Alpha Report: The Credit Cycle, Bond Market Crash, and Final Capitulation

Macro vol is about to explode

Volatility Is Coming:

I believe we are about to enter one of the most volatile periods of macro, and the market is highly complacent. I believe volatility will increase over the next 2-3 months, and if I am right, there will be significant money to be made from trading it correctly. What I am going to do in this report is explain WHERE we have come from to reach this place, WHAT is likely to take place, and HOW to capitalize on it.

I want to remind you that you should never blindly follow anyone, and you should be taking 100% ownership over ALL your decisions. I am not the smartest guy in the room and am wrong all the time. Because I know my own limitations, my starting point is redundancy planning and extreme preparation. I always come back to this clip of the former CEO of Goldman Sachs on this idea:

WHERE did we come from?

Everything in the structural macro regime starts with COVID and the unparalleled injection of money that occurred. Everyone knows about this because you have had the narrative about the “dollar going to zero.”

What occurred in 2020 and 2021 was a step up in basis with inflation in the underlying economy. This inflation has NOT gone away. The chart below shows services inflation for the United States (blue), the Eurozone (green), and the United Kingdom (yellow). Notice that all of these are more than 150bps ABOVE the 2% goal of central banks.

The entire financial industry has made a critical error in anchoring to headline inflation and low-quality metrics like Truflation to assert that inflation is “under control.” Notice that Truflation is BELOW 2%, but bonds continue to sell off, indicating Truflation is being weighted and backfitted for a biased purpose instead of actually mapping inflation.

Part of the miscalculation by consensus is that the services part of the economy has increased in its size since the 1950s, which means that services inflation has become more and more important.

So the implication is that we have a higher step in basis with inflation in the economy, and until an actual recession takes place, it is unlikely that we will have a durable move down to 2%.

This is what brings us to the current risks and tensions that exist. I will break these down into 2 points because it is critical that you understand the full picture so you can properly understand WHAT is likely to take place.

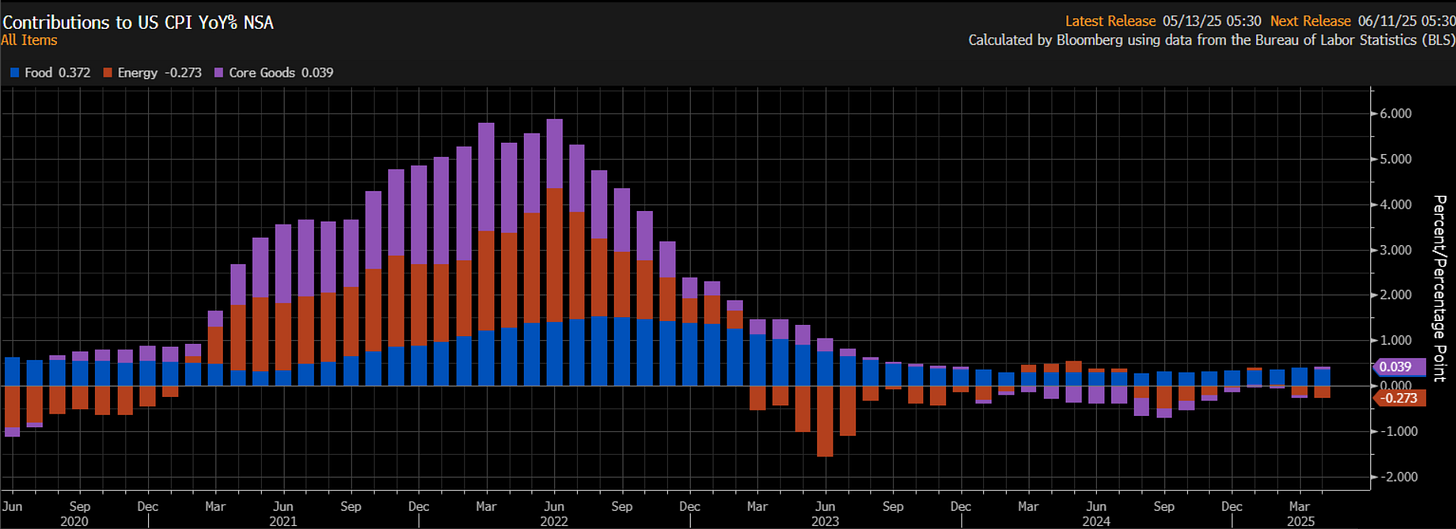

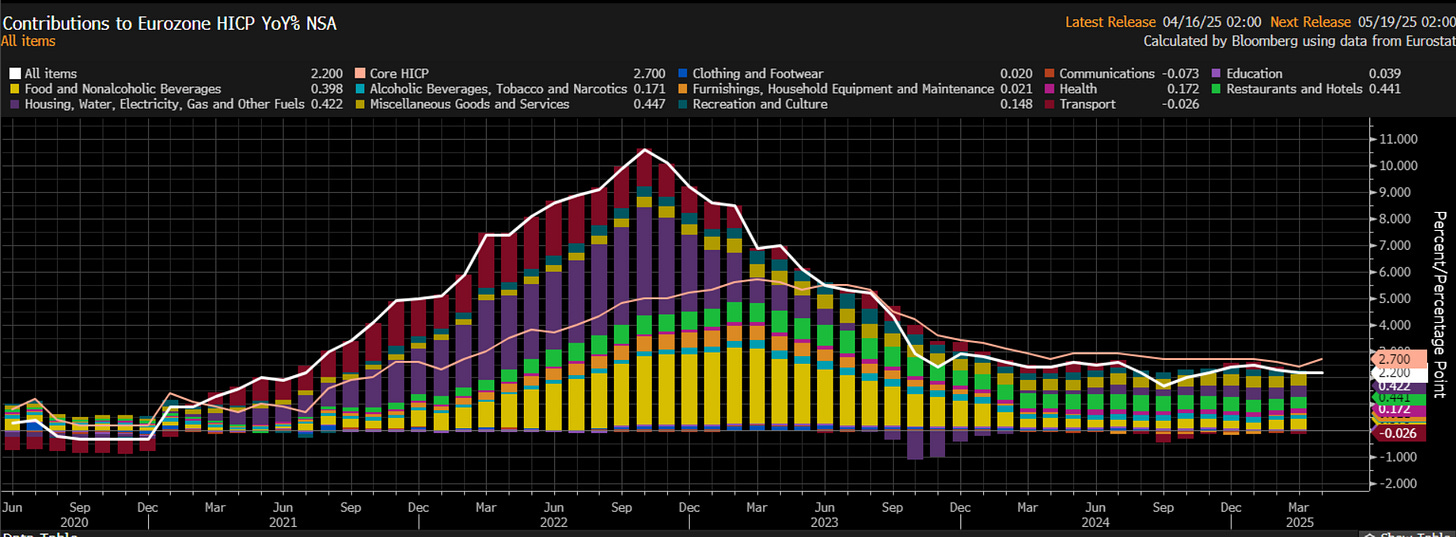

Food, energy, and goods inflation has fallen which has taken marginal pressure off central banks. The Bank of England and European Central Banks have cut rates MORE than the Fed because of these lower prices, even though their economies are net importers of energy. This means they have a higher risk to changes in these line items of inflation. The charts below show food, energy and core goods prices for CPI in the US, EU, and UK:

When inflation is ABOVE the 2% goal, small acceleration in growth or injections in credit by commercial banks can cause long-term rates to rise significantly, even if central banks pause. This is where understanding the credit cycle comes into play (see the Credit Cycle Playbook I wrote here: link). In other words, if central banks pause and inflation is held constant, an acceleration in growth and credit will push long-end rates UP.

IF credit issuance increases AND growth rises, long-end rates are likely to blow out to the upside and cause significant macro volatility. The extent to which credit issuance increases and growth accelerates will determine HOW HIGH rates can move. So the question is, HOW MUCH credit is being issued into the system in each of these countries? The short answer is that credit is flowing into the economy with significant strength. The charts below show YTD issuance for each category:

US High-Yield Issuance:

US Investment Grade Issuance:

European Bonds Issuance:

US Leverage Loans Issuance:

EMEA Leverage Loans Issuance:

Total commercial bank credit is expanding considerably:

And all of the lowest quality financials on the farthest end of the risk curve are rallying off their lows with considerable strength:

If you understand these two tensions of growth, inflation, credit, and how it is interacting with central banks, then you can properly understand WHAT is likely to take place.

I want to frame the next section with the Macro Alpha Primers I wrote. I started these primers on understanding credit risk and duration risk. When we think about all financial assets, we have assets with a credit component (like equities or corporate bonds) and assets that primarily have duration risk (US Treasuries that are “risk free” in that the government can always print money to meet their obligations. This can result in losses in real terms).

Macro Alpha Primers:

Macro Alpha Primer: Credit Risk and Duration Risk and Macro Podcast: Macro Alpha Primer

Macro Alpha Primer: Correlations and Macro Podcast: Macro Alpha Primer

Macro Alpha Primer: Macro Catalysts, Hedging Pressure, and Positioning and Macro Podcast: Macro Alpha Primer

Macro Alpha Primer: Positioning Premiums and Macro Podcast: Macro Alpha Primer

Everything in macro comes down to correctly quantifying BOTH credit risk and duration risk in financial markets. When you properly map these dynamics, the result is a view of the correlation between credit risk and duration risk. Financial literature primarily studies this relationship through the stock-bond correlation. This fundamental relationship will be important to understand because I believe we will see a specific movement in stocks and bonds over the next 2-4 months that will directly connect to the amount of volatility.

Attached below is a 44-page playbook on the stock bond correlation so you can understand HOW it functions historically and HOW it relates to growth, inflation, liquidity, and central banks:

WHAT is likely to take place?

Before taking any views of the future, you must understand the present. The most helpful piece of literature that has helped me understand this:

The foundational quote is from Bastiat’s 1850 essay "That Which is Seen, and That Which is Not Seen":

“In the economic sphere an act, a habit, an institution, a law gives birth not only to an effect, but to a series of effects. Of these effects, the first alone is immediate; it appears simultaneously with its cause; it is seen. The other effects emerge only subsequently; they are not seen. The good economist takes into account both the effect that can be seen and those effects that must be foreseen. The bad economist confines himself to the visible effect.”

This principle became a cornerstone of Austrian and classical liberal economic thought — particularly the idea of opportunity cost and second-order consequences. The Austrian tradition, with thinkers like Mises and Hazlitt, built on this. In fact, Henry Hazlitt, in his book Economics in One Lesson, popularized Bastiat’s insight:

“The art of economics consists in looking not merely at the immediate but at the longer effects of any act or policy; it consists in tracing the consequences of that policy not merely for one group but for all groups.”

Now let’s dig into specific views and trades:

(There are two days left to lock in the lower price for the Substack. The links and details can be found here: link)

Keep reading with a 7-day free trial

Subscribe to Capital Flows to keep reading this post and get 7 days of free access to the full post archives.