consensus that a Trump presidency will bring deregulation (potentially bullish equity driver) and a decrease in geopolitical risk compared to the last 4 years under Biden.

The chart below shows the geopolitical contribution to crude (in green and red bars, at least in rough proxy by Bloomberg model), crude prices (yellow), and crude implied volatility. We had a massive rise in implied volatility earlier this year on geopolitical news but crude barely rallied. This continues to show the macro regime we are in is one that is negative for crude:

From a quantitative portfolio perspective, Prometheus Research has laid out how to think about commodities (link), as well as their recent views on crude.

A recent piece by Cloak and Dagger further explains how the tension between the US and China is primarily in terms of financial markets and economics (link):

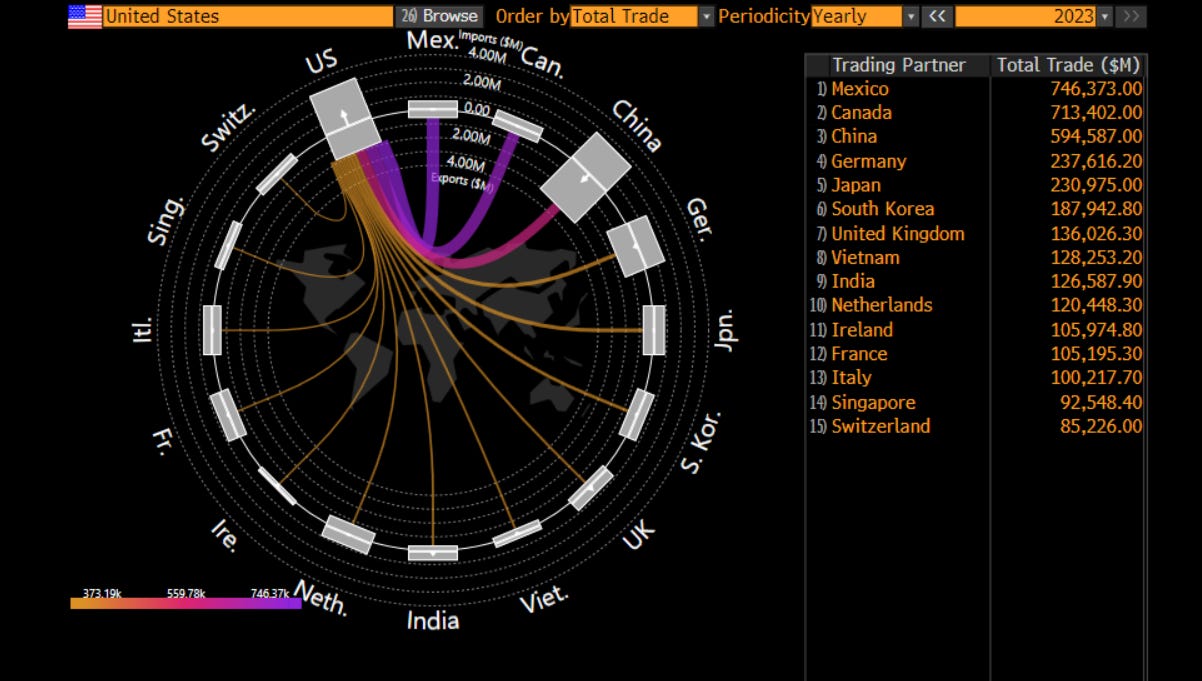

The dollar’s reserve currency status gives them a unique position in a global arena from a trade perspective but China continually tries to leverage trade flows to their advantage as a geopolitical attack. Even though China has dropped to 3rd in terms of trade, they export to the US by proxy through other countries

China’s export growth is actually accelerating considerably right now (link):

“On a year-over-year basis, Chinese export volumes are up 13 percent (data through November, so it will be close to the 2024 annual number) while import volumes are only up 2 percent. With exports around 20 percent of GDP, the 10 percentage point gap implies a net exports contribution to Chinese growth of close to 2 percent of GDP.” (link)

This is one of the main reasons WHY we have seen a rally in Chinese equities:

How does the new Trump administration play into this China dynamic? We don’t know the exact way in which Trump will approach this tension but you can bet that he will be taking aggressive action to push back on China to boost the United States’s position. Watching US industrials against Chinese equities is going to be an important signal here because any onshoring in the US is going to directly benefit US manufacturers AT THE EXPENSE of China. (This needs to be taken in the context of the US equity view laid out here and here):

The dollar’s reserve currency status requires the United States to push back against geopolitical players like China but it also creates unique tensions for macro liquidity that impact assets like equities and Bitcoin.

Macro Liquidity:

Keep reading with a 7-day free trial

Subscribe to Capital Flows to keep reading this post and get 7 days of free access to the full post archives.