Alpha Report: Disruptive Technology Is Built On Disruptive Knowledge

The change in global forces will continue to shake the institutions that control all of the capital

The world we are moving into will be dramatically different than the last 20 years. This applies to financial markets and every industry because the degree of nonlinearity and complexity is exponentially increasing at an accelerating rate every day. The most important thing you can do is correctly understand HOW to interact with the changing environment and HOW to orient yourself toward the future.

Alex Karp provides an exceptional definition of a disruptive business and how to think about the future in his interview with Kevin Warsh (link):

Now it is easy to throw out broad narratives about how “the world is changing,” but it is incredibly difficult to orient yourself in a manner Alex laid out in order to benefit from something that doesn’t even exist yet.

“You have to have a view of what is going to exist in the future and work back from that in the present and then iterate with a subset of a market that doesn’t exist to build a product that becomes real”

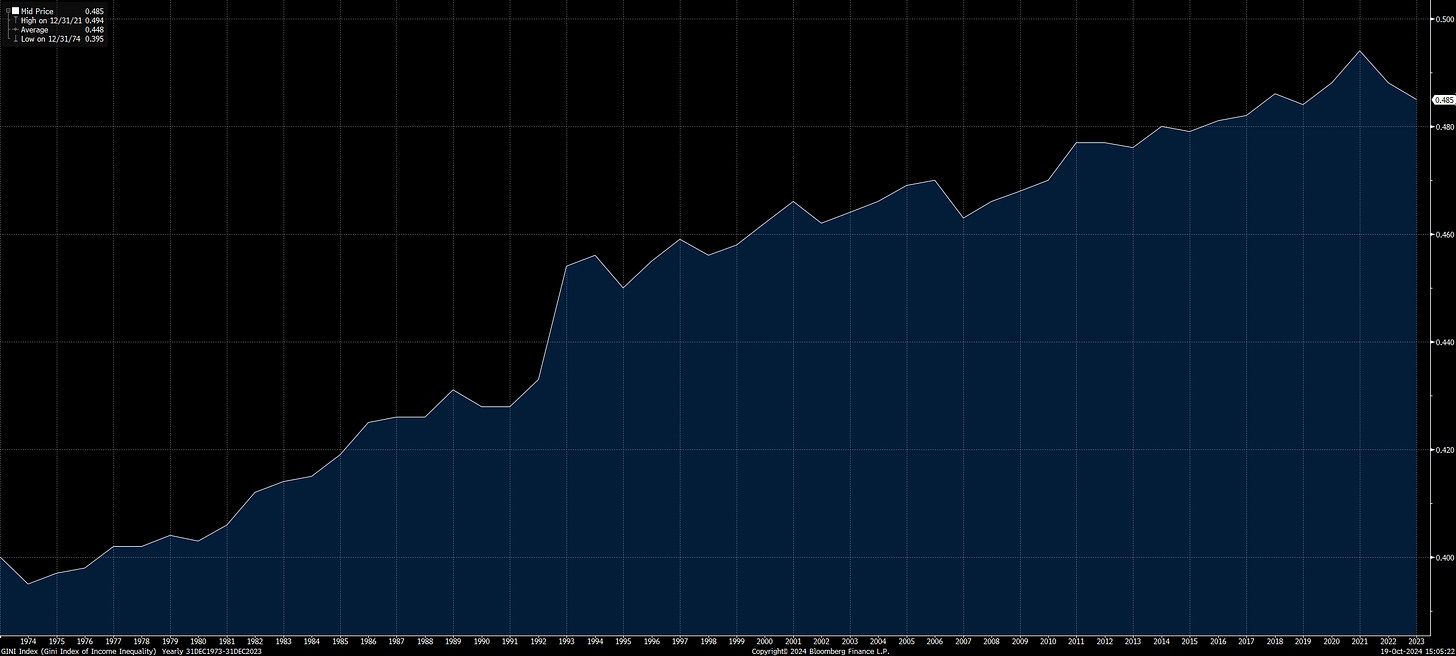

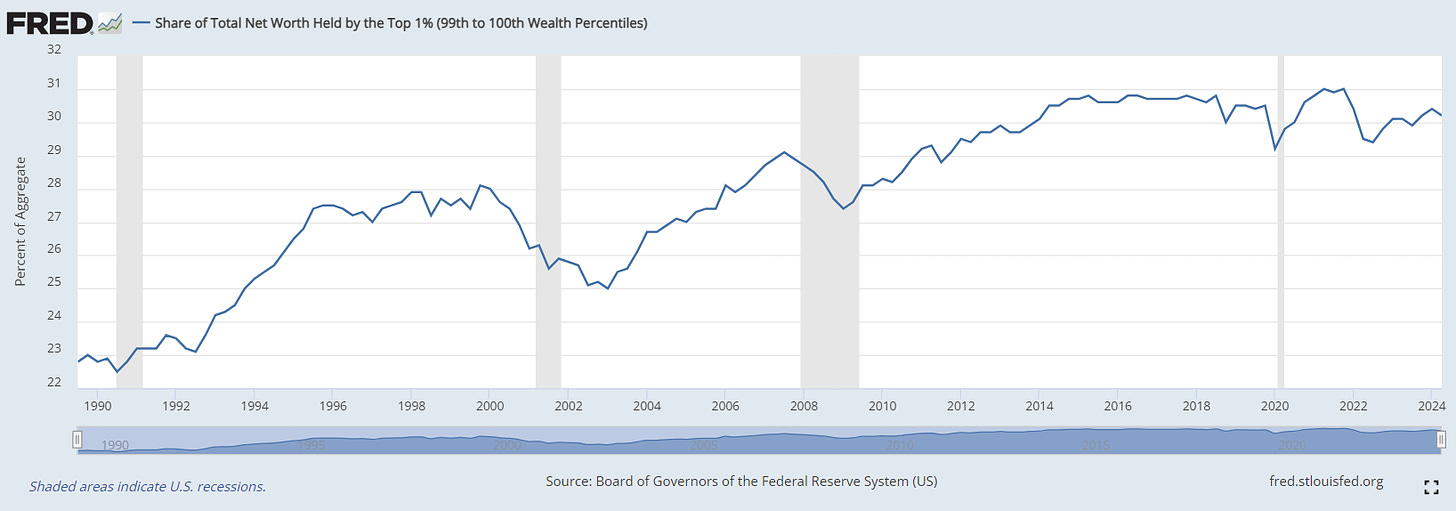

This orientation isn’t just about making money or achieving a degree of “status,” it is about survival. We live in a globally connected world where inequality is rising and institutions command large amounts of power and capital (the chart below is of the Gini Index representing a consistent rise in inequality). This means the average consumer will have less and less of an edge in generating dollars and owning a share of GDP.

The structure of the system implies that intentionality is critical for success and survival. While you don’t have the ability to buy a house at the same valuation as consumers did in the 1970s, the TYPE of age we live in is fundamentally different. It is the age of information and nonlinearity.

In the information age, you simply need to be at the right place, at the right time, with the right information to succeed

These ideas were touched on specifically in the “Books I’m Reading” podcast here:

Main Idea: If we take the ideas Alex Karp laid out about orienting oneself toward the future and connect them with how information and nonlinearity work, we can begin to build a picture of HOW to move forward. The bottom line is that we need to build an interpretive framework and process to feed information through it that consistently takes advantage of the future that doesn’t exist.

The Connection To Markets:

How do we tangibly do all of this for macro and financial markets though? Let me lay it out for you.

Since the beginning of 2023, all aspects of macro have been systematically laid out in both educational primers and real-time analysis (EVERYTHING IS HERE: LINK, and here is the most recent macro report: LINK). This has set the foundation and framework for quantifying capital flows. The KEY is having a framework for quantifying all the moving parts so that you can then build a durable informational edge for a future that doesn’t exist yet. In the same way, Alex Karp talks about building software products for a future that doesn’t exist yet, you should be thinking about HOW to build specialized knowledge for leveraging in the future information age.

As the macro fundamentals become clearer and clearer, you can develop greater informational edges that aren’t reflected in the data and that aren’t functioning on a short-term time horizon. Similar to how AI and the increase in computing power have increased the speed and productivity of tasks in the present, quants and algos in financial markets have increased the speed and efficiency of pricing in the present.

As we move forward in this Substack, these TYPES of informational breakdowns will increase. (These will primarily be reserved for paid subscribers who have locked in the current price. The early adopters of the Capital Flows Substack get to lock in the price for all the future upside).

Macro Redundancy:

With these ideas in mind, we are going to take several pieces of research and connect them to HOW we need to be thinking about macro moving forward.

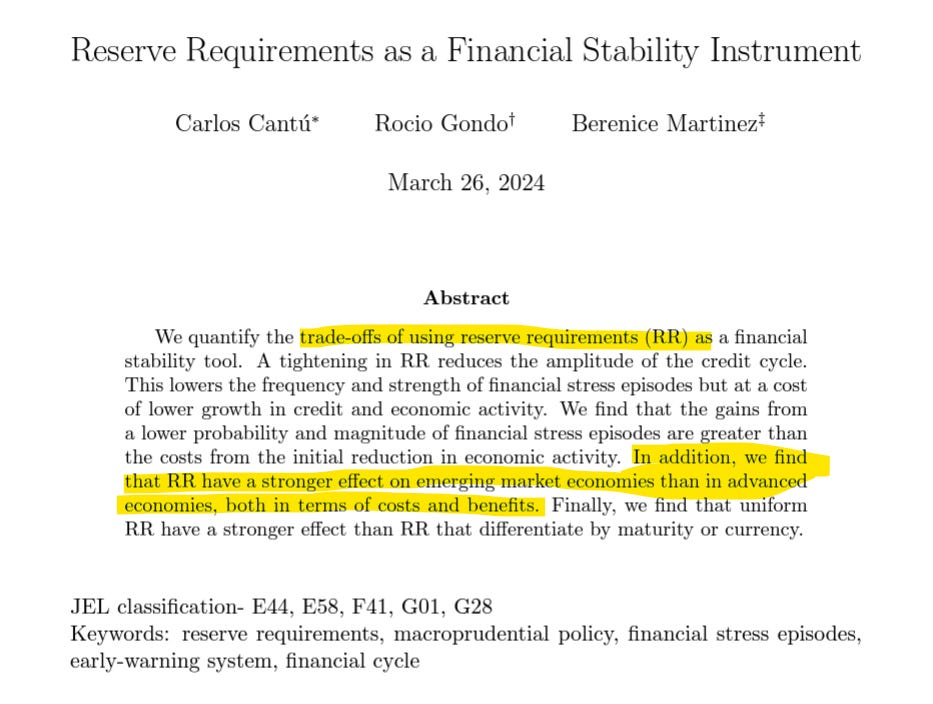

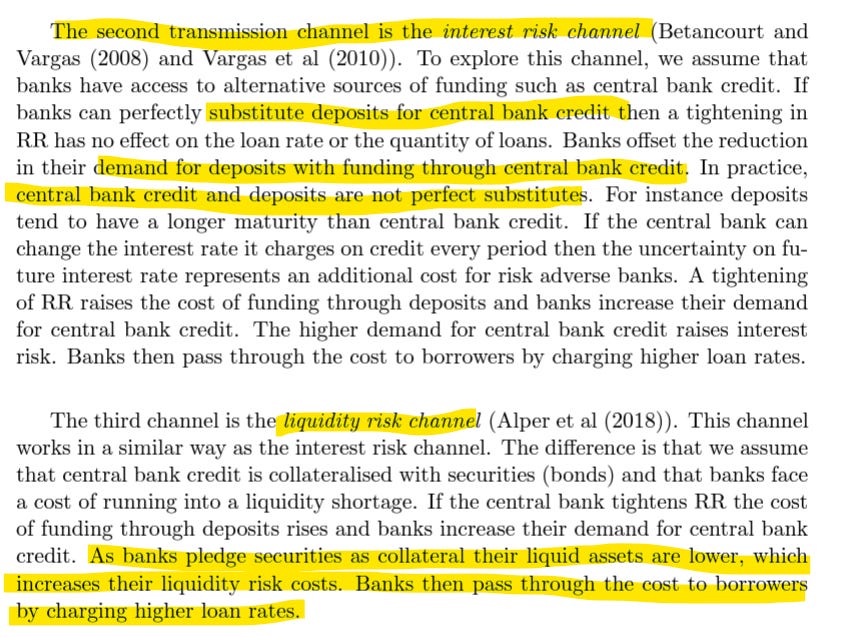

Reserve requirements as a financial stability instrument: Link

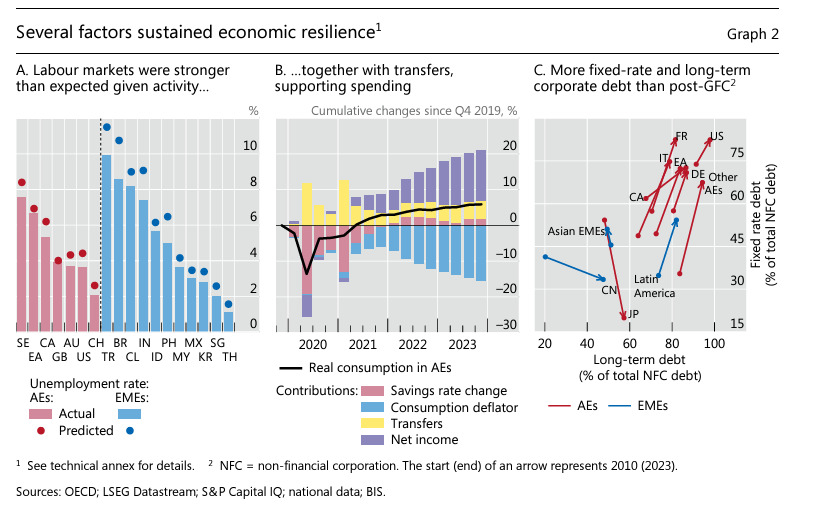

Many macro bears have been confounded by WHY we went through a hiking cycle without a blow-up in credit. Part of the reason behind this is that the Fed is now creating a greater divergence between the price and quantity of money. There is a reason real rates have diverged from reserves.

When the regional banking crisis happened, the Fed didn’t use rate cuts as a tool. In fact, after the short-term spike in bonds, they actually sold off aggressively. Instead, the Fed used facilities that impacted the quantity of money. Other central banks understand that they need to track the Fed’s actions in order to maintain their balance of payments relationship that is optimal for their respective economy. As a result, foreign central banks need to correctly moderate their actions with the Fed in both interest rates and the quantity of money in the system. These actions will ALWAYS have trade-offs and ALWAYS be expressed in either nominal or real terms in other parts of the economy or financial markets.

The quantity of money in the system and transmission of it is important to understand in this context:

As was laid out in a previous macro report, the dollar’s reserve currency status is one of the primary factors determining flows in today’s world:

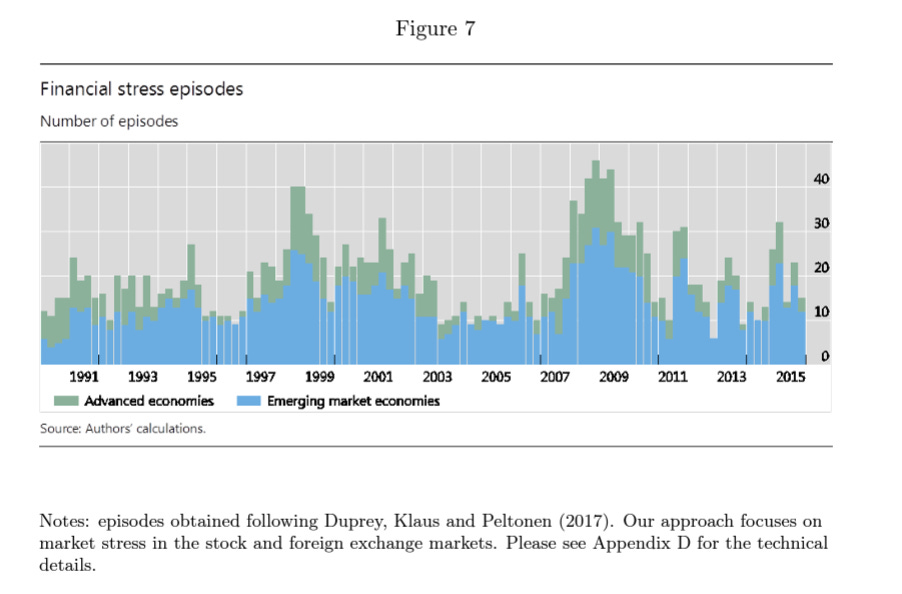

One final chart from the paper:

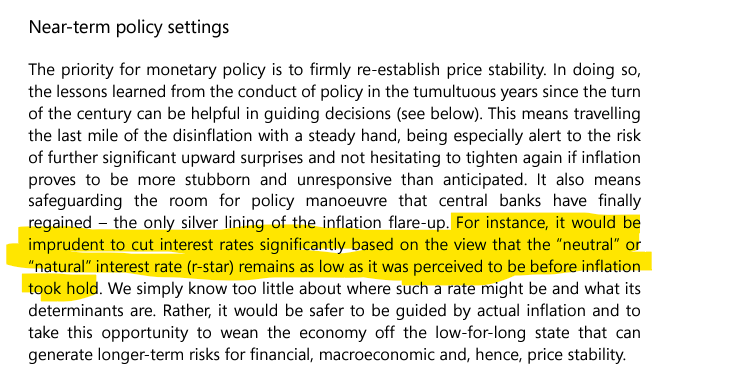

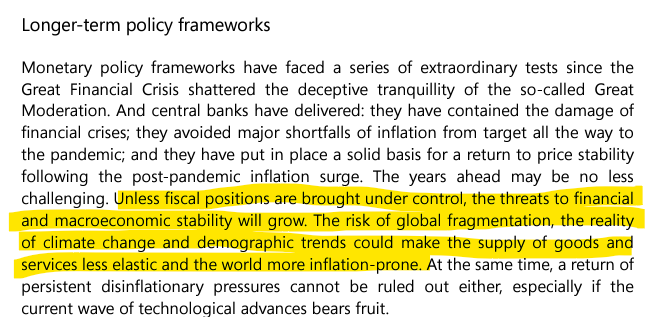

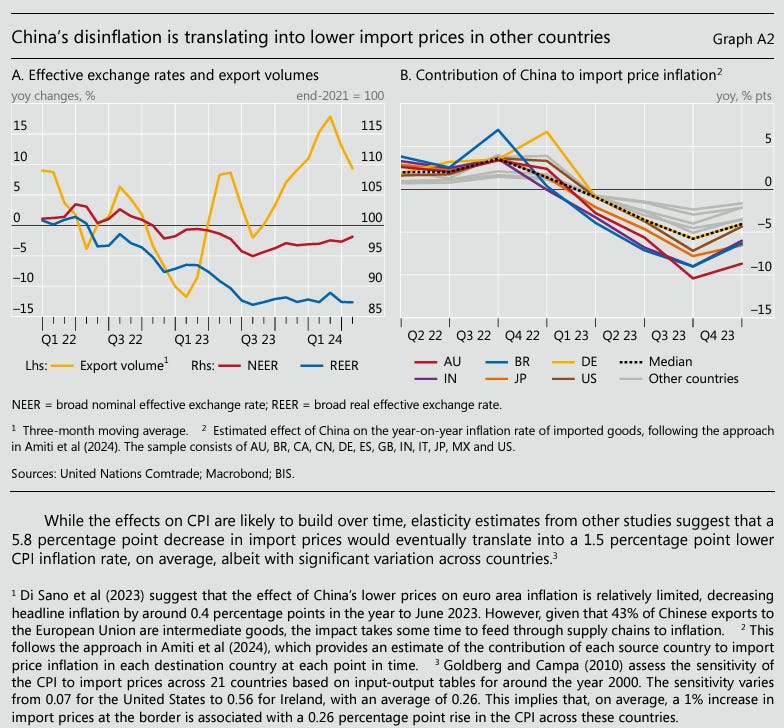

BIS Annual Report Points: Link. This report has a lot of great big-picture points for macro flows.

The R* is almost certainly higher than it was before COVID. This is clear. This plays into the views laid out in the macro report (link). While interest rates are skewed to the downside, a higher base is occurring and a dash to the lower bound on a credit event is unlikely.

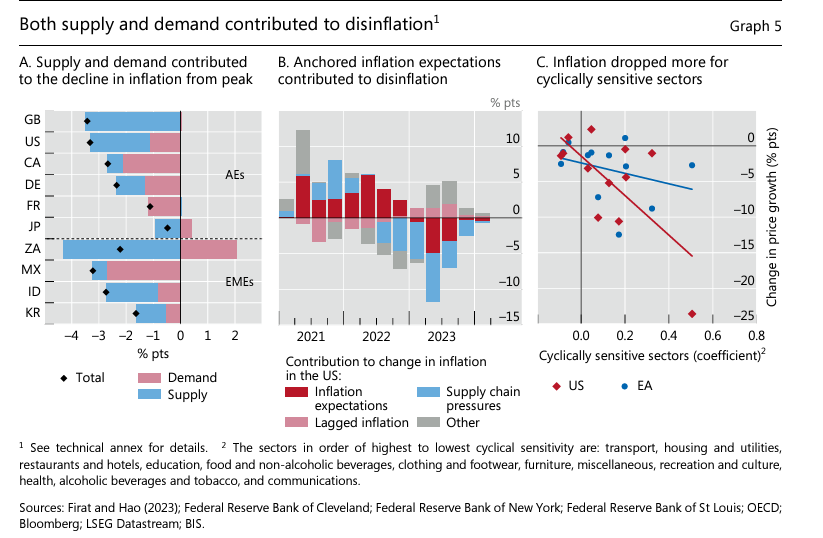

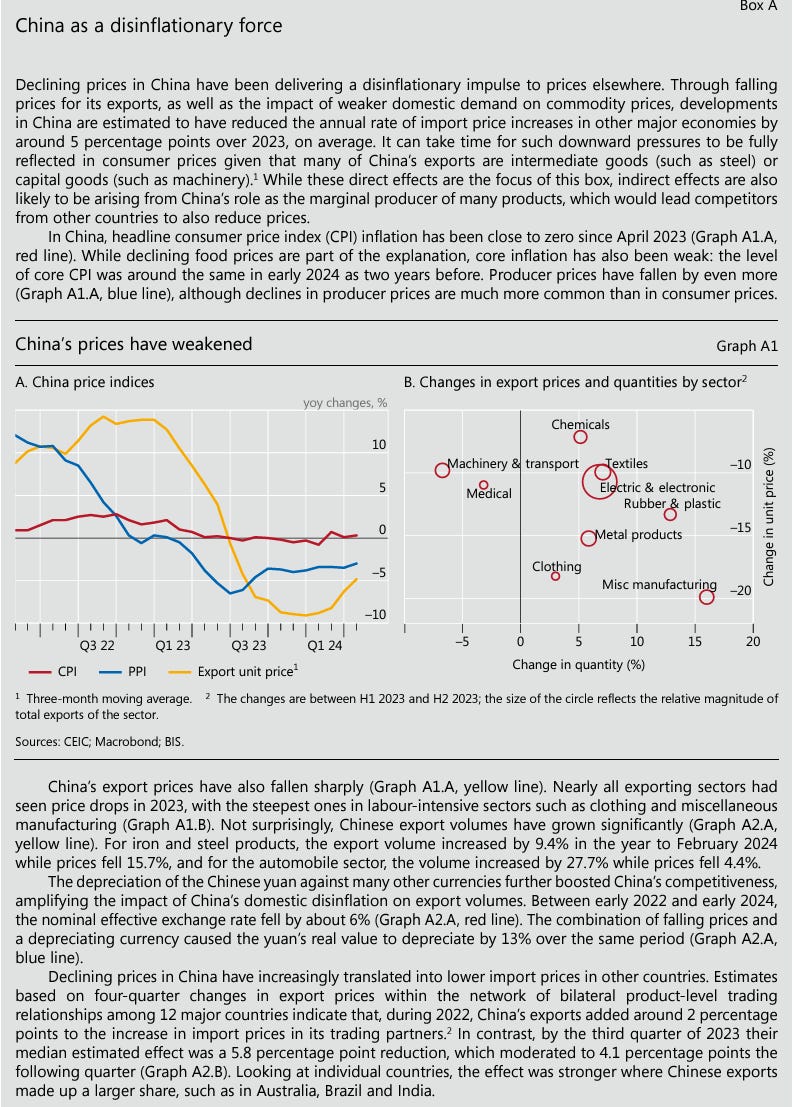

The world we are moving into fundamentally has more fragility in supply chains and commodities. While we are in a period of falling inflation and normalization, a return to the 2010s-type environment is highly unlikely.

Over the next 10 years, there is likely to be large swings between the Fed’s forward guidance and its credibility. It is clear that we keep moving to the extreme ends of the spectrum.

Several additional charts:

We will be expanding on these ideas more and connecting them to financial markets. I would encourage you to read the reports in their entirety in preparation. Personally, I read everything from the BIS. They have an exceptional resource library with tangible concepts and relevant analysis.

Part 2 coming soon. For now, a Pepe for the culture!

The information on this website/Substack is for information purposes only. It is believed to be reliable, but Capital Flows does not warrant its completeness or accuracy. The information on the website/Substack is not intended as an offer or solicitation for the purchase of stock or any financial instrument. The information and materials contained in these pages and the terms, conditions and descriptions that appear, are subject to change without notice. Unauthorized use of Capital Flows websites and systems including but not limited to data scraping, unauthorized entry into Capital Flows systems, misuse of passwords, or misuse of any information posted on a site is strictly prohibited. Your eligibility for particular services is subject to final determination by Capital Flows and/or its affiliates. Investment services are not bank deposits or insured by the FDIC or other entity and are subject to investment risks, including possible loss of principal amount invested. Your use of any information which is proprietary to Capital Flows or a third-party information provider shall only be used on individual devices without any right to redistribute, upload, export, copy, or otherwise transfer the information to any centralized interdepartmental or shared device, directory, database or other repository nor to otherwise make it available to any other entity/person/third party, without the prior written consent of Capital Flows.

"In the information age, you simply need to be at the right place, at the right time, with the right information to succeed" - this reminds of a book I read called Outliers by Malcolm Gladwell. I do agree that these opportunities have become more democratised in the information age. Some who have served may have come across the expression, "hurry up and wait" and if we think what this really means we may come to the conclusion that it's all about being in the right place (high ground), at the right time (before your enemy).

When I look at those charts you posted regarding the 1%, I see what you see, but I also see something else. I can easily make the argument that we are in an increasingly globally connected world where inequality is not rising. Do you see it? It's not easy to be soothsayers, but a lot easier to be bayesian about how we perceive what the future will be like in order to develop the kinds of products that Alex talks about.

The beauty of the information age is the serendipity it has showered upon us and this may well be why the charts we reference are indeed tapering off - the 1% used to have two moats, financial and informational, but now there is a bridgehead over the information moat through google, youtube, facebook, substack, etc.

If I, as a window cleaner, wanted to know about the business cycle in 1992 for example, I would not be starting with intentionality first. I would be starting with serendipity first to know of the existence of the business cycle. Then I would exercise intentionality in the interrogation of the concept of the business cycle. Unfortunately internet-facilitated serendipity was quite scarce back then.

Further, the intentionality required to learn about the business cycle back then would be much more than the intentionality required today - thanks to the information age.