Macro Context:

I have laid out the macro views for everything here:

I have also written two Twitter threads that you can see here and here.

Macro Positioning:

Over the last 3 trading days we saw the CPI print come out and bonds sell off across the US, Eurozone, UK, Australia, and Japan. The question you should be asking is, WHY did bonds sell off when CPI came out in line with expectations?

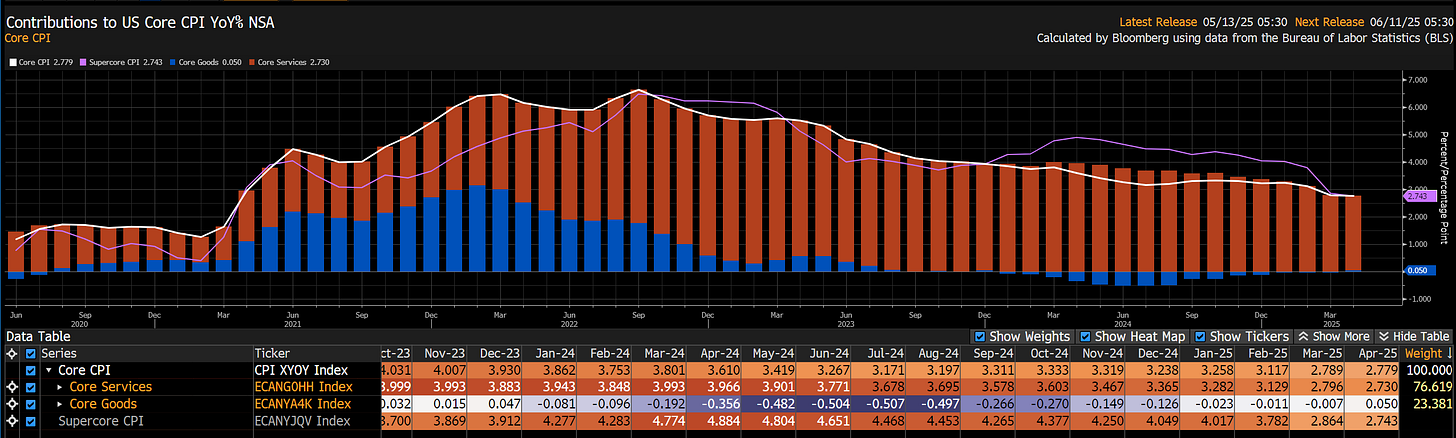

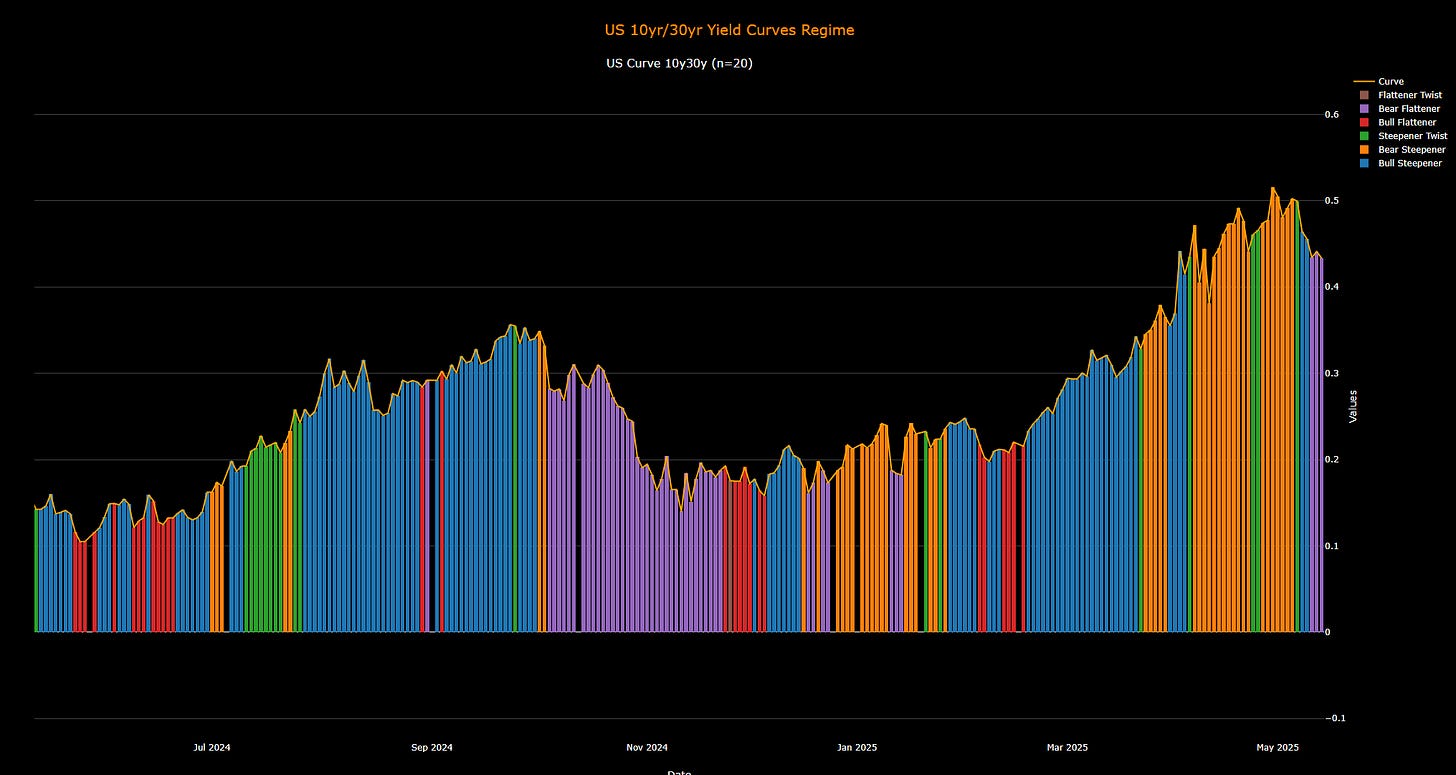

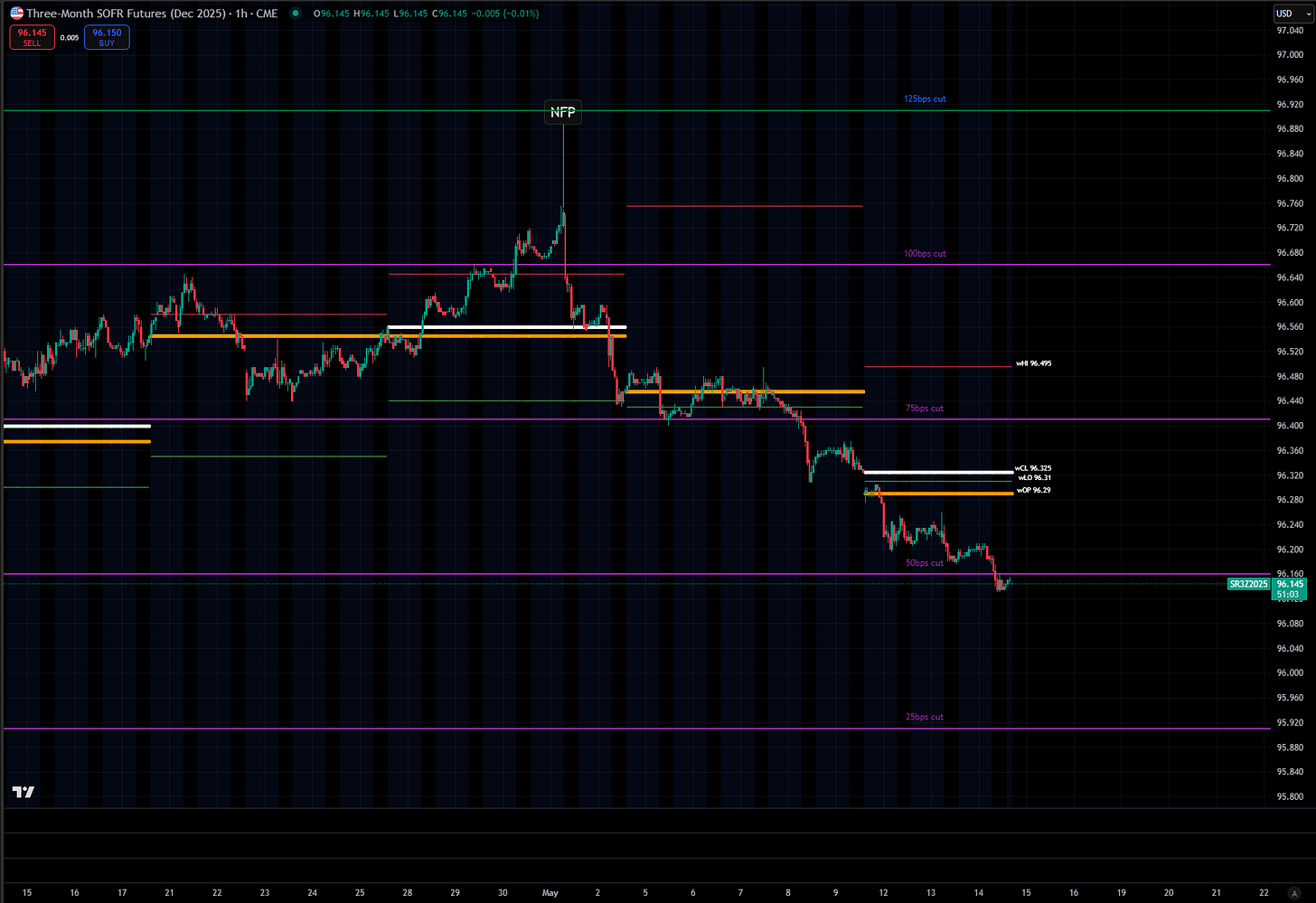

The reason is that long-term nominal GDP expectations are rising aggressively right now, which is moving the long end of the curve. We saw the 10s30s part of the curve bear steepen (orange) as the Fed allowed 75bps of cuts to be priced for 2025 (Z5 SOFR Contract). The entire idea is that moving into the CPI print, every fixed income trader knows that the long end is front running what will be confirmed in the CPI print which is that inflation is unlikely to hit 2% this year. The next two inflation prints are likely to be higher as well.

The Z5 SOFR contract is now pricing 50bps of cuts for 2025, and if equities keep rallying with higher energy prices, we will almost certainly price 25bps.

Here is the risk though, right now 2 year inflation swaps (white) are remaining elevated, and 10-year inflation swaps are beginning to rally. This is a massive problem for central banks. If we rally another 30-40bps in 10 year inflation swaps, the Fed is going to begin bringing the idea of hikes back on the table.

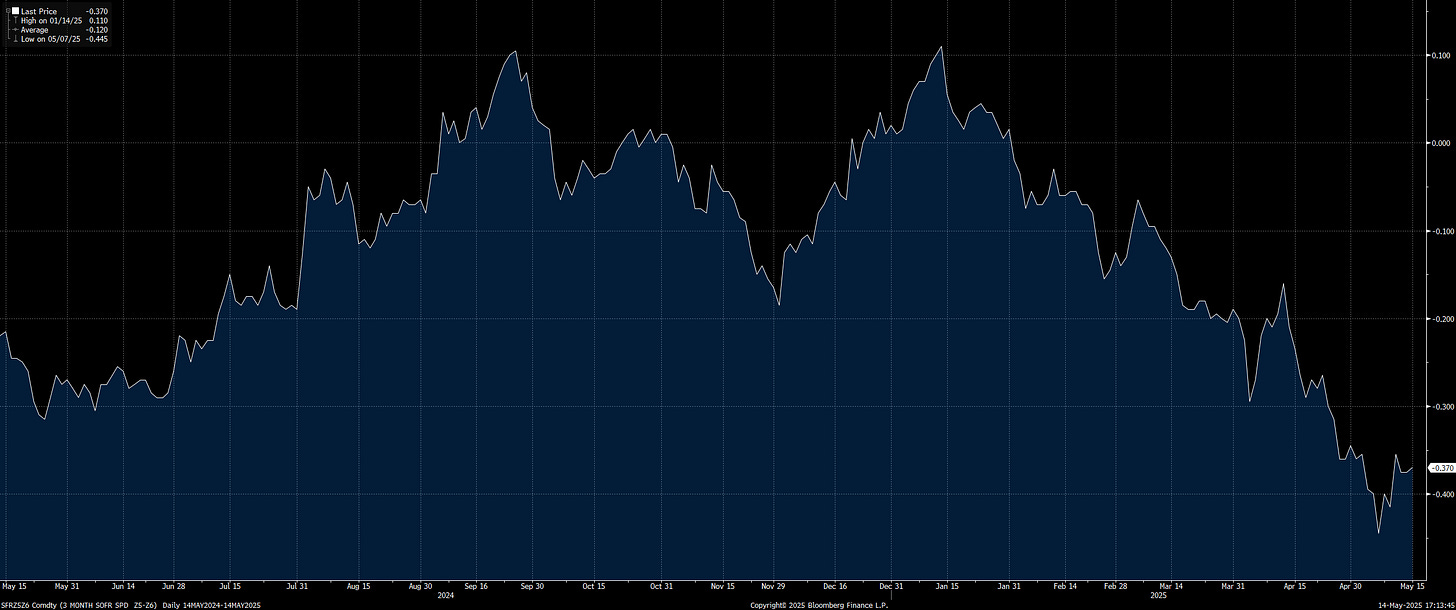

I think they will make a clear pause first because a lot of the cuts have been shifted from 2025 into 2026 as reflected in the Z5Z6 spread. If this is to difficult to understand, just know that the progression will be the Fed pausing, and then bringing the idea of hikes on the table. AFTER that happens, then we will reevaluate economic data and inflation swaps to see if they’ve stopped rallying.

And remember, crude hasn’t even made a real rally yet:

This brings us to the retail sales print and price action for tomorrow.

Keep reading with a 7-day free trial

Subscribe to Capital Flows to keep reading this post and get 7 days of free access to the full post archives.