WHY and WHERE:

It is important to understand WHY there is selling pressure in equities today. If you can understand the WHY behind moves in all assets, then you can know WHERE you are in the macro regime.

The S&P500 directly connects to the macro regime and the underlying drivers. Below is a breakdown of the underlying drivers and how they connect to macro. If you want to dig into this more, you can review all of the educational primers here: link

Since November 11th, the research on the Substack has laid out WHY equities have turned neutral on a macro basis. The Russell is down considerably since this time:

And the S&P500 remains below these levels:

The S&P500 outperformed the Russell marginally due to the Mag7 indexation effect. You can notice the Mag7 index (white) has outperformed over the last 2 months:

The Mag7 outperformance against the S&P500 is likely to slow here and shift marginally, especially as bonds are having difficulty catching a bid.

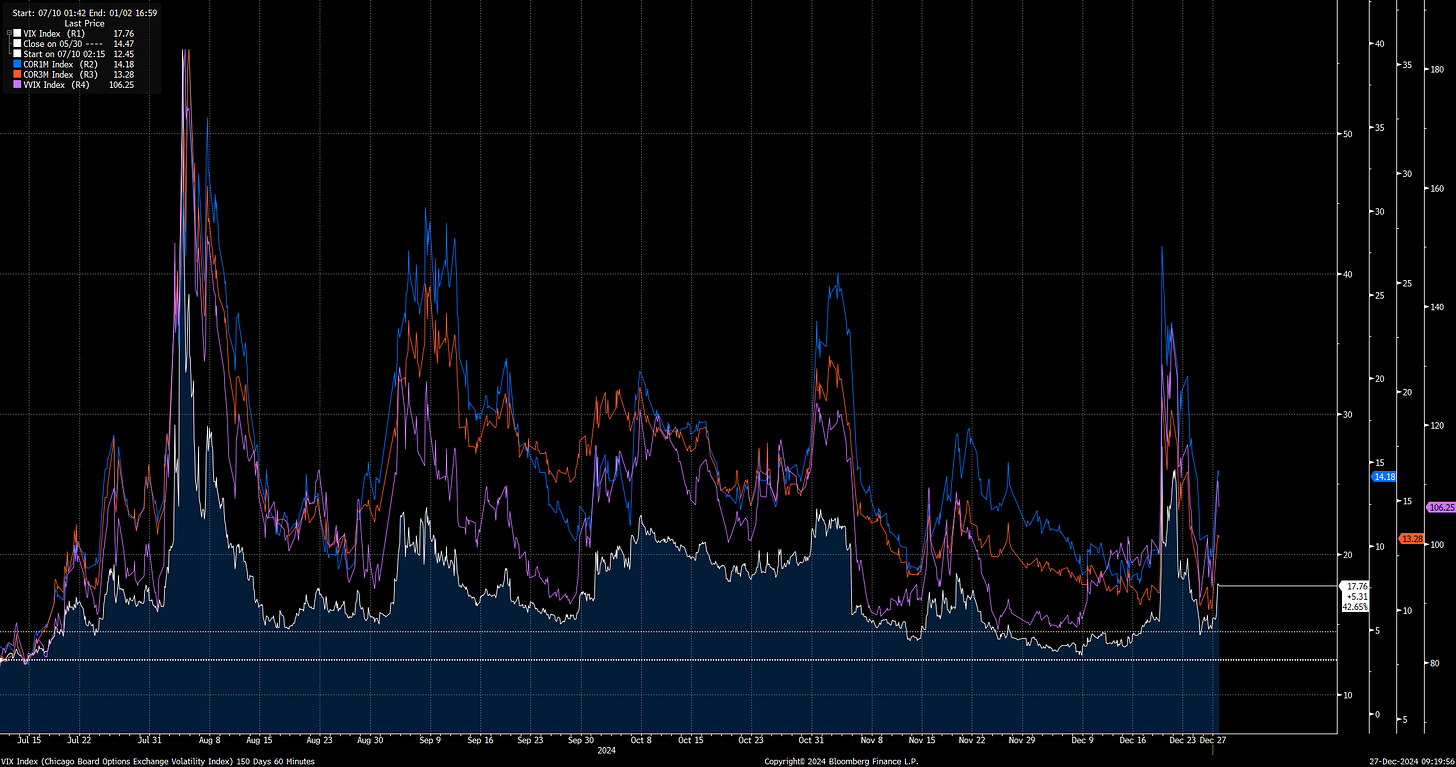

When you have the Mag7 names have less buying pressure and provide less support to the index, this is WHY implied correlation can blow out much easier.

You will notice that breadth went to a bit of an extreme over the last 3 weeks and is now reversing. The result is a higher probability of marginal weakness in the index and more risk of volatility blowing out UNTIL we have a capitulation in positioning.

If you can understand WHEN positioning has capitulated on a macro basis, then you can have a clearer picture of WHEN buying opportunities present themself.

The explanation for the macro drivers has already been laid out in the macro report:

We are now going to dig deeper into this.

Important Reminder:

As a reminder, there will be a price increase for the Substack in 3 days to $150 a month. If you subscribe BEFORE January 1st, you can lock in the lower rate of $90 a month. There will be a TON of additional features released in 2025 for paid subscribers and the early adopters get rewarded with locking in the lower rate. If you want to do a free trial to review the macro report and all of the research, you can do it with this link: Link.

You can also review the free Dashboard and launch video I recorded here where I explained all of the models and research that will be launched next year.

If you are here to play long-term games that produce exponential value then you are in the right place

The Equity Set Up:

Keep reading with a 7-day free trial

Subscribe to Capital Flows to keep reading this post and get 7 days of free access to the full post archives.