Central Banks:

Whether we are in a world of fractional reserve banking like today or the wild west of independent banks like in the 19th century, the central authority is always chasing the real cost of capital; it does not set it.

What does this mean? It means that the central bank is NOT always right. As we have moved into this new world of excessive central bank watching post-2018, many market participants have developed biases about “not fighting the Fed.” While there is a marginal element of truth here, the more important truth is understanding that the Fed (or any central bank) is simply a market participant. Every central bank functions under an array of constraints that are always dynamically changing on various time horizons.

The implicit biases of market participants directly impacts HOW they take bets and thereby make or lose money. An important fundamental belief about the Fed is that they do not have the capacity to be correct. The majority is never right.

“Madness is rare in individuals—but in groups, parties, nations, and ages it is the rule.” - Nietzsche

This tangibly applies to the Fed in that they are never correct in their actions. Our role is simply to ask, HOW WRONG are they, and what is the release valve that will price the consequence of their actions.

Every action the Fed makes will have a corresponding and proportionate effect that will be priced in long-term interest rates, equities, or FX.

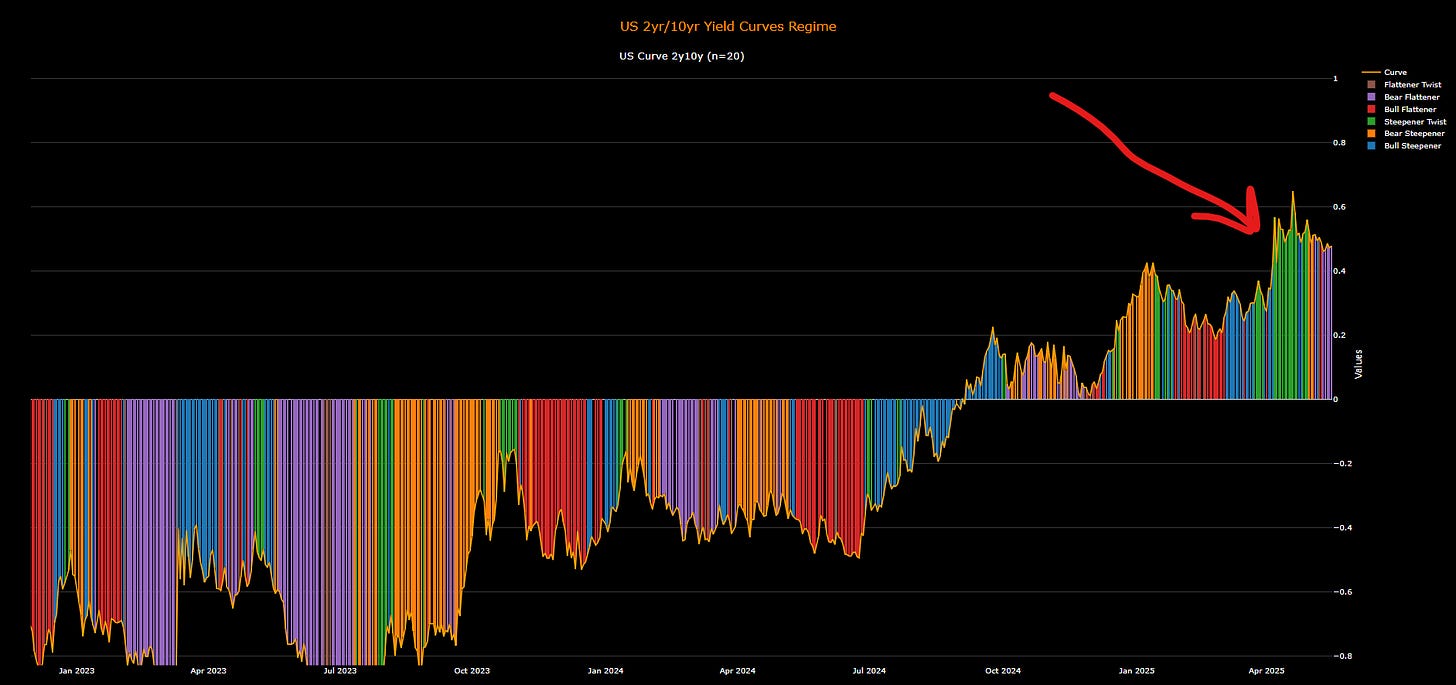

This is WHY understanding the yield curve is so important. Notice that we have gone from a period of steepener twist in the in 2s10s where longer end rates rise as they know a recession isnt happening and moved into a short period of bear flattener. A bear flattener is when bonds are selling off but short end rates are repricing higher than long end rates. In other words, the 2 year is repricing the Fed’s actions MORE than long term nominal GDP is rising (reflected in the 10 year). Now both of these function as an input into each other because the more the short end moves UP, the greater the probability is that rates will put downward pressure on growth and inflation in the long term.

These recent changes fall directly into the framework I have been consistently laying out on the Substack. I have laid out the big picture macro view about central banks and the credit cycle here, and this directly connects into HOW to think about the Fed.

What I want to do is dig into HOW these developments in the fixed income complex and changes by the Fed are impacting STIR contracts AND equity sector rotations. If you understand these, then you can understand WHERE the distribution of probabilities lie for running trades.

STIR:

Keep reading with a 7-day free trial

Subscribe to Capital Flows to keep reading this post and get 7 days of free access to the full post archives.