Macro Alpha Primer: Credit Risk and Duration Risk

Connecting macro to all assets in the investment uninverse

We are going to embark on another round of educational primers for the Substack. I have already written the foundational primers on macro and each major asset class which have function as a resource for everyone:

In today’s world, educational institutions are shattering as they prioritize political agendas instead of actual learning. Talent is turning away from corporations because individual responsibility, merit, and hard work are not rewarded. People are finally waking up to the fact that they need to take personal responsibility for their own learning. At the end of the day, everyone wants to be measured on their own merits and acquire an education that functions as the foundation for a life of exceptional performance.

This is why I will continue sharing this quote from Good Will Hunting:

“You wasted $150,000 on an education you coulda got for $1.50 in late fees at the public library.”

As inefficiency in institutions plagues today’s environment, those individuals who can educate themselves and adapt on the fly will be paid an even higher premium. We live in a world that is dramatically different from the past:

In the information age, you simply need to be at the right place, at the right time, with the right information to succeed

This is why I will be writing another series of educational primers. I will make this promise to you, all of the educational primers I write over the next 30 days will be 100% free. We will continue moving forward together!

Macro Alpha:

“Macro” is one of those topics that everyone seems to talk a lot about but never understand how it actually works. For example, you might be able to wake up every morning and look at how stocks are up and bonds are down but how many people know WHY this is taking place?

Understanding WHY each asset is moving due to macro conditions is actually one of the rareest skill sets. The financial news media retrospectively attributes coinciding events to moves in financial markets but when you try to look deeper into this it seems like noise. For example, there is a constant stream of charts from social media and the news about how the event that just happened ALWAYS precedes some type of melt-up or melt-down.

Let me go through a couple of examples:

How do we know gold rallying is a signal about the Fed cutting rates? If this were the case, wouldn’t interest rates be moving in lockstep with gold?

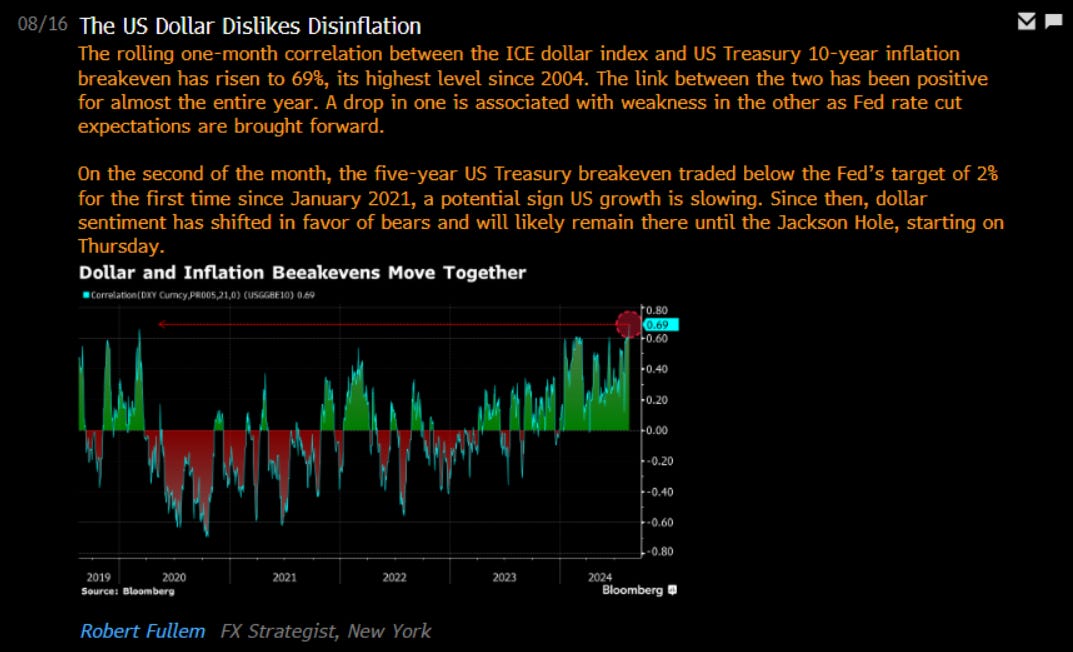

How do we know the significance of the dollar correlation with breakevens? Does this predict anything or is it simply descriptive? Also, why would breakevens falling indicate US growth is slowing? Does that always happen?

Does the 200D moving average provide any help for decision making or is it only pulled out in certain circumstances where evidence for confirmation bias is needed? Does the extension above the 200D moving average imply another bear market similar to 2022 is going to happen?

What we end up with is people who have views based on artificial patterns instead of statistical significance and an understanding of the causal mechanics in the system:

Now I know the meme above is a joke (kinda ;) ) but the truth is people find very professional and elaborate ways to package narratives that have no logical backing. This is why understanding macro is so critical. At the very least, it begins to contextualize the questions you should ask and help you sidestep decisions that could cause setbacks in life.

Credit Risk and Duration Risk:

In macro, the primary categories we organize variables with are: Growth, Inflation, and Liquidity. We use these categories because they properly account for all variables in both the economy and financial system.

Growth, inflation, and liquidity are variables I have gone over extensively in the existing primers (all of them can be found here: Link). We need to connect these variables to financial markets and specifically to asset prices. We connect these to markets by mapping credit risk and duration risk in assets. (There are many other risks but we will only be covering these today).

Let’s first go over some definitions and then qualifications:

Definitions:

Duration Risk: Duration risk primarily addresses how changes in interest rates impact the present value of future cash flows from fixed-income investments. It highlights the sensitivity of a bond's price to interest rate fluctuations, reflecting the time value of money. Bonds with longer durations are more exposed to this risk because their cash flows, spread over a longer period, are more significantly discounted when interest rates rise, leading to greater price volatility.

Credit Risk: Credit risk centers on the uncertainty surrounding the actual receipt of future cash flows promised by a borrower. Unlike duration risk, which deals with the time value of money and interest rate sensitivity, credit risk is concerned with the borrower's ability to make the scheduled payments. This risk underscores the potential for default, where the anticipated cash flows may not materialize at all, impacting the lender's or investor's expected returns.

Scenarios:

Increasing Duration Risk with Increasing Credit Risk:

In this regime, both interest rates and credit concerns are rising. This situation is particularly challenging for bond investors, as the increasing duration risk means bond prices are falling due to higher interest rates, while increasing credit risk indicates a higher likelihood of default, making the bonds even less attractive.

Increasing Duration Risk with Decreasing Credit Risk:

Here, interest rates are rising, increasing the duration risk and causing bond prices to fall. However, the credit risk is decreasing, meaning the likelihood of default is lower, which can partially offset the negative impact on bond prices as the issuer is seen as more creditworthy.

Decreasing Duration Risk with Increasing Credit Risk:

In this scenario, interest rates are falling, reducing duration risk and causing bond prices to rise. At the same time, increasing credit risk suggests a higher chance of default, which can negatively affect bond prices despite the favorable interest rate environment.

Decreasing Duration Risk with Decreasing Credit Risk:

This is an ideal scenario for bond investors, where falling interest rates decrease duration risk and boost bond prices, while decreasing credit risk lowers the likelihood of default, further enhancing the attractiveness and value of the bonds.

Qualifications:

When we move through a typical quarter of economic data, there are both nominal changes and real changes. For example, here is a chart of nominal and real GDP. When mapping these into quantifiable regimes, you want to map the level, rate of change, and spread between these two data points. When you have mapped these data points, then you will have a clearer view into credit risk and duration risk in financial markets.

Typically people will conflate what is happening on a nominal and real basis and then misinturpret why asset prices are moving. For example, the total return index for high yield went down in 2020 for very different reasons than in 2022. One was primarily credit risk (2020) and the other was primarily duration risk (2022).

Personal note: Every morning when I sit down at my desk and review markets, I am always thinking about how BOTH duration risk and credit risk are being priced. Similar to how the forward curve prices the actions of the Fed, every other market is pricing a future expectation of some type of credit risk and duration risk. This is why risk premias exist. See my podcast here on it:

It is this logic that you want to connect to your attribution analysis for assets. For example, I have already written primers on the S&P500 (link) and interest rates (link). In the S&P500 primer, I explained that either the cash flow function or the valuation function drives price action. Within this, you have positioning trying to take views on BOTH of these inputs in order to extract returns.

Notice that in 2008 and 2020, earnings expectations were falling as valuations were rising. The opposite occurring in 2022. The WHY behind this has to do with the level, rate of change and spread between real and nominal GDP. This is why specific attribution analysis occurs at the same time as negative or positive stock-bond correlations.

If this seems a little complicated, perform the following:

Delineate nominal and real GDP into the regimes noted above. From here, map the regimes of credit risk and duration risk (noted above) onto these changes in GDP. From this point, you can connect them with financial assets in their respective attribution analysis.

It is from this foundation that you can begin to connect this framework with every asset AND strategy in the investment universe. Here is a visual of this: Link

Now to be fair, every major hedge fund or institution worth its salt will have models mapping all of the points I noted above with significantly more sophistication. These types of models simply provide clear visibility into the PRESENT. Understanding the present sets the foundation for taking views on the future because path dependency is everything in complex systems like markets.

This is based on the ideas I laid out in the first article I wrote:

How To Think About Markets, Trading, and Wealth Management

This is the first publication so I am going to lay out a number of ideas in order to frame the research, thoughts, and trade ideas I am going to write.

Mapping:

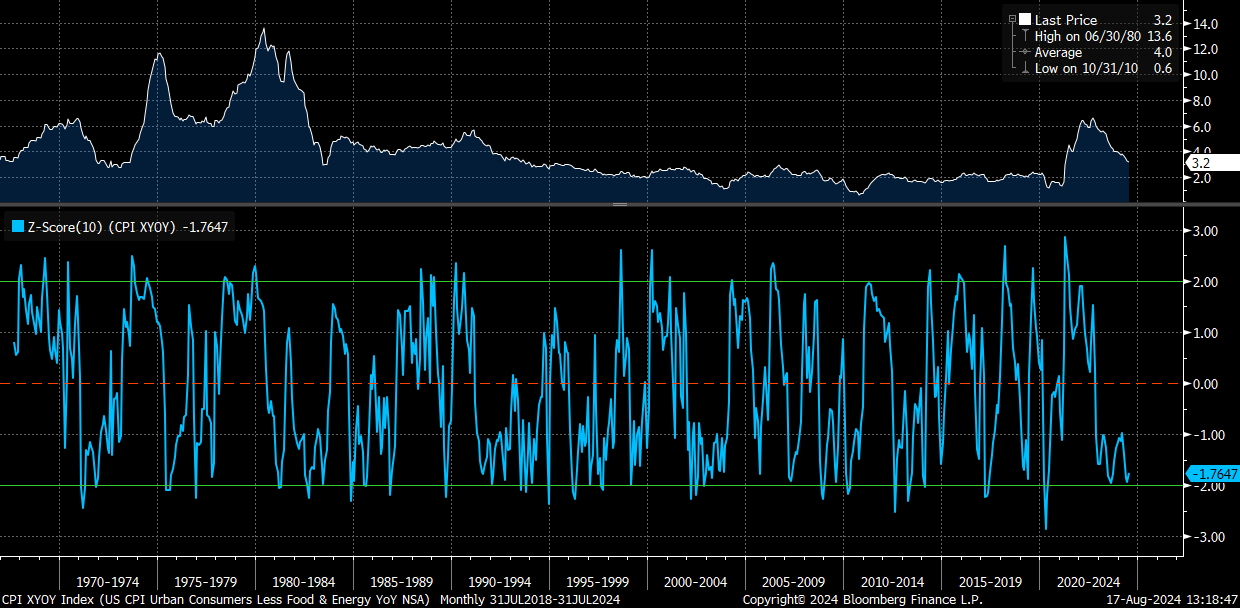

The important thing to remember is that any type of analysis you're conducting on markets will always be temporally dependent. What does this mean? Well, you can easily map the rate of change in a specific datapoint but mapping the standard deviation across multiple timeframes will begin telling you the TYPES of moves that are likely to take place in financial assets.

For example, we can take the Z-Score of inflation and show how extreme the moves in inflation have been. This can be another layer of filtering that we can try to refine our decision-making process through.

It is when there are shifts in the underlying data across a multiplicity of variables, a change in correlations among economic data AND financial markets, and nonlinear moves that provide signals around inflection points in macro. This will be the topic we expand on more in the next primer.

Additional Resources:

Check out these books for more on these ideas in macro:

Academic Papers:

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=1295344

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=1032522

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3879109

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2219548

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=877812

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2298565

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=1112467

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=997276

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=832184

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=479323

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=1433502

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=1733227

The information on this website/Substack is for information purposes only. It is believed to be reliable, but Capital Flows does not warrant its completeness or accuracy. The information on the website/Substack is not intended as an offer or solicitation for the purchase of stock or any financial instrument. The information and materials contained in these pages and the terms, conditions and descriptions that appear, are subject to change without notice. Unauthorized use of Capital Flows websites and systems including but not limited to data scraping, unauthorized entry into Capital Flows systems, misuse of passwords, or misuse of any information posted on a site is strictly prohibited. Your eligibility for particular services is subject to final determination by Capital Flows and/or its affiliates. Investment services are not bank deposits or insured by the FDIC or other entity and are subject to investment risks, including possible loss of principal amount invested. Your use of any information which is proprietary to Capital Flows or a third-party information provider shall only be used on individual devices without any right to redistribute, upload, export, copy, or otherwise transfer the information to any centralized interdepartmental or shared device, directory, database or other repository nor to otherwise make it available to any other entity/person/third party, without the prior written consent of Capital Flows.

Like

Hi, thanks for this information. Seeing how the rubber hits the road is really helpful. I have a question that may be basic: I'm having trouble finding similar datasets to see what you're saying. For those without access to a Bloomberg terminal, are there any publicly available datasets or equivalent resources you could recommend?"