How Interest Rates Work:

Interest rates and FX are ALWAYS two sides of the same coin and NEVER function in a silo. The important thing to remember about interest rates is that they reflect both the nominal and real pricing power of money through time. In other words, as we move out the duration risk curve to longer-term interest rates, there is a difference in how money is being priced.

When we think about both nominal changes in goods/services in the economy, all of these are denominated in the respective currencies. In a traditional economic model illustrating supply and demand curves, we have the demand for goods/services and their respective supply. The way we come to a view about inflation is by asking HOW MUCH nominal demand there is vs the quantity of supply. The difference between the two is inflation. One way to think about inflation is that its not just prices going up but its the revaluing of dollars (which can increase or decrease in value).

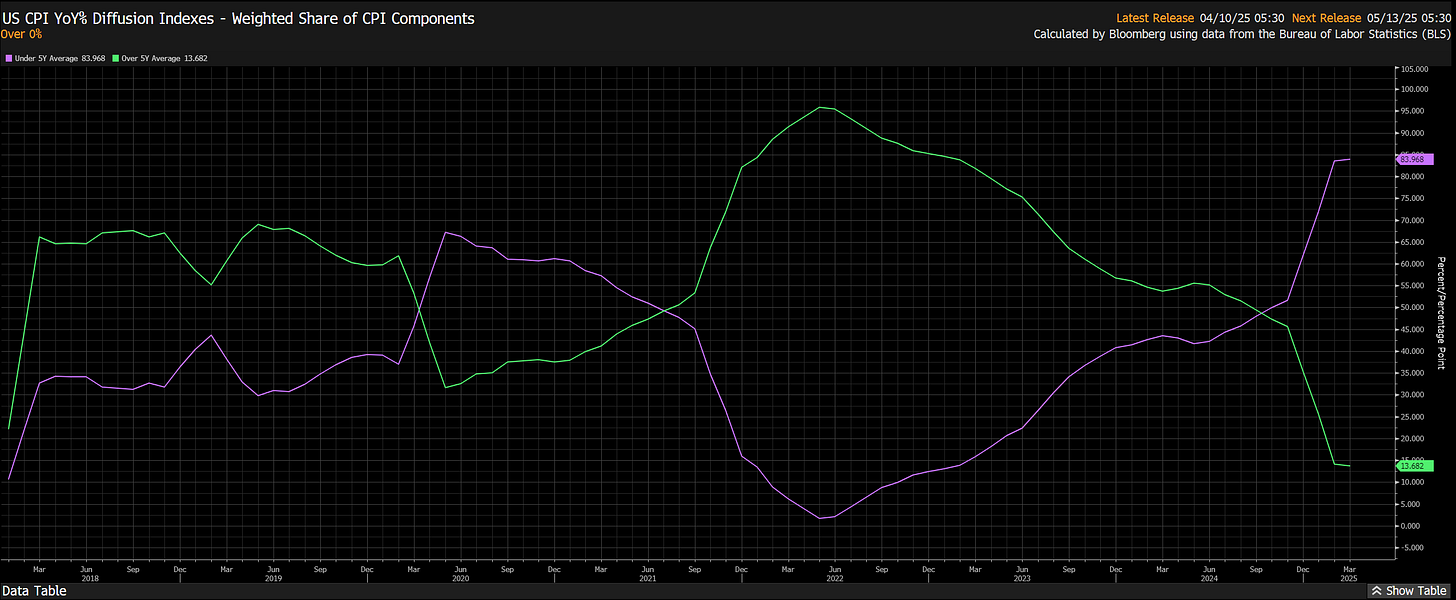

Now here is the problem: the world isn’t an equilibrium supply and demand model. Inflation is never evenly distributed throughout the economy. This is WHY we use things like diffusion indices for CPI so that we can see how pervasive inflationary pressures are:

On top of this, reflexivity and feedback loops occur in the system because BOTH short-term rates and long term rates are direct inputs into supply and demand. In other words, growth/inflation is a direct input into interest rates, and interest rates are a direct input into growth/inflation.

In reality, supply and demand forces function in a highly complex and path-dependent manner that is comparable to a naturalistic system. If you want to learn more about this idea, I would encourage you to check out this paper on it: Link

I have found a lot of complexity economics research (like the paper above) incredibly helpful in informing the underlying logic and presuppositions for making decisions. However, when quantifying economic data, interest rates, and assets, the accounting function is VERY important. If you want to dig into this more, check out the interest rate primer I wrote on it:

Macro Views For Interest Rates:

Keep reading with a 7-day free trial

Subscribe to Capital Flows to keep reading this post and get 7 days of free access to the full post archives.